-

SFWJ / Medcana Announces Strategic Expansion Into Australia With Acquisition of Cannabis Import and Distribution Licenses

SFWJ / Medcana Announces Strategic Expansion Into Australia With Acquisition of Cannabis Import and Distribution Licenses

-

Maresca confident he will survive Chelsea slump

-

Mob beats to death man from persecuted Pakistan minority

Mob beats to death man from persecuted Pakistan minority

-

Lebanon says one killed in Israeli strike near Sidon

-

Arsenal's Havertz could return for Champions League final

Arsenal's Havertz could return for Champions League final

-

US officials split on Ukraine truce prospects

-

Client brain-dead after Paris cryotherapy session goes wrong

Client brain-dead after Paris cryotherapy session goes wrong

-

Flick demands answers from La Liga for 'joke' schedule

-

'Maddest game' sums up Man Utd career for Maguire

'Maddest game' sums up Man Utd career for Maguire

-

Trial opens for students, journalists over Istanbul protests

-

Gaza rescuers say Israeli strikes kill 24 after Hamas rejects truce proposal

Gaza rescuers say Israeli strikes kill 24 after Hamas rejects truce proposal

-

'Really stuck': Ukraine's EU accession drive stumbles

-

'Not the time to discuss future', says Alonso amid Real Madrid links

'Not the time to discuss future', says Alonso amid Real Madrid links

-

74 killed in deadliest US attack on Yemen, Huthis say

-

Southgate's ex-assistant Holland fired by Japan's Yokohama

Southgate's ex-assistant Holland fired by Japan's Yokohama

-

Vance meets Meloni in Rome before Easter at the Vatican

-

Ryan Gosling to star in new 'Star Wars' film

Ryan Gosling to star in new 'Star Wars' film

-

Hamas calls for pressure to end Israel's aid block on Gaza

-

Russia says Ukraine energy truce over, US mulls peace talks exit

Russia says Ukraine energy truce over, US mulls peace talks exit

-

58 killed in deadliest US strike on Yemen, Huthis say

-

Museums rethink how the Holocaust should be shown

Museums rethink how the Holocaust should be shown

-

Three dead after deadly spring storm wreaks havoc in the Alps

-

No need for big changes at Liverpool, says Slot

No need for big changes at Liverpool, says Slot

-

Bloody Philippine passion play sees final performance of veteran 'Jesus'

-

New US envoy prays, delivers Trump 'peace' message at Western Wall

New US envoy prays, delivers Trump 'peace' message at Western Wall

-

Postecoglou sticking around 'a little longer' as Spurs show fight in Frankfurt

-

US threatens to withdraw from Ukraine talks if no progress

US threatens to withdraw from Ukraine talks if no progress

-

Tears and defiance in Sumy as Russia batters Ukraine border city

-

Russia rains missiles on Ukraine as US mulls ending truce efforts

Russia rains missiles on Ukraine as US mulls ending truce efforts

-

Tokyo leads gains in most Asian markets on trade deal hopes

-

Two missing after deadly spring snowstorm wreaks havoc in the Alps

Two missing after deadly spring snowstorm wreaks havoc in the Alps

-

'War has taken everything': AFP reporter returns home to Khartoum

-

US strikes on Yemen fuel port kill 38, Huthis say

US strikes on Yemen fuel port kill 38, Huthis say

-

Slegers targets Lyon scalp in pursuit of Arsenal European glory

-

'Defend ourselves': Refugee girls in Kenya find strength in taekwondo

'Defend ourselves': Refugee girls in Kenya find strength in taekwondo

-

China's manufacturing backbone feels Trump trade war pinch

-

Sri Lankans throng to Kandy for rare display of Buddhist relic

Sri Lankans throng to Kandy for rare display of Buddhist relic

-

Chinese vent anger at Trump's trade war with memes, mockery

-

Heartbroken Brits abandon pets as living costs bite

Heartbroken Brits abandon pets as living costs bite

-

Mongolian LGBTQ youth fight for recognition through music, comedy

-

Cash crunch leaves Syrians queueing for hours to collect salaries

Cash crunch leaves Syrians queueing for hours to collect salaries

-

Lyon left to regroup for Champions League bid after painful European exit

-

Unravelling Real Madrid face Athletic Bilbao Liga test

Unravelling Real Madrid face Athletic Bilbao Liga test

-

Napoli disturbing buoyant Inter's peace in Serie A Easter bonanza

-

Disappointed Dortmund chase consistency with Europe at stake

Disappointed Dortmund chase consistency with Europe at stake

-

Asian markets mixed as traders track tariff talks

-

Yan and Buhai share lead at LA Championship

Yan and Buhai share lead at LA Championship

-

Under fire at debate, Canada PM Carney tries to focus on Trump

-

Liverpool poised for Premier League coronation, Leicester, Ipswich for relegation

Liverpool poised for Premier League coronation, Leicester, Ipswich for relegation

-

India's elephant warning system tackles deadly conflict

Stock markets steady, oil prices fall

Stock markets largely steadied Tuesday while oil prices fell on easing geopolitical concerns surrounding major crude producers Iran and Russia.

French President Emmanuel Macron said he had convinced Russia's Vladimir Putin not to escalate the crisis around Ukraine, ahead of talks in Kyiv aimed at defusing fears Moscow could invade.

Elsewhere, talks to revive a deal with Iran on its contested nuclear programme were set to resume Tuesday after Washington and Tehran signalled their willingness to clinch an agreement as soon as possible.

Edward Moya, analyst at trading group OANDA, said signs of progress in US-Iran nuclear talks -- which could see Tehran sell internationally again -- would likely not have much long-term impact on the oil price rally towards $100 per barrel.

"Energy traders locked in some profits over optimism that the US and Iran might be able to salvage a nuclear deal," he said.

