-

Trump's global tariff takes effect in dramatic US trade shift

Trump's global tariff takes effect in dramatic US trade shift

-

North Korea's Kim fires new sniper rifle while visiting troops

-

Norris fastest in McLaren 1-2 as fires again disrupt Japan GP practice

Norris fastest in McLaren 1-2 as fires again disrupt Japan GP practice

-

Vital European defence startups still facing hurdles

-

'I don't have a voice in my head': Life with no inner monologue

'I don't have a voice in my head': Life with no inner monologue

-

Pakistan chasing 265 to win shortened third New Zealand ODI

-

US soybeans, energy: Who is hit by China's tariff retaliation?

US soybeans, energy: Who is hit by China's tariff retaliation?

-

Green, Sengun lift Rockets over Thunder, Celtics clinch record

-

Ariya downs defending champ Korda to advance at LPGA Match Play

Ariya downs defending champ Korda to advance at LPGA Match Play

-

Ovechkin ties Gretzky's all-time record of 894 NHL goals

-

Under-pressure Doohan vows to learn from Japanese GP smash

Under-pressure Doohan vows to learn from Japanese GP smash

-

Harman goes four clear at Texas Open

-

McLaughlin-Levrone, Thomas cruise to wins at opening Grand Slam Track

McLaughlin-Levrone, Thomas cruise to wins at opening Grand Slam Track

-

Russian strike kills 18 in Ukrainian president's home city

-

US cardinal defrocked for sex abuse dies at 94

US cardinal defrocked for sex abuse dies at 94

-

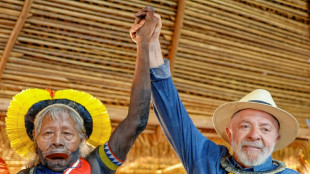

Lula admits 'still a lot to do' for Indigenous Brazilians

-

England, Germany and Spain on mark in women's Nations League

England, Germany and Spain on mark in women's Nations League

-

Bayern's Musiala to miss Inter first leg with injury

-

Judge orders return to US of Salvadoran man deported in error

Judge orders return to US of Salvadoran man deported in error

-

'Class' Freeman eases Northampton past Clermont and into Champions Cup quarters

-

Amadou of Malian blind music duo dies aged 70

Amadou of Malian blind music duo dies aged 70

-

Freeman hat-trick eases Northampton into Champions Cup quarters with Clermont win

-

Defiant Trump dismisses stock market's tariff plunge

Defiant Trump dismisses stock market's tariff plunge

-

Musiala injury sours Bayern win at Augsburg

-

Peruvian schoolkids living in fear of extortion gangs

Peruvian schoolkids living in fear of extortion gangs

-

Top seed Pegula rallies to oust defending champ Collins in Charleston

-

Amadou of Malian blind music duo Amadou & Mariam dies aged 70

Amadou of Malian blind music duo Amadou & Mariam dies aged 70

-

California to defy Trump's tariffs to allay global trade fears

-

Bayern's Musiala subbed off with injury days out from Inter clash

Bayern's Musiala subbed off with injury days out from Inter clash

-

Russian strike kills 16 in Ukraine leader's home city, children among dead

-

NBA fines Grizzlies' Morant for imaginary gun gesture

NBA fines Grizzlies' Morant for imaginary gun gesture

-

Trump tariffs offer opportunity for China

-

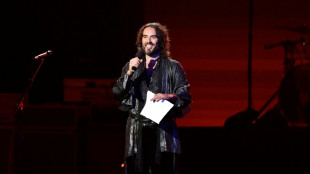

UK comedian Russell Brand charged with rape

UK comedian Russell Brand charged with rape

-

Marsh, Markram help Lucknow edge Mumbai in IPL

-

Trump gives TikTok extra 75 days to find buyer

Trump gives TikTok extra 75 days to find buyer

-

Israel attorney general accuses PM of 'conflict of interest' in security chief dismissal

