-

Ecuador vice president says Noboa seeking her 'banishment'

Ecuador vice president says Noboa seeking her 'banishment'

-

Leicester boss Van Nistelrooy aware of 'bigger picture' as Liverpool await

-

Syria authorities say armed groups have agreed to disband

Syria authorities say armed groups have agreed to disband

-

Maresca expects Man City to be in title hunt as he downplays Chelsea's chancs

-

Man Utd boss Amorim vows to stay on course despite Rashford row

Man Utd boss Amorim vows to stay on course despite Rashford row

-

South Africa opt for all-pace attack against Pakistan

-

Guardiola adamant Man City slump not all about Haaland

Guardiola adamant Man City slump not all about Haaland

-

Global stocks mostly higher in thin pre-Christmas trade

-

Bethlehem marks sombre Christmas under shadow of war

Bethlehem marks sombre Christmas under shadow of war

-

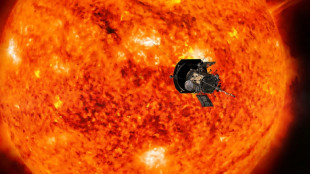

NASA probe makes closest ever pass by the Sun

-

11 killed in blast at Turkey explosives plant

11 killed in blast at Turkey explosives plant

-

Indonesia considers parole for ex-terror chiefs: official

-

Global stocks mostly rise in thin pre-Christmas trade

Global stocks mostly rise in thin pre-Christmas trade

-

Postecoglou says Spurs 'need to reinforce' in transfer window

-

Le Pen says days of new French govt numbered

Le Pen says days of new French govt numbered

-

Global stocks mostly rise after US tech rally

-

Villa boss Emery set for 'very difficult' clash with Newcastle

Villa boss Emery set for 'very difficult' clash with Newcastle

-

Investors swoop in to save German flying taxi startup

-

How Finnish youth learn to spot disinformation

How Finnish youth learn to spot disinformation

-

South Korean opposition postpones decision to impeach acting president

-

12 killed in blast at Turkey explosives plant

12 killed in blast at Turkey explosives plant

-

Panama leaders past and present reject Trump's threat of Canal takeover

-

Hong Kong police issue fresh bounties for activists overseas

Hong Kong police issue fresh bounties for activists overseas

-

Saving the mysterious African manatee at Cameroon hotspot

-

India consider second spinner for Boxing Day Test

India consider second spinner for Boxing Day Test

-

London wall illuminates Covid's enduring pain at Christmas

-

Poyet appointed manager at South Korea's Jeonbuk

Poyet appointed manager at South Korea's Jeonbuk

-

South Korea's opposition vows to impeach acting president

-

The tsunami detection buoys safeguarding lives in Thailand

The tsunami detection buoys safeguarding lives in Thailand

-

Teen Konstas to open for Australia in Boxing Day India Test

-

Asian stocks mostly up after US tech rally

Asian stocks mostly up after US tech rally

-

US panel could not reach consensus on US-Japan steel deal: Nippon

-

The real-life violence that inspired South Korea's 'Squid Game'

The real-life violence that inspired South Korea's 'Squid Game'

-

Blogs to Bluesky: social media shifts responses after 2004 tsunami

-

Tennis power couple de Minaur and Boulter get engaged

Tennis power couple de Minaur and Boulter get engaged

-

Supermaxi yachts eye record in gruelling Sydney-Hobart race

-

Hawaii's Kilauea volcano erupts, spewing columns of lava

Hawaii's Kilauea volcano erupts, spewing columns of lava

-

The Melrose Group Demands Hank Payments Management Facilitate Requisitioned Shareholder Meetings

-

MedMira receives Health Canada approval for its Multiplo(R) Rapid (TP/HIV) Test for Syphilis and HIV

MedMira receives Health Canada approval for its Multiplo(R) Rapid (TP/HIV) Test for Syphilis and HIV

-

The Glimpse Group Regains Compliance with NASDAQ

-

Sokoman Minerals Completes Phase 1 Diamond Drilling Program Fleur de Lys Gold Project, NW Newfoundland

