-

Iran delegation in Oman for high-stakes nuclear talks with US

Iran delegation in Oman for high-stakes nuclear talks with US

-

Australia beat Colombia to end BJK Cup bid on winning note

-

German refinery's plight prompts calls for return of Russian oil

German refinery's plight prompts calls for return of Russian oil

-

Trump carves up world and international order with it

-

Paris theatre soul-searching after allegations of sexual abuse

Paris theatre soul-searching after allegations of sexual abuse

-

US, Iran to hold high-stakes nuclear talks

-

Frustrated families await news days after 222 killed in Dominican club disaster

Frustrated families await news days after 222 killed in Dominican club disaster

-

Jokic triple double as Denver fight back for big win

-

Trump envoy suggests allied zones of control in Ukraine

Trump envoy suggests allied zones of control in Ukraine

-

Iraqi markets a haven for pedlars escaping Iran's economic woes

-

Chinese manufacturers in fighting spirits despite scrapped US orders

Chinese manufacturers in fighting spirits despite scrapped US orders

-

Argentina receives $42 bn from international financial institutions

-

Menendez brothers' resentencing can go ahead: LA judge rules

Menendez brothers' resentencing can go ahead: LA judge rules

-

'Hard on the body': Canadian troops train for Arctic defense

-

Trump, 78, says feels in 'very good shape' after annual checkup

Trump, 78, says feels in 'very good shape' after annual checkup

-

McKellar 'very, very proud' after 'Tahs tame rampant Chiefs

-

Man executed by firing squad in South Carolina

Man executed by firing squad in South Carolina

-

Defending champ Scheffler three back after tough day at Augusta

-

Ballester apologizes to Augusta National for relief in Rae's Creek

Ballester apologizes to Augusta National for relief in Rae's Creek

-

Scorching Coachella kicks off as Lady Gaga set to helm main stage

-

McIlroy, DeChambeau charge but Rose clings to Masters lead

McIlroy, DeChambeau charge but Rose clings to Masters lead

-

Langer misses cut to bring 41st and final Masters appearance to a close

-

Ecuador presidential hopefuls make last pitch to voters

Ecuador presidential hopefuls make last pitch to voters

-

Rose knocking on the door of a major again at the Masters

-

DeChambeau finding right balance at Augusta National

DeChambeau finding right balance at Augusta National

-

Spurs leaker not a player says Postecoglou

-

All Black Barrett helps Leinster into Champions Cup semis

All Black Barrett helps Leinster into Champions Cup semis

-

Round-two rebound: Resilient McIlroy right back in the Masters hunt

-

Asset flight challenges US safe haven status

Asset flight challenges US safe haven status

-

Menendez brothers appear in LA court for resentencing hearing

-

McIlroy, DeChambeau charge as Rose clings to Masters lead

McIlroy, DeChambeau charge as Rose clings to Masters lead

-

UN seeks $275 million in aid for Myanmar quake survivors

-

Frustrated families await news days after 221 killed in Dominican club disaster

Frustrated families await news days after 221 killed in Dominican club disaster

-

Trump wants to halt climate research by key agency: reports

-

Fed official says 'absolutely' ready to intervene in financial markets

Fed official says 'absolutely' ready to intervene in financial markets

-

Slumping Homa happy to be headed into weekend at the Masters

-

Morbidelli fastest ahead of cagey MotoGP title rivals in Qatar practise

Morbidelli fastest ahead of cagey MotoGP title rivals in Qatar practise

-

Musetti stuns Monte Carlo Masters champion Tsitsipas to reach semis

-

Abuse scandal returns to haunt the flying 'butterflies' of Italian gymnastics

Abuse scandal returns to haunt the flying 'butterflies' of Italian gymnastics

-

Trump defends policy after China hits US with 125% tariffs

-

Frustrated families await news days after Dominican club disaster

Frustrated families await news days after Dominican club disaster

-

McLarens dominate Bahrain practice, Verstappen rues 'too slow' Red Bull

-

Eight birdies rescue Masters rookie McCarty after horror start

Eight birdies rescue Masters rookie McCarty after horror start

-

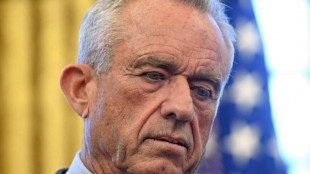

