-

Italian director Nanni Moretti in hospital after heart attack: media

Italian director Nanni Moretti in hospital after heart attack: media

-

LIV Golf stars playing at Doral with Masters on their minds

-

Trump unveils sweeping 'Liberation Day' tariffs

Trump unveils sweeping 'Liberation Day' tariffs

-

Most deadly 2024 hurricane names retired from use: UN agency

-

Boeing chief reports progress to Senate panel after 'serious missteps'

Boeing chief reports progress to Senate panel after 'serious missteps'

-

Is Musk's political career descending to Earth?

-

On Mexico-US border, Trump's 'Liberation Day' brings fears for future

On Mexico-US border, Trump's 'Liberation Day' brings fears for future

-

Starbucks faces new hot spill lawsuit weeks after $50mn ruling

-

Ally of Pope Francis elected France's top bishop

Ally of Pope Francis elected France's top bishop

-

'Determined' Buttler leads Gujarat to IPL win over Bengaluru

-

US judge dismisses corruption case against New York mayor

US judge dismisses corruption case against New York mayor

-

Left-wing party pulls ahead in Greenland municipal elections

-

Blistering Buttler leads Gujarat to IPL win over Bengaluru

Blistering Buttler leads Gujarat to IPL win over Bengaluru

-

Tesla sales slump as pressure piles on Musk

-

Amazon makes last-minute bid for TikTok: report

Amazon makes last-minute bid for TikTok: report

-

Canada Conservative leader warns Trump could break future trade deal

-

British band Muse cancels planned Istanbul gig

British band Muse cancels planned Istanbul gig

-

'I'll be back' vows Haaland after injury blow

-

Trump to unveil 'Liberation Day' tariffs as world braces

Trump to unveil 'Liberation Day' tariffs as world braces

-

New coach Edwards adamant England can win women's cricket World Cup

-

Military confrontation 'almost inevitable' if Iran nuclear talks fail: French FM

Military confrontation 'almost inevitable' if Iran nuclear talks fail: French FM

-

US stocks advance ahead of looming Trump tariffs

-

Scramble for food aid in Myanmar city near quake epicentre

Scramble for food aid in Myanmar city near quake epicentre

-

American Neilson Powless fools Visma to win Across Flanders

-

NATO chief says alliance with US 'there to stay'

NATO chief says alliance with US 'there to stay'

-

Myanmar junta declares quake ceasefire as survivors plead for aid

-

American Neilson Powless fools Visma to win Around Flanders

American Neilson Powless fools Visma to win Around Flanders

-

Tesla first quarter sales sink amid anger over Musk politics

-

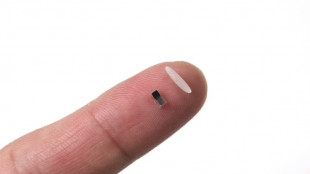

World's tiniest pacemaker is smaller than grain of rice

World's tiniest pacemaker is smaller than grain of rice

-

Judge dismisses corruption case against NY mayor

-

Nintendo to launch Switch 2 console on June 5

Nintendo to launch Switch 2 console on June 5

-

France Le Pen eyes 2027 vote, says swift appeal 'good news'

-

Postecoglou hopes Pochettino gets Spurs return wish

Postecoglou hopes Pochettino gets Spurs return wish

-

US, European stocks fall as looming Trump tariffs raise fears

-

Nintendo says Switch 2 console to be launched on June 5

Nintendo says Switch 2 console to be launched on June 5

-

France's Zemmour fined 10,000 euros over claim WWII leader 'saved' Jews

-

Le Pen ally denies planned rally a 'power play' against conviction

Le Pen ally denies planned rally a 'power play' against conviction

-

Letsile Tebogo says athletics saved him from life of crime

-

Man Utd 'on right track' despite 13th Premier League defeat: Dalot

Man Utd 'on right track' despite 13th Premier League defeat: Dalot

-

Israel says expanding Gaza offensive to seize 'large areas'

-

Certain foreign firms must 'self-certify' with Trump diversity rules: US embassies

Certain foreign firms must 'self-certify' with Trump diversity rules: US embassies

-

Deutsche Bank asset manager DWS fined 25 mn euros for 'greenwashing'

-

UK drawing up new action plan to tackle rising TB

UK drawing up new action plan to tackle rising TB

-

Nigerian president sacks board of state oil company

-

Barca never had financial room to register Olmo: La Liga

Barca never had financial room to register Olmo: La Liga

-

Spain prosecutors to appeal ruling overturning Alves' rape conviction

-

Heathrow 'warned about power supply' days before shutdown

Heathrow 'warned about power supply' days before shutdown

-

Epstein accuser Virginia Giuffre 'stable' after car crash

-

Myanmar quake survivors plead for more help

Myanmar quake survivors plead for more help

-

Greece to spend 25 bn euros in 'drastic' defence overhaul: PM

Ways to Responsibly Manage Your Second Chance Bank Account

NEW YORK CITY, NY / ACCESS Newswire / April 1, 2025 / Starting over financially can be a challenge, but it doesn't have to be overwhelming. Whether you've had past issues with your bank account or are just looking to rebuild your financial health, a second chance bank account can provide the fresh start you need.

