-

Philippine film legend Nora Aunor dies aged 71

Philippine film legend Nora Aunor dies aged 71

-

Taiwan's TSMC net profit soars as US tariff threat looms

-

Cartel recruitment at heart of Mexico's missing persons crisis

Cartel recruitment at heart of Mexico's missing persons crisis

-

Macron to hold Ukraine war talks with Rubio, Witkoff in Paris

-

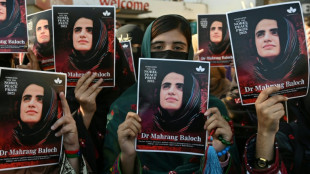

Mahrang Baloch, a child of the resistance for Pakistan's ethnic minority

Mahrang Baloch, a child of the resistance for Pakistan's ethnic minority

-

Myanmar junta says to free nearly 5,000 prisoners in amnesty

-

Taiwan's TSMC says net profit rose 60.3% in first quarter

Taiwan's TSMC says net profit rose 60.3% in first quarter

-

Hermes to hike US prices to offset tariff impact

-

Sri Lanka's women-run hotel breaks down barriers

Sri Lanka's women-run hotel breaks down barriers

-

Sweden turns up Eurovision heat with wacky sauna song

-

Sweden goes into Eurovision as punters' favourite

Sweden goes into Eurovision as punters' favourite

-

Spanish youth keep vibrant Holy Week processions alive

-

Eurovision promises glitz -- and controversy over Israel

Eurovision promises glitz -- and controversy over Israel

-

Italy's Meloni heads to White House seeking EU tariff deal

-

F1 on Jeddah's streets - talking points ahead of the Saudi Arabian GP

F1 on Jeddah's streets - talking points ahead of the Saudi Arabian GP

-

Changing face of war puts Denmark on drone offensive

-

Anger as China club plays hours after striker Boupendza's death

Anger as China club plays hours after striker Boupendza's death

-

Heat scorch Bulls to advance, Mavericks upset Kings

-

Chinese investment sparks rise of Mandarin in Cambodia

Chinese investment sparks rise of Mandarin in Cambodia

-

Unease grows over Trump tariffs despite 'progress' in Japan trade talks

-

Nigerian mixed-faith families sense danger as violence flares

Nigerian mixed-faith families sense danger as violence flares

-

Asian markets boosted by 'Big Progress' in Japan tariff talks

-

No room for sentiment as Hinault returns to site of world title glory

No room for sentiment as Hinault returns to site of world title glory

-

ECB ready to cut rates again as Trump tariffs shake eurozone

-

Heat scorch Bulls to keep playoff dream alive

Heat scorch Bulls to keep playoff dream alive

-

Nigeria, Niger foreign ministers meet for security talks

-

Rugby Australia hits out at French clubs poaching young talent

Rugby Australia hits out at French clubs poaching young talent

-

Canada PM Carney avoids French blunder as he faces attack in key debate

-

El Salvador becoming 'black hole' for US deportees, critics fear

El Salvador becoming 'black hole' for US deportees, critics fear

-

Trump admin proposes redefining 'harm' to endangered animals

-

Australia's Mary Fowler set for long lay-off after ACL injury

Australia's Mary Fowler set for long lay-off after ACL injury

-

Rubio to meet French leaders for talks on Ukraine

-

Webb spots strongest 'hints' yet of life on distant planet

Webb spots strongest 'hints' yet of life on distant planet

-

Evotec SE Unveils New Strategy and Provides 2025 Guidance Bolstered by Strong Q4 2024 Results

-

Arteta's Arsenal come of age with Madrid masterclass

Arteta's Arsenal come of age with Madrid masterclass

-

None spared in Nigeria gun, machete massacre: survivors

-

'No problem' if Real Madrid replace me: Ancelotti

'No problem' if Real Madrid replace me: Ancelotti

-

Inter dreaming of treble glory after reaching Champions League semis

-

'No limits' for treble-hunting Inter, says Pavard

'No limits' for treble-hunting Inter, says Pavard

-

Inter off Bayern to reach Champions League last four

-

Rice 'knew' Arsenal would dethrone Real Madrid

Rice 'knew' Arsenal would dethrone Real Madrid

-

US stocks fall with dollar as Powell warns on tariffs

-

Arsenal oust holders Real Madrid to reach Champions League semis

Arsenal oust holders Real Madrid to reach Champions League semis

-

Arsenal defeat Real Madrid to reach Champions League semis

-

AMD says US rule on chips to China could cost it $800 mn

AMD says US rule on chips to China could cost it $800 mn

-

Inter hold off Bayern to reach Champions League last four

-

El Salvador rejects US senator's plea to free wrongly deported migrant

El Salvador rejects US senator's plea to free wrongly deported migrant

-

Newcastle thrash Crystal Palace to go third in Premier League

-

Zuckerberg denies Meta bought rivals to conquer them

Zuckerberg denies Meta bought rivals to conquer them

-

Starc stars as Delhi beat Rajasthan in Super Over

China's solar goes from supremacy to oversupply

Strong state support and huge private investment have made China's solar industry a global powerhouse, but it faces new headwinds, from punitive tariffs abroad to a brutal price war at home.

