-

Djokovic oozing confidence ahead of century bid

Djokovic oozing confidence ahead of century bid

-

US regulators to investigate Disney diversity efforts

-

Elon Musk says xAI startup buying X platform

Elon Musk says xAI startup buying X platform

-

'Jail or death': migrants expelled by Trump fear for their fate

-

Djokovic closing in on 100th title after Dimitrov downed in Miami

Djokovic closing in on 100th title after Dimitrov downed in Miami

-

Leverkusen beat Bochum to stay hot on Bayern's heels

-

Global markets slide as fears over US tariffs intensify

Global markets slide as fears over US tariffs intensify

-

Dorival Junior sacked as Brazil coach after Argentina humiliation

-

Djokovic cruises past Dimitrov into Miami Open final

Djokovic cruises past Dimitrov into Miami Open final

-

No.1 Scheffler ties Houston Open record with 62 to grab lead

-

Trump auto tariffs strike at heart of North American trade

Trump auto tariffs strike at heart of North American trade

-

Vance says Denmark has 'under invested' in Greenland

-

Green light for Winter Olympics bobsleigh slope

Green light for Winter Olympics bobsleigh slope

-

Musk's DOGE team emerges from the shadows

-

Film stars blast Academy for 'failing to defend' Palestinian filmmaker

Film stars blast Academy for 'failing to defend' Palestinian filmmaker

-

Record fine for UK university renews free speech row

-

Grizzlies fire head coach Jenkins: team

Grizzlies fire head coach Jenkins: team

-

'Game-changing' Hazlewood shines as Bengaluru thrash Chennai in IPL

-

Table-topping Bengaluru thrash Chennai by 50 runs in IPL

Table-topping Bengaluru thrash Chennai by 50 runs in IPL

-

Israel warns of attacks 'everywhere' in Lebanon after rocket fire

-

Utah becomes first US state to ban fluoride in drinking water

Utah becomes first US state to ban fluoride in drinking water

-

Trump prompts US allies to reopen nuclear weapons debate

-

Nigerian police ban Kano Eid parade as rival emirs dispute throne

Nigerian police ban Kano Eid parade as rival emirs dispute throne

-

Ex-Barcelona star Dani Alves has rape conviction overturned

-

French lawyers condemn 'sexism' of Depardieu's defence in abuse trial

French lawyers condemn 'sexism' of Depardieu's defence in abuse trial

-

Stock markets slide over US inflation, tariff fears

-

King of cobbles Van der Poel adds Belgium's E3 to Milan-San Remo win

King of cobbles Van der Poel adds Belgium's E3 to Milan-San Remo win

-

Vance lands in Greenland as anger mounts over Trump takeover bid

-

Teen Brennan wins again, Ayuso retakes lead in Catalonia

Teen Brennan wins again, Ayuso retakes lead in Catalonia

-

Massive quake kills more than 150 in Myanmar, Thailand

-

Trump, Canada PM ease tensions with 'productive' call

Trump, Canada PM ease tensions with 'productive' call

-

Italy tries to fill its Albanian migrant centres after legal woes

-

S.Sudan govt says Vice President Machar 'under house arrest'

S.Sudan govt says Vice President Machar 'under house arrest'

