-

Zelensky says Ukraine will observe Putin's Easter truce but claims violations

Zelensky says Ukraine will observe Putin's Easter truce but claims violations

-

'Fuming' Watkins fires Villa in bid to prove Emery wrong

-

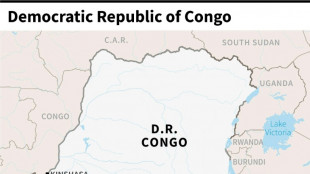

DR Congo boat fire toll revised down to 33

DR Congo boat fire toll revised down to 33

-

England thrash Scotland to set up France Grand Slam showdown

-

Verstappen's Red Bull 'comes alive' to claim record pole in Jeddah

Verstappen's Red Bull 'comes alive' to claim record pole in Jeddah

-

McTominay fires Napoli level with Inter as Conte fuels exit rumours

-

Rajasthan unleash Suryavanshi, 14, as youngest IPL player but lose thriller

Rajasthan unleash Suryavanshi, 14, as youngest IPL player but lose thriller

-

Man City boost top five bid, Aston Villa thrash in-form Newcastle

-

Villa rout Newcastle to rekindle bid to reach Champions League

Villa rout Newcastle to rekindle bid to reach Champions League

-

Dumornay gives Lyon lead over Arsenal in Women's Champions League semis

-

Trans rights supporters rally in London, Edinburgh after landmark ruling

Trans rights supporters rally in London, Edinburgh after landmark ruling

-

'We have to wait': Barca's Flick on Lewandowski injury fear

-

Bordeaux-Begles backups edge Pau to close in on Top 14 summit

Bordeaux-Begles backups edge Pau to close in on Top 14 summit

-

Trans rights supporters rally outside in London, Edinburgh after landmark ruling

-

PSG beat Le Havre to stay on course for unbeaten Ligue 1 season

PSG beat Le Havre to stay on course for unbeaten Ligue 1 season

-

Man City close in on Champions League with Everton late show

-

14-year-old Vaibhav Suryavanshi becomes youngest IPL player

14-year-old Vaibhav Suryavanshi becomes youngest IPL player

-

Barca make stunning comeback to beat Celta Vigo in Liga thriller

-

Zverev sets up birthday bash with Shelton in Munich

Zverev sets up birthday bash with Shelton in Munich

-

Man City boost top five bid, Southampton snatch late leveller

-

US Supreme Court intervenes to pause Trump deportations

US Supreme Court intervenes to pause Trump deportations

-

Alcaraz and Rune race into Barcelona final

-

US, Iran to hold more nuclear talks after latest round

US, Iran to hold more nuclear talks after latest round

-

Man City close in on Champions League thanks to Everton late show

-

Bayern close in on Bundesliga title with Heidenheim thumping

Bayern close in on Bundesliga title with Heidenheim thumping

-

Tunisia opposition figures get jail terms in mass trial

-

Putin announces 'Easter truce' in Ukraine

Putin announces 'Easter truce' in Ukraine

-

McLaren duo in ominous show of force in Saudi final practice

-

Afghan PM condemns Pakistan's 'unilateral' deportations

Afghan PM condemns Pakistan's 'unilateral' deportations

-

Iran says to hold more nuclear talks with US after latest round

-

Comeback queen Liu leads US to World Team Trophy win

Comeback queen Liu leads US to World Team Trophy win

-

Buttler fires Gujarat to top of IPL table in intense heat

-

Unimpressive France stay on course for Grand Slam showdown

Unimpressive France stay on course for Grand Slam showdown

-

Shelton fights past Cerundolo to reach Munich ATP final

-

Vance and Francis: divergent values but shared ideas

Vance and Francis: divergent values but shared ideas

-

Iran, US conclude second round of high-stakes nuclear talks in Rome

-

Dumornay gives Lyon first leg lead over Arsenal in women's Champions League semis

Dumornay gives Lyon first leg lead over Arsenal in women's Champions League semis

-

Trans rights supporters rally outside UK parliament after landmark ruling

-

Rune destroys Khachanov to reach Barcelona Open final

Rune destroys Khachanov to reach Barcelona Open final

-

From Messi to Trump, AI action figures are the rage

-

Vance discusses migration during Vatican meeting with pope's right-hand man

Vance discusses migration during Vatican meeting with pope's right-hand man

-

Afghan FM tells Pakistan's top diplomat deportations are 'disappointment'

