-

Rahm out to break 2025 win drought ahead of US PGA Championship

Rahm out to break 2025 win drought ahead of US PGA Championship

-

Japan tariff envoy departs for round two of US talks

-

Djurgarden eyeing Chelsea upset in historic Conference League semi-final

Djurgarden eyeing Chelsea upset in historic Conference League semi-final

-

Haliburton leads comeback as Pacers advance, Pistons stay alive

-

Bunker-cafe on Korean border paints image of peace

Bunker-cafe on Korean border paints image of peace

-

Tunics & turbans: Afghan students don Taliban-imposed uniforms

-

Asian markets struggle as trade war hits China factory activity

Asian markets struggle as trade war hits China factory activity

-

Norwegian success story: Bodo/Glimt's historic run to a European semi-final

-

Spurs attempt to grasp Europa League lifeline to save dismal season

Spurs attempt to grasp Europa League lifeline to save dismal season

-

Thawing permafrost dots Siberia with rash of mounds

-

S. Korea prosecutors raid ex-president's house over shaman probe: Yonhap

S. Korea prosecutors raid ex-president's house over shaman probe: Yonhap

-

Filipino cardinal, the 'Asian Francis', is papal contender

-

Samsung Electronics posts 22% jump in Q1 net profit

Samsung Electronics posts 22% jump in Q1 net profit

-

Pietro Parolin, career diplomat leading race to be pope

-

Nuclear submarine deal lurks below surface of Australian election

Nuclear submarine deal lurks below surface of Australian election

-

China's manufacturing shrinks in April as trade war bites

-

Financial markets may be the last guardrail on Trump

Financial markets may be the last guardrail on Trump

-

Swedish journalist's trial opens in Turkey

-

Kiss says 'honour of a lifetime' to coach Wallabies at home World Cup

Kiss says 'honour of a lifetime' to coach Wallabies at home World Cup

-

US growth figure expected to make for tough reading for Trump

-

Opposition leader confirmed winner of Trinidad elections

Opposition leader confirmed winner of Trinidad elections

-

Snedeker, Ogilvy to skipper Presidents Cup teams: PGA Tour

-

Win or bust in Europa League for Amorim's Man Utd

Win or bust in Europa League for Amorim's Man Utd

-

Trump celebrates 100 days in office with campaign-style rally

-

Top Cuban dissidents detained after court revokes parole

Top Cuban dissidents detained after court revokes parole

-

Arteta urges Arsenal to deliver 'special' fightback against PSG

-

Trump fires Kamala Harris's husband from Holocaust board

Trump fires Kamala Harris's husband from Holocaust board

-

Pakistan says India planning strike as tensions soar over Kashmir attack

-

Weinstein sex attack accuser tells court he 'humiliated' her

Weinstein sex attack accuser tells court he 'humiliated' her

-

France accuses Russian military intelligence over cyberattacks

-

Global stocks mostly rise as Trump grants auto tariff relief

Global stocks mostly rise as Trump grants auto tariff relief

-

Grand Vietnam parade 50 years after the fall of Saigon

-

Trump fires ex first gentleman Emhoff from Holocaust board

Trump fires ex first gentleman Emhoff from Holocaust board

-

PSG 'not getting carried away' despite holding edge against Arsenal

-

Cuban dissidents detained after court revokes parole

Cuban dissidents detained after court revokes parole

-

Sweden stunned by new deadly gun attack

-

BRICS blast 'resurgence of protectionism' in Trump era

BRICS blast 'resurgence of protectionism' in Trump era

-

Trump tempers auto tariffs, winning cautious praise from industry

-

'Cruel measure': Dominican crackdown on Haitian hospitals

'Cruel measure': Dominican crackdown on Haitian hospitals

-

'It's only half-time': Defiant Raya says Arsenal can overturn PSG deficit

-

Dembele sinks Arsenal as PSG seize edge in Champions League semi-final

Dembele sinks Arsenal as PSG seize edge in Champions League semi-final

-

Les Kiss to take over Wallabies coach role from mid-2026

-

Real Madrid's Rudiger, Mendy and Alaba out injured until end of season

Real Madrid's Rudiger, Mendy and Alaba out injured until end of season

-

US threatens to quit Russia-Ukraine effort unless 'concrete proposals'

