-

T'Wolves dominate Lakers, Nuggets edge Clippers as NBA playoffs start

T'Wolves dominate Lakers, Nuggets edge Clippers as NBA playoffs start

-

Taxes on super rich and tech giants stall under Trump

-

Star Wars series 'Andor' back for final season

Star Wars series 'Andor' back for final season

-

Neighbours improvise first aid for wounded in besieged Sudan city

-

Tariffs could lift Boeing and Airbus plane prices even higher

Tariffs could lift Boeing and Airbus plane prices even higher

-

Analysts warn US could be handing chip market to China

-

Unbeaten Miami edge Columbus in front of big MLS crowd in Cleveland

Unbeaten Miami edge Columbus in front of big MLS crowd in Cleveland

-

Social media helps fuel growing 'sex tourism' in Japan

-

'Pandora's box': alarm bells in Indonesia over rising military role

'Pandora's box': alarm bells in Indonesia over rising military role

-

Alaalatoa hails 'hustling hard' Brumbies for rare Super Rugby clean sheet

-

Trio share lead at tight LA Championship

Trio share lead at tight LA Championship

-

Sampdoria fighting relegation disaster as old heroes ride into town

-

Recovering pope expected to delight crowds at Easter Sunday mass

Recovering pope expected to delight crowds at Easter Sunday mass

-

Nuggets edge Clippers in NBA playoff overtime thriller, Knicks and Pacers win

-

Force skipper clueless about extra-time rules in pulsating Super Rugby draw

Force skipper clueless about extra-time rules in pulsating Super Rugby draw

-

Nuggets edge Clippers in NBA playoff overtime thriller, Pacers thump Bucks

-

Unbeaten Miami edge Columbus in front of big crowd in Cleveland

Unbeaten Miami edge Columbus in front of big crowd in Cleveland

-

Kim takes one-shot lead over Thomas, Novak at RBC Heritage

-

Another round of anti-Trump protests hits US cities

Another round of anti-Trump protests hits US cities

-

'So grateful' - Dodgers star Ohtani and wife welcome first child

-

PSG maintain unbeaten Ligue 1 record, Marseille back up to second

PSG maintain unbeaten Ligue 1 record, Marseille back up to second

-

US, Iran report progress in nuclear talks, will meet again

-

US Supreme Court intervenes to block Trump deportations

US Supreme Court intervenes to block Trump deportations

-

Hamas armed wing says fate of US-Israeli captive unknown

-

Pacers thump Bucks to open NBA playoffs

Pacers thump Bucks to open NBA playoffs

-

Sabalenka reaches Stuttgart semis as Ostapenko extends Swiatek mastery

-

Zelensky says Ukraine will observe Putin's Easter truce but claims violations

Zelensky says Ukraine will observe Putin's Easter truce but claims violations

-

'Fuming' Watkins fires Villa in bid to prove Emery wrong

-

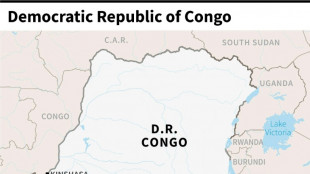

DR Congo boat fire toll revised down to 33

DR Congo boat fire toll revised down to 33

-

England thrash Scotland to set up France Grand Slam showdown

-

Verstappen's Red Bull 'comes alive' to claim record pole in Jeddah

Verstappen's Red Bull 'comes alive' to claim record pole in Jeddah

-

McTominay fires Napoli level with Inter as Conte fuels exit rumours

-

Rajasthan unleash Suryavanshi, 14, as youngest IPL player but lose thriller

Rajasthan unleash Suryavanshi, 14, as youngest IPL player but lose thriller

-

Man City boost top five bid, Aston Villa thrash in-form Newcastle

-

Villa rout Newcastle to rekindle bid to reach Champions League

Villa rout Newcastle to rekindle bid to reach Champions League

-

Dumornay gives Lyon lead over Arsenal in Women's Champions League semis

-

Trans rights supporters rally in London, Edinburgh after landmark ruling

Trans rights supporters rally in London, Edinburgh after landmark ruling

-

'We have to wait': Barca's Flick on Lewandowski injury fear

-

Bordeaux-Begles backups edge Pau to close in on Top 14 summit

Bordeaux-Begles backups edge Pau to close in on Top 14 summit

-

Trans rights supporters rally outside in London, Edinburgh after landmark ruling

-

PSG beat Le Havre to stay on course for unbeaten Ligue 1 season

PSG beat Le Havre to stay on course for unbeaten Ligue 1 season

-

Man City close in on Champions League with Everton late show

-

14-year-old Vaibhav Suryavanshi becomes youngest IPL player

14-year-old Vaibhav Suryavanshi becomes youngest IPL player

-

Barca make stunning comeback to beat Celta Vigo in Liga thriller

-