RFK Jr's autism 'epidemic' study raises anti-vaxx fears

-

Trump -- oldest elected US president -- undergoes physical

Trump -- oldest elected US president -- undergoes physical

-

Rose clings to Masters lead as McIlroy, DeChambeau charge

-

Brazil's Bolsonaro hospitalized with abdominal pain, 'stable'

Brazil's Bolsonaro hospitalized with abdominal pain, 'stable'

-

Canada, US to start trade talks in May: Carney

-

Six arrested for murder of notorious Inter Milan ultra

Six arrested for murder of notorious Inter Milan ultra

-

Pig kidney removed from US transplant patient, but she set record

OPEC+ weighs output decision, with a possible cut

The OPEC+ oil cartel is expected to agree on another small production increase Monday, though it could opt to cut output to lift prices that have tumbled over recession fears.

The 13 members of the Organization of the Petroleum Exporting Countries (OPEC) cartel, led by Saudi Arabia, and their 10 Russian-led allies will hold a regular meeting to adjust their quotas for October.

Oil prices soared to almost $140 a barrel in March after Russia invaded Ukraine, but they have since receded amid recession fears, Covid lockdowns in major consumer China and a possible Iran nuclear deal.

The main international benchmark, Brent, and the US contract, WTI, have since fallen under the $100 mark, fuelling speculation that OPEC+ could cut output to prop up prices.

"The group is expected to leave output targets unchanged but it's likely that a cut will be at least discussed which, if followed through on, would create more volatility and uncertainty at a time of considerable unease," said Craig Erlam, market analyst at OANDA trading platform.

"An output cut won't make them any friends at a time when the world is facing a cost-of-living crisis already and the group has failed to keep up with demand this year," said Erlam.

At its last meeting, OPEC+ agreed to a small increase of 100,000 barrels per day for September -- six times lower than its previous decisions.

OPEC+ cut oil production at the height of the Covid pandemic in 2020 to reverse a drastic drop in prices, but it began to increase them again last year.

The United States has pressed the cartel to step up production in order to tame energy prices that have sent inflation to a decades high, threatening to spark recessions in major economies.

But Saudi Energy Minister Abdulaziz bin Salman last month appeared to open the door to the idea of cutting output, which has since received the support of several member states and the cartel's joint technical committee.

He said "volatility and thin liquidity send erroneous signals to markets at times when clarity is most needed".

Oil prices rose by two percent on Monday, with Brent exceeding $95 per barrel while the US contract, WTI, reached around $89.

- Iran talks -

Matthew Holland, analyst at Energy Aspects research group, said a cut in production -- which would be the first since the drastic cuts made to cope with moribund demand during the coronavirus pandemic -- would come up at the next meeting in October.

Everything will depend on the progress of Iranian nuclear negotiations aimed at reviving a landmark agreement between Tehran and world powers that gave Iran sanctions relief in exchange for curbs on its nuclear programme.

Hopes for a deal, which would be accompanied by an easing of US sanctions notably on oil, have been revived recently.

However, Washington said Thursday that Tehran's latest response to a European Union draft was "unfortunately... not constructive".

Amena Bakr, an analyst at Energy Intelligence, warned against over-interpreting the Saudi energy minister's comments, saying only that "volatility is bad for the market".

"It's a message to all Western governments that have been intervening in the market and trying to manage the market" since the start of the war in Ukraine, she said.

The United States and its allies have released oil from their emergency reserves in efforts to curb prices.

And in an effort to curb Russia's war funding, the G7 group of industrialised powers agreed Friday to move "urgently" towards capping the price of Russian oil.

Moscow has warned that it will no longer sell oil to countries that adopt the unprecedented mechanism.

L.Mason--AMWN