-

French swim star Marchand considered taking year-long break

French swim star Marchand considered taking year-long break

-

Chahal stars as Punjab defend IPL's lowest total of 111

-

Universal Studios, Venice Beach to host LA 2028 events

Universal Studios, Venice Beach to host LA 2028 events

-

IOM chief urges world to step up aid for Haiti

-

French prisons hit by mystery arson and gunfire attacks

French prisons hit by mystery arson and gunfire attacks

-

Alcaraz follows Ruud into Barcelona Open last 16

-

Stocks rise on bank earnings, auto tariff hopes

Stocks rise on bank earnings, auto tariff hopes

-

Trump showdown with courts in spotlight at migrant hearing

-

Ecuador electoral council rejects claims of fraud in presidential vote

Ecuador electoral council rejects claims of fraud in presidential vote

-

Russia jails four journalists who covered Navalny

-

Trump says China 'reneged' on Boeing deal as tensions flare

Trump says China 'reneged' on Boeing deal as tensions flare

-

Trump eyes near 50 percent cut in State Dept budget: US media

-

Trump says would 'love' to send US citizens to El Salvador jail

Trump says would 'love' to send US citizens to El Salvador jail

-

'Unprecedented' Europe raids net 200 arrests, drugs haul

-

Everyone thinks Real Madrid comeback 'nailed-on': Bellingham

Everyone thinks Real Madrid comeback 'nailed-on': Bellingham

-

NATO's Rutte says US-led Ukraine peace talks 'not easy'

-

Harvey Weinstein New York retrial for sex crimes begins

Harvey Weinstein New York retrial for sex crimes begins

-

More than 10% of Afghans could lose healthcare by year-end: WHO

-

Stocks rise as auto shares surge on tariff break hopes

Stocks rise as auto shares surge on tariff break hopes

-

Facebook chief Zuckerberg testifying again in US antitrust trial

-

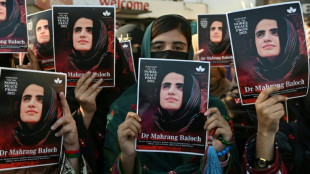

Pakistan court refuses to hear Baloch activist case: lawyers

Pakistan court refuses to hear Baloch activist case: lawyers

-

Inzaghi pushing Inter to end San Siro hoodoo with Bayern and reach Champions League semis

-

Arsenal's Odegaard can prove point on Real Madrid return

Arsenal's Odegaard can prove point on Real Madrid return

-

China's Xi begins Malaysia visit in shadow of Trump tariffs

-

Andrew Tate accusers suing for 'six-figure' sum, UK court hears

Andrew Tate accusers suing for 'six-figure' sum, UK court hears

-

Macron to honour craftspeople who rebuilt Notre Dame

-

Van der Poel E3 'spitter' facing fine

Van der Poel E3 'spitter' facing fine

-

Khamenei says Iran-US talks going well but may lead nowhere

-

Nearly 60,000 Afghans return from Pakistan in two weeks: IOM

Nearly 60,000 Afghans return from Pakistan in two weeks: IOM

-

Auto shares surge on tariff reprieve hopes

-

Sudan war drains life from once-thriving island in capital's heart

Sudan war drains life from once-thriving island in capital's heart

-

Trump trade war casts pall in China's southern export heartland

-

Ukraine's Sumy prepares to bury victims of 'bloody Sunday'

Ukraine's Sumy prepares to bury victims of 'bloody Sunday'

-

Iraq sandstorm closes airports, puts 3,700 people in hospital

-

French prisons targeted with arson, gunfire: ministry

French prisons targeted with arson, gunfire: ministry

-

Pandemic treaty talks inch towards deal

-

Employee dead, client critical after Paris cryotherapy session goes wrong

Employee dead, client critical after Paris cryotherapy session goes wrong

-

Howe will only return to Newcastle dugout when '100 percent' ready

-

Journalist recalls night Mario Vargas Llosa punched Gabriel Garcia Marquez

Journalist recalls night Mario Vargas Llosa punched Gabriel Garcia Marquez

-

Sudan marks two years of war with no end in sight

-

Vance urges Europe not to be US 'vassal'

