-

Battling Forest see off Spurs to boost Champions League hopes

Battling Forest see off Spurs to boost Champions League hopes

-

'I don't miss tennis' says Nadal

-

Biles 'not so sure' about competing at Los Angeles Olympics

Biles 'not so sure' about competing at Los Angeles Olympics

-

Gang-ravaged Haiti nearing 'point of no return', UN warns

-

US assets slump again as Trump sharpens attack on Fed chief

US assets slump again as Trump sharpens attack on Fed chief

-

Forest see off Spurs to boost Champions League hopes

-

Trump says Pope Francis 'loved the world,' will attend funeral

Trump says Pope Francis 'loved the world,' will attend funeral

-

Oscar voters required to view all films before casting ballots

-

Bucks' Lillard upgraded to 'questionable' for game 2 v Pacers

Bucks' Lillard upgraded to 'questionable' for game 2 v Pacers

-

Duplantis and Biles win Laureus World Sports Awards

-

US urges curb of Google's search dominance as AI looms

US urges curb of Google's search dominance as AI looms

-

The Pope with 'two left feet' who loved the 'beautiful game'

-

With Pope Francis death, Trump loses top moral critic

With Pope Francis death, Trump loses top moral critic

-

Mourning Americans contrast Trump approach to late Pope Francis

-

Leeds and Burnley promoted to Premier League

Leeds and Burnley promoted to Premier League

-

Racist gunman jailed for life over US supermarket massacre

-

Trump backs Pentagon chief despite new Signal chat scandal

Trump backs Pentagon chief despite new Signal chat scandal

-

Macron vows to step up reconstruction in cyclone-hit Mayotte

-

Gill, Sudharsan help toppers Gujarat boss Kolkata in IPL

Gill, Sudharsan help toppers Gujarat boss Kolkata in IPL

-

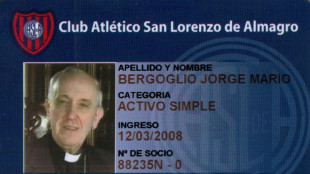

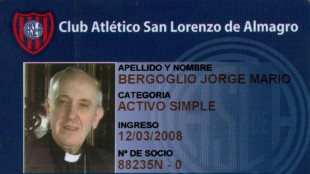

Messi, San Lorenzo bid farewell to football fan Pope Francis

-

Leeds on brink of Premier League promotion after smashing Stoke

Leeds on brink of Premier League promotion after smashing Stoke

-

In Lourdes, Catholic pilgrims mourn the 'pope of the poor'

-

Korir wins men's Boston Marathon, Lokedi upstages Obiri

Korir wins men's Boston Marathon, Lokedi upstages Obiri

-

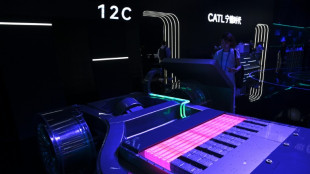

China's CATL launches new EV sodium battery

-

Korir wins Boston Marathon, Lokedi upstages Obiri

Korir wins Boston Marathon, Lokedi upstages Obiri

-

Francis, a pope for the internet age

-

Iraq's top Shiite cleric says Pope Francis sought peace

Iraq's top Shiite cleric says Pope Francis sought peace

-

Mourners flock to world's churches to grieve Pope Francis

-

Trump says Pope Francis 'loved the world'

Trump says Pope Francis 'loved the world'

-

Sri Lanka recalls Pope Francis' compassion on Easter bombing anniversary

-

Pope Francis inspired IOC president Bach to create refugee team

Pope Francis inspired IOC president Bach to create refugee team

-

Alexander-Arnold will be remembered for 'good things' at Liverpool: Van Dijk

-

US VP Vance meets Indian PM Modi for tough talks on trade

US VP Vance meets Indian PM Modi for tough talks on trade

-

Pentagon chief dismisses reports he shared military info with wife

-

15 potential successors to Pope Francis

15 potential successors to Pope Francis

-

The papabili - 15 potential successors to Pope Francis

-

Zhao sets up all-China clash after beating 2024 world snooker finalist Jones

Zhao sets up all-China clash after beating 2024 world snooker finalist Jones

-

Ostapenko stuns Sabalenka to win Stuttgart title

-

Argentina mourns loss of papal son

Argentina mourns loss of papal son

-

African leaders praise Pope Francis's 'legacy of compassion'

