-

EU funding of NGOs 'too opaque', auditors find amid political storm

EU funding of NGOs 'too opaque', auditors find amid political storm

-

La Liga appeal decision allowing Barcelona's Olmo to play again

-

JPMorgan Chase CEO warns tariffs will slow growth

JPMorgan Chase CEO warns tariffs will slow growth

-

World sport-starved Moscow cheers Ovechkin NHL record

-

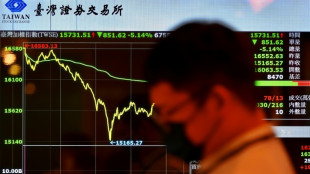

Stocks sink again as Trump holds firm on tariffs

Stocks sink again as Trump holds firm on tariffs

-

Trump warns against 'stupid' panic as markets plummet

-

Thousands of Afghans depart Pakistan under repatriation pressure

Thousands of Afghans depart Pakistan under repatriation pressure

-

Macron rejects any Hamas role in post-war Gaza

-

Boeing settles to avoid civil trial over Ethiopian Airlines crash

Boeing settles to avoid civil trial over Ethiopian Airlines crash

-

EU split on targeting US tech over Trump tariffs

-

Russia, accused of stalling, wants answers before truce

Russia, accused of stalling, wants answers before truce

-

German climate activist faces expulsion from Austria after ban

-

Southampton sack manager Juric after Premier League relegation

Southampton sack manager Juric after Premier League relegation

-

Fowler hits the target as Matildas down South Korea

-

Brook named new England white-ball cricket captain

Brook named new England white-ball cricket captain

-

Honda executive resigns over 'inappropriate conduct'

