-

Lewandowski injury confirmed in blow to Barca quadruple bid

Lewandowski injury confirmed in blow to Barca quadruple bid

-

Russia and Ukraine accuse each other of breaching Easter truce

-

Zimbabwe bowl Bangladesh out for 191 in first Test in Sylhet

Zimbabwe bowl Bangladesh out for 191 in first Test in Sylhet

-

Ukrainians voice scepticism on Easter truce

-

Pope wishes 'Happy Easter' to faithful in appearance at St Peter's Square

Pope wishes 'Happy Easter' to faithful in appearance at St Peter's Square

-

Sri Lanka police probe photo of Buddha tooth relic

-

Home hero Wu wows Shanghai crowds by charging to China Open win

Home hero Wu wows Shanghai crowds by charging to China Open win

-

Less Soviet, more inspiring: Kyrgyzstan seeks new anthem

-

Defending champion Kyren Wilson crashes out in first round of World Snooker Championship

Defending champion Kyren Wilson crashes out in first round of World Snooker Championship

-

NASA's oldest active astronaut returns to Earth on 70th birthday

-

Exec linked to Bangkok building collapse arrested

Exec linked to Bangkok building collapse arrested

-

Zelensky says Russian attacks ongoing despite Putin's Easter truce

-

Vaibhav Suryavanshi: the 14-year-old whose IPL dream came true

Vaibhav Suryavanshi: the 14-year-old whose IPL dream came true

-

Six drowning deaths as huge waves hit Australian coast

-

Ukrainian soldiers' lovers kept waiting as war drags on

Ukrainian soldiers' lovers kept waiting as war drags on

-

T'Wolves dominate Lakers, Nuggets edge Clippers as NBA playoffs start

-

Taxes on super rich and tech giants stall under Trump

Taxes on super rich and tech giants stall under Trump

-

Star Wars series 'Andor' back for final season

-

Neighbours improvise first aid for wounded in besieged Sudan city

Neighbours improvise first aid for wounded in besieged Sudan city

-

Tariffs could lift Boeing and Airbus plane prices even higher

-

Analysts warn US could be handing chip market to China

Analysts warn US could be handing chip market to China

-

Unbeaten Miami edge Columbus in front of big MLS crowd in Cleveland

-

Social media helps fuel growing 'sex tourism' in Japan

Social media helps fuel growing 'sex tourism' in Japan

-

'Pandora's box': alarm bells in Indonesia over rising military role

-

Alaalatoa hails 'hustling hard' Brumbies for rare Super Rugby clean sheet

Alaalatoa hails 'hustling hard' Brumbies for rare Super Rugby clean sheet

-

Trio share lead at tight LA Championship

-

Sampdoria fighting relegation disaster as old heroes ride into town

Sampdoria fighting relegation disaster as old heroes ride into town

-

Recovering pope expected to delight crowds at Easter Sunday mass

-

Nuggets edge Clippers in NBA playoff overtime thriller, Knicks and Pacers win

Nuggets edge Clippers in NBA playoff overtime thriller, Knicks and Pacers win

-

Force skipper clueless about extra-time rules in pulsating Super Rugby draw

-

DEA MARIJUANA SCAM: As DEA Cannabis Program Implodes This 4/20, MMJ Stands Alone in Pursuit of Real Medicine

DEA MARIJUANA SCAM: As DEA Cannabis Program Implodes This 4/20, MMJ Stands Alone in Pursuit of Real Medicine

-

Nuggets edge Clippers in NBA playoff overtime thriller, Pacers thump Bucks

-

Unbeaten Miami edge Columbus in front of big crowd in Cleveland

Unbeaten Miami edge Columbus in front of big crowd in Cleveland

-

Kim takes one-shot lead over Thomas, Novak at RBC Heritage

-

Another round of anti-Trump protests hits US cities

Another round of anti-Trump protests hits US cities

-

'So grateful' - Dodgers star Ohtani and wife welcome first child

-

PSG maintain unbeaten Ligue 1 record, Marseille back up to second

PSG maintain unbeaten Ligue 1 record, Marseille back up to second

-

US, Iran report progress in nuclear talks, will meet again

-

US Supreme Court intervenes to block Trump deportations

US Supreme Court intervenes to block Trump deportations

-

Hamas armed wing says fate of US-Israeli captive unknown

-

Pacers thump Bucks to open NBA playoffs

Pacers thump Bucks to open NBA playoffs

-

Sabalenka reaches Stuttgart semis as Ostapenko extends Swiatek mastery

-

Zelensky says Ukraine will observe Putin's Easter truce but claims violations

Zelensky says Ukraine will observe Putin's Easter truce but claims violations

-

'Fuming' Watkins fires Villa in bid to prove Emery wrong

-

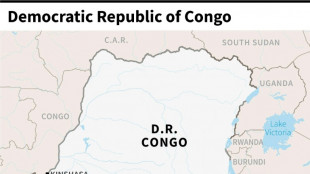

DR Congo boat fire toll revised down to 33

DR Congo boat fire toll revised down to 33

-

England thrash Scotland to set up France Grand Slam showdown

-

Verstappen's Red Bull 'comes alive' to claim record pole in Jeddah

Verstappen's Red Bull 'comes alive' to claim record pole in Jeddah

-

McTominay fires Napoli level with Inter as Conte fuels exit rumours

-

Rajasthan unleash Suryavanshi, 14, as youngest IPL player but lose thriller

Rajasthan unleash Suryavanshi, 14, as youngest IPL player but lose thriller

-

Man City boost top five bid, Aston Villa thrash in-form Newcastle

D. Boral Capital Acted as Sole Bookrunner to EPSIUM ENTERPRISE LIMITED (Nasdaq: EPSM) in connection with its $5.0 Million Initial Public Offering

