-

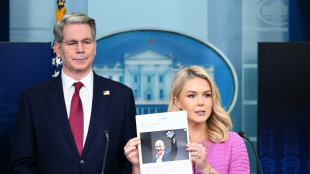

Trump celebrates tumultuous 100 days in office

Trump celebrates tumultuous 100 days in office

-

Sweden gun attack leaves three dead

-

Real Madrid's Rudiger banned for six matches after Copa final red

Real Madrid's Rudiger banned for six matches after Copa final red

-

Firmino, Toney fire Al Ahli into AFC Champions League final

-

Maximum respect for Barca but no fear: Inter's Inzaghi

Maximum respect for Barca but no fear: Inter's Inzaghi

-

Trump signals relief on auto tariffs as industry awaits details

-

Cuban court revokes parole of two prominent dissidents

Cuban court revokes parole of two prominent dissidents

-

Narine leads from the front as Kolkata trump Delhi in IPL

-

Amazon says never planned to show tariff costs, after White House backlash

Amazon says never planned to show tariff costs, after White House backlash

-

Djokovic to miss Italian Open

-

Trossard starts for Arsenal in Champions League semi against PSG

Trossard starts for Arsenal in Champions League semi against PSG

-

Sweden shooting kills three: police

-

Real Madrid's Rudiger, Mendy out injured until end of season

Real Madrid's Rudiger, Mendy out injured until end of season

-

Dubois' trainer accuses Usyk of 'conning boxing world'

-

Femke Bol targets fast return after draining 2024

Femke Bol targets fast return after draining 2024

-

Asterix, Obelix and Netflix: US streamer embraces Gallic heroes

-

Watson wins Tour de Romandie prologue, Evenepoel eighth

Watson wins Tour de Romandie prologue, Evenepoel eighth

-

Amazon says never decided to show tariff costs, after White House backlash

-

India gives army 'operational freedom' to respond to Kashmir attack

India gives army 'operational freedom' to respond to Kashmir attack

-

Stocks advance as investors weigh earnings, car tariff hopes

-

Canadian firm makes first bid for international seabed mining license

Canadian firm makes first bid for international seabed mining license

-

Kardashian robbery suspect says heist was one 'too many'

-

'Chilled' Swiatek scrapes into Madrid Open last eight

'Chilled' Swiatek scrapes into Madrid Open last eight

-

Interconnectivity: the cornerstone of the European electricity network

-

France accuses Russian military intelligence of cyberattacks

France accuses Russian military intelligence of cyberattacks

-

Multiple challenges await Canada's Carney

-

US consumer confidence hits lowest level since onset of pandemic

US consumer confidence hits lowest level since onset of pandemic

-

How climate change turned Sao Paulo's drizzle into a storm

-

Video game rides conclave excitement with cardinal fantasy team

Video game rides conclave excitement with cardinal fantasy team

-

Candles and radios in demand in Spain as blackout lessons sink in

-

Boca Juniors sack coach Gago ahead of Club World Cup

Boca Juniors sack coach Gago ahead of Club World Cup

-

Trump celebrates tumultuous 100 days in office as support slips

-

Forest face 'biggest games of careers' in Champions League chase: Nuno

Forest face 'biggest games of careers' in Champions League chase: Nuno

-

Stocks waver as investors weigh earnings, car tariff hopes

-

US climate assessment in doubt as Trump dismisses authors

US climate assessment in doubt as Trump dismisses authors

-

W. House slams Amazon over 'hostile' plan to display tariff effect on prices

-

What we know ahead of conclave to elect new pope

What we know ahead of conclave to elect new pope

-

EU top court rules 'golden passport' schemes are illegal

-

Mounds of waste dumped near Athens's main river: NGO

Mounds of waste dumped near Athens's main river: NGO

-

Spain starts probing causes of massive blackout

-

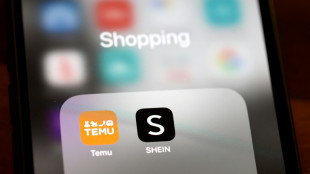

France targets cheap Chinese goods with fee on packages

France targets cheap Chinese goods with fee on packages

-

Amnesty accuses Israel of 'live-streamed genocide' in Gaza

-

Japan, Philippines leaders vow to deepen security ties

Japan, Philippines leaders vow to deepen security ties

-

AstraZeneca moves some production to US amid tariff threat

-

Shadman's ton gives Bangladesh lead in 2nd Zimbabwe Test

Shadman's ton gives Bangladesh lead in 2nd Zimbabwe Test

-

Barca's Yamal: I admire Messi but don't compare myself to him

-

Pfizer profits dip on lower Paxlovid sales

Pfizer profits dip on lower Paxlovid sales

-

French right-wing TV host fans talk of presidential bid

-

Two men in court charged with 'moronic' felling of famed UK tree

Two men in court charged with 'moronic' felling of famed UK tree

-

Amnesty accuses Israel of 'live-streamed genocide' against Gazans

Indian insurance giant slumps after country's biggest-ever IPO

Indian state-owned insurance giant LIC slumped on its market debut Tuesday following the country's biggest-ever initial public offering, opening seven percent below the offer price.

Prime Minister Narendra Modi's government raised $2.7 billion by selling 3.5 percent of Life Insurance Corporation of India as his administration seeks to privatise state assets to plug a gaping budget deficit.

But it was forced to cut back the offer from a planned five percent after markets turned volatile following Russia's invasion of Ukraine and China's Covid lockdowns.

The offer price of 949 rupees had valued LIC at $77 billion, but it opened Tuesday on Mumbai's exchange trading seven percent lower. The share price dropped to 9.4 percent down, before recovering slightly.

The muted debut could test the appetite of new shareholders for further flotations of nationalised companies as Modi seeks to sell off state assets to plug an estimated 16.6 trillion rupee ($213.5 billion) fiscal deficit.

The IPO saw enthusiastic participation from small investors and was oversubscribed nearly three times during the six-day application period.

But foreign investors have withdrawn a net 1.71 trillion rupees ($22 billion) from Indian equities so far this year, stock exchange data showed, as the US monetary policy tightening further roiled sentiment.

- Synonymous with life insurance -

Founded in 1956 by nationalising and combining more than 240 firms, LIC was for decades synonymous with life insurance in post-independence India, until the entry of private companies in 2000.

It continues to lead the pack with a 61 percent share of the market in India, with its army of 1.3 million "LIC agents" giving it huge reach, particularly in remote rural areas.

But LIC's market share has declined steadily in the face of competition from net-savvy private insurers offering specialised products.

The firm warned in its regulatory filing that "there can be no assurance that our corporation will not lose further market share" to private companies.

The IPO followed a years-long effort by bankers and bureaucrats to appraise the mammoth insurer and prepare it for listing.

LIC is also India's largest asset manager, with 39.55 trillion rupees under management as of September 30, including significant stakes in Indian blue chips such as Reliance and Infosys.

LIC's real estate assets include vast offices at prime urban Indian locations, including a 15-storey office in Chennai that was once the country's tallest building.

The firm is also believed to own a large collection of rare and valuable artwork that includes paintings by MF Husain -- known as the Pablo Picasso of India -- although the value of these holdings has not been made public.

F.Dubois--AMWN