-

Inter downed by Roma, AC Milan bounce back with victory in Venice

Inter downed by Roma, AC Milan bounce back with victory in Venice

-

Religious hate has no place in France, says Macron after Muslim killed in mosque

-

Last day of Canada election campaign jolted by Vancouver attack

Last day of Canada election campaign jolted by Vancouver attack

-

Barcelona crush Chelsea to reach women's Champions League final

-

Nine killed as driver plows into Filipino festival in Canada

Nine killed as driver plows into Filipino festival in Canada

-

Germany marks liberation of Bergen-Belsen Nazi camp

-

Hojlund strikes at the death to rescue Man Utd in Bournemouth draw

Hojlund strikes at the death to rescue Man Utd in Bournemouth draw

-

Zelensky says Ukraine not kicked out of Russia's Kursk

-

Zverev, Sabalenka battle through in Madrid Open, Rublev defence over

Zverev, Sabalenka battle through in Madrid Open, Rublev defence over

-

Ruthless Pogacar wins Liege-Bastogne-Liege for third time

-

Bumrah claims 4-22 as Mumbai register five straight IPL wins

Bumrah claims 4-22 as Mumbai register five straight IPL wins

-

No place for racism, hate in France, says Macron after Muslim killed in mosque

-

Greenland leader says Trump's threats disrespectful

Greenland leader says Trump's threats disrespectful

-

Spain's Alex Marquez celebrates maiden MotoGP in home Grand Prix

-

Iran's president visits site of port blast that killed 28

Iran's president visits site of port blast that killed 28

-

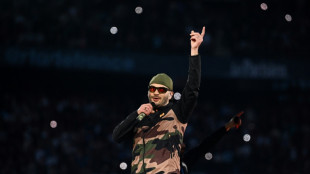

French rapper Jul breaks attendance record at national stadium

-

Gaza ministry says hundreds of war missing confirmed dead, toll at 52,243

Gaza ministry says hundreds of war missing confirmed dead, toll at 52,243

-

Crowds flock to Pope Francis tomb, as eyes turn to conclave

-

'Godfather' director Coppola bags lifetime achievement award

'Godfather' director Coppola bags lifetime achievement award

-

Assefa sets world record, Sawe destroys high class field in London marathon

-

'No excuse': Real Madrid's Rudiger after throwing object at ref

'No excuse': Real Madrid's Rudiger after throwing object at ref

-

Fire blazes day after Iran port blast killed 28, injured 1,000

-

Real Madrid meltdown after third Clasico defeat inevitable end to ugly weekend

Real Madrid meltdown after third Clasico defeat inevitable end to ugly weekend

-

Nine killed as driver plows into Vancouver festival crowd

-

Crumbs! Should French bakeries open on May 1?

Crumbs! Should French bakeries open on May 1?

-

All eyes turn to conclave as Pope Francis tomb opens to public

-

Emotional Penge bounces back from betting ban for first DP Tour win

Emotional Penge bounces back from betting ban for first DP Tour win

-

25 killed, 1,000 injured in huge Iran port blast

-

Greenland PM visits Denmark as Trump threats loom

Greenland PM visits Denmark as Trump threats loom

-

Philippines, US test air defences as China seizes reef

-

25 killed, fires still burning in huge Iran port blast

25 killed, fires still burning in huge Iran port blast

-

India and Pakistan troops exchange fire in Kashmir

-

Eighteen killed, fires still burning in huge Iran port blast

Eighteen killed, fires still burning in huge Iran port blast

-

No handshake at muted India-Pakistan border ceremony

-

Maligned by Trump, White House reporters hold subdued annual gala

Maligned by Trump, White House reporters hold subdued annual gala

-

Austria trials DNA testing to uncover honey fraud

-

Trump trade war pushes firms to consider stockpiling

Trump trade war pushes firms to consider stockpiling

-

D'Backs' Suarez becomes 19th MLB player to hit four homers in one game

-

Continuity or rupture: what direction for the next pope?

Continuity or rupture: what direction for the next pope?