However, managing your second chance account responsibly is key to ensuring that your financial future remains on track. Here are some practical tips to help you manage your second chance account wisely.

1. Understand the account's features and fees

Before diving into managing your second chance bank account, take the time to review all the fine print. Banks that offer second chance accounts may charge different types of fees compared to regular accounts. Some common fees to watch out for include monthly maintenance fees, overdraft charges and ATM withdrawal fees from out-of-network ATMs.

If the account has a maintenance fee, look for ways to avoid it, such as meeting a minimum monthly deposit or maintaining a certain balance. Understanding these fees upfront can help you avoid unnecessary costs that could set back your financial progress.

2. Set up automatic deposits

One of the easiest ways to stay on top of your finances is by setting up automatic deposits. This can include having your paycheck or a portion of it directly deposited into your second chance bank account. By doing this, you can ensure that you have funds available regularly without the temptation to spend everything at once.

Additionally, consider setting up automatic transfers to a savings account. Even small amounts, such as $10 or $20 each month, can add up over time, and before you know it, you'll have a cushion to fall back on in case of emergencies. Having a savings plan can provide you with peace of mind, especially if you're rebuilding your financial history.

3. Use your account for specific purposes

Consider assigning specific purposes to your second chance checking and savings accounts. You can use your checking account for everyday expenses like groceries and transportation while keeping your savings account dedicated to longer-term goals.

Having clear boundaries between the two accounts allows you to budget more effectively and prevents the temptation to dip into savings for short-term needs. Over time, as you rebuild your financial standing, this strategic use of accounts will help you stay organized and focused on your financial goals.

4. Monitor your account regularly

Managing a second chance bank account also means staying on top of your transactions. You don't have to wait for a paper statement to know how much money you have-take advantage of digital notifications. Set up mobile alerts for low balances or upcoming bills. This proactive approach ensures that you're always aware of your account status and can avoid overdrawing your account.

Most banks offer mobile apps where you can check your balance, review recent transactions, and even set up notifications. These digital tools will save you time and help you make adjustments to your spending habits when necessary.

5. Avoid overdrafts and non-sufficient funds fees

When managing a second chance bank account, it's important to understand the consequences of overdrafts and non-sufficient funds (NSF) fees. These fees can quickly pile up if you're not careful with your spending. While some second chance accounts may offer overdraft protection or other assistance, it's still essential to keep a close eye on your available balance.

If your bank doesn't offer overdraft protection, consider linking your checking account to a savings account or a credit card for an automatic backup in case you need to cover an unexpected transaction. This can help you avoid the embarrassment and financial strain of an NSF fee.

6. Don't be afraid to ask for help

Rebuilding your financial habits after a setback can feel daunting. If you're unsure about anything - whether it's fees, transaction limits, or account features - don't hesitate to reach out to your bank for clarification. Most banks are willing to work with you to ensure your account meets your needs.

In addition, consider seeking advice from financial counselors or online resources that offer budgeting and financial management tips. There's no shame in learning more about how to improve your financial habits. The more you understand, the better equipped you'll be to avoid common pitfalls and keep your financial life on track.

7. Keep your goals in mind

Finally, remember why you opened a second chance bank account in the first place: to regain control of your finances. Stay focused on your long-term financial goals, such as building savings, repairing your credit, or managing debt.

It's important to give yourself credit for the progress you make along the way. Mistakes may happen, but don't let them derail your efforts. Make adjustments and keep moving forward. Over time, responsible management of your second chance account will set you up for success and help you achieve your financial goals.

Managing a second chance bank account

Managing a second chance bank account doesn't have to be a complicated process. By understanding your account's terms and using your account strategically, you'll be on your way to taking control of your finances.

Stay organized, avoid common fees, and remember to ask for help when needed. With the right approach, you can use your second chance bank account as a powerful tool for financial stability and success.

Disclaimer: Article content is intended for information only. It may not reflect the publisher nor employees' views. Consult a financial professional before making financial decisions. Publishers or platforms may be compensated for access to third party websites.

CONTACT:

Sonakshi Murze

Manager

[email protected]

SOURCE: iQuanti

View the original press release on ACCESS Newswire

J.Williams--AMWN