-

Asian markets struggle as trade war hits China factory activity

Asian markets struggle as trade war hits China factory activity

-

Norwegian success story: Bodo/Glimt's historic run to a European semi-final

-

Spurs attempt to grasp Europa League lifeline to save dismal season

Spurs attempt to grasp Europa League lifeline to save dismal season

-

Thawing permafrost dots Siberia with rash of mounds

-

S. Korea prosecutors raid ex-president's house over shaman probe: Yonhap

S. Korea prosecutors raid ex-president's house over shaman probe: Yonhap

-

Filipino cardinal, the 'Asian Francis', is papal contender

-

Samsung Electronics posts 22% jump in Q1 net profit

Samsung Electronics posts 22% jump in Q1 net profit

-

Pietro Parolin, career diplomat leading race to be pope

-

Nuclear submarine deal lurks below surface of Australian election

Nuclear submarine deal lurks below surface of Australian election

-

China's manufacturing shrinks in April as trade war bites

-

Financial markets may be the last guardrail on Trump

Financial markets may be the last guardrail on Trump

-

Swedish journalist's trial opens in Turkey

-

Kiss says 'honour of a lifetime' to coach Wallabies at home World Cup

Kiss says 'honour of a lifetime' to coach Wallabies at home World Cup

-

US growth figure expected to make for tough reading for Trump

-

Opposition leader confirmed winner of Trinidad elections

Opposition leader confirmed winner of Trinidad elections

-

Snedeker, Ogilvy to skipper Presidents Cup teams: PGA Tour

-

Win or bust in Europa League for Amorim's Man Utd

Win or bust in Europa League for Amorim's Man Utd

-

Trump celebrates 100 days in office with campaign-style rally

-

Top Cuban dissidents detained after court revokes parole

Top Cuban dissidents detained after court revokes parole

-

Arteta urges Arsenal to deliver 'special' fightback against PSG

-

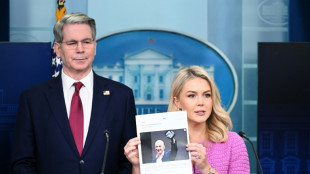

Trump fires Kamala Harris's husband from Holocaust board

Trump fires Kamala Harris's husband from Holocaust board

-

Pakistan says India planning strike as tensions soar over Kashmir attack

-

Weinstein sex attack accuser tells court he 'humiliated' her

Weinstein sex attack accuser tells court he 'humiliated' her

-

France accuses Russian military intelligence over cyberattacks

-

Global stocks mostly rise as Trump grants auto tariff relief

Global stocks mostly rise as Trump grants auto tariff relief

-

Grand Vietnam parade 50 years after the fall of Saigon

-

Trump fires ex first gentleman Emhoff from Holocaust board

Trump fires ex first gentleman Emhoff from Holocaust board

-

PSG 'not getting carried away' despite holding edge against Arsenal

-

Cuban dissidents detained after court revokes parole

Cuban dissidents detained after court revokes parole

-

Sweden stunned by new deadly gun attack

-

BRICS blast 'resurgence of protectionism' in Trump era

BRICS blast 'resurgence of protectionism' in Trump era

-

Trump tempers auto tariffs, winning cautious praise from industry

-

'Cruel measure': Dominican crackdown on Haitian hospitals

'Cruel measure': Dominican crackdown on Haitian hospitals

-

'It's only half-time': Defiant Raya says Arsenal can overturn PSG deficit

-

Dembele sinks Arsenal as PSG seize edge in Champions League semi-final

Dembele sinks Arsenal as PSG seize edge in Champions League semi-final

-

Les Kiss to take over Wallabies coach role from mid-2026

-

Real Madrid's Rudiger, Mendy and Alaba out injured until end of season

Real Madrid's Rudiger, Mendy and Alaba out injured until end of season

-

US threatens to quit Russia-Ukraine effort unless 'concrete proposals'

-

Meta releases standalone AI app, competing with ChatGPT

Meta releases standalone AI app, competing with ChatGPT

-

Zverev crashes as Swiatek scrapes into Madrid Open quarter-finals

-

BRICS members blast rise of 'trade protectionism'

BRICS members blast rise of 'trade protectionism'

