-

England Test captain Stokes to miss early county games in fitness battle

England Test captain Stokes to miss early county games in fitness battle

-

Macron vows to defend science as host of UN oceans summit

-

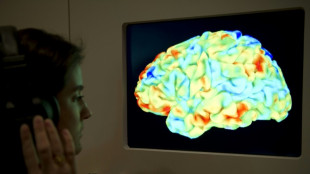

Brain implant turns thoughts into speech in near real-time

Brain implant turns thoughts into speech in near real-time

-

Top aide to Israel's Netanyahu arrested in 'Qatargate' probe

-

Slashed US funding threatens millions of children: charity chief

Slashed US funding threatens millions of children: charity chief

-

China property giant Vanke reports annual loss of $6.8 bn

-

World economies brace for Trump tariffs ahead of deadline

World economies brace for Trump tariffs ahead of deadline

-

Myanmar declares week of mourning as quake toll passes 2,000

-

Japan leads hefty global stock market losses on tariff fears

Japan leads hefty global stock market losses on tariff fears

-

Yes, oui, Cannes! Glamour name eyes place in French Cup final

-

'Different energy' at Man Utd after mini-revival, says Amorim

'Different energy' at Man Utd after mini-revival, says Amorim

-

Fear of aftershocks in Myanmar forces patients into hospital car park

-

Far-right leaders rally around France's Le Pen after election ban

Far-right leaders rally around France's Le Pen after election ban

-

Renault and Nissan shift gears on alliance

-

Hard-hitting drama 'Adolescence' to be shown in UK schools

Hard-hitting drama 'Adolescence' to be shown in UK schools

-

Primark boss resigns after inappropriate behaviour allegation

-

Myanmar declares week of mourning as quake toll passes 2,000, hopes fade for survivors

Myanmar declares week of mourning as quake toll passes 2,000, hopes fade for survivors

-

Mbappe can be Real Madrid 'legend' like Ronaldo: Ancelotti

-

Saka 'ready to go' for Arsenal after long injury lay-off: Arteta

Saka 'ready to go' for Arsenal after long injury lay-off: Arteta

-

Aston Martin to sell stake in Formula One team

-

Three talking points ahead of clay-court season

Three talking points ahead of clay-court season

-

French court hands Le Pen five-year election ban

-

Probe accuses ex J-pop star Nakai of sexual assault

Probe accuses ex J-pop star Nakai of sexual assault

-

Japan leads hefty global stock market losses on tariff woes

-

Saka 'ready to go' after long injury lay-off: Arteta

Saka 'ready to go' after long injury lay-off: Arteta

-

Ingebrigtsen Sr, on trial for abusing Olympic champion, says he was 'overly protective'

-

Tourists and locals enjoy 'ephemeral' Tokyo cherry blossoms

Tourists and locals enjoy 'ephemeral' Tokyo cherry blossoms

-

Khamenei warns of 'strong' response if Iran attacked

-

France fines Apple 150 million euros over privacy feature

France fines Apple 150 million euros over privacy feature

-

UK PM urges nations to smash migrant smuggling gangs 'once and for all'

-

Thai authorities probe collapse at quake-hit construction site

Thai authorities probe collapse at quake-hit construction site

-

France's Le Pen convicted in fake jobs trial

-

Chinese tech giant Huawei says profits fell 28% last year

Chinese tech giant Huawei says profits fell 28% last year

-

Trump says confident of TikTok deal before deadline

-

Myanmar declares week of mourning as hopes fade for quake survivors

Myanmar declares week of mourning as hopes fade for quake survivors

-

Japan's Nikkei leads hefty market losses, gold hits record

-

Tears in Taiwan for relatives hit by Myanmar quake

Tears in Taiwan for relatives hit by Myanmar quake

-

Venezuela says US revoked transnational oil, gas company licenses

-

'Devastated': Relatives await news from Bangkok building collapse

'Devastated': Relatives await news from Bangkok building collapse

-

Arsenal, Tottenham to play pre-season North London derby in Hong Kong

-

Japan's Nikkei leads hefty equity market losses; gold hits record

Japan's Nikkei leads hefty equity market losses; gold hits record

-

Israel's Netanyahu picks new security chief, defying legal challenge

-

Trump says US tariffs to hit 'all countries'

