-

Australia's in-form Head confirmed fit for Boxing Day Test

Australia's in-form Head confirmed fit for Boxing Day Test

-

Brazilian midfielder Oscar returns to Sao Paulo

-

'Wemby' and 'Ant-Man' to make NBA Christmas debuts

'Wemby' and 'Ant-Man' to make NBA Christmas debuts

-

US agency focused on foreign disinformation shuts down

-

On Christmas Eve, Pope Francis launches holy Jubilee year

On Christmas Eve, Pope Francis launches holy Jubilee year

-

'Like a dream': AFP photographer's return to Syria

-

Chiefs seek top seed in holiday test for playoff-bound NFL teams

Chiefs seek top seed in holiday test for playoff-bound NFL teams

-

Panamanians protest 'public enemy' Trump's canal threat

-

Cyclone death toll in Mayotte rises to 39

Cyclone death toll in Mayotte rises to 39

-

Ecuador vice president says Noboa seeking her 'banishment'

-

Leicester boss Van Nistelrooy aware of 'bigger picture' as Liverpool await

Leicester boss Van Nistelrooy aware of 'bigger picture' as Liverpool await

-

Syria authorities say armed groups have agreed to disband

-

Maresca expects Man City to be in title hunt as he downplays Chelsea's chancs

Maresca expects Man City to be in title hunt as he downplays Chelsea's chancs

-

Man Utd boss Amorim vows to stay on course despite Rashford row

-

South Africa opt for all-pace attack against Pakistan

South Africa opt for all-pace attack against Pakistan

-

Guardiola adamant Man City slump not all about Haaland

-

Global stocks mostly higher in thin pre-Christmas trade

Global stocks mostly higher in thin pre-Christmas trade

-

Bethlehem marks sombre Christmas under shadow of war

-

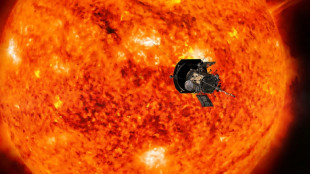

NASA probe makes closest ever pass by the Sun

NASA probe makes closest ever pass by the Sun

-

11 killed in blast at Turkey explosives plant

-

Indonesia considers parole for ex-terror chiefs: official

Indonesia considers parole for ex-terror chiefs: official

-

Global stocks mostly rise in thin pre-Christmas trade

-

Postecoglou says Spurs 'need to reinforce' in transfer window

Postecoglou says Spurs 'need to reinforce' in transfer window

-

Le Pen says days of new French govt numbered

-

Global stocks mostly rise after US tech rally

Global stocks mostly rise after US tech rally

-

Villa boss Emery set for 'very difficult' clash with Newcastle

-

Investors swoop in to save German flying taxi startup

Investors swoop in to save German flying taxi startup

-

How Finnish youth learn to spot disinformation

-

South Korean opposition postpones decision to impeach acting president

South Korean opposition postpones decision to impeach acting president

-

12 killed in blast at Turkey explosives plant

-

Panama leaders past and present reject Trump's threat of Canal takeover

Panama leaders past and present reject Trump's threat of Canal takeover

-

Hong Kong police issue fresh bounties for activists overseas

-

Saving the mysterious African manatee at Cameroon hotspot

Saving the mysterious African manatee at Cameroon hotspot

-

India consider second spinner for Boxing Day Test

-

London wall illuminates Covid's enduring pain at Christmas

London wall illuminates Covid's enduring pain at Christmas

-

Poyet appointed manager at South Korea's Jeonbuk

-

South Korea's opposition vows to impeach acting president

South Korea's opposition vows to impeach acting president

-

The tsunami detection buoys safeguarding lives in Thailand

-

Teen Konstas to open for Australia in Boxing Day India Test

Teen Konstas to open for Australia in Boxing Day India Test

-

Asian stocks mostly up after US tech rally

-

US panel could not reach consensus on US-Japan steel deal: Nippon

US panel could not reach consensus on US-Japan steel deal: Nippon

-

The real-life violence that inspired South Korea's 'Squid Game'

