-

Other governments 'weaponising' Trump language to attack NGOs: rights groups

Other governments 'weaponising' Trump language to attack NGOs: rights groups

-

UK imposes online entry permit on European visitors

-

How a Brazilian chief is staving off Amazon destruction

How a Brazilian chief is staving off Amazon destruction

-

Meme politics: White House embraces aggressive alt-right online culture

-

China launches military drills in Taiwan Strait

China launches military drills in Taiwan Strait

-

US senator smashes record with 25-hour anti-Trump speech

-

Brazil binman finds newborn baby on garbage route

Brazil binman finds newborn baby on garbage route

-

US senator smashes record with marathon anti-Trump speech

-

Trump advisor Waltz faces new pressure over Gmail usage

Trump advisor Waltz faces new pressure over Gmail usage

-

Niger junta frees ministers of overthrown government

-

Trump set to unleash 'Liberation Day' tariffs

Trump set to unleash 'Liberation Day' tariffs

-

Boeing chief to acknowledge 'serious missteps' at US Senate hearing

-

Real Madrid hold Real Sociedad in eight-goal thriller to reach Copa del Rey final

Real Madrid hold Real Sociedad in eight-goal thriller to reach Copa del Rey final

-

Nuno salutes 'special' Elanga after stunning strike fires Forest

-

PSG survive scare against Dunkerque to reach French Cup final

PSG survive scare against Dunkerque to reach French Cup final

-

Sundowns edge Esperance as crowd violence mars quarter-final

-

Nottingham Forest beat Man Utd, Saka scores on Arsenal return

Nottingham Forest beat Man Utd, Saka scores on Arsenal return

-

Elanga wonder-goal sinks Man Utd as Forest eye Champions League berth

-

Stock markets mostly advance ahead of Trump tariffs deadline

Stock markets mostly advance ahead of Trump tariffs deadline

-

US movie theaters urge 45-day 'baseline' before films hit streaming

-

Saka scores on return as Arsenal beat Fulham

Saka scores on return as Arsenal beat Fulham

-

Third-division Bielefeld shock holders Leverkusen in German Cup

-

Ball-blasting 'Torpedo bats' making waves across MLB opening weekend

Ball-blasting 'Torpedo bats' making waves across MLB opening weekend

-

Newsmax shares surge more than 2,000% in days after IPO

-

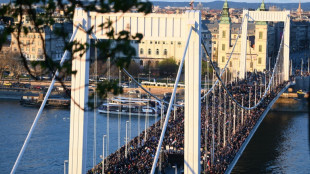

Thousands of Hungarians protest against Pride ban law

Thousands of Hungarians protest against Pride ban law

-

GM leads first quarter US auto sales as tariffs loom

-

Tesla sales tumble in Europe in the first quarter

Tesla sales tumble in Europe in the first quarter

-

No 'eye for an eye' approach to US tariffs: Mexico

-

NFL club owners back dynamic kickoffs, delay tush push vote

NFL club owners back dynamic kickoffs, delay tush push vote

-

Trump 'perfecting' new tariffs as nervous world braces

-

Trump nominee says to press UK on Israel arms

Trump nominee says to press UK on Israel arms

-

French court says Le Pen appeal ruling could come before presidential vote

-

The battle to control assets behind Bosnia crisis

The battle to control assets behind Bosnia crisis

-

Prabhsimran powers Punjab to IPL win over Lucknow

-

Mass layoffs targeting 10,000 jobs hit US health agencies

Mass layoffs targeting 10,000 jobs hit US health agencies

-

Tiger's April Foolishness: plan to play Masters just a joke

-

Myanmar quake toll passes 2,700, nation halts to honour victims

Myanmar quake toll passes 2,700, nation halts to honour victims

-

Turkish fans, artists urge Muse to cancel Istanbul gig

-

US seeks death penalty for accused killer of insurance CEO

US seeks death penalty for accused killer of insurance CEO

-

UK govt moves to block sentencing guidelines for minority defendants

-

Trump puts world on edge as 'Liberation Day' tariffs loom

Trump puts world on edge as 'Liberation Day' tariffs loom

-

Swedish journalist jailed in Turkey kept 'isolated': employer

-

Stock markets advance ahead of Trump tariffs deadline

Stock markets advance ahead of Trump tariffs deadline

-

Gulf between Everton and Liverpool has never been bigger, says Moyes

-

Finland to withdraw from anti-personnel mine ban treaty

Finland to withdraw from anti-personnel mine ban treaty

-

UK vows £20 million to boost drone and 'flying taxi' services

-

Ford's US auto sales dip in first quarter as tariffs loom

Ford's US auto sales dip in first quarter as tariffs loom

-

Digging for box office gold, 'A Minecraft Movie' hits cinemas

-

Southampton boss Juric desperate to avoid Premier League 'worst team' tag

Southampton boss Juric desperate to avoid Premier League 'worst team' tag

-

Thailand rescue dogs double as emotional support

China property giant Vanke reports annual loss of $6.8 bn

Debt-laden Chinese property giant Vanke reported annual losses of 49.5 billion yuan ($6.8 billion) on Monday, citing falling sales and shrinking profit margins despite Beijing's attempts to revive the housing market.

Vanke said 2024 was an "exceptionally challenging year" in a filing to the Hong Kong stock exchange and apologised for "distress caused... due to the significant decline in sales, substantial losses and pressure on our liquidity".

Beijing has in recent years grappled with a prolonged crisis in the country's vast real estate sector, once a key pillar of the economy but now beset with sprawling debt.

Hong Kong-listed Vanke is part-owned by the government of Shenzhen and was China's fourth-largest real estate firm by sales last year, according to research firm CRIC.

Vanke said on Monday that it "failed to break free from expansion inertia of high-debt, high-turnover and high-leverage in a timely manner, which led to problems" such as aggressive investment and over-expansion.

Last year marked Vanke's first annual loss since it was listed in 1991 and the magnitude exceeded the firm's January estimate of $6.2 billion.

Revenue fell 26 percent year-on-year to $47.3 million.

Vanke partly attributed the losses to "significant decrease in the settlement scale and gross profit margin of the development business".

Company chief operating officer and executive vice president Liu Xiao resigned from his position on Monday "due to work adjustments", the firm said.

"After stepping down from these roles, (Liu) will continue to work for the Company, focusing on strategic investment business," according to the company.

Vanke has seen a shakeup of its top management, including the resignation of its CEO Zhu Jiusheng on January 27 which the company said was "due to health reasons".

That month, Chinese outlet the Economic Reporter cited sources as saying Zhu had been "taken away by public security authorities", without specifying his alleged offences.

Beijing announced support measures in November for the ailing property sector that included lowering deed tax rates for certain first and second homes in four major cities, including Beijing and Shanghai.

Despite the policy package, Vanke suffered net losses of $4.35 billion in the final quarter of last year.

The company said it will face a concentrated repayment of its public debts this year, "further intensifying the liquidity pressure".

Chinese authorities were mulling plans to help Vanke plug a funding gap of $6.8 billion this year, Bloomberg News reported last month.

Vanke is among several major Chinese property firms mired in a debt crisis in recent years that has left developers in severe financial distress.

Troubled property developers Kaisa and Country Garden -- both fending off winding up petitions in Hong Kong courts -- also reported losses separately.

Kaisa said on Monday that its losses for the year grew 48.4 percent to $4.03 billion in 2024.

Country Garden reported an annual loss attributable to company owners of $4.5 billion on Sunday, adding that its total debt amounted to $34.9 billion as of the end of last year.

S.Gregor--AMWN