-

Asian markets edge up but uncertainty rules ahead of Trump tariffs

Asian markets edge up but uncertainty rules ahead of Trump tariffs

-

Nintendo's megahit Switch console: what to know

-

Nintendo to unveil upgrade to best-selling Switch console

Nintendo to unveil upgrade to best-selling Switch console

-

China practises hitting key ports, energy sites in Taiwan drills

-

Oil, sand and speed: Saudi gearheads take on towering dunes

Oil, sand and speed: Saudi gearheads take on towering dunes

-

All eyes on Tsunoda at Japan GP after ruthless Red Bull move

-

'Image whisperers' bring vision to the blind at Red Cross museum

'Image whisperers' bring vision to the blind at Red Cross museum

-

Hay shines as New Zealand make 292-8 in Pakistan ODI

-

Other governments 'weaponising' Trump language to attack NGOs: rights groups

Other governments 'weaponising' Trump language to attack NGOs: rights groups

-

UK imposes online entry permit on European visitors

-

How a Brazilian chief is staving off Amazon destruction

How a Brazilian chief is staving off Amazon destruction

-

Meme politics: White House embraces aggressive alt-right online culture

-

China launches military drills in Taiwan Strait

China launches military drills in Taiwan Strait

-

US senator smashes record with 25-hour anti-Trump speech

-

Brazil binman finds newborn baby on garbage route

Brazil binman finds newborn baby on garbage route

-

US senator smashes record with marathon anti-Trump speech

-

Trump advisor Waltz faces new pressure over Gmail usage

Trump advisor Waltz faces new pressure over Gmail usage

-

Niger junta frees ministers of overthrown government

-

Trump set to unleash 'Liberation Day' tariffs

Trump set to unleash 'Liberation Day' tariffs

-

Boeing chief to acknowledge 'serious missteps' at US Senate hearing

-

Real Madrid hold Real Sociedad in eight-goal thriller to reach Copa del Rey final

Real Madrid hold Real Sociedad in eight-goal thriller to reach Copa del Rey final