-

Stocks, oil prices sink further as Trump stands firm over tariffs

Stocks, oil prices sink further as Trump stands firm over tariffs

-

'Alarming' microplastic pollution in Europe's great rivers

-

Spurs boss Postecoglou glad of Johnson revival ahead of Europa quarter-final

Spurs boss Postecoglou glad of Johnson revival ahead of Europa quarter-final

-

Major garment producer Bangladesh says US buyers halting orders

-

Former Wales fly-half Biggar to retire at end of rugby season

Former Wales fly-half Biggar to retire at end of rugby season

-

African players in Europe: Iwobi ends goal drought to help sink Reds

-

The worst market crashes since 1929

The worst market crashes since 1929

-

Japan emperor visits World War II battleground Iwo Jima

-

'Everyone is losing money': Hong Kong investors rattled by market rout

'Everyone is losing money': Hong Kong investors rattled by market rout

-

China vows to stay 'safe and promising land' for foreign investment

-

Stocks savaged as China retaliation to Trump tariffs fans trade war

Stocks savaged as China retaliation to Trump tariffs fans trade war

-

Unification Church appeals Japan's decision to revoke legal status

-

Belgian prince seeks social security on top of allowance

Belgian prince seeks social security on top of allowance

-

European airlines hit turbulence over Western Sahara flights

-

Boeing faces new civil trial over 2019 Ethiopian Airlines crash

Boeing faces new civil trial over 2019 Ethiopian Airlines crash

-

'Fear and anxiety': Bangkok residents seek quake-proof homes

-

Injuries threaten to derail Bayern's home final dreams against Inter

Injuries threaten to derail Bayern's home final dreams against Inter

-

Real Madrid vulnerability evident ahead of Arsenal clash

-

Texans warily eye impact of Trump's tariffs on their beloved trucks

Texans warily eye impact of Trump's tariffs on their beloved trucks

-

Equities savaged as China retaliation to Trump tariffs fans trade war

-

Sara Duterte back in Philippines after month with detained father

Sara Duterte back in Philippines after month with detained father

-

Netanyahu and Trump to talk tariffs, Iran and Gaza

-

Max power, Tsunoda's mixed debut, quick Kimi: Japan GP talking points

Max power, Tsunoda's mixed debut, quick Kimi: Japan GP talking points

-

Luis Enrique's revolution leaves PSG stronger without the superstars

-

Messi on target but Miami held by lowly Toronto

Messi on target but Miami held by lowly Toronto

-

Inter's bold treble bid bumps up against past glory at Bayern Munich

-

Sagstrom digs deep to win LPGA Match Play

Sagstrom digs deep to win LPGA Match Play

-

The music industry is battling AI -- with limited success

-

New app hopes to empower artists against AI

New app hopes to empower artists against AI

-

Haiti jazz festival is rare respite for violence-racked capital

-

Johnson satisfied after opening Grand Slam series event

Johnson satisfied after opening Grand Slam series event

-

China would have agreed TikTok deal if not for US tariffs: Trump

-

5 Strategies to Protect Your Credit from Identity Theft

5 Strategies to Protect Your Credit from Identity Theft

-

SOHM, Inc. Launches New AI Team to Advance ABBIE System and Genome Editing Innovations

5 Common Mistakes to Avoid When Using a Small Business Line of Credit

NEW YORK CITY, NY / ACCESS Newswire / April 7, 2025 / A small business line of credit provides access to funds much like a credit card does, so businesses can withdraw money as needed up to a pre-approved limit. Unlike a traditional loan, interest is only charged on the amount drawn, making it a cost-effective solution for short-term financial needs. But this flexible financing option can feel easy to take advantage of, and often, business owners make mistakes when they have access to this tool. The five mistakes below are the easiest to make - and if a business owner isn't careful, they can impact the trajectory of their financial success.

Mistake #1: Using the Line of Credit for Non-Business Expenses

It might be tempting to see a line of credit as yet another source of income, it can be a huge blow to your business to use it as a personal bank. Mixing personal and business finances can lead to difficulty tracking your expenses, inaccurate reporting, and potential tax implications. Furthermore, using a business line of credit for personal expenses can strain your business, as it diverts resources from operational needs and into your pocket. Maintaining a clear separation between business and personal finances is a much safer option that avoids potential legal and tax issues.

Mistake #2: Ignoring the Terms and Interest Rates

Don't ignore the fine print on your line of credit, as it can really make or break your financial experience in the long run. Make yourself knowledgeable on repayment terms of a business loan, including interest rates, repayment schedules, and any associated fees. High interest rates can impact a business's cash flow, putting a dent in your available finances. And unforeseen increases in interest rates, particularly with variable rates, can make planning for the future difficult. When you apply for a line of credit, analyze the total cost, including all fees and interest accrued over the repayment period.

Mistake #3: Not Monitoring Your Credit Usage

Tracking your credit is essential for responsible business financial management. Exceeding credit limits can cause you to face higher interest rates or reduced access to future financing. For small businesses, keeping the utilization ratio low is a solid strategy. Keeping the ratio typically below 30% is encouraged for keeping a healthy credit score.

Mistake #4: Failing to Pay Off the Balance Regularly

Failing to pay off the balance regularly on a business line of credit or any loan can quickly become a problem. Accumulating interest on outstanding balances escalates a business' total debt, compounding interest and potential fees for non-payment. Additionally, late or missed payments damage a business' credit score, which can impact potential borrowing in the future. Consistent, timely payments will keep your credit profile and your line of credit well-managed, avoiding the costly consequences of accumulating unnecessary debt.

Mistake #5: Overreliance on the Credit Line

Relying too much on your business line of credit can create a cycle of dependency. While a line of credit provides a valuable safety net, it shouldn't replace your efforts to grow revenue. If you need borrowed funds to stay above water, you could be ignoring underlying financial weaknesses with your business model. Prioritizing revenue generation, optimizing operational efficiency, and exploring alternative funding sources like grants, equity financing, or long-term loans.

Leveraging Your Line of Credit

To ensure a business line of credit is a tool rather than a burden, focus on the mistakes that are the easiest to avoid. Don't use it for non-business expenses, understand repayment terms and the impact of high interest, and track credit usage to stay within your limits. If you have clear financial planning and disciplined repayment, a line of credit will allow you to support growth without compromising long-term financial stability.

CONTACT:

Sonakshi Murze

Manager

[email protected]

SOURCE: iQuanti

View the original press release on ACCESS Newswire

M.Thompson--AMWN