-

Iraq's top Shiite cleric says Pope Francis sought peace

Iraq's top Shiite cleric says Pope Francis sought peace

-

Mourners flock to world's churches to grieve Pope Francis

-

Trump says Pope Francis 'loved the world'

Trump says Pope Francis 'loved the world'

-

Sri Lanka recalls Pope Francis' compassion on Easter bombing anniversary

-

Pope Francis inspired IOC president Bach to create refugee team

Pope Francis inspired IOC president Bach to create refugee team

-

Alexander-Arnold will be remembered for 'good things' at Liverpool: Van Dijk

-

US VP Vance meets Indian PM Modi for tough talks on trade

US VP Vance meets Indian PM Modi for tough talks on trade

-

Pentagon chief dismisses reports he shared military info with wife

-

15 potential successors to Pope Francis

15 potential successors to Pope Francis

-

The papabili - 15 potential successors to Pope Francis

-

Zhao sets up all-China clash after beating 2024 world snooker finalist Jones

Zhao sets up all-China clash after beating 2024 world snooker finalist Jones

-

Ostapenko stuns Sabalenka to win Stuttgart title

-

Argentina mourns loss of papal son

Argentina mourns loss of papal son

-

African leaders praise Pope Francis's 'legacy of compassion'

-

Mehidy's five wickets help Bangladesh fight back in first Zimbabwe Test

Mehidy's five wickets help Bangladesh fight back in first Zimbabwe Test

-

'The voice of god': Filipinos wrestle with death of Pope Francis

-

Prayers, disbelief in East Timor after Pope Francis death

Prayers, disbelief in East Timor after Pope Francis death

-

Real Madrid hold minute's silence as La Liga mourns Pope Francis

-

World leaders pay tribute to Pope Francis, dead at 88

World leaders pay tribute to Pope Francis, dead at 88

-

World leaders react to the death of Pope Francis

-

Zimbabwe lead first Test despite Bangladesh spinner Mehidy's five wickets

Zimbabwe lead first Test despite Bangladesh spinner Mehidy's five wickets

-

Vatican postpones sainthood for 'God's influencer' after pope's death

-

Pope's death prompts CONI to call for sporting postponements, minute's silence

Pope's death prompts CONI to call for sporting postponements, minute's silence

-

Stunned and sad, faithful gather at St Peter's to remember Francis

-

Asian scam centre crime gangs expanding worldwide: UN

Asian scam centre crime gangs expanding worldwide: UN

-

Davos meet founder Klaus Schwab steps down from WEF board

-

Himalayan snow at 23-year low, threatening 2 billion people: report

Himalayan snow at 23-year low, threatening 2 billion people: report

-

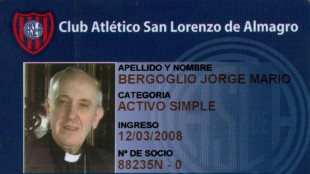

The beautiful game: Pope Francis's passion for football

-

Clerical sex abuse: Pope Francis's thorniest challenge

Clerical sex abuse: Pope Francis's thorniest challenge

-

Pope Francis's delicate ties with politics in Argentina

-

Russia resumes attacks on Ukraine after Easter truce

Russia resumes attacks on Ukraine after Easter truce

-

Pope Francis has died aged 88

-

Gaza civil defence describes medic killings as 'summary executions'

Gaza civil defence describes medic killings as 'summary executions'