-

Blogs to Bluesky: social media shifts responses after 2004 tsunami

Blogs to Bluesky: social media shifts responses after 2004 tsunami

-

Tennis power couple de Minaur and Boulter get engaged

-

Supermaxi yachts eye record in gruelling Sydney-Hobart race

Supermaxi yachts eye record in gruelling Sydney-Hobart race

-

Hawaii's Kilauea volcano erupts, spewing columns of lava

-

Battery X Metals Announces Closing of Non-Brokered Private Placement and Debt Settlement

Battery X Metals Announces Closing of Non-Brokered Private Placement and Debt Settlement

-

MGO Global Announces Closing of Upsized $6.0 Million Public Offering

-

The Melrose Group Demands Hank Payments Management Facilitate Requisitioned Shareholder Meetings

The Melrose Group Demands Hank Payments Management Facilitate Requisitioned Shareholder Meetings

-

MedMira receives Health Canada approval for its Multiplo(R) Rapid (TP/HIV) Test for Syphilis and HIV

Oil prices higher on China boost, Syria uncertainty

World oil prices jumped Monday on fresh moves by China to boost its economy and as traders tracked an uncertain future for Syria and the wider crude-rich Middle East.

Major stock markets diverged as investors reacted to political crises in South Korea and France.

Gold, seen as a haven investment, gained nearly one percent.

"The week has kicked off on a largely upbeat tone following the welcome announcement that Chinese authorities plan to enact further stimulus over the year ahead," noted Joshua Mahony, analyst at traders Scope Markets.

"This shift has already fuelled sharp gains in key assets, with the Hang Seng surging 2.8 percent and commodities like copper, zinc, iron ore, and palladium rallying on expectations of increased demand."

Oil prices rose more than one percent as traders tracked developments in Syria after president Bashar al-Assad fled the country over the weekend as Islamist-led rebels swept into Damascus.

Investors also reacted to news China where President Xi Jinping and other top leaders said Monday they would adopt a more "relaxed" approach to monetary policy as they hashed out plans to boost the economy next year.

The world's second-largest economy is battling sluggish domestic consumption, a persistent crisis in the property sector and soaring government debt -- all of which threaten Beijing's official growth target for this year.

Leaders are also eyeing the second term of Donald Trump in the White House, with the president-elect indicating he will reignite his hardball trade policies, fuelling fears of another standoff between the superpowers.

On Monday, South Korean stocks tumbled as the country was racked with political uncertainty after President Yoon Suk Yeol escaped impeachment following his brief imposition of martial law last week.

The won was trading at around 1,432 per dollar Monday, compared with 1,413 on Friday.

The euro rose against the dollar, having taken a hit last week when France's new government fell after a no-confidence vote.

The Paris stock market rose in midday deals Monday.

President Emmanuel Macron, who had faced calls to step down, lifted sentiment when he said would serve out his term and that a budget could be passed in the coming weeks.

Macron held talks with French political leaders on the left and right on Friday as he sought to quickly name a new prime minister after Michel Barnier's ouster over his 2025 budget plan.

The European Central Bank is expected to lower borrowing costs this week.

- Key figures around 1130 GMT -

Paris - CAC 40: UP 0.4 percent at 7,459.51 points

Frankfurt - DAX: DOWN 0.2 percent at 20,351.93

London - FTSE 100: UP 0.3 percent at 8,333.14

Seoul - Kospi: DOWN 2.8 percent at 2,360.58 (close)

Tokyo - Nikkei 225: UP 0.2 percent at 39,160.50 (close)

Hong Kong - Hang Seng Index: UP 2.8 percent at 20,414.09 (close)

Shanghai - Composite: DOWN 0.1 percent at 3,402.53 (close)

New York - Dow: DOWN 0.3 percent at 44,642.52 points (close)

Euro/dollar: UP at $1.0582 from $1.0566 on Friday

Pound/dollar: UP at $1.2779 from $1.2740

Dollar/yen: UP at 150.42 yen from 149.97 yen

Euro/pound: DOWN at 82.80 from 82.93 pence

Brent North Sea Crude: UP 1.1 percent at $71.90 per barrel

West Texas Intermediate: UP 1.3 percent at $68.04 per barrel

F.Dubois--AMWN