-

Less Soviet, more inspiring: Kyrgyzstan seeks new anthem

Less Soviet, more inspiring: Kyrgyzstan seeks new anthem

-

Defending champion Kyren Wilson crashes out in first round of World Snooker Championship

-

NASA's oldest active astronaut returns to Earth on 70th birthday

NASA's oldest active astronaut returns to Earth on 70th birthday

-

Exec linked to Bangkok building collapse arrested

-

Zelensky says Russian attacks ongoing despite Putin's Easter truce

Zelensky says Russian attacks ongoing despite Putin's Easter truce

-

Vaibhav Suryavanshi: the 14-year-old whose IPL dream came true

-

Six drowning deaths as huge waves hit Australian coast

Six drowning deaths as huge waves hit Australian coast

-

Ukrainian soldiers' lovers kept waiting as war drags on

-

T'Wolves dominate Lakers, Nuggets edge Clippers as NBA playoffs start

T'Wolves dominate Lakers, Nuggets edge Clippers as NBA playoffs start

-

Taxes on super rich and tech giants stall under Trump

-

Star Wars series 'Andor' back for final season

Star Wars series 'Andor' back for final season

-

Neighbours improvise first aid for wounded in besieged Sudan city

-

Tariffs could lift Boeing and Airbus plane prices even higher

Tariffs could lift Boeing and Airbus plane prices even higher

-

Analysts warn US could be handing chip market to China

-

Unbeaten Miami edge Columbus in front of big MLS crowd in Cleveland

Unbeaten Miami edge Columbus in front of big MLS crowd in Cleveland

-

Social media helps fuel growing 'sex tourism' in Japan

-

'Pandora's box': alarm bells in Indonesia over rising military role

'Pandora's box': alarm bells in Indonesia over rising military role

-

Alaalatoa hails 'hustling hard' Brumbies for rare Super Rugby clean sheet

-

Trio share lead at tight LA Championship

Trio share lead at tight LA Championship

-

Sampdoria fighting relegation disaster as old heroes ride into town

-

Recovering pope expected to delight crowds at Easter Sunday mass

Recovering pope expected to delight crowds at Easter Sunday mass

-

Nuggets edge Clippers in NBA playoff overtime thriller, Knicks and Pacers win

-

Force skipper clueless about extra-time rules in pulsating Super Rugby draw

Force skipper clueless about extra-time rules in pulsating Super Rugby draw

-

DEA MARIJUANA SCAM: As DEA Cannabis Program Implodes This 4/20, MMJ Stands Alone in Pursuit of Real Medicine

-

Nuggets edge Clippers in NBA playoff overtime thriller, Pacers thump Bucks

Nuggets edge Clippers in NBA playoff overtime thriller, Pacers thump Bucks

-

Unbeaten Miami edge Columbus in front of big crowd in Cleveland

-

Kim takes one-shot lead over Thomas, Novak at RBC Heritage

Kim takes one-shot lead over Thomas, Novak at RBC Heritage

-

Another round of anti-Trump protests hits US cities

-

'So grateful' - Dodgers star Ohtani and wife welcome first child

'So grateful' - Dodgers star Ohtani and wife welcome first child

-

PSG maintain unbeaten Ligue 1 record, Marseille back up to second

-

US, Iran report progress in nuclear talks, will meet again

US, Iran report progress in nuclear talks, will meet again

-

US Supreme Court intervenes to block Trump deportations

-

Hamas armed wing says fate of US-Israeli captive unknown

Hamas armed wing says fate of US-Israeli captive unknown

-

Pacers thump Bucks to open NBA playoffs

-

Sabalenka reaches Stuttgart semis as Ostapenko extends Swiatek mastery

Sabalenka reaches Stuttgart semis as Ostapenko extends Swiatek mastery

-

Zelensky says Ukraine will observe Putin's Easter truce but claims violations

-

'Fuming' Watkins fires Villa in bid to prove Emery wrong

'Fuming' Watkins fires Villa in bid to prove Emery wrong

-

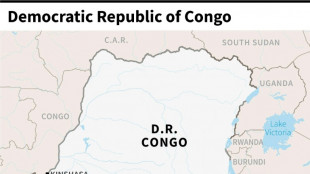

DR Congo boat fire toll revised down to 33

-

England thrash Scotland to set up France Grand Slam showdown

England thrash Scotland to set up France Grand Slam showdown

-

Verstappen's Red Bull 'comes alive' to claim record pole in Jeddah

-

McTominay fires Napoli level with Inter as Conte fuels exit rumours

McTominay fires Napoli level with Inter as Conte fuels exit rumours

-

Rajasthan unleash Suryavanshi, 14, as youngest IPL player but lose thriller

-

Man City boost top five bid, Aston Villa thrash in-form Newcastle

Man City boost top five bid, Aston Villa thrash in-form Newcastle

-

Villa rout Newcastle to rekindle bid to reach Champions League

-

Dumornay gives Lyon lead over Arsenal in Women's Champions League semis

Dumornay gives Lyon lead over Arsenal in Women's Champions League semis

-

Trans rights supporters rally in London, Edinburgh after landmark ruling

-

'We have to wait': Barca's Flick on Lewandowski injury fear

'We have to wait': Barca's Flick on Lewandowski injury fear

-

Bordeaux-Begles backups edge Pau to close in on Top 14 summit

-

Trans rights supporters rally outside in London, Edinburgh after landmark ruling

Trans rights supporters rally outside in London, Edinburgh after landmark ruling

-

PSG beat Le Havre to stay on course for unbeaten Ligue 1 season

Tortoise Capital Provides Unaudited Balance Sheet Information and Asset Coverage Ratio Updates as of March 31, 2025, for TYG and TEAF

OVERLAND PARK, KS / ACCESS Newswire / April 1, 2025 / Tortoise Capital today announced the following unaudited balance sheet information and asset coverage ratio updates for closed-end funds TYG and TEAF.

