-

Kim takes one-shot lead over Thomas, Novak at RBC Heritage

Kim takes one-shot lead over Thomas, Novak at RBC Heritage

-

Another round of anti-Trump protests hits US cities

-

'So grateful' - Dodgers star Ohtani and wife welcome first child

'So grateful' - Dodgers star Ohtani and wife welcome first child

-

PSG maintain unbeaten Ligue 1 record, Marseille back up to second

-

US, Iran report progress in nuclear talks, will meet again

US, Iran report progress in nuclear talks, will meet again

-

US Supreme Court intervenes to block Trump deportations

-

Hamas armed wing says fate of US-Israeli captive unknown

Hamas armed wing says fate of US-Israeli captive unknown

-

Pacers thump Bucks to open NBA playoffs

-

Sabalenka reaches Stuttgart semis as Ostapenko extends Swiatek mastery

Sabalenka reaches Stuttgart semis as Ostapenko extends Swiatek mastery

-

Zelensky says Ukraine will observe Putin's Easter truce but claims violations

-

'Fuming' Watkins fires Villa in bid to prove Emery wrong

'Fuming' Watkins fires Villa in bid to prove Emery wrong

-

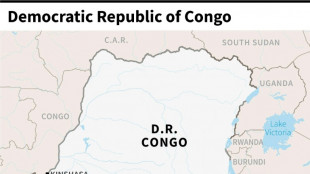

DR Congo boat fire toll revised down to 33

-

England thrash Scotland to set up France Grand Slam showdown

England thrash Scotland to set up France Grand Slam showdown

-

Verstappen's Red Bull 'comes alive' to claim record pole in Jeddah

-

McTominay fires Napoli level with Inter as Conte fuels exit rumours

McTominay fires Napoli level with Inter as Conte fuels exit rumours

-

Rajasthan unleash Suryavanshi, 14, as youngest IPL player but lose thriller

-

Man City boost top five bid, Aston Villa thrash in-form Newcastle

Man City boost top five bid, Aston Villa thrash in-form Newcastle

-

Villa rout Newcastle to rekindle bid to reach Champions League

-

Dumornay gives Lyon lead over Arsenal in Women's Champions League semis

Dumornay gives Lyon lead over Arsenal in Women's Champions League semis

-

Trans rights supporters rally in London, Edinburgh after landmark ruling

-

'We have to wait': Barca's Flick on Lewandowski injury fear

'We have to wait': Barca's Flick on Lewandowski injury fear

-

Bordeaux-Begles backups edge Pau to close in on Top 14 summit

-

Trans rights supporters rally outside in London, Edinburgh after landmark ruling

Trans rights supporters rally outside in London, Edinburgh after landmark ruling

-

PSG beat Le Havre to stay on course for unbeaten Ligue 1 season

-

Man City close in on Champions League with Everton late show

Man City close in on Champions League with Everton late show

-

14-year-old Vaibhav Suryavanshi becomes youngest IPL player

-

Barca make stunning comeback to beat Celta Vigo in Liga thriller

Barca make stunning comeback to beat Celta Vigo in Liga thriller

-

Zverev sets up birthday bash with Shelton in Munich

-

Man City boost top five bid, Southampton snatch late leveller

Man City boost top five bid, Southampton snatch late leveller

-

US Supreme Court intervenes to pause Trump deportations

-

Alcaraz and Rune race into Barcelona final

Alcaraz and Rune race into Barcelona final

-

US, Iran to hold more nuclear talks after latest round

-

Man City close in on Champions League thanks to Everton late show

Man City close in on Champions League thanks to Everton late show

-

Bayern close in on Bundesliga title with Heidenheim thumping

-

Tunisia opposition figures get jail terms in mass trial

Tunisia opposition figures get jail terms in mass trial

-

Putin announces 'Easter truce' in Ukraine

-

McLaren duo in ominous show of force in Saudi final practice

McLaren duo in ominous show of force in Saudi final practice

-

Afghan PM condemns Pakistan's 'unilateral' deportations

-

Iran says to hold more nuclear talks with US after latest round

Iran says to hold more nuclear talks with US after latest round

-

Comeback queen Liu leads US to World Team Trophy win

-

Buttler fires Gujarat to top of IPL table in intense heat

Buttler fires Gujarat to top of IPL table in intense heat

-

Unimpressive France stay on course for Grand Slam showdown

-

Shelton fights past Cerundolo to reach Munich ATP final

Shelton fights past Cerundolo to reach Munich ATP final

-

Vance and Francis: divergent values but shared ideas

-

Iran, US conclude second round of high-stakes nuclear talks in Rome

Iran, US conclude second round of high-stakes nuclear talks in Rome

-

Dumornay gives Lyon first leg lead over Arsenal in women's Champions League semis

-

Trans rights supporters rally outside UK parliament after landmark ruling

Trans rights supporters rally outside UK parliament after landmark ruling

-

Rune destroys Khachanov to reach Barcelona Open final

-

From Messi to Trump, AI action figures are the rage

From Messi to Trump, AI action figures are the rage

-

Vance discusses migration during Vatican meeting with pope's right-hand man

Swiss mining giant Glencore drops plan to exit coal

Swiss commodities giant Glencore announced Wednesday that it had decided against spinning off its coal business for now after consulting shareholders who view the polluting fossil fuel as a cash-generating activity.

Glencore completed its takeover of the steelmaking coal unit of Teck Resources in July following a protracted battle over the business with the Canadian company.

The Swiss mining and commodities trading group had considered merging the newly acquired business, Elk Valley Resources, with its own coal activities and spinning it off.

But Glencore said that after consulting its shareholders, most expressed a preference for retaining the coal and carbon steel materials business.

"Following extensive consultation with our shareholders, whose views were very clear, and our own analysis, the Board believes retention offers the lowest risk pathway to create value for Glencore shareholders today," chairman Kalidas Madhavpeddi said.

"The expected cash generative capacity of the coal and carbon steel materials business significantly enhances the quality of our portfolio," Madhavpeddi added in a statement.

The company said shareholders preferred to keep the coal business "primarily on the basis that retention should enhance Glencore's cash generating capacity to fund opportunities in our transition metals portfolio" such as copper.

They also concluded that it would "accelerate and optimise the return of excess cash flows to shareholders".

Oil, gas and coal companies are under pressure to transition away from fossil fuels, the biggest contributor to climate change.

While Glencore's Australian rival Rio Tinto and British group Anglo American are exiting coal, the Swiss company has a "managed decline" strategy to ensure a "responsible" phase out its coal operations.

Glencore said Wednesday that while it has decided to keep coal, its board "preserves the option to consider a demerger of all or part of this business in the future if circumstances change".

Separately, Glencore posted a $233-million loss for the first half of the year, after earning $4.6 billion over the same period last year, as commodity prices fell, "particularly thermal coal".

P.M.Smith--AMWN