-

Francis: radical leader who broke the papal mould

-

Oscar stars, Max keeps mum, Sainz alive - Saudi GP talking points

Oscar stars, Max keeps mum, Sainz alive - Saudi GP talking points

-

Iyer, Kishan win back India contracts as Pant's deal upgraded

-

Vance lands in India for tough talks on trade

Vance lands in India for tough talks on trade

-

Inside South Africa's wildlife CSI school helping to catch poachers

-

Nigerian Afrobeat legend Femi Kuti takes a look inward

Nigerian Afrobeat legend Femi Kuti takes a look inward

-

Kim Kardashian: From sex tape to Oval Office via TV and Instagram

-

Vance in India for tough talks on trade

Vance in India for tough talks on trade

-

Thunder crush Grizzlies as Celtics, Cavs and Warriors win

-

Vance heads to India for tough talks on trade

Vance heads to India for tough talks on trade

-

China slams 'appeasement' of US as nations rush to secure trade deals

-

'Grandpa robbers' go on trial for Kardashian heist in Paris

'Grandpa robbers' go on trial for Kardashian heist in Paris

-

Swede Lindblad gets first win in just third LPGA start

-

Gold hits record, dollar drops as tariff fears dampen sentiment

Gold hits record, dollar drops as tariff fears dampen sentiment

-

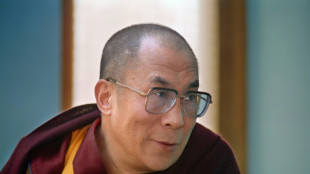

As Dalai Lama approaches 90, Tibetans weigh future

-

US defense chief shared sensitive information in second Signal chat: US media

US defense chief shared sensitive information in second Signal chat: US media

-

Swede Lingblad gets first win in just third LPGA start

| RBGPF | 0.22% | 63.59 | $ | |

| GSK | 0.32% | 36.045 | $ | |

| RYCEF | -0.96% | 9.41 | $ | |

| RIO | -0.15% | 58.08 | $ | |

| CMSC | -0.44% | 21.725 | $ | |

| BTI | 0.32% | 42.507 | $ | |

| VOD | -0.59% | 9.255 | $ | |

| RELX | 0.01% | 52.205 | $ | |

| NGG | 0.77% | 72.67 | $ | |

| BP | -2.26% | 27.695 | $ | |

| AZN | -0.42% | 67.31 | $ | |

| SCS | -4.44% | 9.345 | $ | |

| CMSD | -0.66% | 21.815 | $ | |

| JRI | -1.02% | 12.275 | $ | |

| BCC | -4.13% | 89.765 | $ | |

| BCE | 0.23% | 22.09 | $ |

Stocks fall, oil prices rise in choppy trade after Fed decision

Wall Street stocks slipped Thursday after the US Federal Reserve sought to calm fears over President Donald Trump's tariffs, while eurozone equities slumped.

Meanwhile, oil prices jumped and gold hit a new record high on continued geopolitical tensions -- particularly concerning Gaza and Yemen -- and fresh US sanctions on Iranian oil.

All three major indices on Wall Street closed lower, giving up some of their gains from Wednesday after Fed chair Jerome Powell suggested that any increase to consumer prices caused by tariffs would likely be short-lived.

"We started off in the red, went solidly into the green, only to go back into the red, then back into the green and now we're kind of flatlining," CFRA's Sam Stovall told AFP, shortly before US markets slipped further to close in the red.

The major eurozone markets of Frankfurt, Milan and Paris gave up around one percent or more after European Central Bank chief Christine Lagarde warned a trade war between the United States and Europe could shave half a percentage point off eurozone growth and push up inflation.

Lingering tariff fears and geopolitical developments helped safe-haven gold to another record above $3,057.49 an ounce.

The price of copper reached a five-month high above $10,000 a tonne as US companies stock up on the metal targeted by Trump's tariffs.

- Oil 'in the spotlight' -

Oil prices jumped amid a fresh upsurge in Gaza hostilities and worries about Iran-backed Huthi rebels.

"The prospect of an extended US campaign against the Huthis combines with Israel's renewed Gaza offensive to put oil squarely back in the spotlight," said Chris Beauchamp, chief market analyst at online trading platform IG.

In other central bank action, the Bank of England and Sweden's Riksbank held interest rates steady Thursday, following in the footsteps of the Fed and the Bank of Japan a day earlier.

Meanwhile, the Swiss central bank cut its rates on Thursday, citing "high uncertainty" in the global economy.

Nevertheless, most markets had their focus Thursday on the United States, the world's biggest economy.

"Great uncertainty remains over the direction of travel for the US economy, with business activity likely to remain subdued until we see greater clarity over the trade relationships and potential pricing for US imports and exports," noted Scope Markets analyst Joshua Mahony.

Trump's painful duties on imports into the United States and threats of further tariffs have stoked recession fears.

But the Fed only trimmed its forecast for US growth this year to 1.7 percent from a previous estimate of 2.1 percent in December, suggesting it does not think a recession is likely at this moment.

Policymakers expect inflation -- excluding volatile food and energy prices -- to hit 2.8 percent this year, up from 2.5 percent in its last forecast in December.

But Fed Chair Jerome Powell continued to insist that any increase in inflation would be "transitory."

- Key figures around 2045 GMT -

New York - Dow: DOWN less than 0.1 percent at 41,953.32 points (close)

New York - S&P: DOWN 0.2 percent 5,662.89 (close)

New York - Nasdaq: DOWN 0.2 percent at 17,691.63 (close)

London - FTSE 100: DOWN less than 0.1 percent at 8,701.99 (close)

Paris - CAC 40: DOWN 1.0 percent at 8,094.20 (close)

Frankfurt - DAX: DOWN 1.2 percent at 22,999.15 (close)

Hong Kong - Hang Seng Index: DOWN 2.2 percent at 24,219.95 (close)

Shanghai - Composite: DOWN 0.5 percent at 3,408.95 (close)

Tokyo - Nikkei 225: Closed for a holiday

Euro/dollar: DOWN at $1.0856 from $1.0903 on Wednesday

Pound/dollar: DOWN at $1.2967 from $1.3002

Dollar/yen: UP at 148.76 yen from 148.71 yen

Euro/pound: DOWN at 83.72 pence from 83.82 pence

West Texas Intermediate: UP 1.6 percent at $68.26 per barrel

Brent North Sea Crude: UP 1.7 percent at $72.00 per barrel

burs-da-ni/gv

A.Mahlangu--AMWN