-

Trump's global tariff takes effect in dramatic US trade shift

Trump's global tariff takes effect in dramatic US trade shift

-

North Korea's Kim fires new sniper rifle while visiting troops

-

Norris fastest in McLaren 1-2 as fires again disrupt Japan GP practice

Norris fastest in McLaren 1-2 as fires again disrupt Japan GP practice

-

Vital European defence startups still facing hurdles

-

'I don't have a voice in my head': Life with no inner monologue

'I don't have a voice in my head': Life with no inner monologue

-

Pakistan chasing 265 to win shortened third New Zealand ODI

-

US soybeans, energy: Who is hit by China's tariff retaliation?

US soybeans, energy: Who is hit by China's tariff retaliation?

-

Green, Sengun lift Rockets over Thunder, Celtics clinch record

-

Ariya downs defending champ Korda to advance at LPGA Match Play

Ariya downs defending champ Korda to advance at LPGA Match Play

-

Ovechkin ties Gretzky's all-time record of 894 NHL goals

-

Under-pressure Doohan vows to learn from Japanese GP smash

Under-pressure Doohan vows to learn from Japanese GP smash

-

Harman goes four clear at Texas Open

-

McLaughlin-Levrone, Thomas cruise to wins at opening Grand Slam Track

McLaughlin-Levrone, Thomas cruise to wins at opening Grand Slam Track

-

Russian strike kills 18 in Ukrainian president's home city

-

US cardinal defrocked for sex abuse dies at 94

US cardinal defrocked for sex abuse dies at 94

-

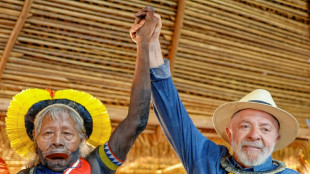

Lula admits 'still a lot to do' for Indigenous Brazilians

-

England, Germany and Spain on mark in women's Nations League

England, Germany and Spain on mark in women's Nations League

-

Bayern's Musiala to miss Inter first leg with injury

-

Judge orders return to US of Salvadoran man deported in error

Judge orders return to US of Salvadoran man deported in error

-

'Class' Freeman eases Northampton past Clermont and into Champions Cup quarters

-

Amadou of Malian blind music duo dies aged 70

Amadou of Malian blind music duo dies aged 70

-

Freeman hat-trick eases Northampton into Champions Cup quarters with Clermont win

-

Defiant Trump dismisses stock market's tariff plunge

Defiant Trump dismisses stock market's tariff plunge

-

Musiala injury sours Bayern win at Augsburg

-

Peruvian schoolkids living in fear of extortion gangs

Peruvian schoolkids living in fear of extortion gangs

-

Top seed Pegula rallies to oust defending champ Collins in Charleston

-

Amadou of Malian blind music duo Amadou & Mariam dies aged 70

Amadou of Malian blind music duo Amadou & Mariam dies aged 70

-

California to defy Trump's tariffs to allay global trade fears

-

Bayern's Musiala subbed off with injury days out from Inter clash

Bayern's Musiala subbed off with injury days out from Inter clash

-

Russian strike kills 16 in Ukraine leader's home city, children among dead

-

NBA fines Grizzlies' Morant for imaginary gun gesture

NBA fines Grizzlies' Morant for imaginary gun gesture

-

Trump tariffs offer opportunity for China

-

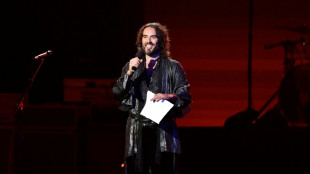

UK comedian Russell Brand charged with rape

UK comedian Russell Brand charged with rape

-

Marsh, Markram help Lucknow edge Mumbai in IPL

-

Trump gives TikTok extra 75 days to find buyer

Trump gives TikTok extra 75 days to find buyer

-

Israel attorney general accuses PM of 'conflict of interest' in security chief dismissal

