-

Asian markets edge up but uncertainty rules ahead of Trump tariffs

Asian markets edge up but uncertainty rules ahead of Trump tariffs

-

Nintendo's megahit Switch console: what to know

-

Nintendo to unveil upgrade to best-selling Switch console

Nintendo to unveil upgrade to best-selling Switch console

-

China practises hitting key ports, energy sites in Taiwan drills

-

Oil, sand and speed: Saudi gearheads take on towering dunes

Oil, sand and speed: Saudi gearheads take on towering dunes

-

All eyes on Tsunoda at Japan GP after ruthless Red Bull move

-

'Image whisperers' bring vision to the blind at Red Cross museum

'Image whisperers' bring vision to the blind at Red Cross museum

-

Hay shines as New Zealand make 292-8 in Pakistan ODI

-

Other governments 'weaponising' Trump language to attack NGOs: rights groups

Other governments 'weaponising' Trump language to attack NGOs: rights groups

-

UK imposes online entry permit on European visitors

-

How a Brazilian chief is staving off Amazon destruction

How a Brazilian chief is staving off Amazon destruction

-

Meme politics: White House embraces aggressive alt-right online culture

-

China launches military drills in Taiwan Strait

China launches military drills in Taiwan Strait

-

US senator smashes record with 25-hour anti-Trump speech

-

Brazil binman finds newborn baby on garbage route

Brazil binman finds newborn baby on garbage route

-

US senator smashes record with marathon anti-Trump speech

-

Trump advisor Waltz faces new pressure over Gmail usage

Trump advisor Waltz faces new pressure over Gmail usage

-

Niger junta frees ministers of overthrown government

-

Trump set to unleash 'Liberation Day' tariffs

Trump set to unleash 'Liberation Day' tariffs

-

Boeing chief to acknowledge 'serious missteps' at US Senate hearing

-

Real Madrid hold Real Sociedad in eight-goal thriller to reach Copa del Rey final

Real Madrid hold Real Sociedad in eight-goal thriller to reach Copa del Rey final

-

Nuno salutes 'special' Elanga after stunning strike fires Forest

-

PSG survive scare against Dunkerque to reach French Cup final

PSG survive scare against Dunkerque to reach French Cup final

-

Sundowns edge Esperance as crowd violence mars quarter-final

-

Nottingham Forest beat Man Utd, Saka scores on Arsenal return

Nottingham Forest beat Man Utd, Saka scores on Arsenal return

-

Elanga wonder-goal sinks Man Utd as Forest eye Champions League berth

-

Stock markets mostly advance ahead of Trump tariffs deadline

Stock markets mostly advance ahead of Trump tariffs deadline

-

US movie theaters urge 45-day 'baseline' before films hit streaming

-

Saka scores on return as Arsenal beat Fulham

Saka scores on return as Arsenal beat Fulham

-

Third-division Bielefeld shock holders Leverkusen in German Cup

-

Ball-blasting 'Torpedo bats' making waves across MLB opening weekend

Ball-blasting 'Torpedo bats' making waves across MLB opening weekend

-

Newsmax shares surge more than 2,000% in days after IPO

-

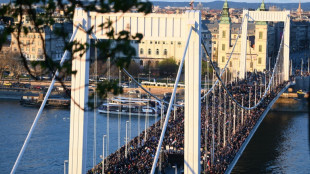

Thousands of Hungarians protest against Pride ban law

Thousands of Hungarians protest against Pride ban law

-

GM leads first quarter US auto sales as tariffs loom

-

Tesla sales tumble in Europe in the first quarter

Tesla sales tumble in Europe in the first quarter

-

No 'eye for an eye' approach to US tariffs: Mexico

-

NFL club owners back dynamic kickoffs, delay tush push vote

NFL club owners back dynamic kickoffs, delay tush push vote

-

Trump 'perfecting' new tariffs as nervous world braces

-

Trump nominee says to press UK on Israel arms

Trump nominee says to press UK on Israel arms

-

French court says Le Pen appeal ruling could come before presidential vote

-

The battle to control assets behind Bosnia crisis

The battle to control assets behind Bosnia crisis

-

Prabhsimran powers Punjab to IPL win over Lucknow

-

Mass layoffs targeting 10,000 jobs hit US health agencies

Mass layoffs targeting 10,000 jobs hit US health agencies

-

Tiger's April Foolishness: plan to play Masters just a joke

-

Myanmar quake toll passes 2,700, nation halts to honour victims

Myanmar quake toll passes 2,700, nation halts to honour victims

-

Turkish fans, artists urge Muse to cancel Istanbul gig

-

US seeks death penalty for accused killer of insurance CEO

US seeks death penalty for accused killer of insurance CEO

-

UK govt moves to block sentencing guidelines for minority defendants

-

Trump puts world on edge as 'Liberation Day' tariffs loom

Trump puts world on edge as 'Liberation Day' tariffs loom

-

Swedish journalist jailed in Turkey kept 'isolated': employer

'Huge uncertainty' for EU firms over China's Covid curbs, chamber warns

Many European firms are rethinking their investments in China because of its strict Covid controls, a top business group said Monday, warning that disruptions had pummelled operations.

While the rest of the world has steadily removed coronavirus curbs, China has remained committed to its zero-Covid strategy, using lockdowns and mass testing to stamp out all infections.

But this strategy has hammered businesses and snarled supply chains -- 60 percent of respondents in a survey of European businesses said it has become harder to do business in China, in large part due to Covid controls.

"We hope that China is really waking up," Bettina Schoen-Behanzin, vice president of the European Union Chamber of Commerce in China, told AFP.

"(We hope) that they find a way to get out of this zero-tolerance Covid strategy because it causes huge uncertainty and this is for sure not good for investment."

The chamber conducted the survey on over 600 member firms in February and March just as strict lockdowns were imposed in several areas to control China's worst Covid outbreak in two years -- from business hub Shanghai to the northern breadbasket province of Jilin.

The body also did a follow-up in April to assess the impact of the lockdowns and the Russian invasion of Ukraine.

It found that 92 percent of member companies were hit by supply chain problems, and three-quarters said their operations were negatively impacted by the Covid controls.

Further, 60 percent of respondents said in April that they had lowered their 2022 revenue projections.

The Ukraine war also impacted confidence -- a third of the firms surveyed cited geopolitical tensions as a reason for the Chinese market becoming less attractive.

"The role China played over the last two years in bolstering European companies' global revenues looks set to diminish," the report released on Monday said.

"And recent events have led many to question just how many eggs they are willing to keep in their China basket."

The Covid containment measures also hampered European firms' ability to recruit international and local talent, the chamber said.

Its annual survey found that 58 percent of companies faced difficulties in recruiting international and local talent, pointing to the Covid controls and "a wealth of ever-changing visa and work permit procedures and extreme limitations on travel in and out of China".

- 'The world does not wait' -

China is the world's second-biggest economy with a huge market, however, making it difficult for firms to walk away.

"Companies, businesses are not leaving China, because the market is too big, the market is too important, and there are for sure many growth opportunities ahead," Schoen-Behanzin told AFP.

"But they are localising, they are onshoring, and they are rethinking their footprint in China, in Asia," she added.

"They are shifting, especially future investments."

However, if the Covid restrictions drag on for another year, companies could start to feel even more pain.

"The world does not wait for China," Schoen-Behanzin said.

"If there is no change, then definitely companies will start to think about backup plans and they obviously would go into other markets."

H.E.Young--AMWN