-

Newsmax shares surge more than 2,000% in days after IPO

Newsmax shares surge more than 2,000% in days after IPO

-

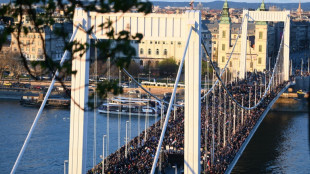

Thousands of Hungarians protest against Pride ban law

-

GM leads first quarter US auto sales as tariffs loom

GM leads first quarter US auto sales as tariffs loom

-

Tesla sales tumble in Europe in the first quarter

-

No 'eye for an eye' approach to US tariffs: Mexico

No 'eye for an eye' approach to US tariffs: Mexico

-

NFL club owners back dynamic kickoffs, delay tush push vote

-

Trump 'perfecting' new tariffs as nervous world braces

Trump 'perfecting' new tariffs as nervous world braces

-

Trump nominee says to press UK on Israel arms

-

French court says Le Pen appeal ruling could come before presidential vote

French court says Le Pen appeal ruling could come before presidential vote

-

The battle to control assets behind Bosnia crisis

-

Prabhsimran powers Punjab to IPL win over Lucknow

Prabhsimran powers Punjab to IPL win over Lucknow

-

Mass layoffs targeting 10,000 jobs hit US health agencies

-

Tiger's April Foolishness: plan to play Masters just a joke

Tiger's April Foolishness: plan to play Masters just a joke

-

Myanmar quake toll passes 2,700, nation halts to honour victims

-

Turkish fans, artists urge Muse to cancel Istanbul gig

Turkish fans, artists urge Muse to cancel Istanbul gig

-

US seeks death penalty for accused killer of insurance CEO

-

UK govt moves to block sentencing guidelines for minority defendants

UK govt moves to block sentencing guidelines for minority defendants

-

Trump puts world on edge as 'Liberation Day' tariffs loom

-

Swedish journalist jailed in Turkey kept 'isolated': employer

Swedish journalist jailed in Turkey kept 'isolated': employer

-

Stock markets advance ahead of Trump tariffs deadline

-

Gulf between Everton and Liverpool has never been bigger, says Moyes

Gulf between Everton and Liverpool has never been bigger, says Moyes

-

Finland to withdraw from anti-personnel mine ban treaty

-

UK vows £20 million to boost drone and 'flying taxi' services

UK vows £20 million to boost drone and 'flying taxi' services

-

Ford's US auto sales dip in first quarter as tariffs loom

-

Digging for box office gold, 'A Minecraft Movie' hits cinemas

Digging for box office gold, 'A Minecraft Movie' hits cinemas

-

Southampton boss Juric desperate to avoid Premier League 'worst team' tag

-

Thailand rescue dogs double as emotional support

Thailand rescue dogs double as emotional support

-

Five takeaways from Marine Le Pen verdict

-

Stock markets split ahead of Trump tariffs deadline

Stock markets split ahead of Trump tariffs deadline

-

Turkish fans, artists urge Muse to cancel Istanbul gig over protest dispute

-

Former captain Edwards named new England women's cricket coach

Former captain Edwards named new England women's cricket coach

-

Haaland ruled out for up to seven weeks: Man City boss Guardiola

-

UK Supreme Court opens car loans hearing as banks risk huge bill

UK Supreme Court opens car loans hearing as banks risk huge bill

-

Haaland ruled out for up to seven weeks: Guardiola

-

Trophies are what count: Barca's Flick before Atletico cup clash

Trophies are what count: Barca's Flick before Atletico cup clash

-

Trump signs executive order targeting ticket scalping

-

Eurozone inflation eases in March as tariff threat looms

Eurozone inflation eases in March as tariff threat looms

-

Howe targets 'game-changing' Champions League return for Newcastle

-

Chinese developer under scrutiny over Bangkok tower quake collapse

Chinese developer under scrutiny over Bangkok tower quake collapse

-

Sirens wail and families cry at Myanmar disaster site

-

Three things on Australia's former Russian tennis star Daria Kasatkina

Three things on Australia's former Russian tennis star Daria Kasatkina

-

Stock markets rise ahead of Trump tariffs deadline

-

Facing US tariffs, Canadians hunt for business in Europe

Facing US tariffs, Canadians hunt for business in Europe

-

Trumpets, guns, horses: northern Nigeria's Durbar ends Ramadan in style

-

Defiant French far right insists 'we will win' despite Le Pen ban

Defiant French far right insists 'we will win' despite Le Pen ban

-

Hezbollah official among four dead in Israeli strike on Beirut

-

Liverpool's Slot unfazed by Alexander-Arnold Real Madrid links

Liverpool's Slot unfazed by Alexander-Arnold Real Madrid links

-

Hezbollah official targeted in deadly Israeli strike on Beirut

