-

Lewandowski injury confirmed in blow to Barca quadruple bid

Lewandowski injury confirmed in blow to Barca quadruple bid

-

Russia and Ukraine accuse each other of breaching Easter truce

-

Zimbabwe bowl Bangladesh out for 191 in first Test in Sylhet

Zimbabwe bowl Bangladesh out for 191 in first Test in Sylhet

-

Ukrainians voice scepticism on Easter truce

-

Pope wishes 'Happy Easter' to faithful in appearance at St Peter's Square

Pope wishes 'Happy Easter' to faithful in appearance at St Peter's Square

-

Sri Lanka police probe photo of Buddha tooth relic

-

Home hero Wu wows Shanghai crowds by charging to China Open win

Home hero Wu wows Shanghai crowds by charging to China Open win

-

Less Soviet, more inspiring: Kyrgyzstan seeks new anthem

-

Defending champion Kyren Wilson crashes out in first round of World Snooker Championship

Defending champion Kyren Wilson crashes out in first round of World Snooker Championship

-

NASA's oldest active astronaut returns to Earth on 70th birthday

-

Exec linked to Bangkok building collapse arrested

Exec linked to Bangkok building collapse arrested

-

Zelensky says Russian attacks ongoing despite Putin's Easter truce

-

Vaibhav Suryavanshi: the 14-year-old whose IPL dream came true

Vaibhav Suryavanshi: the 14-year-old whose IPL dream came true

-

Six drowning deaths as huge waves hit Australian coast

-

Ukrainian soldiers' lovers kept waiting as war drags on

Ukrainian soldiers' lovers kept waiting as war drags on

-

T'Wolves dominate Lakers, Nuggets edge Clippers as NBA playoffs start

-

Taxes on super rich and tech giants stall under Trump

Taxes on super rich and tech giants stall under Trump

-

Star Wars series 'Andor' back for final season

-

Neighbours improvise first aid for wounded in besieged Sudan city

Neighbours improvise first aid for wounded in besieged Sudan city

-

Tariffs could lift Boeing and Airbus plane prices even higher

-

Analysts warn US could be handing chip market to China

Analysts warn US could be handing chip market to China

-

Unbeaten Miami edge Columbus in front of big MLS crowd in Cleveland

-

Social media helps fuel growing 'sex tourism' in Japan

Social media helps fuel growing 'sex tourism' in Japan

-

'Pandora's box': alarm bells in Indonesia over rising military role

-

Alaalatoa hails 'hustling hard' Brumbies for rare Super Rugby clean sheet

Alaalatoa hails 'hustling hard' Brumbies for rare Super Rugby clean sheet

-

Trio share lead at tight LA Championship

-

Sampdoria fighting relegation disaster as old heroes ride into town

Sampdoria fighting relegation disaster as old heroes ride into town

-

Recovering pope expected to delight crowds at Easter Sunday mass

-

Nuggets edge Clippers in NBA playoff overtime thriller, Knicks and Pacers win

Nuggets edge Clippers in NBA playoff overtime thriller, Knicks and Pacers win

-

Force skipper clueless about extra-time rules in pulsating Super Rugby draw

-

DEA MARIJUANA SCAM: As DEA Cannabis Program Implodes This 4/20, MMJ Stands Alone in Pursuit of Real Medicine

DEA MARIJUANA SCAM: As DEA Cannabis Program Implodes This 4/20, MMJ Stands Alone in Pursuit of Real Medicine

-

Nuggets edge Clippers in NBA playoff overtime thriller, Pacers thump Bucks

-

Unbeaten Miami edge Columbus in front of big crowd in Cleveland

Unbeaten Miami edge Columbus in front of big crowd in Cleveland

-

Kim takes one-shot lead over Thomas, Novak at RBC Heritage

-

Another round of anti-Trump protests hits US cities

Another round of anti-Trump protests hits US cities

-

'So grateful' - Dodgers star Ohtani and wife welcome first child

-

PSG maintain unbeaten Ligue 1 record, Marseille back up to second

PSG maintain unbeaten Ligue 1 record, Marseille back up to second

-

US, Iran report progress in nuclear talks, will meet again

-

US Supreme Court intervenes to block Trump deportations

US Supreme Court intervenes to block Trump deportations

-

Hamas armed wing says fate of US-Israeli captive unknown

-

Pacers thump Bucks to open NBA playoffs

Pacers thump Bucks to open NBA playoffs

-

Sabalenka reaches Stuttgart semis as Ostapenko extends Swiatek mastery

-

Zelensky says Ukraine will observe Putin's Easter truce but claims violations

Zelensky says Ukraine will observe Putin's Easter truce but claims violations

-

'Fuming' Watkins fires Villa in bid to prove Emery wrong

-

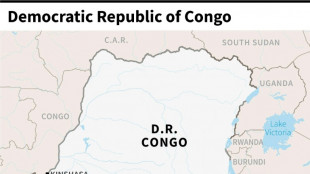

DR Congo boat fire toll revised down to 33

DR Congo boat fire toll revised down to 33

-

England thrash Scotland to set up France Grand Slam showdown

-

Verstappen's Red Bull 'comes alive' to claim record pole in Jeddah

Verstappen's Red Bull 'comes alive' to claim record pole in Jeddah

-

McTominay fires Napoli level with Inter as Conte fuels exit rumours

-

Rajasthan unleash Suryavanshi, 14, as youngest IPL player but lose thriller

Rajasthan unleash Suryavanshi, 14, as youngest IPL player but lose thriller

-

Man City boost top five bid, Aston Villa thrash in-form Newcastle

Clear Start Tax Helps Client Reduce Tax Debt from $9,059 to Just $323, Securing Financial Relief

