-

Real Madrid hold Real Sociedad in eight-goal thriller to reach Copa del Rey final

Real Madrid hold Real Sociedad in eight-goal thriller to reach Copa del Rey final

-

Nuno salutes 'special' Elanga after stunning strike fires Forest

-

PSG survive scare against Dunkerque to reach French Cup final

PSG survive scare against Dunkerque to reach French Cup final

-

Sundowns edge Esperance as crowd violence mars quarter-final

-

Nottingham Forest beat Man Utd, Saka scores on Arsenal return

Nottingham Forest beat Man Utd, Saka scores on Arsenal return

-

Elanga wonder-goal sinks Man Utd as Forest eye Champions League berth

-

Stock markets mostly advance ahead of Trump tariffs deadline

Stock markets mostly advance ahead of Trump tariffs deadline

-

US movie theaters urge 45-day 'baseline' before films hit streaming

-

Saka scores on return as Arsenal beat Fulham

Saka scores on return as Arsenal beat Fulham

-

Third-division Bielefeld shock holders Leverkusen in German Cup

-

Ball-blasting 'Torpedo bats' making waves across MLB opening weekend

Ball-blasting 'Torpedo bats' making waves across MLB opening weekend

-

Newsmax shares surge more than 2,000% in days after IPO

-

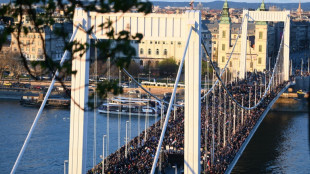

Thousands of Hungarians protest against Pride ban law

Thousands of Hungarians protest against Pride ban law

-

GM leads first quarter US auto sales as tariffs loom

-

Tesla sales tumble in Europe in the first quarter

Tesla sales tumble in Europe in the first quarter

-

No 'eye for an eye' approach to US tariffs: Mexico

-

NFL club owners back dynamic kickoffs, delay tush push vote

NFL club owners back dynamic kickoffs, delay tush push vote

-

Trump 'perfecting' new tariffs as nervous world braces

-

Trump nominee says to press UK on Israel arms

Trump nominee says to press UK on Israel arms

-

French court says Le Pen appeal ruling could come before presidential vote

-

The battle to control assets behind Bosnia crisis

The battle to control assets behind Bosnia crisis

-

Prabhsimran powers Punjab to IPL win over Lucknow

-

Mass layoffs targeting 10,000 jobs hit US health agencies

Mass layoffs targeting 10,000 jobs hit US health agencies

-

Tiger's April Foolishness: plan to play Masters just a joke

-

Myanmar quake toll passes 2,700, nation halts to honour victims

Myanmar quake toll passes 2,700, nation halts to honour victims

-

Turkish fans, artists urge Muse to cancel Istanbul gig

-

US seeks death penalty for accused killer of insurance CEO

US seeks death penalty for accused killer of insurance CEO

-

UK govt moves to block sentencing guidelines for minority defendants

-

Trump puts world on edge as 'Liberation Day' tariffs loom

Trump puts world on edge as 'Liberation Day' tariffs loom

-

Swedish journalist jailed in Turkey kept 'isolated': employer

-

Stock markets advance ahead of Trump tariffs deadline

Stock markets advance ahead of Trump tariffs deadline

-

Gulf between Everton and Liverpool has never been bigger, says Moyes

-

Finland to withdraw from anti-personnel mine ban treaty

Finland to withdraw from anti-personnel mine ban treaty

-

UK vows £20 million to boost drone and 'flying taxi' services

-

Ford's US auto sales dip in first quarter as tariffs loom

Ford's US auto sales dip in first quarter as tariffs loom

-

Digging for box office gold, 'A Minecraft Movie' hits cinemas

-

Southampton boss Juric desperate to avoid Premier League 'worst team' tag

Southampton boss Juric desperate to avoid Premier League 'worst team' tag

-

Thailand rescue dogs double as emotional support

-

Five takeaways from Marine Le Pen verdict

Five takeaways from Marine Le Pen verdict

-

Stock markets split ahead of Trump tariffs deadline

-

Turkish fans, artists urge Muse to cancel Istanbul gig over protest dispute

Turkish fans, artists urge Muse to cancel Istanbul gig over protest dispute

-

Former captain Edwards named new England women's cricket coach

-

Haaland ruled out for up to seven weeks: Man City boss Guardiola

Haaland ruled out for up to seven weeks: Man City boss Guardiola

-

UK Supreme Court opens car loans hearing as banks risk huge bill

-

Haaland ruled out for up to seven weeks: Guardiola

Haaland ruled out for up to seven weeks: Guardiola

-

Trophies are what count: Barca's Flick before Atletico cup clash

-

Trump signs executive order targeting ticket scalping

Trump signs executive order targeting ticket scalping

-

Eurozone inflation eases in March as tariff threat looms

-