-

Surridge scores four as Nashville smash seven past Chicago

-

Chinese tea hub branches into coffee as tastes change

Chinese tea hub branches into coffee as tastes change

-

Diplomacy likely to trump geography in choice of new pope

-

All eyes turn to conclave after Pope Francis's funeral

All eyes turn to conclave after Pope Francis's funeral

-

Doves, deaths and rations: Papal elections over time

-

Progressive Canadians say social issues blown off election agenda

Progressive Canadians say social issues blown off election agenda

-

Liverpool primed for Premier League title party

-

Buenos Aires bids farewell to Francis with tears, calls to action

Buenos Aires bids farewell to Francis with tears, calls to action

-

Thunder sweep past Grizzlies in NBA playoffs, Cavs on brink

-

Major blast at Iran port kills 14, injures 750

Major blast at Iran port kills 14, injures 750

-

'What we live for': Kounde after winning Barca Copa del Rey final

Asian markets drop as US rout, China worries hit sentiment

Asian markets fell in holiday-thinned trade Monday following another tech-led rout on Wall Street, with focus on the Federal Reserve's expected interest rate hike this week.

Adding to the dour mood was data showing Chinese manufacturing activity shrank last month at its fastest pace since the start of the pandemic owing to Covid lockdowns in the country's biggest cities.

The government's refusal to shift from its zero-Covid policy and strict containment measures is fanning fears about the world's number two economy and key driver of global growth.

Trading floors around the world have been buffeted for months by a perfect storm of crises including China's lockdowns, surging inflation, Fed plans to hike rates, elevated oil prices and the war in Ukraine.

All eyes are on the US central bank's policy meeting this week, which is expected to see it hike borrowing costs by half a point -- the most since 2000 -- and follow it with several more increases before the end of the year.

And now some analysts are predicting it could even announce a three-quarter-point increase at some point as it battles more than 40-year-high inflation.

However, with some commentators warning rates could go as high as three percent, there are also worries the Fed could be too heavy-handed and tip the US economy into recession.

Fed boss Jerome Powell "could cement the view that 50 (basis points) is the new 25, but more worrying for stock pickers, there are lots of QE to unwind", said SPI Asset Management's Stephen Innes, referring to the quantitative easing bond-buying programme used by the Fed to keep rates low.

"So, the question is, how much of the impact of the balance sheet runoff" has been priced in.

The prospect of higher borrowing costs has been compounded by a sharp slowdown in China, with lockdowns in the biggest cities including Shanghai slamming output and snarling supply chains.

Data at the weekend showed the country's manufacturing activity shrank the most it has since February 2020, and the near future does not look promising as officials shut down cinemas and gyms over the May Day holiday.

Beijing on Friday further flagged plans to provide support to the economy and signalled an easing of a painful tech crackdown. But the announcement follows several other recent pledges and traders are yet to see any concrete measures, with most wanting to see a softer approach to controlling the virus.

"We remain deeply concerned about growth," Nomura Holdings economists said in a note.

"Despite the raft of policy measures announced by the Politburo meeting (Friday), we still believe markets should remain focused on the development of the pandemic and the corresponding zero-Covid strategy. All other policies are of secondary importance.”

On equity markets, Tokyo, Sydney, Seoul and Wellington all fell, though Manila ticked up.

Hong Kong and mainland Chinese markets were closed along with those in Taipei, Singapore, Bangkok and Jakarta.

The struggles in China, the world's biggest crude importer, led to a drop in prices of the commodity on demand concerns, offsetting worries about supplies from Russia caused by the Ukraine war.

European Union talks to scale back imports of oil from Russia, following embargoes by the United States and Britain, continue to provide support.

"But further gains will be limited to weaker oil demand prospects from China due to the continued expansion of lockdowns and mass testing across the region," added SPI's Innes.

- Key figures at around 0230 GMT -

Tokyo - Nikkei 225: DOWN 0.5 percent at 26,704.60 (close)

Hong Kong - Hang Seng Index: Closed for a holiday

Shanghai - Composite: Closed for a holiday

Dollar/yen: UP at 130.14 yen from 129.89 yen on Friday

Euro/dollar: DOWN at $1.0523 from $1.0550

Pound/dollar: DOWN at $1.2560 from $1.2578

Euro/pound: DOWN at 83.77 pence from 83.86 pence

West Texas Intermediate: DOWN 1.0 percent at $103.62 per barrel

Brent North Sea crude: DOWN 1.1 percent at $105.95 per barrel

New York - Dow: DOWN 2.8 percent at 32,977.21 (close)

London - FTSE 100: UP 0.5 percent at 7,544.55 (close)

P.Costa--AMWN