-

Mehidy's five wickets help Bangladesh fight back in first Zimbabwe Test

Mehidy's five wickets help Bangladesh fight back in first Zimbabwe Test

-

'The voice of god': Filipinos wrestle with death of Pope Francis

-

Prayers, disbelief in East Timor after Pope Francis death

Prayers, disbelief in East Timor after Pope Francis death

-

Real Madrid hold minute's silence as La Liga mourns Pope Francis

-

World leaders pay tribute to Pope Francis, dead at 88

World leaders pay tribute to Pope Francis, dead at 88

-

World leaders react to the death of Pope Francis

-

Zimbabwe lead first Test despite Bangladesh spinner Mehidy's five wickets

Zimbabwe lead first Test despite Bangladesh spinner Mehidy's five wickets

-

Vatican postpones sainthood for 'God's influencer' after pope's death

-

Pope's death prompts CONI to call for sporting postponements, minute's silence

Pope's death prompts CONI to call for sporting postponements, minute's silence

-

Stunned and sad, faithful gather at St Peter's to remember Francis

Stock climb before Fed decision, gold hits fresh high

European and US stocks mostly rose on Wednesday a Fed rate decision, while gold set a new record high as geopolitical concerns returned to the fore.

"There is a modicum of buy-the-dip interest in the mega-cap stocks, which led yesterday's slide" on Wall Street said Briefing.com analyst Patrick O'Hare.

The US Federal Reserve was widely expected to extend its rate cut pause later on Wednesday Investors were eagerly awaiting comments from Fed Chairman Jerome Powell about how the bank seeks to chart a path through the economic turbulence unleashed by US President Donald Trump's ever-changing approach to tariffs.

"One should expect the overarching message from Fed Chair Powell to be that the Fed is waiting to see what policies are enacted, and their effects on economic activity, before making any additional policy moves," said O'Hare.

That may make the Fed's updated Summary of Economic Projections the main event for investors. The previously quarterly summary, issued in December, predicted two interest rate cuts in 2025.

But Susannah Streeter, head of money and markets at Hargreaves Lansdown, said the possibility of more cuts may not cheer investors.

"Even the prospect of lowering borrowing costs unlikely to provide much solace given that they would be seen as indicating increasing weakness in the US economy," she said.

Many economists have warned that the tariffs -- which are being met with retaliation by some countries -- will tip the US economy, and possibly others, into recession.

Wall Street stocks were higher in early afternoon trading.

In Europe, Paris rose, London was flat and Frankfurt succumbed to profit-taking.

Official data showed eurozone inflation eased more than previously estimated in February, driven by a slowdown in consumer price increases in Germany.

Inflation in the single currency area slowed to 2.3 percent last month, a slight change from the 2.4 percent figure published on March 3.

Meanwhile, the price of gold, seen as a safe-haven investment, struck a record high above $3,045 an ounce. That came on fears of a fresh upsurge in hostilities in the Middle East after Israel launched its most intense strikes on Gaza since a ceasefire with Hamas took effect.

Oil prices edged higher, even as Hamas said it remained open to negotiations while calling for pressure on Israel to implement a Gaza truce.

In Moscow, Russia accused Ukraine of trying to "derail" agreements reached between Vladimir Putin and Trump to halt strikes on energy infrastructure.

Elsewhere, the Turkish lira plunged to an all-time low against the dollar on Wednesday, after police raided the home of Istanbul's powerful opposition mayor, Ekrem Imamoglu.

The currency hit a low of more than 40 liras per dollar after the mayor, a key opponent of President Recep Tayyip Erdogan, was detained over a corruption probe, a move denounced by his opposition CHP party as a "coup".

Trading on Istanbul stock exchange was temporarily halted and it finished the day 8.7 percent lower.

The yen gave up initial gains against the dollar after the Bank of Japan kept interest rates on hold, warning about "high uncertainties" including over trade.

Japan's Nikkei 225 stock index also gave up gains to end lower.

- Key figures around 1630 GMT -

New York - Dow: UP 0.7 percent at 41,873.08 points

New York - S&P 500: UP 0.8 percent at 5,661.64

New York - Nasdaq Composite: UP 1.1 percent at 17,699.44

London - FTSE 100: FLAT at 8, (close)

Paris - CAC 40: UP 0.7 percent at 8,171.47 (close)

Frankfurt - DAX: DOWN 0.4 percent at 23,288.06 (close)

Tokyo - Nikkei 225: DOWN 0.3 percent at 37,751.88 (close)

Hong Kong - Hang Seng Index: UP 0.1 percent at 24,771.14 (close)

Shanghai - Composite: DOWN 0.1 percent at 3,426.43 (close)

Euro/dollar: DOWN at $1.0884 from $1.0944 on Tuesday

Pound/dollar: DOWN at 1.2973 from 1.3003

Dollar/yen: UP at 149.88 yen from 149.36 yen

Euro/pound: DOWN at 83.89 pence from 84.16 pence

West Texas Intermediate: UP 0.3 percent at $66.93 per barrel

Brent North Sea Crude: UP 0.3 percent at $70.77 per barrel

burs-rl/jj

L.Miller--AMWN