-

British cycling icon Hoy and wife provide solace for each other's ills

British cycling icon Hoy and wife provide solace for each other's ills

-

Money, power, violence in high-stakes Philippine elections

-

Iran, US hold second round of high-stakes nuclear talks in Rome

Iran, US hold second round of high-stakes nuclear talks in Rome

-

Japanese warships dock at Cambodia's Chinese-renovated naval base

-

US Supreme Court pauses deportation of Venezuelans from Texas

US Supreme Court pauses deportation of Venezuelans from Texas

-

Pakistan foreign minister arrives in Kabul as Afghan deportations rise

-

Heat and Grizzlies take final spots in the NBA playoffs

Heat and Grizzlies take final spots in the NBA playoffs

-

Iran, US to hold second round of high-stakes nuclear talks in Rome

Stocks rebound, oil falls in volatile trading

US and European stocks surged on Wednesday while oil fell after days of market turmoil over Russia's invasion of Ukraine.

Wall Street opened sharply higher, with the S&P 500 and tech-heavy Nasdaq above two percent.

In Europe, Frankfurt's benchmark DAX index soared by more than six percent and the Paris CAC 40 jumped more than five percent in afternoon trading.

London's FTSE 100 was up more than two percent, despite losses earlier in Asia.

"European markets rebound as investors fish for bargains," summarised Russ Mould, investment director at AJ Bell.

Other analysts said investors were hopeful that a diplomatic solution could be found in the conflict in Ukraine.

"Given the state of things in the world, one can easily extrapolate from these indications that market participants are feeling better about the Russia-Ukraine situation," said Briefing.com analyst Patrick O'Hare.

"Market participants should know by now, of course, that talk from Russia is cheap," O'Hare said.

OANDA analyst Craig Erlam told AFP the surge in European stocks is likey a "dead cat bounce" -- a market term referring to a rebound that briefly interrupts a prolonged downturn.

"We appear to be seeing a temporary corrective move," Erlam said, predicting the rebound would not last as Russia continues to wage war on Ukraine.

"The invasion is still happening, sanctions are still being imposed and oil prices are still high," he noted.

"None of that is conducive with a sustainable stock market recovery."

Major Asian markets declined Wednesday as investors dwelled on Washington's Russian oil and gas ban.

EU nations, which receive roughly 40 percent of their gas imports and one quarter of their oil from Russia, opted to set a goal of cutting their Russian gas imports by two-thirds.

Brent crude fell five percent to around $121 per barrel, still a high figure one day after the United States and Britain moved to ban imports of Russian crude as part of Western sanctions on Moscow.

- $240 oil? -

Brent had spiked to $139 on Monday -- about $8 short of an all-time record -- in expectation of the US embargo.

European natural gas prices languished far below this week's record peak, despite fears over the region's reliance on Russian gas.

Europe gas reference Dutch TTF slid 28 percent to 154.53 euros per megawatt hour, having leapt at the start of this week to an all-time high at 345 euros.

Oil prices could rocket further if more nations slap sanctions on Russian crude, according to Bjornar Tonhaugen, head of oil markets at Rystad Energy.

"Oil prices could hit $240 per barrel this summer in the worst-case scenario if Western countries roll out sanctions on Russia's oil exports en masse," Tonhaugen said.

"Market volatility is at an all-time high, with ... the expectation that supply will further tighten due to restrictive sanctions on Russian energy from the West."

The crisis has also fuelled fears that the fragile global recovery from Covid-19 will be replaced by a period of stagflation, in which inflation surges and economies flatline or contract.

Haven investment gold declined Wednesday, one day after hitting a near-record $2,070 per ounce -- the highest since August 2020.

- Key figures around 1440 GMT -

New York - Dow: UP 1.9 percent at 33,264.40 points

Frankfurt - DAX: UP 6.1 percent at 13,608.30

Paris - CAC 40: UP 5.6 percent at 6,298.69

London - FTSE 100: UP 2.2 percent at 7,117.80

EURO STOXX 50: UP 5.8 percent at 3,708.75

Tokyo - Nikkei 225: DOWN 0.3 percent at 24,717.53 (close)

Hong Kong - Hang Seng Index: DOWN 0.7 percent at 20,627.71 (close)

Shanghai - Composite: DOWN 1.1 percent at 3,256.39 (close)

Brent North Sea crude: DOWN 5.0 percent at $121.62 per barrel

West Texas Intermediate: DOWN 4.8 percent at $117.76

Euro/dollar: UP at $1.1041 from $1.0899 Tuesday

Pound/dollar: UP at $1.3173 from $1.3104

Euro/pound: UP at 83.79 pence from 83.18 pence

Dollar/yen: UP at 115.72 yen from 115.67 yen

burs-rfj-lth/rl

M.Thompson--AMWN