Officials meeting in Baku next month for the COP29 summit hope to agree on new finance targets to help developing countries respond to climate change, including ditching fossil fuels.

Last year, countries agreed to triple global installed renewable energy capacity by 2030.

China is installing almost twice as much solar and wind power as every other country combined.

And it dominates the market.

It makes eight out of every 10 solar panels and controls 80 percent of every stage of the manufacturing process.

It is also home to the world's top 10 suppliers of solar panel manufacturing equipment, and its related exports hit a record $49 billion last year, according to Wood Mackenzie.

That supremacy is not accidental: Chinese state support has been key, analysts say.

Beijing invested over $50 billion in new solar supply capacity from 2011 to 2022, according to the International Energy Agency.

The industry has also benefited from access to cheap raw materials, readily available capital from state-owned banks, and huge engineering manpower.

"Chinese producers were ahead of everyone else on cost," said Lauri Myllyvirta, co-founder of the Centre for Research on Energy and Clean Air, a climate think tank.

"That meant new investment takes place in China, because that's where it's most competitive," he told AFP.

The focus has driven a "steep learning curve... both in solar cell technology and manufacturing know-how", added Johannes Bernreuter, a longtime solar industry analyst.

That in turn has created "an efficient industry ecosystem", he said.

- 'Overcapacity'-

As countries around the world race to convert their power systems, China's solar supremacy has become a growing concern.

The United States and other Western countries have accused Beijing of deliberate "overcapacity" and flooding global markets with cut-price solar exports intended to undercut competition.

Washington has doubled tariffs on Chinese panels to 50 percent, part of a broader package targeting $18 billion worth of Chinese imports in strategic sectors including electric vehicles, batteries, critical minerals and medical products.

The European Union is also probing Chinese-owned solar panel manufacturers for allegedly receiving unfair subsidies.

Most US solar panel imports now come from Southeast Asia, but Washington says Chinese manufacturers have relocated operations there to circumvent barriers.

China also accounts for almost all of Europe's imports of solar panels from outside the bloc.

That means many markets will struggle to catch up "with two decades of very forceful and very successful industrial policy in China", said Myllyvirta.

China's solar industry faces its own struggles though, beyond trade barriers in the West.

The sector's supersonic expansion has overleveraged the domestic industry, overloaded China's grid and sparked a brutal price war, experts say.

Industry leaders have reportedly warned of an "ice age" and urged government intervention to stem slumping prices, but there has been little sign of relief.

This year saw a wave of bankruptcies, and new solar projects fell by over 75 percent in the first half of 2024, an industry group said in July.

- 'Lots of companies will fail' -

The price wars, which are so fierce that solar export earnings fell last year despite volumes hitting a new high, are like a "snake eating its own tail", warned analyst David Fishman.

Companies get stuck "in this circle of competition where whoever is able to endure the pain for longest comes out as the victor," said Fishman, a senior manager at the Lantau Group specialising in China's power sector.

"Lots of companies will fail along the way."

And while the manufacturing glut has helped China hit a wind and solar installation target nearly six years ahead of schedule, the country's grid is struggling to keep up.

Increasingly, renewable supply is being blocked to prevent the grid from becoming overwhelmed, a process known as curtailment.

Solar curtailment rose four percent in the first quarter of 2024 from a year earlier, according to Fitch Ratings.

Authorities will soon be forced to "stop approving new projects or allowing projects to connect to the grid if it means curtailment rates are at risk of going higher", Fishman said.

"They've got to build," he added. "They have to catch up."

Blocked in the West and running out of track at home, China's solar is seeking new markets, and this year, Europe was overtaken by Asia as the biggest export market for solar products, according to an industry body.

Exports to Africa also soared 187 percent year-on-year in 2023, though the continent still buys a small fraction compared to Europe, according to energy think tank Ember.

The industry is now in a "restructuring and shakeout phase", said Bernreuter.

After that, "the Chinese solar industry will march on with unperturbed pace and a more global manufacturing footprint".

S.Gregor--AMWN