-

Meta releases standalone AI app, competing with ChatGPT

Meta releases standalone AI app, competing with ChatGPT

-

Zverev crashes as Swiatek scrapes into Madrid Open quarter-finals

-

BRICS members blast rise of 'trade protectionism'

BRICS members blast rise of 'trade protectionism'

-

Trump praises Bezos as Amazon denies plan to display tariff cost

-

France to tax small parcels from China amid tariff fallout fears

France to tax small parcels from China amid tariff fallout fears

-

Hong Kong releases former opposition lawmakers jailed for subversion

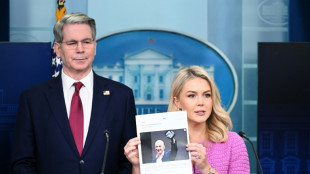

Financial markets may be the last guardrail on Trump

Since returning to the White House, Donald Trump has ushered in sweeping changes to international geopolitics and US government administration with little regard for norms that have constrained predecessors.

But there has been one source of restraint on a president determined to push the limits of US governance: financial markets.

The stock market's response to Trump's "Liberation Day" tariff announcement was "probably the most influential force to date" in tempering Trump's policies, said Terrence Guay, professor of international business at Pennsylvania State University.

In just two days, Wall Street equities shredded some $6 trillion in value as the S&P 500 suffered its worst session since the darkest days of Covid-19 in 2020.

"The market does tend to be ... kind of like a seismograph. It reacts to the slightest little tremor," said Steven Kyle, professor of applied economics at Cornell University.

A week after Trump's announcement of reciprocal tariffs threw markets into turmoil, the Republican suddenly scaled back his plan's most draconian elements for every country except China. The pivot sent stocks skyrocketing.

Last week, market watchers perceived another significant Trump retreat after another round of scary market action. The gyrations came after the president combined an ever-worsening tit-for-tat trade war with China with threats to oust Federal Reserve Chair Jerome Powell.

The White House quickly shifted its tone on China and Trump reassured the public that he won't fire Powell.

"Markets 'punished' his policies and he must have realized," along with his advisors, "that trade wars are not that easy to win," said Petros Mavroidis, a professor at Columbia Law School and a former member of the World Trade Organization.

"I am sure he doesn't want to be known as the president who led to a stock market crash," Guay added.

- Bond market angst -

But if "Wall Street sent the loudest signal, it wasn't the only signal," said University of Richmond finance professor Art Durnev.

Even more than the stock market, "the bond market is a stronger force and this is the primary driver" of Trump's shift, Durnev said.

Like gold or the Swiss franc, US Treasury bonds have traditionally been seen as a refuge for investors during times of duress in financial markets, or in the real economy.

But demand for US Treasury bonds -- a bedrock during the 2008 financial crisis and other perilous moments -- has been shaken in recent weeks as Trump's aggressive policies have pushed yields higher in a sign of flagging demand for American issues.

Trump himself acknowledged the import of the bond market gyrations, saying investors were getting "a little bit yippy." That word means nervous.

The bond market "also had a big impact," Guay said. "Many investors have pulled their money out of the US."

Besides Trump's ambitious attempts to overhaul international trade, analysts have tied bond market volatility to worries that planned tax cuts could worsen the US deficit.

Then there is Powell, whom Trump also criticized in his first presidential term. The most recent round of Treasury market panic followed Trump's social media post on April 21 branding Powell a "major loser" for not cutting interest rates.

But by the following day, Trump had pulled back, saying he had "no intention of firing" Powell.

The combination of these factors means investors are beginning to realize that "the US may not be, under this administration, the stable environment we've seen for decades," Guay said.

F.Dubois--AMWN