-

BASF exits Xinjiang ventures after Uyghur abuse reports

BASF exits Xinjiang ventures after Uyghur abuse reports

-

Nordics, Lithuania plan joint purchase of combat vehicles

-

Gold hits record, stocks diverge as Trump fuels Fed fears

Gold hits record, stocks diverge as Trump fuels Fed fears

-

World could boost growth by reducing trade doubt: IMF chief economist

-

IMF slashes global growth outlook on impact of US tariffs

IMF slashes global growth outlook on impact of US tariffs

-

IMF slashes China growth forecasts as trade war deepens

-

Skipper Shanto leads Bangladesh fightback in Zimbabwe Test

Skipper Shanto leads Bangladesh fightback in Zimbabwe Test

-

US VP Vance says 'progress' in India trade talks

-

Ex-England star Youngs to retire from rugby

Ex-England star Youngs to retire from rugby

-

Black Ferns star Woodman-Wickliffe returning for World Cup

-

Kremlin warns against rushing Ukraine talks

Kremlin warns against rushing Ukraine talks

-

Mbappe aiming for Copa del Rey final return: Ancelotti

-

US universities issue letter condemning Trump's 'political interference'

US universities issue letter condemning Trump's 'political interference'

-

Pope Francis's unfulfilled wish: declaring PNG's first saint

-

Myanmar rebels prepare to hand key city back to junta, China says

Myanmar rebels prepare to hand key city back to junta, China says

-

Hamas team heads to Cairo for Gaza talks as Israel strikes kill 26

-

Pianist to perform London musical marathon

Pianist to perform London musical marathon

-

India's Bumrah, Mandhana win top Wisden cricket awards

-

Zurab Tsereteli, whose monumental works won over Russian elites, dies aged 91

Zurab Tsereteli, whose monumental works won over Russian elites, dies aged 91

-

Roche says will invest $50 bn in US, as tariff war uncertainty swells

-

Pope Francis's funeral set for Saturday, world leaders expected

Pope Francis's funeral set for Saturday, world leaders expected

-

US official asserts Trump's agenda in tariff-hit Southeast Asia

-

World leaders set to attend Francis's funeral as cardinals gather

World leaders set to attend Francis's funeral as cardinals gather

-

Gold hits record, stocks mixed as Trump fuels Fed fears

-

Roche says will invest $50 bn in US over next five years

Roche says will invest $50 bn in US over next five years

-

Fleeing Pakistan, Afghans rebuild from nothing

-

US Supreme Court to hear case against LGBTQ books in schools

US Supreme Court to hear case against LGBTQ books in schools

-

Pistons snap NBA playoff skid, vintage Leonard leads Clippers

-

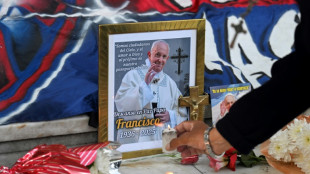

Migrants mourn pope who fought for their rights

Migrants mourn pope who fought for their rights

-

Duplantis kicks off Diamond League amid Johnson-led changing landscape

-

Taliban change tune towards Afghan heritage sites

Taliban change tune towards Afghan heritage sites

-

Kosovo's 'hidden Catholics' baptised as Pope Francis mourned

-

Global warming is a security threat and armies must adapt: experts

Global warming is a security threat and armies must adapt: experts

-

Can Europe's richest family turn Paris into a city of football rivals?