Trump says US tariffs to hit 'all countries'

-

Prayers and tears for Eid in quake-hit Mandalay

-

After flops, movie industry targets fresh start at CinemaCon

After flops, movie industry targets fresh start at CinemaCon

-

Tsunoda targets podium finish in Japan after 'unreal' Red Bull move

-

French chefs await new Michelin guide

French chefs await new Michelin guide

-

UK imposes travel permit on Europeans from Wednesday

-

At his academy, Romanian legend Hagi shapes future champions

At his academy, Romanian legend Hagi shapes future champions

-

Referee's lunch break saved Miami winner Mensik from early exit

Chip crisis pushes European car sales to new low

EU car sales fell to a new low last year as the auto sector was hobbled by the Covid pandemic and a shortage of computer chips, industry figures showed Tuesday.

Registrations of new passenger cars in the EU slid by 2.4 percent in 2021, to 9.7 million vehicles, the worst performance since statistics began in 1990, according to data from the European Automobile Manufacturers Association (ACEA).

That follows the historic fall of nearly 24 percent suffered in 2020 due to pandemic restrictions, and brought new car registrations in the EU to 3.3 million below the pre-crisis sales of 2019.

The lack of semiconductors, the computer chips used in a multitude of car systems in both traditional and electric vehicles, was the main reason holding the industry back.

"This fall was the result of the semiconductor shortage that negatively impacted car production throughout the year, but especially during the second half of 2021," said the ACEA.

Car manufacturers initially downplayed the impact of the chip shortage, but it eventually led them to slow production and even idle factories.

EU car sales did rebound strongly in the second quarter, but for most of the second half they were down by around 20 percent.

The short-term perspectives for supplies are not good.

"The start of 2022 will still be difficult in terms of supplies of chips," Alexandre Marian at the AlixPartners consultancy told AFP.

"The situation should improve in the middle of the year, but that doesn't mean other problems won't crop up, concerning raw materials, supply chains and labour shortages," he said.

The chip shortage is a consequence of the pandemic as manufacturers were disrupted by lockdowns and sick employees, as well as supply chain problems and increased global demand for electronics.

The pandemic has also sent prices for many raw materials soaring and caused labour shortages in some areas.

- Germany stuck in reverse -

If the markets in France, Italy and Spain posted modest gains, a 10.1-percent drop in Germany dragged down the overall EU figure.

Germany is by far Europe's largest car market, accounting for a quarter of total sales at over 2.6 million last year.

If the shortage of semiconductors was the major factor holding back a rebound, the EU also underperformed compared to the other major markets where the recovery from the pandemic was stronger.

The Chinese car market grew by 4.4 percent and the US market by 3.7 percent.

The decline in European sales may also reflect "the sharp increase in the average price of cars as well as an expectant attitude by consumers concerning electric vehicles which is pushing them to put off purchases and hold on to their current vehicle longer," said analysts at Inovev, an automotive data analytics firm.

- Renault hits sales pothole -

Europe's top three auto manufacturers all saw a drop in sales in the bloc.

Volkswagen managed to retain the top spot, but a 4.8-percent drop in sales to 1.4 million vehicles caused its market share to dip to 25.1 percent.

Stellantis, which was formed from the merger of Italy's Fiat group and France's Peugeot-Citroen, suffered a smaller 2.1-percent drop to 2.1 million units, nudging its market share higher to 21.9 percent.

Renault group suffered a 10-percent drop, with sales of its eponymous brand tumbling by 16 percent, while sales of both its low-cost Dacia brand and sporty Alpine brands rose.

The French automotive group saw its market share narrow to 10.6 percent.

Germany's BMW managed a 1.5-percent increase in registrations, but Daimler -- the owner of the Mercedes and Smart brands -- suffered a 12.4-percent drop.

Korea's Hyundai Group -- which includes both the Hyundai and Kia brands -- solidified its position as the number-four carmaker in the EU with an 18.4-percent gain to over 828,000 vehicles.

Its market share rose to 8.5 percent.

The data, which are supplied by ACEA members, do not include sales by US electric vehicle manufacturer Tesla.

The ACEA data also did not include a breakdown by petrol, diesel and electric vehicles, which are provided in a separate quarterly report.

P.M.Smith--AMWN