Tortoise Energy Infrastructure Corp. (NYSE:TYG) today announced that as of Mar. 31, 2025, the company's unaudited total assets were approximately $1.0 billion and its unaudited net asset value was $822.4 million, or $47.72 per share.

As of Mar. 31, 2025, the company's asset coverage ratio under the 1940 Act with respect to senior securities representing indebtedness was 612%, and its coverage ratio for preferred shares was 484%. For more information on the company's coverage ratios, please refer to the leverage summary web page at https://cef.tortoiseadvisors.com.

Set forth below is a summary of the company's unaudited balance sheet at Mar. 31, 2025.

Unaudited balance sheet

(in Millions) | Per Share | |||

Investments | $ | 1,044.1 | $ | 60.58 |

Cash and Cash Equivalents | 0.9 | 0.05 | ||

Current Tax Assets | 0.4 | 0.03 | ||

Other Assets | 3.0 | 0.17 | ||

Total Assets | 1,048.4 | 60.83 | ||

Short-Term Borrowings | 71.3 | 4.14 | ||

Senior Notes | 98.1 | 5.69 | ||

Preferred Stock | 44.9 | 2.61 | ||

Total Leverage | 214.3 | 12.44 | ||

Payable for Investments Purchased | 1.6 | 0.09 | ||

Other Liabilities | 4.5 | 0.26 | ||

Deferred Tax Liability | 5.6 | 0.32 | ||

Net Assets | $ | 822.4 | $ | 47.72 |

17.24 million common shares currently outstanding.

Tortoise Sustainable and Social Impact Term Fund (NYSE:TEAF) today announced that as of Mar. 31, 2025 the company's unaudited total assets were approximately $214.2 million and its unaudited net asset value was $179.8 million, or $13.33 per share.

As of Mar. 31, 2025, the company's asset coverage ratio under the 1940 Act with respect to senior securities representing indebtedness was 638%. For more information on the company's coverage ratios, please refer to the leverage summary web page at https://cef.tortoiseadvisors.com.

Set forth below is a summary of the company's unaudited balance sheet at Mar. 31, 2025.

Unaudited balance sheet

(in Millions) | Per Share | |||

Investments | $ | 211.5 | $ | 15.68 |

Cash and Cash Equivalents | 2.1 | 0.16 | ||

Other Assets | 0.6 | 0.04 | ||

Total Assets | 214.2 | 15.88 | ||

Credit Facility Borrowings | 33.4 | 2.48 | ||

Other Liabilities | 1.0 | 0.07 | ||

Net Assets | $ | 179.8 | $ | 13.33 |

13.49 million common shares outstanding.

The top 10 holdings for TYG and TEAF as of the most recent month-end can be found on each fund's portfolio web page at https://cef.tortoiseadvisors.com.

TEAF also provides update on direct investments.

TEAF provides an update on the fund's direct investments on the company website at https://cef.tortoiseadvisors.com/funds/teaf/#portfolio. Details on each private deal that has taken place over the prior month will be published on the website at https://cef.tortoiseadvisors.com/funds/teaf/#deal-summaries-list. The list includes all deals completed since the fund's inception.

About Tortoise Capital

With approximately $9.6 billion in assets under management as of Feb. 28, 2025, Tortoise Capital's record of investment experience and research dates back more than 20 years. As an early investor in midstream energy, Tortoise Capital believes it is well-

positioned to be at the forefront of the global energy evolution that is under way. Based in Overland Park, Kansas, Tortoise Capital Advisors, L.L.C. is an SEC-registered fund manager that invests primarily in publicly traded companies in the energy and power infrastructure sectors-from production to transportation to distribution. For more information about Tortoise Capital, visit http://www.TortoiseAdvisors.com.

Tortoise Capital Advisors, L.L.C. is the adviser to Tortoise Energy Infrastructure Corp. and Tortoise Sustainable and Social Impact Term Fund.

For additional information on these funds, please visit cef.tortoiseadvisors.com.

Cautionary Statement Regarding Forward-Looking Statements

This press release contains certain statements that may include "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements, other than statements of historical fact, included herein are "forward-looking statements." Although the funds and Tortoise Capital Advisors believe that the expectations reflected in these forward-looking statements are reasonable, they do involve assumptions, risks and uncertainties, and these expectations may prove to be incorrect. Actual results could differ materially from those anticipated in these forward-looking statements as a result of a variety of factors, including those discussed in the fund's reports that are filed with the Securities and Exchange Commission. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this press release. Other than as required by law, the funds and Tortoise Capital Advisors do not assume a duty to update this forward-looking statement.

Safe harbor statement

This press release shall not constitute an offer to sell or a solicitation to buy, nor shall there be any sale of these securities in any state or jurisdiction in which such offer or solicitation or sale would be unlawful prior to registration or qualification under the laws of such state or jurisdiction.

Contact information

For more information contact Eva Lipner at (913) 890-2165 or [email protected].

SOURCE: Tortoise Capital

View the original press release on ACCESS Newswire

P.Martin--AMWN