-

T'Wolves push Lakers to brink of elimination, Celtics and Knicks win

T'Wolves push Lakers to brink of elimination, Celtics and Knicks win

-

Suspect charged with murder in Canada car attack that left 11 dead

-

Smart driving new front in China car wars despite fatal crash

Smart driving new front in China car wars despite fatal crash

-

Cardinals set to pick conclave date to elect new pope

-

Miami's unbeaten MLS run ends after Dallas comeback

Miami's unbeaten MLS run ends after Dallas comeback

-

After 100 days in office, Trump voters still back US president

-

US anti-disinformation guardrails fall in Trump's first 100 days

US anti-disinformation guardrails fall in Trump's first 100 days

-

Dick Barnett, two-time NBA champ with Knicks, dies at 88

-

PSG hope to have Dembele firing for Arsenal Champions League showdown

PSG hope to have Dembele firing for Arsenal Champions League showdown

-

Arteta faces Champions League showdown with mentor Luis Enrique

-

Niemann wins LIV Mexico City to secure US Open berth

Niemann wins LIV Mexico City to secure US Open berth

-

Slot plots more Liverpool glory after Premier League triumph

-

Novak and Griffin win PGA pairs event for first tour titles

Novak and Griffin win PGA pairs event for first tour titles

-

Inter Miami unbeaten MLS run ends after Dallas comeback

-

T'Wolves rally late to beat Lakers, Knicks edge Pistons amid controversy

T'Wolves rally late to beat Lakers, Knicks edge Pistons amid controversy

-

Japan's Saigo wins playoff for LPGA Chevron title and first major win

-

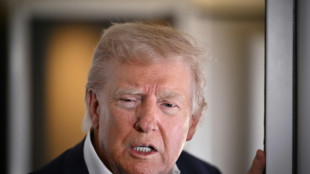

Trump tells Putin to 'stop shooting' and make a deal

Trump tells Putin to 'stop shooting' and make a deal

-

US says it struck 800 targets in Yemen, killed 100s of Huthis since March 15

-

Conflicts spur 'unprecedented' rise in military spending

Conflicts spur 'unprecedented' rise in military spending

-

Gouiri hat-trick guides Marseille back to second in Ligue 1

-

Racing 92 thump Stade Francais to push rivals closer to relegation

Racing 92 thump Stade Francais to push rivals closer to relegation

-

Inter downed by Roma, McTominay fires Napoli to top of Serie A

-

Usyk's unification bout against Dubois confirmed for July 19

Usyk's unification bout against Dubois confirmed for July 19

-

Knicks edge Pistons for 3-1 NBA playoff series lead

-

Slot praises Klopp after Liverpool seal Premier League title

Slot praises Klopp after Liverpool seal Premier League title

-

FA Cup glory won't salvage Man City's troubled season: Guardiola

-

Bumrah, Krunal Pandya star as Mumbai and Bengaluru win in IPL

Bumrah, Krunal Pandya star as Mumbai and Bengaluru win in IPL

-

Amorim says 'everything can change' as Liverpool equal Man Utd title record

-

Iran's Khamenei orders probe into port blast that killed 40

Iran's Khamenei orders probe into port blast that killed 40

-

Salah revels in Liverpool's 'way better' title party

-

Arsenal stun Lyon to reach Women's Champions League final

Arsenal stun Lyon to reach Women's Champions League final

-

Slot 'incredibly proud' as Liverpool celebrate record-equalling title

-

Israel strikes south Beirut, prompting Lebanese appeal to ceasefire guarantors

Israel strikes south Beirut, prompting Lebanese appeal to ceasefire guarantors

-

Smart Slot reaps rewards of quiet revolution at Liverpool

-

Krunal Pandya leads Bengaluru to top of IPL table

Krunal Pandya leads Bengaluru to top of IPL table

-

Can Trump-Zelensky Vatican talks bring Ukraine peace?