Howe targets 'game-changing' Champions League return for Newcastle

Howe targets 'game-changing' Champions League return for Newcastle

-

Chinese developer under scrutiny over Bangkok tower quake collapse

A$19.5m Raised in Strongly Supported Placement

ANNOUNCEMENT TO THE TORONTO STOCK EXCHANGE AND AUSTRALIAN SECURITIES EXCHANGE

HIGHLIGHTS

RTG Mining Inc. has received firm commitments to raise approximately A$19.5 million via a two-tranche institutional placement

The placement received strong support from a number of leading institutional investors including both existing shareholders and a number of new investors

Placement strengthens RTG's balance sheet enabling the Company to advance the Mabilo Project towards start-up together with other business development opportunities

Placement follows recently secured partnership with one of the largest natural resource companies in the world, Glencore International AG, to finance Stage 1 start-up of the high-grade Copper and Gold Mabilo Project

Secured Financing Facility from Glencore provides for a total of up to US$30m in three-tranches covering 100% of the estimated capex for Stage 1

SUBIACO, AU / ACCESS Newswire / March 31, 2025 / The Board of RTG Mining Inc. ("RTG", the "Company") (TSX Code:RTG)(ASX Code:RTG) is pleased to announce that the Company has received commitments to raise approximately A$19.5 million (circa US$12.3 million) in a placement to institutional and sophisticated investors ("Placement").

As recently reported (see ASX announcement dated 6 March 2025), the Secured Financing Facility with Glencore International AG ("Glencore"), provides for a total of up to US$30 million (in three-tranches), on attractive terms, for the development of Stage 1 of the high-grade copper and gold Mabilo Project in the Philippines. Subsequent to securing binding finance and offtake arrangements with Glencore, the Placement has received strong institutional demand, demonstrating the considerable support for RTG's high-grade copper and gold strategy.

The Placement will result in the issue of approximately 783 million Chess Depository Instruments ("New Securities") to be listed on the ASX at an issue price of A$0.025 per Security ("Issue Price"), representing a 3.8% discount to RTG's last closing price on the ASX of A$0.026.

Net proceeds of the Placement will be used to provide working capital to advance the Mabilo Project towards start-up and operations to unlock the early and strong cashflows of the project, with the first phase being a Direct Shipping Operation. RTG will also be well funded to progress plans for additional exploration at the Mabilo Project to expand the current reserve in the oxide layer, including additional high grade supergene chalcocite copper material and further drilling to then expand the reserves in the primary skarn material for Stage 2.

In addition to this drilling, RTG will commit to a 5,000m drill program at the Chanach Project, including 3,000m into the potential high grade porphyry target identified in the recent 3DIP programs. This will run from late May through to October/November depending on the available field season. Other work plans include continuing the pursuit of new potential business development opportunities, including the Panguna Project in the Autonomous Region of Bougainville and general working capital purposes.

Placement Details:

The Placement consists of 783 million New Securities to be issued at the Issue Price of A$0.025 per Security to raise total funds of circa A$19.5 million. The Placement will be conducted in two tranches. The first tranche of approximately 169,297,750 New Securities is expected to be issued on or around 9 April 2025 using the Company's 15% placement capacity under ASX Listing Rule 7.1 to raise ~A$4.2 million (before costs).

The second tranche of New Securities, being the balance of the Placement (~613.7 million New Securities), will be issued as follows:

subject to receiving shareholder approval under ASX Listing Rule 10.11, the issue of up to 7 million New Securities to the RTG Directors and up to 241 million New Securities to Equinox Partners LP, which is deemed to be a 'related party' of the Company by virtue of Non-Executive Director Mr Sean Fieler's position as a controlling member of Equinox Partners GP, the General Partner of Equinox Partners LP; and

subject to receiving shareholder approval under ASX Listing Rule 7.1, the further issue of a total of up to 365 million New Securities to institutional and sophisticated investors (including existing shareholders of RTG).