NEW YORK CITY, NY / ACCESS Newswire / March 31, 2025 / On March. 27, 2025, EPSIUM ENTERPRISE LIMITED (Nasdaq:EPSM) (the "Company" or "EPSIUM"), a company engaged in importing and wholesaling primarily alcoholic beverages in Macau, announced the closing of its initial public offering (the "Offering") of 1,250,000 ordinary shares at a public offering price of US$4.00 per ordinary share. The ordinary shares began trading on the Nasdaq Capital Market on March 26, 2025 under the ticker symbol "EPSM."

The Company received aggregate gross proceeds of US$5.0 million from the Offering, before deducting underwriting discounts and other related expenses payable by the Company. In addition, the Company has granted the underwriters a 45-day option to purchase up to an additional 187,500 ordinary shares at the public offering price, less underwriting discounts.

Net proceeds from the Offering will be used for (i) approximately 10% of the net proceeds for sales and product innovation and brand building, (ii) approximately 60% of the net proceeds for the acquisition of, or investment in, assets, technologies, solutions, or businesses that complement our business, (iii) approximately 20% of the net proceeds for general corporate purposes, and (iv) approximately 10% of the net proceeds for reserve and subject to the discretion of the board of directors.

The Offering was conducted on a firm commitment basis. D. Boral Capital LLC acted as the sole underwriter for the Offering. iTKG Law LLC acted as U.S. securities counsel to the Company, and Schlueter & Associates, P.C. acted as U.S. counsel to the underwriter in connection with the Offering.

A registration statement on Form F-1 relating to the Offering was filed with the U.S. Securities and Exchange Commission (the "SEC") (File Number: 333-276313) and was declared effective by the SEC on March 25, 2025. The Offering is being made only by means of a prospectus, forming a part of the registration statement. Copies of the prospectus relating to the Offering may be obtained from D. Boral Capital LLC, Attn: 590 Madison Avenue 39th Floor, New York, NY 10022, or by email at [email protected], or by telephone at +1(212)-970-5150. In addition, copies of the prospectus relating to the Offering may be obtained via the SEC's website at www.sec.gov.

This press release shall not constitute an offer to sell, or the solicitation of an offer to buy, any of the Company's securities, nor shall such securities be offered or sold in the United States absent registration or an applicable exemption from registration, nor shall there be any offer, solicitation or sale of any of the Company's securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

About EPSIUM ENTERPRISE LIMITED

Through its Macau operating entity, Companhia de Comercio Luz Limitada ("Luz"), a limited liability company organized under Macau laws in 2010, EPSIUM is engaged in importing and wholesaling primarily alcoholic beverages in Macau. Through Luz, the Company imports and sells a broad range of premium beverages, primarily alcoholic beverages and, in 2022, a small quantity of tea and fruit juice. The alcoholic beverages the Company sells include Chinese liquor, French cognac, Scottish whiskey, fine wine, Champagne, and other miscellaneous beverage alcohol. Sales of Chinese liquor is by far the Company's most significant operations, and the Company is a top wholesaler of high-end Chinese liquor in Macau. For more information, please visit the Company's website: www.epsium-group.com.

About D. Boral Capital

D. Boral Capital LLC is a premier, relationship-driven global investment bank headquartered in New York. The firm is dedicated to delivering exceptional strategic advisory and tailored financial solutions to middle-market and emerging growth companies. With a proven track record, D. Boral Capital provides expert guidance to clients across diverse sectors worldwide, leveraging access to capital from key markets, including the United States, Asia, Europe, the UAE, and Latin America.

A recognized leader on Wall Street, D. Boral Capital has successfully aggregated over $23 billion in capital since its inception in 2020, executing approximately 300 transactions across a broad range of investment banking products.

Forward-Looking Statement

Certain statements in this press release are forward-looking statements, including, but not limited to, the Company's proposed Offering. These forward-looking statements involve known and unknown risks and uncertainties and are based on the Company's current expectations and projections about future events that the Company believes may affect its financial condition, results of operations, business strategy and financial needs, including the expectation that the Offering will be successfully completed. Investors can find many (but not all) of these statements by the use of words such as "approximates," "believes," "hopes," "expects," "anticipates," "estimates," "projects," "intends," "plans," "will," "would," "should," "could," "may" or other similar expressions in this press release. The Company undertakes no obligation to update or revise publicly any forward-looking statements to reflect subsequent occurring events or circumstances, or changes in its expectations, except as may be required by law. These statements are subject to uncertainties and risks, including, but not limited to, the uncertainties related to market conditions, and other factors discussed in the "Risk Factors" section of the Registration Statement filed with the SEC. Although the Company believes that the expectations expressed in these forward-looking statements are reasonable, it cannot assure you that such expectations will turn out to be correct, and the Company cautions investors that actual results may differ materially from the anticipated results and encourages investors to review other factors that may affect its future results in the Company's registration statement and other filings with the SEC. Additional factors are discussed in the Company's filings with the SEC, which are available for review at www.sec.gov.

For more information, please contact:

D. Boral Capital LLC

Email: [email protected]

Telephone: +1(212)-970-5150

SOURCE: D. Boral Capital

View the original press release on ACCESS Newswire

G.Stevens--AMWN