Zverev sets up birthday bash with Shelton in Munich

Zverev sets up birthday bash with Shelton in Munich

-

Man City boost top five bid, Southampton snatch late leveller

-

US Supreme Court intervenes to pause Trump deportations

US Supreme Court intervenes to pause Trump deportations

-

Alcaraz and Rune race into Barcelona final

-

US, Iran to hold more nuclear talks after latest round

US, Iran to hold more nuclear talks after latest round

-

Man City close in on Champions League thanks to Everton late show

Climate change risk stirs oil market

From forest fires to hurricanes and other natural disasters: climate change risk is increasingly influencing oil prices, just as the world is struggling to shift away from high-polluting fossil fuels.

Hurricane Beryl became the latest weather phenomenon to jangle market nerves, boosting crude prices as it passed through Texas earlier this month.

Texas accounts for some 42 percent of total US crude oil production, according to Energy Information Administration data. It also possesses the largest number of crude oil refineries among US states.

"Almost half of the total US petroleum refining capacity is located along the Gulf, with Texas accounting for one-third of total US refining capacity," Exinity analyst Han Tan told AFP.

And industry experts fear Beryl could herald a "super charged" hurricane season this year, according to Tan.

The World Meteorological Organization has warned that Beryl's early formation and swift intensification could foreshadow similarly severe storms in the future.

Earlier this year meanwhile, oil market sentiment was jarred in May as forest fires broke out in Canada.

Traders took flight as out-of-control wildfires threatened to spread to the crude-producing hub of Fort McMurray, the nation's largest oil sands mining facility.

- 'More visible and more extreme' -

Traders, more used to pricing in geopolitical turmoil, are now also weighing up the risks arising from the climate crisis.

"Climate change and its effect is a major source of risk in the oil markets, and I expect that that risk will only increase in the coming years as the effects of climate change become more visible and extreme," Rystad Energy analyst Jorge Leon told AFP.

"Geopolitical risk is –- at least partly -– manageable by different actors. For example, international diplomacy could prevent a war.

"However, climate risk is less manageable in the short and medium run. In the long run, you can manage it by trying to reduce emissions," he added.

At the same time, climate disruption is also having an increasingly visible impact on the operations of oil and gas companies, which are frequently slammed by environmentalists over their role in global warming.

"Climate change has been and will be affecting production," summarised Tamas Varga, analyst at PVM Oil Associates.

He added that it also impacted refinery utilisation rates because "hot weather leads to malfunctioning" of the facilities.

Many European refineries were designed in the 1960s and 1970s to withstand colder rather than warmer temperatures, according to Tan.

Fossil fuels -- coal, gas and oil -- are responsible for over 75 percent of global greenhouse gas emissions, according to estimates from the United Nations.

At the COP28 UN climate conference in Dubai last December, almost 200 countries agreed to a call for a transition away from fossil fuels and a tripling of renewable energy capacity this decade.

However, the text crucially stopped short of a direct call for phasing out fossil fuels, while there were major concessions to the oil and gas industry and producer countries.

- 'Economics can't find solution' -

Analysts argue that the oil market participants are simply focused on generating profit rather than saving the environment.

That throws the onus onto the world's politicians and regulators, they add.

"Investors can't be rationally expected to reverse the phenomenon when they try to maximise profits," SwissQuote analyst Ipek Ozkardeskaya told AFP.

"Unless financial costs of climate damages outweigh the financial benefits, the economics can't find the solution to the climate problem."

"So, the ball is in politicians' hands. Only concrete, sharp and worldwide regulatory changes with meaningful financial impact/incentives... could shift capital toward clean and sustainable energies."

D.Kaufman--AMWN