Shareholder approval for the issue of the New Securities under the second tranche of the Placement will be sought at a General Meeting of the Company expected to be held in May 2025. Settlement and allotment of New Securities under the second tranche of the Placement are expected to occur shortly after approval is obtained at the General Meeting. Furter details relating to the issue of these New Securities will be set out in a Notice of Meeting to be sent to shareholders in due course.

Foster Stockbroking Pty Ltd ("FSB") acted as lead manager and bookrunner to the Placement ("Lead Manager").

The Placement will be conducted under exemptions from prospectus and registration requirements of securities laws in relevant countries. The Placement is subject to approval of TSX.

ABOUT RTG MINING INC

RTG Mining Inc. is a mining and exploration company listed on the main board of the Toronto Stock Exchange and the Australian Securities Exchange. RTG is currently focused primarily on progressing the Mabilo Project to start-up having now received a mining permit for the Project, with a view to moving quickly and safely to a producing gold and copper company.

RTG also has several exciting new opportunities including the Panguna Project in Bougainville, which it remains committed to while also considering further new business development opportunities.

RTG has an experienced management team which has to date developed seven mines in five different countries, including being responsible for the development of the Masbate Gold Mine in the Philippines through CGA Mining Limited. RTG has some of the most respected international institutional investors as shareholders including Equinox Partners and Franklin Templeton.

ENQUIRIES

President & CEO - Justine Magee

Tel: +61 8 6489 2900

Email: [email protected]

Australian Investor and Media Contact

Sam Burns: +61 400 164 067

Email: [email protected]

COMPLIANCE STATEMENT

Date: 31 March 2025

Authorised for release by: By the Board of Directors

CAUTIONARY NOTE STATEMENT

The Toronto Stock Exchange has not reviewed nor does it accept responsibility for the accuracy or adequacy of this press release, which has been prepared by management.

This announcement includes certain "forward-looking statements" within the meaning of Canadian securities legislation. All statements in this announcement, other than statements of historical facts are forward-looking statements, including statements made or implied relating to the anticipated timing, closing, size, structure of and exemptions utilized under the Placement, the use of the net proceeds from the Placement, the timing of the shareholder meeting to approve Tranche 2 of the Placement, the Company's opportunities to diversify its Philippine interests and to participate in the redevelopment of the Panguna Mine in Bougainville, the Company's objectives, strategies to achieve those objectives, the Company's beliefs, plans, estimates and intentions, and similar statements concerning anticipated future events, plans for further exploration. Forward-looking statements involve various risks and uncertainties and are based on certain factors and assumptions. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from RTG's expectations include uncertainties related to market conditions and demand for the Placement, the receipt of requisite shareholder and regulatory approvals, fluctuations in gold and other commodity prices and currency exchange rates; uncertainties relating to interpretation of drill results and the geology, continuity and grade of mineral deposits; uncertainty of estimates of capital and operating costs, recovery rates, production estimates and estimated economic return; the need for cooperation of government agencies in the development of RTG's mineral projects; the need to obtain additional financing to develop RTG's mineral projects; the possibility of delay in development programs or in construction projects and uncertainty of meeting anticipated program milestones for RTG's mineral projects and other risks and uncertainties as discussed in RTG's annual report for the year ended December 31, 2024 and detailed from time to time in our other filings with the Canadian securities regulatory authorities available at www.sedar.com. The forward‐looking statements made in this announcement relate only to events as of the date on which the statements are made. RTG will not release publicly any revisions or updates to these forward‐looking statements to reflect events, circumstances or unanticipated events occurring after the date of this announcement except as required by law or by any appropriate regulatory authority.

NOT FOR RELEASE OR DISTRIBUTION IN THE UNITED STATES

This announcement has been prepared for publication in Canada and Australia and may not be released to US wire services or distributed in the United States. This announcement does not constitute an offer to sell, or a solicitation of an offer to buy, securities in the United States or any other jurisdiction. Any securities described in this announcement have not been, and will not be, registered under the US Securities Act of 1933, as amended (the "US Securities Act"), or any state securities laws, and may not be offered or sold in the United States or to or for the account or benefit of a U.S. Person (as defined in Regulation S under the US Securities Act), except in transactions exempt from, or not subject to, registration under the US Securities Act and applicable US state securities laws.

SOURCE: RTG Mining Inc.

View the original press release on ACCESS Newswire

M.Thompson--AMWN