-

Emery glad to see Rashford make landmark appearance

Emery glad to see Rashford make landmark appearance

-

Sean 'Diddy' Combs faces more charges ahead of criminal trial

-

Russian missile strike kills 14 in Ukraine leader's home city

Russian missile strike kills 14 in Ukraine leader's home city

-

Trump's tariff Big Bang puts global economy under threat

-

I Am Maximus backed for National as Mullins hot streak continues

I Am Maximus backed for National as Mullins hot streak continues

-

2014 World Cup winner Hummels to retire at season's end

-

Intercommunal violence kills dozens in central Nigeria

Intercommunal violence kills dozens in central Nigeria

-

Nigerian, S. African music saw 'extraordinary growth' in 2024: Spotify

-

Russell Brand: From Hollywood star to rape suspect

Russell Brand: From Hollywood star to rape suspect

-

France soccer star Mbappe unveiled in London... in waxwork form

-

Trump goads China as global trade war escalates

Trump goads China as global trade war escalates

-

Israel expands Gaza ground offensive, hits Hamas in Lebanon

-

TikTok faces new US deadline to ditch Chinese owner

TikTok faces new US deadline to ditch Chinese owner

-

US Fed Chair warns tariffs will likely raise inflation, cool growth

| RBGPF | 100% | 69.02 | $ | |

| JRI | -7.19% | 11.96 | $ | |

| SCS | -0.56% | 10.68 | $ | |

| BCE | 0.22% | 22.71 | $ | |

| GSK | -6.79% | 36.53 | $ | |

| RELX | -6.81% | 48.16 | $ | |

| CMSD | 0.7% | 22.83 | $ | |

| BCC | 0.85% | 95.44 | $ | |

| RYCEF | -18.79% | 8.25 | $ | |

| CMSC | 0.13% | 22.29 | $ | |

| AZN | -7.98% | 68.46 | $ | |

| BTI | -5.17% | 39.86 | $ | |

| NGG | -5.25% | 65.93 | $ | |

| VOD | -10.24% | 8.5 | $ | |

| RIO | -6.88% | 54.67 | $ | |

| BP | -10.43% | 28.38 | $ |

Most Asian markets up as traders eye Ukraine, Fed eases rate fears

Asian markets mostly rose Thursday as investors assess the situation in Ukraine after the West said Russia had not started withdrawing troops from its border, while minutes from the Federal Reserve's January meeting eased concerns it was set to hike rates sharply.

Meanwhile, oil prices tumbled more than two percent on further signs of a breakthrough in Iran nuclear talks.

Global equities were sent plunging and crude surged after a top US official said Russia could invade imminently, but Moscow appeared to soothe those fears Tuesday by saying it had started withdrawing some soldiers.

The announcement and an apparently more conciliatory tone from the Kremlin provided a much-needed lift to markets.

However, while the general mood on trading floors was upbeat that tensions had eased, Washington dismissed the Russian claims and accused it of sending more soldiers, adding that there were "indications they could launch a false pretext at any moment to justify an invasion".

That came after NATO joined Ukraine in saying there was no sign of any retreat, while chief Jens Stoltenberg said tensions in the east with Russia were "the new normal in Europe".

The geopolitical uncertainty jolted US markets Wednesday, though they enjoyed a late rally from intraday lows after the Fed minutes provided no surprises.

The release had been keenly awaited as the bank tries to walk a fine line of reining in four-decade-high inflation while not knocking the healthy economic recovery off track.

Expectations are for officials to hike interest rates in March and then several times again before the end of the year, but there has been much debate about how much its initial move will be and how many more there will be.

It has also said it will start to offload the bonds it has on its balance sheet, which are also helping to keep borrowing costs down.

Some have warned of a 50-basis-point hike at first -- twice what it usually announced -- and as many as six or seven more before January.

"The Fed's Minutes showed interest rate hikes are coming and that they are readying for a significant reduction in the size of the balance sheet," said OANDA's Edward Moya.

"Investors that were worried that the Fed would be pressured to begin the balance sheet runoff fairly soon could breathe a sigh of relief.

"The Fed sees inflation pressures broadening deep into the year but they would not be rushed into making any decisions at a faster tightening pace."

National Australia Bank's Ray Attrill added that the minutes did not "appear to give an obvious succour to the idea of the Fed kicking off the tightening cycle with a 50-point move".

And Minneapolis Fed boss Neel Kashkari said aggressive rate hikes would risk a recession, adding the bank should "not overdo it".

In early trade, Hong Kong, Shanghai, Sydney, Seoul, Wellington, Taipei and Manila all rose, though Tokyo and Jakarta dipped.

On oil markets both main contracts tanked on growing hopes that talks on the Iran nuclear deal could soon bear fruit.

Tehran's top negotiator Ali Bagheri Kani said an agreement was "closer than ever" and while US and French officials were a little more circumspect, the comments raised the possibility that Iranian crude could return to the market soon.

"Positive developments in the US-Iran nuclear negotiations are helping to calm oil prices," Claudio Galimberti of Rystad Energy said.

"Although not a done deal yet, prices are sliding on news of progress and broad consensus in the talks as it could ultimately see up to 900,000 barrels a day of crude added to the market by December this year."

The developments offset uncertainty over the Russia-Ukraine crisis, which had helped propel prices towards $100 for the first time in more than seven years, and comes as demand continues to improve as the world economy reopens.

Data showed US stockpiles at their lowest since 2018.

- Key figures around 0240 GMT -

Tokyo - Nikkei 225: DOWN 0.2 percent at 27,395.85 (break)

Hong Kong - Hang Seng Index: UP 0.3 percent at 24,783.36

Shanghai - Composite: UP 0.1 percent at 3,470.23

West Texas Intermediate: DOWN 2.3 percent at $91.50 per barrel

Brent North Sea crude: DOWN 2.1 percent at $92.78 per barrel

Euro/dollar: UP at $1.1381 from $1.1377 late Wednesday

Pound/dollar: UP at $1.3589 from $1.3584

Euro/pound: UP at 83.75 pence from 83.72 pence

Dollar/yen: UP at 115.49 yen from 115.46 yen

New York - Dow: DOWN 0.2 percent at 34,934.27 (close)

London - FTSE 100: DOWN less than 0.1 percent at 7,603.78 (close)

A.Rodriguezv--AMWN