-

No.1 Scheffler goes for third Masters crown in four years

No.1 Scheffler goes for third Masters crown in four years

-

Where Trump's tariffs could hurt Americans' wallets

-

Trump says 'very close to a deal' on TikTok

Trump says 'very close to a deal' on TikTok

-

Trump tariffs on Mexico: the good, the bad, the unknown

-

Postecoglou denies taunting Spurs fans in Chelsea defeat

Postecoglou denies taunting Spurs fans in Chelsea defeat

-

Oscar-winning Palestinian director speaks at UN on Israeli settlements

-

With tariff war, Trump also reshapes how US treats allies

With tariff war, Trump also reshapes how US treats allies

-

Fernandez fires Chelsea into fourth as pressure mounts on Postecoglou

-

South Korea court to decide impeached president's fate

South Korea court to decide impeached president's fate

-

Penguin memes take flight after Trump tariffs remote island

-

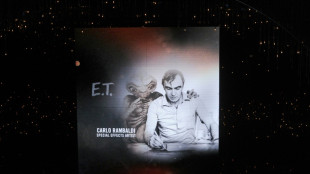

E.T., no home: Original model of movie alien doesn't sell at auction

E.T., no home: Original model of movie alien doesn't sell at auction

-

Italy's Brignone has surgery on broken leg with Winter Olympics looming

-

Trump defiant as tariffs send world markets into panic

Trump defiant as tariffs send world markets into panic

-

City officials vote to repair roof on home of MLB Rays

-

Rockets forward Brooks gets one-game NBA ban for technicals

Rockets forward Brooks gets one-game NBA ban for technicals

-

Pentagon watchdog to probe defense chief over Signal chat row

-

US tariffs could push up inflation, slow growth: Fed official

US tariffs could push up inflation, slow growth: Fed official

-

New Bruce Springsteen music set for June 27 release

-

Tom Cruise pays tribute to Val Kilmer

Tom Cruise pays tribute to Val Kilmer

-

Mexico president welcomes being left off Trump's tariffs list

-

Zuckerberg repeats Trump visits in bid to settle antitrust case

Zuckerberg repeats Trump visits in bid to settle antitrust case

-

US fencer disqualified for not facing transgender rival

-

'Everyone worried' by Trump tariffs in France's champagne region

'Everyone worried' by Trump tariffs in France's champagne region

-

Italy's Brignone suffers broken leg with Winter Olympics looming

-

Iyer blitz powers Kolkata to big IPL win over Hyderabad

Iyer blitz powers Kolkata to big IPL win over Hyderabad

-

Russian soprano Netrebko to return to London's Royal Opera House

-

French creche worker gets 25 years for killing baby with drain cleaner

French creche worker gets 25 years for killing baby with drain cleaner

-

UK avoids worst US tariffs post-Brexit, but no celebrations

-

Canada imposing 25% tariff on some US auto imports

Canada imposing 25% tariff on some US auto imports

-

Ruud wants 'fair share' of Grand Slam revenue for players

-

Lesotho, Africa's 'kingdom in the sky' jolted by Trump

Lesotho, Africa's 'kingdom in the sky' jolted by Trump

-

Trump's trade math baffles economists

-

Gaza heritage and destruction on display in Paris

Gaza heritage and destruction on display in Paris

-

'Unprecedented crisis' in Africa healthcare: report

-

Pogacar gunning for blood and thunder in Tour of Flanders

Pogacar gunning for blood and thunder in Tour of Flanders

-

Macron calls for suspension of investment in US until tariffs clarified

-

Wall St leads rout as world reels from Trump tariffs

Wall St leads rout as world reels from Trump tariffs

-

Mullins gets perfect National boost with remarkable four-timer

-

Trump tariffs hammer global stocks, dollar and oil

Trump tariffs hammer global stocks, dollar and oil

-

Authors hold London protest against Meta for 'stealing' work to train AI

-

Tate Modern gifted 'extraordinary' work by US artist Joan Mitchell

Tate Modern gifted 'extraordinary' work by US artist Joan Mitchell

-

Mexico president welcomes being left off Trump's new tariffs list

-

Tonali eager to lead Newcastle back into Champions League

Tonali eager to lead Newcastle back into Champions League

-

Lesotho hardest hit as new US tariffs rattle Africa

-

Stellantis pausing some Canada, Mexico production over Trump auto tariffs

Stellantis pausing some Canada, Mexico production over Trump auto tariffs

-

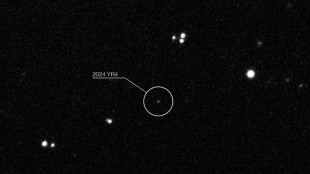

Rising odds asteroid that briefly threatened Earth will hit Moon

-

Italy reels from Brignone broken leg with Winter Olympics looming

Italy reels from Brignone broken leg with Winter Olympics looming

-

Is the Switch 2 worth the price? Reviews are mixed

-

Ancelotti’s tax trial wraps up in Spain with prosecutors seeking jail

Ancelotti’s tax trial wraps up in Spain with prosecutors seeking jail

-

Civilians act to bring aid to Myanmar earthquake victims

OPEC+ walks 'fine line' between US and Russia

The OPEC+ group of oil exporters are set to hammer out a new strategy at their meeting Wednesday, with all eyes on how they will react to soaring crude prices.

The 13 core members of OPEC, led by Saudi Arabia, and the 10 further states in OPEC+ -- chief among them Russia -- find themselves at a crossroads.

After the drastic output cuts they agreed to in spring 2020 in reaction to the plunge in demand caused by the coronavirus pandemic, the member states of the alliance are once again producing at pre-virus levels -- at least on paper.

In normal times they would perhaps have stopped at that but faced with runaway prices and pressure from Washington, this scenario is viewed as unlikely.

- Biden's controversial voyage -

US President Joe Biden travelled to Saudi Arabia in mid-July despite his promise to make the country a "pariah" in the wake of the 2018 killing of journalist Jamal Khashoggi.

Part of the reason for the controversial trip was to convince Riyadh to continue loosening the production taps to stabilise the market and curb rampant inflation.

Wednesday's meeting will reveal whether his efforts were successful.

"The US administration appears to be anticipating some good news but it's hard to know whether that's based on assurances during Biden's trip or not," Craig Erlam, analyst at Oanda, told AFP.

"It wouldn't be a surprise to see the Saudis announce something that Biden could tout as a win to voters at home," according to Stephen Innes of SPI Asset Management.

- Sceptical market -

According to the London-based research institute Energy Aspects, OPEC+ could adjust its current agreement in order to keep raising crude production volumes.

However, analysts warn against expecting any drastic increases.

OPEC+ has to take into account the fact that the interests of Russia -- a key player in the alliance -- are diametrically opposed to those of Washington.

"Saudi Arabia has to walk a fine line," says Tamas Varga, analyst at PVM Energy.

The task will be to allow the United States to save face while also placating Moscow in order to ensure the stability of the alliance.

Any decision on Wednesday will have to be unanimous, which may lead to a longer meeting than normal.

The videoconference meeting is due to start at around 1300 GMT on Wednesday (or 3 pm at the cartel's Vienna headquarters).

"Any new OPEC+ deal aimed at further ramping up supplies is likely to be met with market scepticism, considering the supply constraints already evident within the alliance," says Han Tan at Exinity.

The alliance already regularly fails to fill the production quotas already allotted and has struggled to get back to pre-pandemic volumes.

D.Kaufman--AMWN