-

Crowds flock to tomb of Pope Francis, as eyes turn to conclave

Crowds flock to tomb of Pope Francis, as eyes turn to conclave

-

Inter downed by Roma, AC Milan bounce back with victory in Venice

-

Religious hate has no place in France, says Macron after Muslim killed in mosque

Religious hate has no place in France, says Macron after Muslim killed in mosque

-

Last day of Canada election campaign jolted by Vancouver attack

-

Barcelona crush Chelsea to reach women's Champions League final

Barcelona crush Chelsea to reach women's Champions League final

-

Nine killed as driver plows into Filipino festival in Canada

-

Germany marks liberation of Bergen-Belsen Nazi camp

Germany marks liberation of Bergen-Belsen Nazi camp

-

Hojlund strikes at the death to rescue Man Utd in Bournemouth draw

-

Zelensky says Ukraine not kicked out of Russia's Kursk

Zelensky says Ukraine not kicked out of Russia's Kursk

-

Zverev, Sabalenka battle through in Madrid Open, Rublev defence over

-

Ruthless Pogacar wins Liege-Bastogne-Liege for third time

Ruthless Pogacar wins Liege-Bastogne-Liege for third time

-

Bumrah claims 4-22 as Mumbai register five straight IPL wins

-

No place for racism, hate in France, says Macron after Muslim killed in mosque

No place for racism, hate in France, says Macron after Muslim killed in mosque

-

Greenland leader says Trump's threats disrespectful

-

Spain's Alex Marquez celebrates maiden MotoGP in home Grand Prix

Spain's Alex Marquez celebrates maiden MotoGP in home Grand Prix

-

Iran's president visits site of port blast that killed 28

-

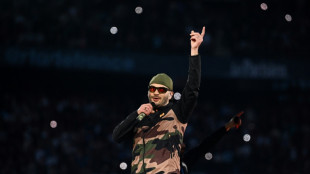

French rapper Jul breaks attendance record at national stadium

French rapper Jul breaks attendance record at national stadium

-

Gaza ministry says hundreds of war missing confirmed dead, toll at 52,243

-

Crowds flock to Pope Francis tomb, as eyes turn to conclave

Crowds flock to Pope Francis tomb, as eyes turn to conclave

-

'Godfather' director Coppola bags lifetime achievement award

-

Assefa sets world record, Sawe destroys high class field in London marathon

Assefa sets world record, Sawe destroys high class field in London marathon

-

'No excuse': Real Madrid's Rudiger after throwing object at ref

-

Fire blazes day after Iran port blast killed 28, injured 1,000

Fire blazes day after Iran port blast killed 28, injured 1,000

-

Real Madrid meltdown after third Clasico defeat inevitable end to ugly weekend

-

Nine killed as driver plows into Vancouver festival crowd

Nine killed as driver plows into Vancouver festival crowd

-

Crumbs! Should French bakeries open on May 1?

-

All eyes turn to conclave as Pope Francis tomb opens to public

All eyes turn to conclave as Pope Francis tomb opens to public

-

Emotional Penge bounces back from betting ban for first DP Tour win

-

25 killed, 1,000 injured in huge Iran port blast

25 killed, 1,000 injured in huge Iran port blast

-

Greenland PM visits Denmark as Trump threats loom

-

Philippines, US test air defences as China seizes reef

Philippines, US test air defences as China seizes reef

-

25 killed, fires still burning in huge Iran port blast

-

India and Pakistan troops exchange fire in Kashmir

India and Pakistan troops exchange fire in Kashmir

-

Eighteen killed, fires still burning in huge Iran port blast

-

No handshake at muted India-Pakistan border ceremony

No handshake at muted India-Pakistan border ceremony

-

Maligned by Trump, White House reporters hold subdued annual gala

-

Austria trials DNA testing to uncover honey fraud

Austria trials DNA testing to uncover honey fraud

-

Trump trade war pushes firms to consider stockpiling

-

D'Backs' Suarez becomes 19th MLB player to hit four homers in one game

D'Backs' Suarez becomes 19th MLB player to hit four homers in one game

-

Continuity or rupture: what direction for the next pope?