Sokoman Minerals Completes Phase 1 Diamond Drilling Program Fleur de Lys Gold Project, NW Newfoundland

-

Canadian Government Provides C$100 Million Financing LOI to Green Technology Metals in Support of Electric Royalties' Flagship Lithium Royalty Asset in Ontario

-

Sendero Resources Announces First Tranche Closing of Its Non-Brokered Private Placement

Sendero Resources Announces First Tranche Closing of Its Non-Brokered Private Placement

-

EVSX Completes Installation of Multi Chemistry Line

-

InterContinental Hotels Group PLC Announces Transaction in Own Shares - December 24

InterContinental Hotels Group PLC Announces Transaction in Own Shares - December 24

-

El Salvador Congress votes to end ban on metal mining

-

Five things to know about Panama Canal, in Trump's sights

Five things to know about Panama Canal, in Trump's sights

-

NBA fines Minnesota guard Edwards $75,000 for outburst

-

Haitians massacred for practicing voodoo were abducted, hacked to death: UN

Haitians massacred for practicing voodoo were abducted, hacked to death: UN

-

Inter beat Como to keep in touch with leaders Atalanta

| RIO | -0.11% | 59.165 | $ | |

| RBGPF | -1.17% | 59.8 | $ | |

| CMSC | -0.68% | 23.74 | $ | |

| SCS | 0.55% | 11.715 | $ | |

| NGG | -0.32% | 58.83 | $ | |

| RELX | 0.53% | 45.835 | $ | |

| RYCEF | 0% | 7.25 | $ | |

| GSK | -0.37% | 33.935 | $ | |

| BCE | 0.34% | 22.919 | $ | |

| VOD | 0.71% | 8.43 | $ | |

| AZN | -0.5% | 66.3 | $ | |

| BP | 0.18% | 28.801 | $ | |

| CMSD | -0.51% | 23.43 | $ | |

| JRI | 0.74% | 12.19 | $ | |

| BCC | 0.91% | 123.36 | $ | |

| BTI | -0.01% | 36.215 | $ |

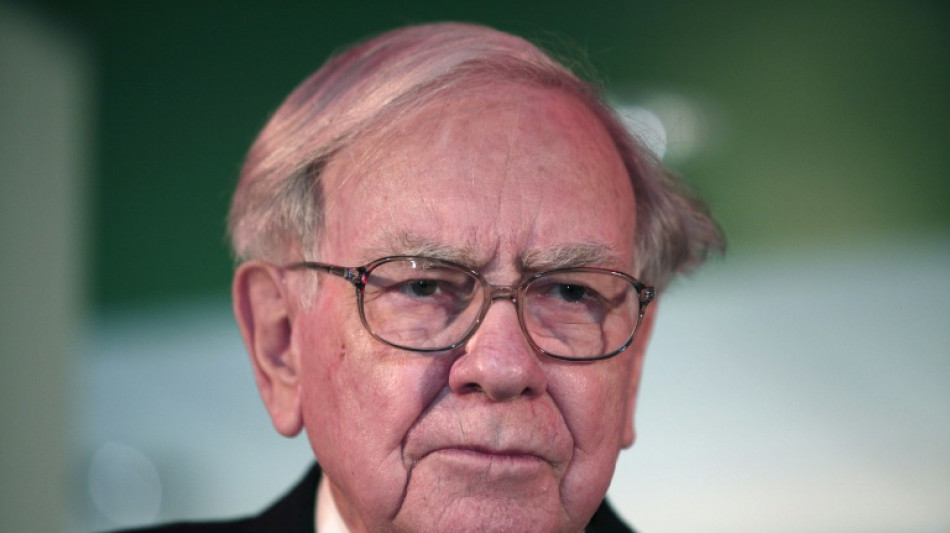

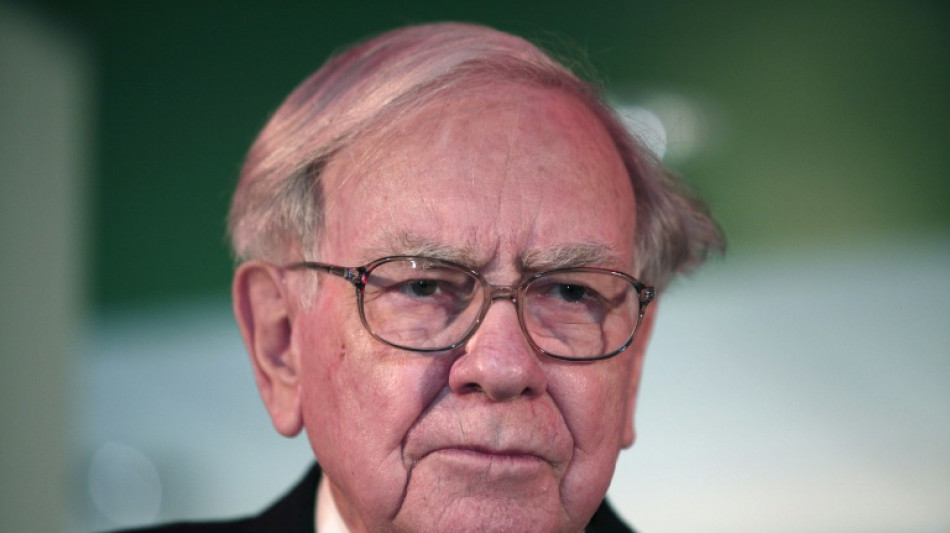

Chinese electric carmaker BYD plummets after Buffett sale

Shares in Chinese electric carmaker BYD plunged on Wednesday after its largest backer, Warren Buffett's Berkshire Hathaway, reduced its stake amid speculation of a potential exit.

Hong Kong-listed shares of the EV manufacturer fell by as much as 13 percent, a day after a regulatory filing showed Berkshire reducing its holdings from 20.04 percent to 19.92 percent.

It ended the day 7.9 percent lower, while its Shenzhen-listed stock finished 7.4 percent down.

The sale of around 1.33 million securities was valued at approximately $47 million.