-

Nuno salutes 'special' Elanga after stunning strike fires Forest

-

PSG survive scare against Dunkerque to reach French Cup final

PSG survive scare against Dunkerque to reach French Cup final

-

Sundowns edge Esperance as crowd violence mars quarter-final

-

Nottingham Forest beat Man Utd, Saka scores on Arsenal return

Nottingham Forest beat Man Utd, Saka scores on Arsenal return

-

Elanga wonder-goal sinks Man Utd as Forest eye Champions League berth

-

Stock markets mostly advance ahead of Trump tariffs deadline

Stock markets mostly advance ahead of Trump tariffs deadline

-

US movie theaters urge 45-day 'baseline' before films hit streaming

-

Saka scores on return as Arsenal beat Fulham

Saka scores on return as Arsenal beat Fulham

-

Third-division Bielefeld shock holders Leverkusen in German Cup

-

Ball-blasting 'Torpedo bats' making waves across MLB opening weekend

Ball-blasting 'Torpedo bats' making waves across MLB opening weekend

-

Newsmax shares surge more than 2,000% in days after IPO

-

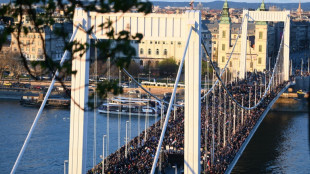

Thousands of Hungarians protest against Pride ban law

Thousands of Hungarians protest against Pride ban law

-

GM leads first quarter US auto sales as tariffs loom

-

Tesla sales tumble in Europe in the first quarter

Tesla sales tumble in Europe in the first quarter

-

No 'eye for an eye' approach to US tariffs: Mexico

-

NFL club owners back dynamic kickoffs, delay tush push vote

NFL club owners back dynamic kickoffs, delay tush push vote

-

Trump 'perfecting' new tariffs as nervous world braces

-

Trump nominee says to press UK on Israel arms

Trump nominee says to press UK on Israel arms

-

French court says Le Pen appeal ruling could come before presidential vote

-

The battle to control assets behind Bosnia crisis

The battle to control assets behind Bosnia crisis

-

Prabhsimran powers Punjab to IPL win over Lucknow

-

Mass layoffs targeting 10,000 jobs hit US health agencies

Mass layoffs targeting 10,000 jobs hit US health agencies

-

Tiger's April Foolishness: plan to play Masters just a joke

-

Myanmar quake toll passes 2,700, nation halts to honour victims

Myanmar quake toll passes 2,700, nation halts to honour victims

-

Turkish fans, artists urge Muse to cancel Istanbul gig

-

US seeks death penalty for accused killer of insurance CEO

US seeks death penalty for accused killer of insurance CEO

-

UK govt moves to block sentencing guidelines for minority defendants

-

Trump puts world on edge as 'Liberation Day' tariffs loom

Trump puts world on edge as 'Liberation Day' tariffs loom

-

Swedish journalist jailed in Turkey kept 'isolated': employer

Air tickets set to keep climbing from pandemic low: experts

Propelled by inflation, the price of air tickets has begun to take off again after tumbling during the pandemic, a reversal that looks set to intensify due to environmental pressures, experts say.

For members of the International Air Transport Association, gathered in Doha for their annual meeting this week, minds are focused on how far such increases risk undermining passenger growth targets.

The IATA is also pleading for government support in reconciling the long-term commitment to net zero carbon emissions with those ambitious targets.

The aviation industry has just gone through two years where planes flew with rows of empty seats, even as they offered fares much lower than before the Covid-19 pandemic.

But with the sector still mired in the red despite movement restrictions being largely lifted, the bargain bonanza for passengers is very much over.

In the United States, the average price of an internal flight has shot up, from $202 in October 2021 to $336 in May this year, according to the Federal Reserve Bank of Saint Louis.

In the European Union, the price of a return ticket before tax in April returned to that seen in the same month of 2019, after a near-20 percent fall in 2020, according to aviation research specialists Cirium.

The oil price shock stoked by Russia's invasion of Ukraine is the most obvious factor in these price rises.

Airlines estimate that fuel prices will account for 24 percent of their total costs this year, up five percentage points from last year.

Ticket prices are also being stoked by wider inflation -- now at 40-year-highs in developed markets -- as well as stronger-than-expected demand for tickets and labour shortages.

- Reality check -

But Scott Kirby, chief executive of United Airlines, said despite the trend clearly rising, prices had yet to shoot beyond historical norms.

"In real terms, pricing is back to 2014 levels... and it's lower than it was essentially every year before" then, he said.

"So... I don't think we're going to see demand destruction."

But Vik Krishnan, a partner at McKinsey & Co, is cautious about how long the current high demand will last.

"Some of the travel that we're seeing right now is a function of all the stimulus that governments" pumped into economies during the pandemic, boosting citizens' spare income, he said.

"The number one discretionary income spending is travel and that's what people are doing.

But "how long that lasts remains to be seen", he added.

- Climate crisis versus cheap holidays -

Beyond rising costs and fears that government stimulus will fade, airlines face commitments that sit very uneasily alongside each other.

On the one hand, they target carrying a total of 10 billion passengers by 2050, up from 4.5 billion in 2019.

And yet over the same time horizon, they are beholden to achieving "net zero" carbon emissions.

The total cost of transitioning the sector to "net zero" is estimated by the IATA at an eye-watering $1.55 trillion.

"Airlines don't have the ability to absorb" the cost of that transition, IATA director general Willie Walsh said this week.

To reduce carbon emissions, the industry focus is on sustainable aviation fuels (SAFs), which are currently two to four times more expensive than fossil-based aviation fuel.

Some governments have already imposed SAF quotas, albeit in small quantities, resulting in airlines in turn imposing surcharges.

On Tuesday, the IATA urged governments to provide subsidies to ensure SAF production reaches 30 billion litres in 2030, up from 125 million litres in 2021. It also wants price curbs.

But even if such subsidies are forthcoming, "the transition to net zero will have to be reflected in ticket prices," Walsh said.

Could that reverse the long-standing global trend of air travel progressively extending beyond the wealthy?

Krishnan believes such "democratisation" will become "harder".

But he also said "low cost airlines have unleashed a world where people living in Northern Europe took it for granted that they could go on cheap vacations in Southern Europe".

It would be "very hard for governments to unwind" such entrenched expectations, he warned.

D.Cunningha--AMWN