-

Surridge scores four as Nashville smash seven past Chicago

Surridge scores four as Nashville smash seven past Chicago

-

Chinese tea hub branches into coffee as tastes change

-

Diplomacy likely to trump geography in choice of new pope

Diplomacy likely to trump geography in choice of new pope

-

All eyes turn to conclave after Pope Francis's funeral

-

Doves, deaths and rations: Papal elections over time

Doves, deaths and rations: Papal elections over time

-

Progressive Canadians say social issues blown off election agenda

-

Liverpool primed for Premier League title party

Liverpool primed for Premier League title party

-

Buenos Aires bids farewell to Francis with tears, calls to action

-

Thunder sweep past Grizzlies in NBA playoffs, Cavs on brink

Thunder sweep past Grizzlies in NBA playoffs, Cavs on brink

-

Major blast at Iran port kills 14, injures 750

Markets waver, oil falls on weak Chinese data, looming US rate hike

Stock markets diverged and oil prices fell on Monday as traders tracked weak Chinese economic data and a looming US interest rate hike that could tame inflation but also thwart growth.

Equities kicked off the month of May on the wrong foot after Wall Street finished a tough April by closing sharply down on Friday following disappointing results from tech giant Amazon.

"The markets remain skittish regarding an expected aggressive Fed monetary policy tightening cycle as the Central Bank is set to hike rates this week," said analysts at Charles Schwab investment firm.

"Moreover, global sentiment continues to be hampered by the ongoing war in Ukraine, the recent spike in interest rates, the rallying US dollar, and slowing economic activity in China," they said.

Wall Street seesawed in early deals.

Eurozone markets were down sharply in afternoon trading, with Paris almost two percent lower and Frankfurt tumbling 1.3 percent. London was closed for a bank holiday.

Tokyo, Seoul, Mumbai, Manila, Sydney and Wellington all finished lower. Hong Kong and mainland Chinese markets were closed along with several other Asian markets.

Data at the weekend showed Chinese manufacturing activity shrank last month at its fastest pace since the start of the pandemic as the government applies Covid-19 lockdowns in the biggest cities of the world's second biggest economy.

While economic hub Shanghai remains locked down, Beijing has tightened virus controls in the capital, requiring clear Covid tests to visit public spaces.

This followed gloomy economic data in Europe on Friday showing that Russia's invasion of Ukraine was weighing on growth.

The struggles in China, the world's biggest crude importer, led to a drop in prices of the commodity on demand concerns, offsetting worries about tighter supply as the EU eyes a ban on Russian oil over its invasion of Ukraine.

Oil prices fell more than three percent, with Brent North Sea crude, the benchmark international contract, falling to $103.71.

The European Commission is preparing a sanctions text that could be put to the 27 member states as early as Wednesday, sources said, adding that the ban would be introduced over six to eight months to give countries time to diversify their supply.

- Rate hike looms large -

Investors are also looking ahead at the US Federal Reserve's two-day policy meeting, which starts Tuesday and is expected to see the central bank hike borrowing costs by half a point -- the most since 2000 -- to tame soaring consumer prices.

Some analysts are predicting the Fed could even announce a three-quarter-point increase at some point as it battles more than 40-year-high inflation.

With some commentators warning rates could go as high as three percent, there are also worries the Fed could be too heavy handed and tip the US economy into recession.

"The Fed must make up for lost time and act quick and strongly as it faces inflation which keeps surprising as it rises," said Franck Dixmier, head of fixed income at Allianz Global Investors.

"The challenge in executing the normalisation of its monetaryt policy is to ensure a soft landing of the US economy ... while maintaining a dynamic labour market and above all avoiding triggering a recession," he said.

- Key figures at around 1400 GMT -

New York - Dow: UP 0.2 percent at 33,045.26 points

Frankfurt - DAX: DOWN 0.8 percent at 13,987.69

Paris - CAC 40: DOWN 1.5 percent at 6,438.19

EURO STOXX 50: DOWN 1.6 percent at 3,743.16

London - FTSE 100: Closed for a holiday

Tokyo - Nikkei 225: DOWN 0.1 percent at 26,818.53 (close)

Hong Kong - Hang Seng Index: Closed for a holiday

Shanghai - Composite: Closed for a holiday

Euro/dollar: DOWN at $1.0530 from $1.0550 on Friday

Pound/dollar: DOWN at $1.2545 from $1.2578

Euro/pound: UP at 83.91 pence from 83.86 pence

Dollar/yen: UP at 130.03 yen from 129.89 yen

West Texas Intermediate: DOWN 3.5 percent at $101.04 per barrel

Brent North Sea crude: DOWN 3.2 percent at $103.71 per barrel

D.Sawyer--AMWN