-

Brazil binman finds newborn baby on garbage route

Brazil binman finds newborn baby on garbage route

-

US senator smashes record with marathon anti-Trump speech

-

Trump advisor Waltz faces new pressure over Gmail usage

Trump advisor Waltz faces new pressure over Gmail usage

-

Niger junta frees ministers of overthrown government

-

Trump set to unleash 'Liberation Day' tariffs

Trump set to unleash 'Liberation Day' tariffs

-

Boeing chief to acknowledge 'serious missteps' at US Senate hearing

-

Real Madrid hold Real Sociedad in eight-goal thriller to reach Copa del Rey final

Real Madrid hold Real Sociedad in eight-goal thriller to reach Copa del Rey final

-

Nuno salutes 'special' Elanga after stunning strike fires Forest

-

PSG survive scare against Dunkerque to reach French Cup final

PSG survive scare against Dunkerque to reach French Cup final

-

Sundowns edge Esperance as crowd violence mars quarter-final

-

Nottingham Forest beat Man Utd, Saka scores on Arsenal return

Nottingham Forest beat Man Utd, Saka scores on Arsenal return

-

Elanga wonder-goal sinks Man Utd as Forest eye Champions League berth

-

Stock markets mostly advance ahead of Trump tariffs deadline

Stock markets mostly advance ahead of Trump tariffs deadline

-

US movie theaters urge 45-day 'baseline' before films hit streaming

-

Saka scores on return as Arsenal beat Fulham

Saka scores on return as Arsenal beat Fulham

-

Third-division Bielefeld shock holders Leverkusen in German Cup

-

Ball-blasting 'Torpedo bats' making waves across MLB opening weekend

Ball-blasting 'Torpedo bats' making waves across MLB opening weekend

-

Newsmax shares surge more than 2,000% in days after IPO

-

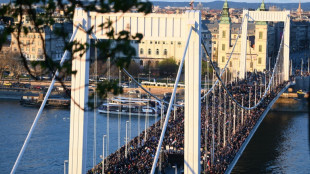

Thousands of Hungarians protest against Pride ban law

Thousands of Hungarians protest against Pride ban law

-

GM leads first quarter US auto sales as tariffs loom

-

Tesla sales tumble in Europe in the first quarter

Tesla sales tumble in Europe in the first quarter

-

No 'eye for an eye' approach to US tariffs: Mexico

-

NFL club owners back dynamic kickoffs, delay tush push vote

NFL club owners back dynamic kickoffs, delay tush push vote

-

Trump 'perfecting' new tariffs as nervous world braces

-

Trump nominee says to press UK on Israel arms

Trump nominee says to press UK on Israel arms

-

French court says Le Pen appeal ruling could come before presidential vote

-

The battle to control assets behind Bosnia crisis

The battle to control assets behind Bosnia crisis

-

Prabhsimran powers Punjab to IPL win over Lucknow

-

Mass layoffs targeting 10,000 jobs hit US health agencies

Mass layoffs targeting 10,000 jobs hit US health agencies

-

Tiger's April Foolishness: plan to play Masters just a joke

-

Myanmar quake toll passes 2,700, nation halts to honour victims

Myanmar quake toll passes 2,700, nation halts to honour victims

-

Turkish fans, artists urge Muse to cancel Istanbul gig

-

US seeks death penalty for accused killer of insurance CEO

US seeks death penalty for accused killer of insurance CEO

-

UK govt moves to block sentencing guidelines for minority defendants

-

Trump puts world on edge as 'Liberation Day' tariffs loom

Trump puts world on edge as 'Liberation Day' tariffs loom

-

Swedish journalist jailed in Turkey kept 'isolated': employer

-

Stock markets advance ahead of Trump tariffs deadline

Stock markets advance ahead of Trump tariffs deadline

-

Gulf between Everton and Liverpool has never been bigger, says Moyes

-

Finland to withdraw from anti-personnel mine ban treaty

Finland to withdraw from anti-personnel mine ban treaty

-

UK vows £20 million to boost drone and 'flying taxi' services

-

Ford's US auto sales dip in first quarter as tariffs loom

Ford's US auto sales dip in first quarter as tariffs loom

-

Digging for box office gold, 'A Minecraft Movie' hits cinemas

-

Southampton boss Juric desperate to avoid Premier League 'worst team' tag

Southampton boss Juric desperate to avoid Premier League 'worst team' tag

-

Thailand rescue dogs double as emotional support

-

Five takeaways from Marine Le Pen verdict