-

Van Dijk hails Liverpool's 'special' title triumph

Van Dijk hails Liverpool's 'special' title triumph

-

Five games that won Liverpool the Premier League

-

'Sinners' tops N.America box office for second week

'Sinners' tops N.America box office for second week

-

Imperious Liverpool smash Tottenham to win Premier League title

-

Man City sink Forest to reach third successive FA Cup final

Man City sink Forest to reach third successive FA Cup final

-

Toll from Iran port blast hits 40 as fire blazes

-

Canada car attack suspect had mental health issues, 11 dead

Canada car attack suspect had mental health issues, 11 dead

-

Crowds flock to tomb of Pope Francis, as eyes turn to conclave

-

Inter downed by Roma, AC Milan bounce back with victory in Venice

Inter downed by Roma, AC Milan bounce back with victory in Venice

-

Religious hate has no place in France, says Macron after Muslim killed in mosque

-

Last day of Canada election campaign jolted by Vancouver attack

Last day of Canada election campaign jolted by Vancouver attack

-

Barcelona crush Chelsea to reach women's Champions League final

-

Nine killed as driver plows into Filipino festival in Canada

Nine killed as driver plows into Filipino festival in Canada

-

Germany marks liberation of Bergen-Belsen Nazi camp

Asian markets drift ahead of key Fed rate decision

Investors shifted cautiously in Asian trade Wednesday as they nervously awaited what is expected to be the biggest Federal Reserve interest rate hike in more than two decades.

With inflation showing little sign of easing from its 40-year highs, the US central bank has set itself on a hawkish course of tightening this year, sending shivers through world markets.

The prospect of higher borrowing costs has been compounded by a range of crises including the war in Ukraine, elevated oil prices and China's Covid lockdowns that have strangled crucial global supply chains.

The Fed now has to walk a fine line between getting control of surging prices and making sure it does not knock the recovery in the world's top economy off course.

"The Fed remains very focused on bringing inflation down, however, any further hawkish pivots will likely be tempered to some extent by the desire to achieve a soft landing," said Blerina Uruci at T. Rowe Price.

The Fed is expected to announce a 50 percentage point lift Wednesday -- its biggest since 2000 -- but boss Jerome Powell's post-meeting news conference will be closely watched for an idea about future hikes.

Speculation was swirling that 75 points could be on the table at some point this year.

"Powell will fall back to 'we are not on pre-set rate hikes' or something along those lines -- 'we go in with an open mind each meeting and will talk it over and we'll see where we go from there'," said Tony Farren, managing director at Mischler Financial Group.

"The market would take that as hawkish. For his comments to seem dovish, he'd have to shut down the talk of 75 basis points. And while I don't think he'll endorse it, I don't think he'll shut it down."

After a broadly positive lead from Wall Street, Asian markets were mixed in holiday-thinned trade.

Hong Kong, Singapore and Manila slipped but Sydney, Seoul, Taipei and Wellington dropped.

Tokyo, Shanghai, Jakarta, Kuala Lumpur and Bangkok were closed.

Oil prices enjoyed gains after another drop on Tuesday fuelled by the expected hit to demand from China's coronavirus lockdowns, including in the country's biggest city Shanghai.

The measures have offset supply concerns caused by the Ukraine war and bans on imports of Russian fuel, even as the European Union discusses following US and British embargoes.

A huge release of crude from reserves by dozens of countries including the United States has also helped keep prices tempered.

Investors are waiting for a meeting Thursday of OPEC and other major producers including Russia, where they will discuss whether or not to lift output more than expected.

- Key figures at around 0230 GMT -

Hong Kong - Hang Seng Index: DOWN 0.8 percent at 20,943.01

Tokyo - Nikkei 225: Closed for a holiday

Shanghai - Composite: Closed for a holiday

Euro/dollar: UP at $1.0528 from $1.0519 on Tuesday

Pound/dollar: UP at $1.2494 from $1.2491

Euro/pound: UP at 84.28 pence from 84.17 pence

Dollar/yen: DOWN at 130.09 yen from 130.14 yen

West Texas Intermediate: UP 1.0 percent at $103.43 per barrel

Brent North Sea crude: UP 0.9 percent at $105.93 per barrel

New York - Dow: UP 0.2 percent at 33,128.79 (close)

London - FTSE 100: UP 0.2 percent at 7,561.33 (close)

A.Rodriguezv--AMWN