-

Zelensky slams 'weak' US reply to Russian strike on his hometown

Zelensky slams 'weak' US reply to Russian strike on his hometown

-

Musiala hamstring tear compounds Bayern's injury crisis

-

Selfies, goals and cheers at South Africa's grannies World Cup

Selfies, goals and cheers at South Africa's grannies World Cup

-

Tsunoda frustrated with 15th in Red Bull qualifying debut

-

Rain forecast adds new element to combustible Japanese GP

Rain forecast adds new element to combustible Japanese GP

-

Ukraine mourns 18 killed in Russian missile strike

-

Germany's Mueller to leave Bayern Munich after 25 years

Germany's Mueller to leave Bayern Munich after 25 years

-

India's Modi clinches defence, energy deals in Sri Lanka

-

Verstappen snatches 'special' pole for Japan GP with lap record

Verstappen snatches 'special' pole for Japan GP with lap record

-

Cambodia hails opening of naval base renovated by China

-

Verstappen snatches 'insane' pole for Japan GP in track record

Verstappen snatches 'insane' pole for Japan GP in track record

-

Thousands rally for South Korea's impeached ex-president Yoon

-

New Zealand hammer Pakistan by 43 runs to sweep ODI series 3-0

New Zealand hammer Pakistan by 43 runs to sweep ODI series 3-0

-

Myanmar quake death toll passes 3,300: state media

-

India's Modi in Sri Lanka for defence and energy deals

India's Modi in Sri Lanka for defence and energy deals

-

'No one to return to': Afghans fear Pakistan deportation

-

Fractious Republicans seek unity over Trump tax cuts

Fractious Republicans seek unity over Trump tax cuts

-

America's passion for tariffs rarely pays off, economists warn

-

Trump's global tariff takes effect in dramatic US trade shift

Trump's global tariff takes effect in dramatic US trade shift

-

North Korea's Kim fires new sniper rifle while visiting troops

-

Norris fastest in McLaren 1-2 as fires again disrupt Japan GP practice

Norris fastest in McLaren 1-2 as fires again disrupt Japan GP practice

-

Vital European defence startups still facing hurdles

-

'I don't have a voice in my head': Life with no inner monologue

'I don't have a voice in my head': Life with no inner monologue

-

Pakistan chasing 265 to win shortened third New Zealand ODI

-

US soybeans, energy: Who is hit by China's tariff retaliation?

US soybeans, energy: Who is hit by China's tariff retaliation?

-

Green, Sengun lift Rockets over Thunder, Celtics clinch record

-

Ariya downs defending champ Korda to advance at LPGA Match Play

Ariya downs defending champ Korda to advance at LPGA Match Play

-

Ovechkin ties Gretzky's all-time record of 894 NHL goals

-

Under-pressure Doohan vows to learn from Japanese GP smash

Under-pressure Doohan vows to learn from Japanese GP smash

-

Harman goes four clear at Texas Open

-

McLaughlin-Levrone, Thomas cruise to wins at opening Grand Slam Track

McLaughlin-Levrone, Thomas cruise to wins at opening Grand Slam Track

-

Russian strike kills 18 in Ukrainian president's home city

-

US cardinal defrocked for sex abuse dies at 94

US cardinal defrocked for sex abuse dies at 94

-

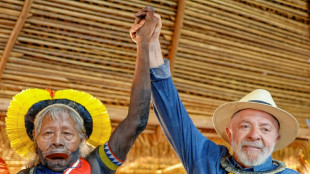

Lula admits 'still a lot to do' for Indigenous Brazilians

-

England, Germany and Spain on mark in women's Nations League

England, Germany and Spain on mark in women's Nations League

-

Bayern's Musiala to miss Inter first leg with injury

-

Judge orders return to US of Salvadoran man deported in error

Judge orders return to US of Salvadoran man deported in error

-

'Class' Freeman eases Northampton past Clermont and into Champions Cup quarters

-

Amadou of Malian blind music duo dies aged 70

Amadou of Malian blind music duo dies aged 70

-

Freeman hat-trick eases Northampton into Champions Cup quarters with Clermont win