Vance urges Europe not to be US 'vassal'

-

China tells airlines to suspend Boeing jet deliveries: report

-

Stocks rise as stability returns, autos surge on exemption hope

Stocks rise as stability returns, autos surge on exemption hope

-

Harvard sees $2.2bn funding freeze after defying Trump

-

'Tough' Singapore election expected for non-Lee leader

'Tough' Singapore election expected for non-Lee leader

-

Japan orders Google to cease alleged antitrust violation

-

Stocks rise as stability returns, autos lifted by exemption hope

Stocks rise as stability returns, autos lifted by exemption hope

-

Malawi's debt crisis deepens as aid cuts hurt

-

Danish brewer adds AI 'colleagues' to human team

Danish brewer adds AI 'colleagues' to human team

-

USAID cuts rip through African health care systems

Stocks rise on tech tariffs respite, gold hits new high

Stock markets rose firmly on Monday after fears over US President Donald Trump's trade war were tempered by tariff exemptions for smartphones, laptops, semiconductors and other electronic products.

But suggestions by Trump that the exemptions would be temporary added to market uncertainty as the dollar extended losses, helping gold to a fresh record high.

European indices jumped around two percent in midday deals following last week's rollercoaster for equities as the United States and China exchanged tit-for-tat levies.

That tracked gains in Asia, with tech firms helping push Hong Kong up more than two percent, while Tokyo and Shanghai also closed higher.

The United States on Friday appeared to slightly dial down the pressure on its trade war with Beijing, sparing electronic products -- for which China is a major source -- from painful "reciprocal" levies.

US levies imposed on China have risen to 145 percent, and Beijing set a retaliatory 125 percent band on US imports.

Trump on Sunday stressed that the exemptions had been misconstrued and that no country would get "off the hook" in his trade war -- especially China.

He said they would only be temporary as his team pursued fresh tariffs against many items on the list, including on semiconductors "over the next week".

The US leader's comments "have complicated matters with this category of goods apparently set to be placed in a different tariff 'bucket'", said AJ Bell investment director Russ Mould.

"Adding another layer of complexity on to an already complex trade policy may not be that well received by investors, but in the short term there is still likely to be palpable relief, particularly for the likes of Apple and Nvidia," he added.

Data on Monday showed Chinese exports soared more than 12 percent last month ahead of the swingeing tariffs, with the United States remaining the largest single destination, accounting for $115.6 billion worth of goods.

"But shipments are set to drop back over the coming months and quarters," warned Julian Evans-Pritchard, head of China economics at Capital Economics.

"It could be years before Chinese exports regain current levels."

Amid uncertainty over Trump's trade policy, the dollar extended losses against its major peers on Monday, with the euro around a three-year high and the Swiss franc at its strongest in 10 years.

Treasuries also remained under pressure amid worries that China and other nations might dump their vast holdings, which could call into question the US government bonds as a safe haven.

And gold, a go-to asset of safety in times of turmoil, hit a new peak of $3,245.75 an ounce Monday.

Wall Street finished solidly higher Friday, helped by comments from a top Federal Reserve official that the central bank was prepared to step in to support financial markets.

- Key figures around 1040 GMT -

London - FTSE 100: UP 1.9 percent at 8,113.90 points

Paris - CAC 40: UP 2.3 percent at 7,264.99

Frankfurt - DAX: UP 2.5 percent at 20,884.13

Tokyo - Nikkei 225: UP 1.2 percent at 33,982.36 (close)

Hong Kong - Hang Seng Index: UP 2.4 percent at 21,417.40 (close)

Shanghai - Composite: UP 0.8 percent at 3,262.81 (close)

New York - Dow: UP 1.6 percent at 40,212.71 (close)

Dollar/yen: DOWN at 143.16 yen from 143.49 yen on Friday

Euro/dollar: UP at $1.1388 from $1.1359

Pound/dollar: UP at $1.3184 from $1.3088

Euro/pound: DOWN at 86.36 pence from 86.80 pence

Brent North Sea Crude: UP 0.9 percent at $65.36 per barrel

West Texas Intermediate: UP 1.0 percent at $62.10 per barrel

D.Sawyer--AMWN