-

Trump praises Bezos as Amazon denies plan to display tariff cost

-

France to tax small parcels from China amid tariff fallout fears

France to tax small parcels from China amid tariff fallout fears

-

Hong Kong releases former opposition lawmakers jailed for subversion

-

Trump celebrates tumultuous 100 days in office

Trump celebrates tumultuous 100 days in office

-

Sweden gun attack leaves three dead

-

Real Madrid's Rudiger banned for six matches after Copa final red

Real Madrid's Rudiger banned for six matches after Copa final red

-

Firmino, Toney fire Al Ahli into AFC Champions League final

-

Maximum respect for Barca but no fear: Inter's Inzaghi

Maximum respect for Barca but no fear: Inter's Inzaghi

-

Trump signals relief on auto tariffs as industry awaits details

Global stocks mostly rise as Trump grants auto tariff relief

Global stocks mostly rose despite fresh signs of a tariff hit to corporate earnings, while Wall Street cheered President Donald Trump's moves to soften the levies hitting automakers.

Trump's pivot includes limitations on the impact of multiple tariffs on carmakers and a measure to allow carmakers to offset a portion of the levy for two years.

All three major US indices posted solid gains, with the S&P 500 adding 0.6 percent.

Investors are "encouraged by the Trump decision to be a little more flexible (...) with the autos," said CFRA Research's Sam Stovall, who predicted stocks could go higher.

"There's definitely uncertainty, but I believe that the risk is to the upside, meaning that the market has already priced in the impact of the tariffs," he said.

In Europe, the London FTSE 100 index and Frankfurt's DAX closed higher but the Paris CAC 40 ended in the red.

Stocks moved sideways on Monday after notching four straight positive sessions last week as Trump adopted a more conciliatory posture on the trade war with China and said he doesn't plan to fire Federal Reserve Chair Jerome Powell.

But tariff talk has been prominent during earnings season.

In Europe, shares in Volvo Cars sank nearly 10 percent after it announced plans to cut costs by almost $2 billion, including through job cuts, as its profits fall.

"Tougher market conditions and lower volumes combined with increased price pressure and tariff effects are impacting profitability," Volvo Cars chief executive Hakan Samuelsson said.

Shares in German sportswear giant Adidas fell 2.8 percent as it warned that tariffs would increase prices for its products in the United States.

British pharmaceutical giant AstraZeneca said it has begun to move some of its European production to the United States, ahead of Trump's possible tariffs on the sector, helping its shares rise 0.9 percent.

Amazon shares initially slid nearly two percent after the White House slammed the online retailer over a report in Punchbowl News that it would soon tell consumers how much Trump's tariffs have contributed to the price tag on its goods, branding it a "hostile and political act".

Without fully denying the Punchbowl report, Amazon released a statement saying its low-cost Amazon Haul store had "considered the idea of listing import charges on certain products."

"This was never approved and is not going to happen," said the statement from Amazon, which finished down 0.2 percent.

Elsewhere, oil prices fell further on Tuesday on fears that global trade tensions may lead to a slowdown in economic activity that would hamper energy demand.

- Key figures at 2130 GMT -

New York - Dow: UP 0.8 percent at 40,527.62 (close)

New York - S&P 500: UP 0.6 percent at 5,560.83 (close)

New York - Nasdaq: UP 0.6 percent at 17,461.32 (close)

London - FTSE 100: UP 0.6 percent at 8,463.46 (close)

Paris - CAC 40: DOWN 0.2 percent at 7,555.87 (close)

Frankfurt - DAX: UP 0.7 percent at 22,425.83 (close)

Hong Kong - Hang Seng Index: UP 0.2 percent at 22,008.11 (close)

Shanghai - Composite: DOWN 0.1 percent at 3,286.65 (close)

Tokyo - Nikkei 225: Closed for a holiday

Euro/dollar: DOWN at $1.1390 from $1.1420 on Monday

Pound/dollar: DOWN at $1.3399 from $1.3441

Dollar/yen: UP at 142.22 yen from 142.01 yen

Euro/pound: UP at 85.08 pence from 84.96 pence

West Texas Intermediate: DOWN 2.6 percent at $60.42 per barrel

Brent North Sea Crude: DOWN 2.4 percent at $64.25 per barrel

burs-jmb/dw

O.Karlsson--AMWN