-

Emery glad to see Rashford make landmark appearance

Emery glad to see Rashford make landmark appearance

-

Sean 'Diddy' Combs faces more charges ahead of criminal trial

-

Russian missile strike kills 14 in Ukraine leader's home city

Russian missile strike kills 14 in Ukraine leader's home city

-

Trump's tariff Big Bang puts global economy under threat

-

I Am Maximus backed for National as Mullins hot streak continues

I Am Maximus backed for National as Mullins hot streak continues

-

2014 World Cup winner Hummels to retire at season's end

-

Intercommunal violence kills dozens in central Nigeria

Intercommunal violence kills dozens in central Nigeria

-

Nigerian, S. African music saw 'extraordinary growth' in 2024: Spotify

-

Russell Brand: From Hollywood star to rape suspect

Russell Brand: From Hollywood star to rape suspect

-

France soccer star Mbappe unveiled in London... in waxwork form

-

Trump goads China as global trade war escalates

Trump goads China as global trade war escalates

-

Israel expands Gaza ground offensive, hits Hamas in Lebanon

-

TikTok faces new US deadline to ditch Chinese owner

TikTok faces new US deadline to ditch Chinese owner

-

US Fed Chair warns tariffs will likely raise inflation, cool growth

| NGG | -5.25% | 65.93 | $ | |

| SCS | -0.56% | 10.68 | $ | |

| CMSC | 0.13% | 22.29 | $ | |

| GSK | -6.79% | 36.53 | $ | |

| RIO | -6.88% | 54.67 | $ | |

| RBGPF | 100% | 69.02 | $ | |

| BCC | 0.85% | 95.44 | $ | |

| RYCEF | -18.79% | 8.25 | $ | |

| JRI | -7.19% | 11.96 | $ | |

| BCE | 0.22% | 22.71 | $ | |

| BTI | -5.17% | 39.86 | $ | |

| CMSD | 0.7% | 22.83 | $ | |

| RELX | -6.81% | 48.16 | $ | |

| AZN | -7.98% | 68.46 | $ | |

| VOD | -10.24% | 8.5 | $ | |

| BP | -10.43% | 28.38 | $ |

'Drill, baby, drill': Trump policy poses risks, opportunities for oil industry

Donald Trump's election as US president brings back a champion of the oil industry to the White House, but experts warn that his push for low prices could be at odds with petroleum companies' priorities.

On the campaign trail, Trump repeatedly said he would "unleash" the US oil sector by boosting production and curbing the move towards renewable energy pushed by outgoing president Joe Biden.

"We will have an administration that will work with the US oil and gas industry and not disparage them by calling them war profiteers or price gougers like they were called by Biden," said Andy Lipow of Lipow Oil Associates.

"I will lower the cost of energy," Trump said at the Republican National Convention. "We will drill, baby, drill."

The president-elect's vow to press for aggressive oil and gas development is, however, something experts say is not the main priority of a sector that has been criticized in the past for not carefully investing capital.

"Producers have plenty of acreage they're sitting on that they could be drilling, and some of it they're drilling, but they're also trying to placate their shareholders," said Stewart Glickman of CFRA Research. "And the shareholders want dividends and buybacks just as much as they want volume growth."

A significant increase in output -- already at record highs -- risks glutting the market depending on how medium-term demand evolves in places like China, where the economic outlook is uncertain.

"The problem is the capital markets," said Bill O'Grady of Confluence Investment Management. "Investors don't want them to do that (raise production) because they want to get paid."

Higher output could add to downward pressure on oil prices at a time when the strong dollar is also expected to weigh on the commodity.

- Pressure to produce -

US oil output began heading significantly higher in the 2010s with the emergence of shale production, but the domestic industry has faced obstacles along the way.

With shale booming, Saudi Arabia opened the spigots enough to send crude prices down to $26 a barrel in 2016.

That tumble in prices reverberated through the oil industry, leading to multiple bankruptcies.

Darren Woods, chief executive of ExxonMobil, said last week that industry investment is more influenced by its drive for profitability than regulatory questions.

"I don't think the level of production in the US is being constrained by external restrictions," Woods said. "I think it is being driven by the internal discipline of the industry."

Glickman expressed skepticism that Trump would alter the industry's approach to investment, which is to only boost drilling when higher oil prices call for it.

But O'Grady said the administration will push to bring crude prices lower, perhaps to between $50 to $60 a barrel, leading to lower gasoline prices.

"I suspect they're going to figure out a way to get what they want and produce more and bring down the price," O'Grady said. "The industry doesn't necessarily want that, but they may not have a whole lot of choice."

Another source of unease in the sector is Trump's confrontational approach on trade, which could lead to higher tariffs, particularly on items from China.

Tariff hikes discussed by the president-elect "would likely trigger slower economic growth both in the US and globally, reducing demand for liquid fuels, driving down oil prices, and ultimately affecting the refining industry," said Wood Mackenzie, an energy data analytics company.

The industry does, however, stand poised to benefit from Trump's expected retreat from energy transition investments favored by the Biden administration.

"There is a case to be made for oil prices going higher" over the medium term, according to Glickman.

O.M.Souza--AMWN