Electronic carmakers in China were left scrambling after the government response to coronavirus outbreaks this year disrupted supply chains, with plants across the country suspending production for weeks.

While the Shenzhen-based firm reported strong earnings this week, rumours have swelled that the legendary American investor behind Berkshire may be looking to offload his entire stake.

Berkshire first bought 225 million BYD shares in 2008 and has been the biggest stakeholder in the company, now China's largest EV manufacturer and a major rival to Tesla.

Berkshire sold around 6.3 million shares in BYD between June 30 and August 24, Bloomberg News reported, citing filings from both companies.

BYD told Chinese media that there was "no need to over-interpret" the stake sale, adding that the company was operating normally and had no major moves to disclose.

On Monday, the Shenzhen-based company reported that net income had tripled to 3.6 billion yuan ($521 million) from a year earlier, overcoming supply chain disruptions caused by the pandemic and China's economic slowdown.

BYD said in a filing that it achieved record output and sales in the first half, with revenue jumping 66 percent year-on-year to 151 billion yuan.

The carmaker added that it was leading the domestic new energy vehicle sector with 24.7 percent market share in the first six months, citing data from the China Automobile Association.

"Investors could interpret this as the beginning of Berkshire closing its position in BYD," Bridget McCarthy, a market research analyst at hedge fund Snow Bull Capital, told Bloomberg.

"I would expect arguably one of the world's greatest investors to take some profits after over a decade, especially on his highest-returning investment, percentage-wise."

Some analysts have argued that BYD's strong fundamentals, coupled with Beijing's push to develop its domestic green energy sector, means the company still has room to grow.

"Despite the short term share price struggle, there is value to invest in the company with its solid business model in the medium to long term," Andy Wong, fund manager at LW Asset Management Advisors in Hong Kong, said.

Last month, a stake identical to the size of Berkshire's holdings was entered into Hong Kong's Central Clearing and Settlement System.

Hong Kong requires anyone who owns more than five percent of a listed company to notify the stock exchange when initiating a trade that changes the stake percentage into the next whole number.

F.Schneider--AMWN