-

Defiant Trump dismisses stock market's tariff plunge

Defiant Trump dismisses stock market's tariff plunge

-

Musiala injury sours Bayern win at Augsburg

-

Peruvian schoolkids living in fear of extortion gangs

Peruvian schoolkids living in fear of extortion gangs

-

Top seed Pegula rallies to oust defending champ Collins in Charleston

-

Amadou of Malian blind music duo Amadou & Mariam dies aged 70

Amadou of Malian blind music duo Amadou & Mariam dies aged 70

-

California to defy Trump's tariffs to allay global trade fears

-

Bayern's Musiala subbed off with injury days out from Inter clash

Bayern's Musiala subbed off with injury days out from Inter clash

-

Russian strike kills 16 in Ukraine leader's home city, children among dead

-

NBA fines Grizzlies' Morant for imaginary gun gesture

NBA fines Grizzlies' Morant for imaginary gun gesture

-

Trump tariffs offer opportunity for China

| JRI | -7.19% | 11.96 | $ | |

| BCC | 0.85% | 95.44 | $ | |

| SCS | -0.56% | 10.68 | $ | |

| BCE | 0.22% | 22.71 | $ | |

| GSK | -6.79% | 36.53 | $ | |

| CMSC | 0.13% | 22.29 | $ | |

| AZN | -7.98% | 68.46 | $ | |

| CMSD | 0.7% | 22.83 | $ | |

| RIO | -6.88% | 54.67 | $ | |

| NGG | -5.25% | 65.93 | $ | |

| RELX | -6.81% | 48.16 | $ | |

| BTI | -5.17% | 39.86 | $ | |

| RYCEF | -18.79% | 8.25 | $ | |

| VOD | -10.24% | 8.5 | $ | |

| BP | -10.43% | 28.38 | $ | |

| RBGPF | 100% | 69.02 | $ |

Markets mixed as Ukraine fears return, oil extends losses

Equity markets were mixed Friday following a steep drop on Wall Street fuelled by renewed fears that Russia will soon invade Ukraine, adding to long-running angst about the Federal Reserve's plans to hike interest rates.

While tensions in Eastern Europe continue to absorb most of the attention, oil extended losses as traders grow increasingly optimistic of a deal on Iran's nuclear programme that could see it restart crude exports.

After a disappointing start to the year, investors are still to get their mojo back as they contend with a range of risk-off issues including Russia-Ukraine, soaring inflation, imminent rate hikes, supply chain snarls and China's Covid outbreaks.

And analysts warned the uncertainty will likely last for some time.

For now eyes are on the Russia-Ukraine border after Joe Biden warned Vladimir Putin's forces could attack any time soon.

There had been optimism the crisis had passed after Moscow said troops were withdrawing but Western powers said there is no sign that is the case, while accusing it of preparing a "false flag operation" as a pretext for invasion.

Putin denies he is planning any incursion but investors remain on edge as observers warn such a move could have wide-ranging implications for the world economic recovery, particularly with Russia being a major energy exporter.

The mood was given a little help when Washington said Thursday that US Secretary of State Antony Blinken and his Russian counterpart Sergei Lavrov will meet next week if there is no invasion.

All three main US indexes ended well down, with the Nasdaq almost three percent off, though Asia fared slightly better.

Tokyo, Hong Kong, Sydney, Singapore, Taipei, Wellington and Manila slipped, though Shanghai, Mumbai, Jakarta and Bangkok edged up slightly. Seoul was flat.

London opened higher after data showed a bounce in UK retail sales, while Paris and Frankfurt also rose.

"For now, simmering frictions in the Ukraine are keeping markets nervous and after (Thursday's) glimpses of a risk of tone, news over the past 24 hours have turned sentiment decisively negative," said National Australia Bank's Rodrigo Catril.

Still, oil prices remain in their downward spiral, dropping again Friday after a two percent drop Thursday as it emerged that Tehran and world powers were edging closer to an agreement on its nuclear programme.

A deal could see the return of hundreds of thousands of barrels of crude to the global market, providing a much-needed boost to supplies just as demand surges and uncertainty reigns in Europe. Both main contracts remain around their 2014 levels, however, and analysts expect them to break $100 this year.

The crisis in the Ukraine comes as traders continue to contend with the prospect of interest rates rising sharply this year as the Fed tries to rein in inflation at a 40-year high.

After spending most of last year saying surging prices would be transitory, the US central bank is now in full-on firefighting mode but commentators fear it may be behind the curve and will have to act more stringently than previously thought.

While minutes from January's meeting appeared to ease worries of a big 50 basis point rise in March, there is an expectation it could still lift borrowing costs as many as seven times this year. As early as late 2021 markets were pricing in three.

The prospect of higher costs has dealt a blow to the two-year pandemic rally and while the economy continues to recover, observers warn the uncertainty will not go away soon.

"We've been calling for a long time for increased volatility, but when it finally comes it's nerve wracking for everybody," Carol Schleif, at BMO Family Office, told Bloomberg TV.

"It's important to remember that the Fed isn't going to start pulling back its support for the economy -- either in terms of the balance sheet purchases or interest-rate raises -- if they weren't trying to cool a very strong economy."

- Key figures around 0820 GMT -

Tokyo - Nikkei 225: DOWN 0.4 percent at 27,122.07 (close)

Hong Kong - Hang Seng Index: DOWN 1.9 percent at 24,327.71 (close)

Shanghai - Composite: DOWN 0.7 percent at 3,490.76 (close)

London - FTSE 100: UP 0.3 percent at 7,559.01

West Texas Intermediate: DOWN 0.9 percent at $90.97 per barrel

Brent North Sea crude: DOWN 0.7 percent at $92.31 per barrel

Euro/dollar: UP at $1.1368 from $1.1366 late Wednesday

Pound/dollar: UP at $1.3626 from $1.3615

Euro/pound: DOWN at 83.43 pence from 83.44 pence

Dollar/yen: DOWN at 115.13 yen from 114.91 yen

New York - Dow: DOWN 1.8 percent at 34,312.03 (close)

P.Silva--AMWN