-

Erdogan turns sights on opposition CHP with his main rival in jail

-

Mateta 'ready' to return for Palace in FA Cup after horror injury

Mateta 'ready' to return for Palace in FA Cup after horror injury

-

US 'in arrears' at the WTO

-

Massive quake kills nearly 150 in Myanmar, Thailand

Massive quake kills nearly 150 in Myanmar, Thailand

-

Fleeing Trump: four Americans who chose Mexico

-

US Fed's preferred inflation gauge shows some cause for concern

US Fed's preferred inflation gauge shows some cause for concern

-

Journalist, protester killed at Nepal pro-monarchy rally

-

Barca blow as Olmo ruled out for three weeks

Barca blow as Olmo ruled out for three weeks

-

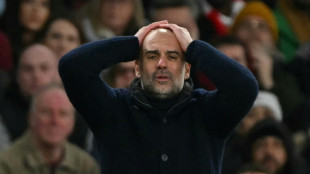

Guardiola seeks redemption as Man City head to Bournemouth in FA Cup

-

Stock markets fall over US inflation, tariff fears

Stock markets fall over US inflation, tariff fears

-

PSG 'feel like champions' as Ligue 1 title nears, says Luis Enrique

-

'We don't deserve bonus': Man City boss Guardiola

'We don't deserve bonus': Man City boss Guardiola

-

Cuba resurrects dollar-only stores, a symbol of inequality

-

Germany says 'nothing off table' in US tariff row

Germany says 'nothing off table' in US tariff row

-

Chinese regulator to vet Panama ports deal: Hong Kong media

-

Pro-Duterte rallies as ex-Philippine leader marks 80th birthday in jail

Pro-Duterte rallies as ex-Philippine leader marks 80th birthday in jail

-

Israel hits Beirut after rockets fired from south Lebanon

Rising student debt to worsen money woes of young Britons

Rhiannon Muise graduated from Edge Hill University in northwest England last year with a mountain of student debt, which is growing even larger due to surging inflation.

The 21-year-old dance and drama graduate said it will take a "lifetime" for her to pay back the £45,000 ($55,000) she owes for tuition fees and living expenses, particularly if she stays within her chosen field where salaries can be low.

Muise's plight echoes that of students across Britain, who are already struggling with a cost-of-living crisis.

Britons heading to university next year face major changes that critics argue will worsen the financial pain.

- Exhausting -

The pressure is "exhausting, especially for someone in their 20s who has just started thinking about their career", Muise told AFP.

Her current job as Edge Hill student engagement officer pays below the threshold that activates repayments.

UK graduates shoulder more debt than any other developed country, according to House of Commons Library data.

About 1.5 million students borrow nearly £20 billion in loans every year in England alone.

And on average, graduates of 2020 have amassed £45,000 in debt.

Zeno, a 25-year-old student in London who gave only his first name, said he owes just short of £75,000 for his loans.

Unless he "wins the lottery", he accepts he will probably be paying the money back from his salary for the next 30 years.

- Tuition fees -

University used to be free in the UK, with means-tested grants for the poorest students to cover living costs.

But after the sector was opened up in the 1990s, numbers surged and, despite protests from student bodies, tuition fees have been gradually introduced in the last decade to help universities meet costs.

With education a devolved matter for the governments in Scotland, Wales and Northern Ireland, different tuition fee arrangements are in place across the UK.

Accommodation and living costs are extra.

In England, undergraduate tuition fees are capped at £9,250 a year for UK and Irish students -- up from £3,375 in 2011 when the government cut most ongoing direct public funding.

The cap in Wales is £9,000 and £4,030 in Northern Ireland.

Scottish students studying in Scotland pay £1,820 but those from the rest of the UK attending universities north of the border with England pay £9,250.

- Inflation worry -

The picture is further complicated by rocketing inflation because the student loan interest rate is linked to the retail price index (RPI).

Loan interest is calculated by adding up to 3.0 percentage points to the RPI rate.

Inflation however soared to 30-year highs this year, particularly on rocketing energy costs and fallout from the Ukraine conflict.

Graduates could therefore pay an interest rate of 12 percent from September -- or more if prices rise even higher.

The UK government plays a large part in student financing, providing loans that only demand repayment when a graduate earns above a threshold of £27,295 per year.

What borrowers repay depends on how much they earn. Unlike private lenders, they have up to 30 years to repay. The debt is cancelled after this time.

"This system is more progressive than in the United States, with generous write-offs for lower-paid graduates," said Nick Hillman, director of the Higher Education Policy Institute in Oxford.

Current and recent students faced huge upheaval during courses due to coronavirus restrictions, with the pandemic also hitting job opportunities.

A combination of high debt repayments, high cost of living and wages that have failed to keep pace with inflation, add yet more stress.

- Conundrum -

Student finance poses a major conundrum for the public purse because the UK forecasts outstanding loans will top £560 billion by 2050.

From next year, Britain will lower the repayment threshold for new borrowers to £25,000 and lengthen the repayment time from 30 to 40 years.

This will however increase costs for low-earners, while benefiting richer graduates who can pay back more quickly.

The UK government forecasts however that half of new students will repay their loans in full under the new plan.

Student debt has long been a concern in the United States, where the Federal Reserve estimates that it amounts to a staggering $1.76 trillion.

US students on average have outstanding debt of close to $41,000, according to think-tank Education Data Initiative.

President Joe Biden this year extended a moratorium on student loan repayment and interest -- and is holding talks over partial debt write-offs.

F.Dubois--AMWN