-

Climate campaigners praise a cool pope

Climate campaigners praise a cool pope

-

As world mourns, cardinals prepare pope's funeral

-

US to impose new duties on solar imports from Southeast Asia

US to impose new duties on solar imports from Southeast Asia

-

Draft NZ law seeks 'biological' definition of man, woman

-

Auto Shanghai to showcase electric competition at sector's new frontier

Auto Shanghai to showcase electric competition at sector's new frontier

-

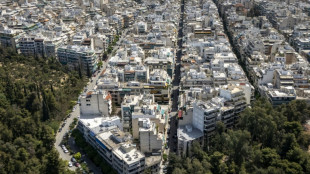

Tentative tree planting 'decades overdue' in sweltering Athens

-

Indonesia food plan risks 'world's largest' deforestation

Indonesia food plan risks 'world's largest' deforestation

-

Gold hits record, stocks slip as Trump fuels Fed fears

-

Trump helps enflame anti-LGBTQ feeling from Hungary to Romania

Trump helps enflame anti-LGBTQ feeling from Hungary to Romania

-

Woe is the pinata, a casualty of Trump trade war

-

'Like orphans': Argentina mourns loss of papal son

'Like orphans': Argentina mourns loss of papal son

-

Trump tariffs torch chances of meeting with China's Xi

-

X rival Bluesky adds blue checks for trusted accounts

X rival Bluesky adds blue checks for trusted accounts

-

China to launch new crewed mission into space this week

-

Morocco volunteers on Sahara clean-up mission

Morocco volunteers on Sahara clean-up mission

-

Latin America fondly farewells its first pontiff

Don't Miss the April 30 Deadline: Prepare Q1 2025 Form 941 Filing with Tax1099

Stay ahead of the curve! Tax1099, a leading IRS-authorized e-filing platform, reminds businesses to prepare and file Form 941 before the due date to ensure compliance and avoid costly IRS penalties.

FAYETTEVILLE, AR and DALLAS, TX / ACCESS Newswire / April 22, 2025 / With the form 941 due date of April 30, 2025, fast approaching, Tax1099 encourages businesses to start preparing now to streamline their federal employment tax reporting. Form 941, the Employer's Quarterly Federal Tax Return, is critical for reporting withheld income taxes, Social Security, and Medicare taxes, and must be filed by the last day of the month following each quarter.

Form 941 eFile through Tax1099 simplifies the process, offering speed, accuracy, and security. Whether you're managing a single return or multiple filings, Tax1099's intuitive platform makes compliance effortless for businesses of all sizes.

Don't Forget Schedule B!

For businesses with semiweekly tax liabilities, Form 941 Schedule B is required to report daily tax liabilities. E-file it alongside Form 941 to ensure full compliance. Tax1099 seamlessly handles both, so you're covered without the hassle.

Form 941 Due Dates for 2025 Tax Year

Q1 (January-March): 941 Due Date April 30, 2025

Q2 (April-June): 941 Due Date July 31, 2025

Q3 (July-September): 941 Due Date October 31, 2025

Q4 (October-December): 941 Due Date January 31, 2026

Businesses need to report federal withholdings from employees, including:

Wages paid to employees.

All federal income tax withholdings.

All reported employee tips.

Employer and employee shares of Social Security and Medicare taxes in addition to any additional Medicare tax withholdings.

Any quarterly adjustments to Social Security or Medicare taxes for things like sick pay or tips.

Don't Risk Penalties-Act Now!

Miss the Form 941 due date, and the IRS could hit you with fines starting at 5% of unpaid taxes per month, up to 25%, plus interest. Tax1099's all-in-one platform automates prep, validates data, and delivers flawless submissions. Trusted by over 1 million businesses, it's your ticket to fast, error-free filings by every Quarterly Form 941 due dates.

Benefits of E-Filing with Tax1099

Seamless Integration: Syncs with accounting software like QuickBooks and Xero to import payroll data effortlessly.

Bulk Filing: Efficiently handle multiple Form 941 submissions for businesses with complex payroll needs.

Step-by-Step Guidance: Clear prompts and instructions ensure accurate filings, even for first-time users.

Team Collaboration: Invite team members, assign roles, and manage permissions for a streamlined workflow.

Top-Tier Security: Protects sensitive data with 256-bit encryption, TIN masking, and two-factor authentication.

Beat the Clock-File Today! Don't let penalties sneak up. With Tax1099, you can file your Form 941 now and keep your business in the clear. Get started at Tax1099.com!

About Zenwork Tax1099

Tax1099, an IRS-authorized e-filing service, simplifies tax compliance for over 750,000 businesses nationwide. Supporting 40+ federal and state-compliant forms, including Form 941, Tax1099 offers robust features like bulk filing, TIN matching, API integration, and 24/7 support. Learn more at www.tax1099.com.

About Zenwork Inc.

Zenwork Inc., the parent company of Tax1099, is a leader in digital tax compliance. With a decade of experience, Zenwork Inc. has assisted over 750,000 businesses and 70,000 CPA firms in simplifying compliance. Learn more about Zenwork and its products at www.zenwork.com, www.tax1099.com, and www.compliancely.com

Contact:

Ed Pratt

Zenwork Inc.

[email protected]

SOURCE: ZENWORK INC

View the original press release on ACCESS Newswire

M.A.Colin--AMWN