-

Israel PM drops security chief nominee under fire from Trump ally

Israel PM drops security chief nominee under fire from Trump ally

-

Stock markets edge up but Trump tariff fears dampen mood

| CMSC | 0.04% | 22.41 | $ | |

| JRI | 0.38% | 12.99 | $ | |

| GSK | -2.45% | 37.815 | $ | |

| BCC | 0.66% | 98.74 | $ | |

| CMSD | 0.21% | 22.858 | $ | |

| NGG | 0.3% | 65.81 | $ | |

| AZN | -1.32% | 72.545 | $ | |

| RIO | 0.37% | 60.305 | $ | |

| SCS | 3.01% | 11.3 | $ | |

| RBGPF | 1.47% | 68 | $ | |

| BTI | -0.62% | 41.115 | $ | |

| RYCEF | 3.87% | 10.09 | $ | |

| BP | 0.04% | 33.805 | $ | |

| BCE | -0.68% | 22.805 | $ | |

| VOD | -1.13% | 9.265 | $ | |

| RELX | 0.47% | 50.65 | $ |

Japan's Nikkei leads big losses in Asian markets as gold hits record

Tokyo led another plunge across Asian markets Monday while gold hit a record high as investors steel themselves for a wave of US tariffs this week that has fuelled recession fears.

Equities across the planet have been hammered in recent weeks ahead of Donald Trump's "Liberation Day" on April 2, when his administration will unveil a series of levies against friend and foe alike, citing what he says are unfair trading practices.

His announcement last week that he would also impose 25 percent duties on imports of all vehicles and parts ramped up the fear factor on trading floors, hammering car giants including Japan's Toyota, the world's biggest.

Governments around the world have pushed back on Trump's tariffs, and could announce more countermeasures, while Canadian Prime Minister Mark Carney told Trump on Friday that he will implement retaliatory tariffs to protect his country's workers and economy.

Adding to the dour mood was data showing the Federal Reserve's preferred gauge of inflation rose more than expected last month amid worries Trump's tariffs will fan price rises and further dent hopes for interest rate cuts.

Japan's Nikkei 225 index plunged more than four percent at one point, extending last week's slide, as Toyota, Nissan and Mazda shed more around three percent, while tech investment titan SoftBank tanked more than five percent.

Zensho Holdings, which owns several Japanese restaurant franchises, plunged five percent after its beef bowl chain Sukiya said it would temporarily shut nearly all of its roughly 2,000 branches after a rat was found in a miso soup and a bug in another meal.

Seoul was also sharply lower.

"Within the Asia-Pacific region, the car levies will hit Japan and South Korea the hardest. About six percent of Japan's total exports are cars shipped to the US. In South Korea's case, it's four percent," Moody's Analytics economists wrote.

"Such a sizeable tariff hike will undermine confidence, hit production and reduce orders. Given the long and complex supply chains in car manufacturing, the impact will ripple through these countries' economies.

"Back-of-the-envelope calculations suggest the action could shave 0.2 to 0.5 percentage points from growth in each."

There were also losses in Hong Kong, Sydney, Shanghai, Wellington, Taipei and Manila.

Gold, a safe haven in times of uncertainty and turmoil, hit a record high of $3,106.79.

The selling followed a hefty selloff on Wall Street, where the Dow tumbled 1.7 percent, the S&P 500 lost 2.0 percent and the Nasdaq dived 2.7 percent.

US investors were jolted by figures showing the core personal consumption expenditures (PCE) index came in above forecasts in February.

Analysts said that while the reading was not a blowout, its timing amid a period of uncertainty added to the sense of gloom, when traders had been hoping for a little reassurance.

"Markets will now be fully at the mercy of an impending deluge of tariff-related headlines, while highly reactive to any US economic data that accelerates the thematic of slower economic activity and higher expected inflation," said Chris Weston at Pepperstone.

- Key figures around 0230 GMT -

Tokyo - Nikkei 225: DOWN 3.9 percent at 35,691.52 (break)

Hong Kong - Hang Seng Index: DOWN 0.6 percent at 23,278.18

Shanghai - Composite: DOWN 0.1 percent at 3,349.68

Euro/dollar: DOWN at $1.0833 from $1.0838 on Friday

Pound/dollar: UP at $1.2958 from $1.2947

Dollar/yen: DOWN at 149.05 yen from 149.72 yen

Euro/pound: DOWN at 83.60 pence from 83.68 pence

West Texas Intermediate: DOWN 0.4 percent at $69.08 per barrel

Brent North Sea Crude: DOWN 0.3 percent at $73.42 per barrel

New York - Dow: DOWN 1.7 percent at 41,583.90 (close)

London - FTSE 100: DOWN 0.1 percent at 8,658.85 (close)

O.Norris--AMWN