-

Vance lands in India for tough talks on trade

Vance lands in India for tough talks on trade

-

Inside South Africa's wildlife CSI school helping to catch poachers

-

Nigerian Afrobeat legend Femi Kuti takes a look inward

Nigerian Afrobeat legend Femi Kuti takes a look inward

-

Kim Kardashian: From sex tape to Oval Office via TV and Instagram

-

Vance in India for tough talks on trade

Vance in India for tough talks on trade

-

Thunder crush Grizzlies as Celtics, Cavs and Warriors win

-

Vance heads to India for tough talks on trade

Vance heads to India for tough talks on trade

-

China slams 'appeasement' of US as nations rush to secure trade deals

-

'Grandpa robbers' go on trial for Kardashian heist in Paris

'Grandpa robbers' go on trial for Kardashian heist in Paris

-

Swede Lindblad gets first win in just third LPGA start

-

Gold hits record, dollar drops as tariff fears dampen sentiment

Gold hits record, dollar drops as tariff fears dampen sentiment

-

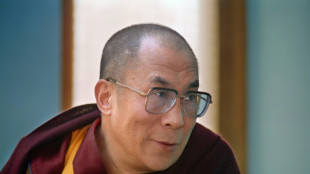

As Dalai Lama approaches 90, Tibetans weigh future

-

US defense chief shared sensitive information in second Signal chat: US media

US defense chief shared sensitive information in second Signal chat: US media

-

Swede Lingblad gets first win in just third LPGA start

-

South Korea ex-president back in court for criminal trial

South Korea ex-president back in court for criminal trial

-

Thunder crush Grizzlies, Celtics and Cavs open NBA playoffs with wins

-

Beijing slams 'appeasement' of US in trade deals that hurt China

Beijing slams 'appeasement' of US in trade deals that hurt China

-

Trump in his own words: 100 days of quotes

-

Padres say slugger Arraez 'stable' after scary collision

Padres say slugger Arraez 'stable' after scary collision

-

Trump tariffs stunt US toy imports as sellers play for time

-

El Salvador offers to swap US deportees with Venezuela

El Salvador offers to swap US deportees with Venezuela

-

Higgo holds on for win after Dahmen's late collapse

-

El Salvador's president proposes prisoner exchange with Venezuela

El Salvador's president proposes prisoner exchange with Venezuela

-

Gilgeous-Alexander, Jokic, Antetokounmpo named NBA MVP finalists

-

Thomas ends long wait with playoff win over Novak

Thomas ends long wait with playoff win over Novak

-

Thunder rumble to record win over Grizzlies, Celtics top Magic in NBA playoff openers

-

Linesman hit by projectile as Saint-Etienne edge toward safety

Linesman hit by projectile as Saint-Etienne edge toward safety

-

Mallia guides Toulouse to Top 14 win over Stade Francais

-

Israel cancels visas for French lawmakers

Israel cancels visas for French lawmakers

-

Russia and Ukraine trade blame over Easter truce, as Trump predicts 'deal'

-

Valverde stunner saves Real Madrid title hopes against Bilbao

Valverde stunner saves Real Madrid title hopes against Bilbao

-

Ligue 1 derby interrupted after assistant referee hit by projectile

-

Leclerc bags Ferrari first podium of the year

Leclerc bags Ferrari first podium of the year

-

Afro-Brazilian carnival celebrates cultural kinship in Lagos

-

Ligue 1 derby halted after assistant referee hit by projectile

Ligue 1 derby halted after assistant referee hit by projectile

-

Thunder rumble with record win over Memphis in playoff opener

-

Leverkusen held at Pauli to put Bayern on cusp of title

Leverkusen held at Pauli to put Bayern on cusp of title

-

Israel says Gaza medics' killing a 'mistake,' to dismiss commander

-

Piastri power rules in Saudi as Max pays the penalty

Piastri power rules in Saudi as Max pays the penalty

-

Leaders Inter level with Napoli after falling to late Orsolini stunner at Bologna

-

David rediscovers teeth as Chevalier loses some in nervy Lille win

David rediscovers teeth as Chevalier loses some in nervy Lille win

-

Piastri wins Saudi Arabian Grand Prix, Verstappen second

-

Kohli, Rohit star as Bengaluru and Mumbai win in IPL

Kohli, Rohit star as Bengaluru and Mumbai win in IPL

-

Guirassy helps Dortmund past Gladbach, putting top-four in sight

-

Alexander-Arnold lauds 'special' Liverpool moments

Alexander-Arnold lauds 'special' Liverpool moments

-

Pina strikes twice as Barca rout Chelsea in Champions League semi

-

Rohit, Suryakumar on song as Mumbai hammer Chennai in IPL

Rohit, Suryakumar on song as Mumbai hammer Chennai in IPL

-

Dortmund beat Gladbach to keep top-four hopes alive

-

Leicester relegated from the Premier League as Liverpool close in on title

Leicester relegated from the Premier League as Liverpool close in on title

-

Alexander-Arnold fires Liverpool to brink of title, Leicester relegated

Cedar Realty Trust Announces Preliminary Results of Series C Tender Offer and Extension of Series B Tender Offer

