-

Tesla sales slump as pressure piles on Musk

Tesla sales slump as pressure piles on Musk

-

Amazon makes last-minute bid for TikTok: report

-

Canada Conservative leader warns Trump could break future trade deal

Canada Conservative leader warns Trump could break future trade deal

-

British band Muse cancels planned Istanbul gig

-

'I'll be back' vows Haaland after injury blow

'I'll be back' vows Haaland after injury blow

-

Trump to unveil 'Liberation Day' tariffs as world braces

-

New coach Edwards adamant England can win women's cricket World Cup

New coach Edwards adamant England can win women's cricket World Cup

-

Military confrontation 'almost inevitable' if Iran nuclear talks fail: French FM

-

US stocks advance ahead of looming Trump tariffs

US stocks advance ahead of looming Trump tariffs

-

Scramble for food aid in Myanmar city near quake epicentre

-

American Neilson Powless fools Visma to win Across Flanders

American Neilson Powless fools Visma to win Across Flanders

-

NATO chief says alliance with US 'there to stay'

-

Myanmar junta declares quake ceasefire as survivors plead for aid

Myanmar junta declares quake ceasefire as survivors plead for aid

-

American Neilson Powless fools Visma to win Around Flanders

-

Tesla first quarter sales sink amid anger over Musk politics

Tesla first quarter sales sink amid anger over Musk politics

-

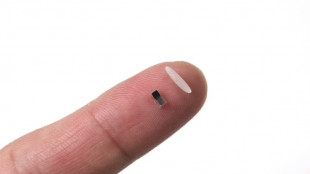

World's tiniest pacemaker is smaller than grain of rice

-

Judge dismisses corruption case against NY mayor

Judge dismisses corruption case against NY mayor

-

Nintendo to launch Switch 2 console on June 5

-

France Le Pen eyes 2027 vote, says swift appeal 'good news'

France Le Pen eyes 2027 vote, says swift appeal 'good news'

-

Postecoglou hopes Pochettino gets Spurs return wish

-

US, European stocks fall as looming Trump tariffs raise fears

US, European stocks fall as looming Trump tariffs raise fears

-

Nintendo says Switch 2 console to be launched on June 5

-

France's Zemmour fined 10,000 euros over claim WWII leader 'saved' Jews

France's Zemmour fined 10,000 euros over claim WWII leader 'saved' Jews

-

Le Pen ally denies planned rally a 'power play' against conviction

-

Letsile Tebogo says athletics saved him from life of crime

Letsile Tebogo says athletics saved him from life of crime

-

Man Utd 'on right track' despite 13th Premier League defeat: Dalot

-

Israel says expanding Gaza offensive to seize 'large areas'

Israel says expanding Gaza offensive to seize 'large areas'

-

Certain foreign firms must 'self-certify' with Trump diversity rules: US embassies

-

Deutsche Bank asset manager DWS fined 25 mn euros for 'greenwashing'

Deutsche Bank asset manager DWS fined 25 mn euros for 'greenwashing'

-

UK drawing up new action plan to tackle rising TB

-

Nigerian president sacks board of state oil company

Nigerian president sacks board of state oil company

-

Barca never had financial room to register Olmo: La Liga

-

Spain prosecutors to appeal ruling overturning Alves' rape conviction

Spain prosecutors to appeal ruling overturning Alves' rape conviction

-

Heathrow 'warned about power supply' days before shutdown

-

Epstein accuser Virginia Giuffre 'stable' after car crash

Epstein accuser Virginia Giuffre 'stable' after car crash

-

Myanmar quake survivors plead for more help

-

Greece to spend 25 bn euros in 'drastic' defence overhaul: PM

Greece to spend 25 bn euros in 'drastic' defence overhaul: PM

-

Maresca non-committal over Sancho's future at Chelsea

-

WHO facing $2.5-bn gap even after slashing budget: report

WHO facing $2.5-bn gap even after slashing budget: report

-

Real Madrid coach Ancelotti tells tax trial did not seek to defraud

-

Chinese tourists pine for Taiwan's return as Beijing jets surround island

Chinese tourists pine for Taiwan's return as Beijing jets surround island

-

Singapore detains teenage boy allegedly planning to kill Muslims

-

What is the 'Qatargate' scandal roiling Israel?

What is the 'Qatargate' scandal roiling Israel?

-

AI coming for anime but Ghibli's Miyazaki irreplaceable, son says

-

Swedish insurer drops $160 mn Tesla stake over labour rights

Swedish insurer drops $160 mn Tesla stake over labour rights

-

Hunger returns to Gaza as Israeli blockade forces bakeries shut

-

Rubio heads to Europe as transatlantic tensions soar

Rubio heads to Europe as transatlantic tensions soar

-

Like 'living in hell': Quake-hit Mandalay monastery clears away rubble

-

'Give me a break': Trump tariffs threaten Japan auto sector

'Give me a break': Trump tariffs threaten Japan auto sector

-

US approves $5.58 bn fighter jet sale to Philippines

UK Supreme Court opens car loans hearing as banks risk huge bill

The UK's highest court on Tuesday began a hearing to determine whether controversial car loans were unlawful, in a case that could cost banks billions of pounds in compensation.

Banks are appealing a landmark ruling by a Court of Appeal in November that deemed it unlawful for car dealers to receive a commission on loans without sufficiently informing borrowers.

It is estimated that millions of drivers would be eligible for compensation should the Supreme Court side with borrowers in the three-day hearing.

The loans, which were around for 14 years from 2007, incentivised car dealers to set higher interest rates in return for a bigger commission from the banks.

Britain's financial watchdog has made the commissions illegal.

The Supreme Court will consider two cases against South African lender FirstRand bank and one against British bank Close Brothers.

Outside the Supreme Court on Tuesday, Desmond Gourde, a supervisor at a bus company, told AFP that he was there to support those who want to claim back money.

Gourde managed to receive compensation after he purchased a used Honda Jazz in 2018 for more than £8,000 including interest -- without knowledge of a nearly £800 commission for the dealer.

"I had no idea there was a commission. I just applied for the finance, signed the paperwork, but no one told me about the commission," the 56-year old said.

- Hidden commission -

In preparation for the ruling, British banks have set aside considerable sums, including Lloyds Bank, which has earmarked nearly £1.2 billion ($1.6 billion).

Contacted by AFP, the banks declined to comment at the start of the latest hearing.

Consumer group Which! estimated it could cost banks up to £16 billion, while other analysts expect the sums to be higher, with those at HSBC suggesting it could hit £44 billion.

The highest figures could put it on the same scale as the fallout from payment protection insurance (PPI), one of Britain's most costly consumer scandals, according to analysts.

Kavon Hussain, a lawyer for one of the claimants, said that "when you went to buy a car the interest rate that you paid was set by the car dealer".

He explained that car dealers would likely have judged who could afford more or who could afford less to determine the rate.

Amid concerns over the economic fallout, the UK government made an unsuccessful attempt to intervene in the case earlier this year.

Analysts said that the Labour administration may be concerned about the impact on banks' willingness to provide credit at a time when the economic outlook remains uncertain.

"The bigger the car dealership network, the bigger the commissions," said Sam Ward, lead investigator at Sentinel Legal, who has worked on several of these car finance cases.

"We found one car dealership network where they got paid £39 million as an advance commission before they'd sold even one car finance policy," he told AFP.

The Financial Conduct Authority, which banned undisclosed commissions in 2021, plans to wait for the judgement before deciding whether to start a programme for automatic compensation.

Y.Aukaiv--AMWN