Five takeaways from Marine Le Pen verdict

-

Stock markets split ahead of Trump tariffs deadline

-

Turkish fans, artists urge Muse to cancel Istanbul gig over protest dispute

Turkish fans, artists urge Muse to cancel Istanbul gig over protest dispute

-

Former captain Edwards named new England women's cricket coach

-

Haaland ruled out for up to seven weeks: Man City boss Guardiola

Haaland ruled out for up to seven weeks: Man City boss Guardiola

-

UK Supreme Court opens car loans hearing as banks risk huge bill

5 Types of Home Improvement Loans: Which One Makes Sense for You?

NEW YORK, NY / ACCESS Newswire / March 26, 2025 / While home renovations are exciting, they don't come cheap. The good news is you can still improve your home without thousands of dollars of cash at your disposal. With a home improvement loan, you may receive the funds you need to complete just about any project.

Since there are several home improvement loans out there, it's important to compare your options and hone in on the ideal one. Here are five types of home improvement loans to consider.

1. Personal Loan

Many lenders offer personal loans that you can use to cover home improvement expenses. Since most personal loans are unsecured, you won't need collateral, like your house or car, to take one out. In some cases, you can apply online and receive the funds quickly, sometimes as soon as the same day you apply. And, you don't always need the best credit score to get approved. You can pre-qualify for a few personal loans online without impacting your credit and choose the best option.

2. Home Equity Loan

A home equity loan (HEL) lets you borrow against the equity you've built up in your home. Your home equity is the difference between the value of your home and what you still owe on your mortgage. Depending on the lender and your unique situation, you may borrow up to 100% of your equity-though it's more common to be approved for less. You'll get a lump sum of money upfront and may be able to score a reasonably low interest rate. You might also be able to deduct your interest. The only caveat is that you'll need sufficient home equity to go this route.

3. Home Equity Line of Credit (HELOC)

Just like a home equity loan, a HELOC uses your home equity. The difference, however, is that a HELOC works like a credit card. You can borrow as much or as little as you'd like up to a set credit limit that you're approved for. You'll only pay interest on the funds you withdraw rather than the entire amount you're approved for. A HELOC can be a great option if you're looking for a flexible loan because you're unsure of how much money your home improvement project will cost.

4. Cash-Out Refinance

A cash-out refinance is when you take out a new mortgage with a larger balance than what you currently owe. Then, you pay off your existing mortgage and pocket the difference. You can use the remaining cash to pay for a home improvement. Remember, you'll have to pay closing costs and refinancing restarts your loan term.

5. Credit Cards

A credit card can come in handy if you have a smaller home improvement project. It's convenient and may even earn you rewards, like cash back or travel points. A credit card is a smart move if you feel confident you'll be able to repay your balance in full at the end of each month. It might also be worthwhile if you're able to get a card with a 0% introductory offer. As long as you repay your balance before the intro period is up, you won't have to pay any interest.

The Bottom Line

Not all home improvement loans are created equal. That's why shopping around and exploring all your options is important. If you own a home with lots of equity, a home equity loan or HELOC might be your best bet. On the other hand, a personal loan is ideal if you don't want to put any assets on the line. A credit card can be a solid pick if you have a smaller project. Best of luck in your search for the perfect loan!

SPONSORED CONTENT

CONTACT:

Sonakshi Murze

Manager

[email protected]

SOURCE: OneMain Financial

View the original press release on ACCESS Newswire

O.Norris--AMWN