See How Expert Guidance and the IRS Fresh Start Program Delivered a Life-Changing Tax Settlement

IRVINE, CA / ACCESS Newswire / March 31, 2025 / Clear Start Tax, a leader in tax resolution, has helped another client, Tracy, overcome a crushing tax burden. Through expert negotiation and IRS advocacy, the company successfully reduced her $9,059 tax debt to just $323, giving her and her family a fresh financial start.

From Overwhelming Debt to a Manageable Solution

For Tracy, tax season had become a time of stress and frustration. Year after year, she owed more money, with no relief in sight.

"I knew that I owed a ton of money, and every year when I would do my taxes, I would not get back any money. Instead, I would owe more and more, and it was very, very distressful." Tracy shared

Every year, instead of receiving a refund, she found herself owing even more, with penalties and interest piling up. As the debt reached $9,059, she feared it could spiral out of control, potentially doubling over time. Unsure where to turn, Tracy sought the help of Clear Start Tax, hoping for a way to regain control of her finances.

Personalized Approach Leads to Success

After a thorough financial review, Clear Start Tax identified a strategic path forward. By leveraging their expertise in IRS negotiations, they secured a compromise settlement that drastically reduced Tracy's tax liability.

"My tax issue got pretty out of hand. We ended up owing over $9,059. I now don't owe anything but $323. The tax relief company, Clear Start Tax, made a compromise with the IRS on my behalf, and I only owe $323, which I paid back. Now my taxes and my husband's taxes are zero!"

With this resolution, Tracy avoided thousands of dollars in payments and escaped a growing debt cycle, restoring financial stability for her family.

Unmatched Client Support Every Step of the Way

Throughout the process, Tracy experienced exceptional customer service, with the Clear Start Tax team ensuring she was informed at every stage. Whether she had questions or concerns, the team provided quick and clear answers, making sure she never felt lost or overwhelmed.

"My experience with Clear Start while going through the process was amazing. If I called to ask a question and the main person was unavailable, each and every person that worked there would look up the file and answer any questions I had."

This dedicated approach is what sets Clear Start Tax apart from other tax relief firms.

A Recommendation for Those Facing Tax Challenges

Now free from tax debt, Tracy encourages others facing similar struggles to seek professional help.

"I would tell anybody that asked and had a major tax crisis to definitely call Clear Start Tax Relief and use them as their company. I would definitely recommend Clear Start Tax to all my friends and family. They've been amazing!"

About Clear Start Tax

Clear Start Tax is a full-service tax liability resolution firm that serves taxpayers throughout the United States. The company specializes in assisting individuals and businesses with a wide range of IRS and state tax issues, including back taxes, wage garnishment relief, IRS appeals, and offers in compromise. Clear Start Tax helps taxpayers apply for the IRS Fresh Start Program, providing expert guidance in tax resolution. Fully accredited and A+ rated by the Better Business Bureau, the firm's unique approach and commitment to long-term client success distinguish it as a leader in the tax resolution industry.

Need Help With Back Taxes?

Click the link below:

https://clearstarttax.com/qualifytoday/

Contact Information

Clear Start Tax

Corporate Communications Department

[email protected]

949-800-4044

Testimonials Disclaimer

All estimates and statements regarding program performance are based on historical client outcomes. Results for each individual may vary depending on their specific tax situation, financial status, and the timely and accurate submission of information. Among Clear Start Tax clients who enroll in tax resolution services, approximately 30% qualify for an Offer in Compromise (OIC), 40% qualify for Installment Agreements (IA) or Partial Payment Installment Agreements (PPIA), 15% qualify for Installment Agreements (IA) with Penalty Abatement, and 15% are placed in Currently Not Collectible (CNC) status. We do not guarantee that your tax debt will be reduced by a specific amount or percentage, or that your taxes will be paid off within a certain time frame. Interest and penalties will continue to accrue until your tax liability is resolved in full.

Testimonials provided by Clear Start Tax clients reflect their individual experiences and are based on their specific circumstances. Compensation may have been provided for their honest feedback. These are individual results, which will vary depending on the situation. No testimonial should be considered a promise, guarantee, or prediction of the outcome of your case.

SOURCE: Clear Start Tax

View the original press release on ACCESS Newswire

J.Oliveira--AMWN