"The oil market still remains heavily in deficit and whatever weakness happens to prices will likely be short-lived."

Surging oil prices -- Brent crude hit the highest level for more than seven years at $94 per barrel on Monday -- saw BP swing back into a big profit last year, the British energy giant announced.

The expected turnaround -- after huge losses in 2020 as the pandemic slammed oil prices -- saw BP's share price rise only modestly in London midday deals Tuesday.

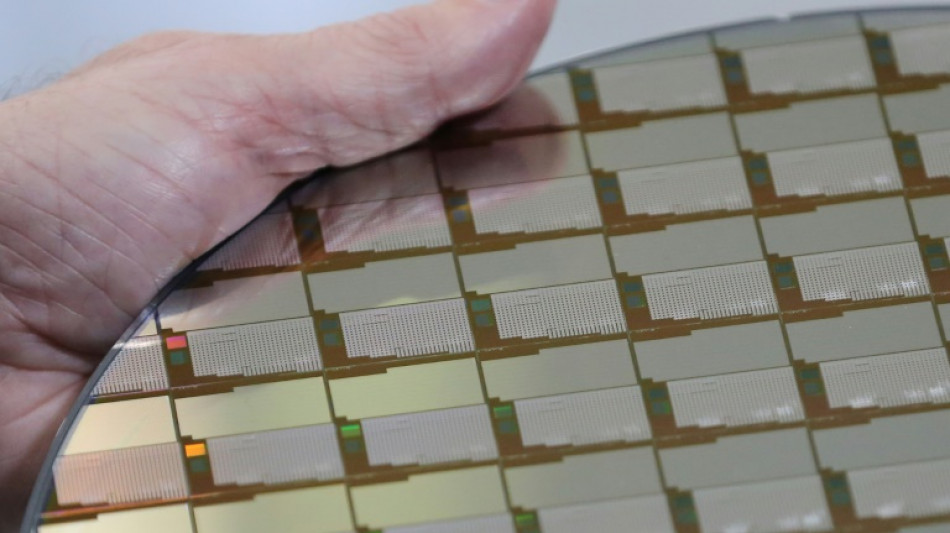

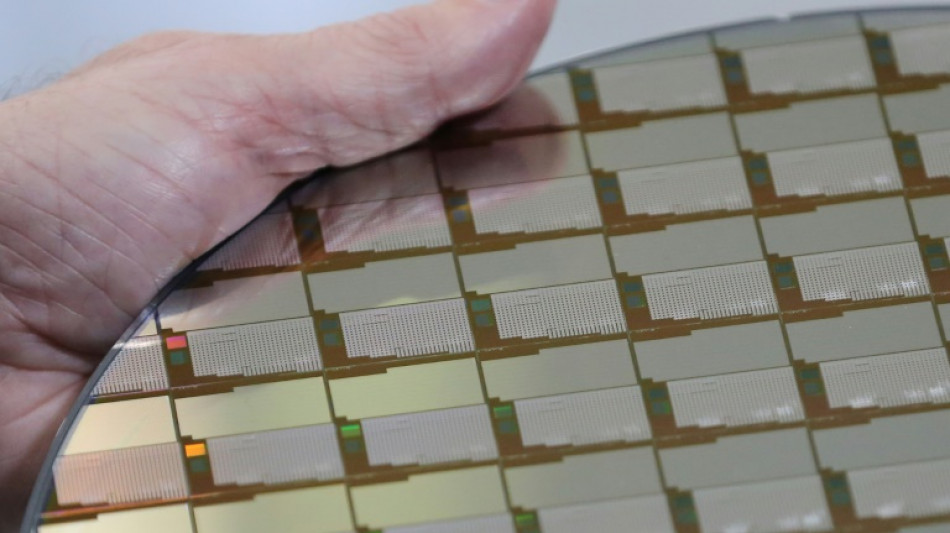

- Chips race -

The big corporate story out of Asia was SoftBank's announcement that the $40 billion sale of chip powerhouse Arm to Nvidia had collapsed because of "significant regulatory challenges" over competition concerns.

Alongside the news, the Japanese telecoms firm-turned-investment giant reported a net profit of $251 million in the third quarter.

In Europe, the EU unveiled a 43-billion-euro plan to quadruple the supply of semiconductors in the region by 2030, hoping to limit the bloc's dependence on Asia for a key component used in electric cars and smartphones.

Stock markets in London and Paris were up while Frankfurt was down at around midday as traders await key US inflation data Thursday that is tipped to show more painful price rises in January after a four-decade high in December.

Investors are bracing for central banks to raise interest rates to tame inflation, a move that could weigh down on the global economic recovery.

- Key figures around 1200 GMT -

London - FTSE 100: UP 0.1 percent at 7,578.62 points

Frankfurt - DAX: DOWN 0.1 percent at 15,185.20

Paris - CAC 40: UP 0.2 percent at 7,021.25

EURO STOXX 50: DOWN 0.1 percent at 4,115.71

Tokyo - Nikkei 225: UP 0.1 percent at 27,284.52 (close)

Hong Kong - Hang Seng Index: DOWN 1.0 percent at 24,329.49 (close)

Shanghai - Composite: UP 0.7 percent at 3,452.63 (close)

New York - Dow: FLAT at 35,091.13 (close)

Euro/dollar: DOWN at $1.1432 from $1.1440 late Monday

Pound/dollar: UP at $1.3562 from $1.3532

Euro/pound: DOWN at 84.30 pence from 84.51 pence

Dollar/yen: UP at 115.30 from 115.10 yen

Brent North Sea crude: DOWN 1.9 percent at $90.95 per barrel

West Texas Intermediate: DOWN 1.8 percent at $89.64 per barrel

T.Ward--AMWN