VIRGINIA BEACH, VA / ACCESS Newswire / March 24, 2025 / Cedar Realty Trust, Inc. (NYSE:CDRpB)(NYSE:CDRpC) (the "Company") announced today the preliminary results of its offer to purchase up to 584,615 shares of its 6.50% Series C Cumulative Redeemable Preferred Stock (the "Series C Shares") for a purchase price of $16.25 per share, in cash (the "Series C Offer"), which expired at 5:00 p.m., New York City time, on March 21, 2025. The Company also announced an extension of its offer to purchase shares of its 7.25% Series B Cumulative Redeemable Preferred Stock (the "Series B Shares") for a purchase price of $17.75 per share, in cash (the "Series B Offer" and, together with the Series C Offer, the "Offers") and an increase in the number of Series B Shares that may be purchased.

The Series B Offer, which was originally intended to expire at 5:00 p.m., New York City time, on March 21, 2025, will remain open until 5:00 p.m., New York City time, on April 4, 2025. The aggregate amount of shares that may be purchased pursuant to the Offers was increased by $10,00,000 to $19,500,0000 following the expiration of the Series C Offer, such that up to 563,380 Series B Shares may be purchased in the Series B Offer.

Based on the preliminary count by Computershare Inc. ("Computershare"), the depositary for the Offers, as of March 21, 2025, approximately 1,758,747 Series C Shares and 757,127 Series B Shares were properly tendered and not properly withdrawn.

In accordance with the terms and conditions of the tender offer, the Company expects to purchase approximately 584,615 Series C Shares, for an aggregate purchase price of approximately $9.5 million. The determination of the final number of Series C Shares to be purchased and the final price per share is subject to confirmation by Computershare of the proper delivery of the Series C Shares validly tendered and not withdrawn. Because the Series C Offer was oversubscribed, the number of Series C Shares that will be purchased from each holder will be prorated based on the number of Series C Shares properly tendered.

The number of Series C Shares to be purchased are subject to verification by Computershare and subject to change for a number of reasons. The actual number of Series C Shares to be purchased will be announced following the expiration of the guaranteed delivery period and completion of the confirmation process by Computershare. Promptly after the announcement of the final results of the Series C Offer, Computershare will issue payment for the Series C Shares validly tendered and accepted for payment under the Series C Offer and will return Series C Shares tendered and not purchased in the Series C Offer.

The Company may purchase additional Series C Shares in the future. The amount and timing of any such purchases depends on a number of factors, including the availability of cash and/or financing on acceptable terms, the amount and timing of dividend payments, if any, and periods in which the Company is restricted from repurchasing Series C Shares, as well as any decision to use cash for other strategic objectives. Under applicable law, the Company may not repurchase any additional Series C Shares until at least ten business days after the expiration of the Series C Offer.

For all questions relating to the Offers, please call the information agent, Georgeson LLC toll-free at (866) 735-3807; banks and brokers may call the depositary, Computershare Inc., at (800) 736-3001.

About Cedar Realty Trust

Cedar Realty Trust, Inc., a wholly-owned subsidiary of Wheeler Real Estate Investment Trust, Inc., is a Maryland corporation (taxed as a real estate investment trust) that focuses on owning and operating income producing retail properties with a primary focus on grocery-anchored shopping centers in the Northeast. Cedar's portfolio comprises 14 properties, with approximately 2.3 million square feet of gross leasable area.

For additional financial and descriptive information on the Company, its operations and its portfolio, please refer to the Company's website at www.whlr.us.

Contact Information:

Cedar Realty Trust, Inc.

(757) 627-9088

Cautionary Statement Regarding Forward-Looking Statements

This press release contains forward-looking statements that are subject to risks, uncertainties and other factors which may cause the actual results, performance or achievements to be materially different from future results, performance or achievements expressed or implied by such forward-looking statements. Forward-looking statements, which are based on certain assumptions and describe the Company's future plans, strategies and expectations, are generally identifiable by use of the words "may", "will", "should", "estimates", "projects", "anticipates", "believes", "expects", "intends", "future", and words of similar import, or the negative thereof. These statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond the Company's control, are difficult to predict and could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements.

Forward-looking statements that were true at the time made may ultimately prove to be incorrect or false. You are cautioned to not place undue reliance on forward-looking statements. The Company undertakes no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results.

SOURCE: Cedar Realty Trust, Inc.

View the original press release on ACCESS Newswire

F.Bennett--AMWN