-

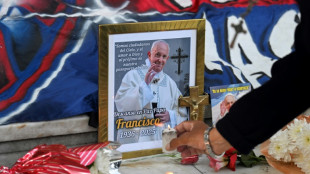

The world leaders set to attend Francis's funeral

The world leaders set to attend Francis's funeral

-

East Timor mourns Pope Francis months after emotional visit

-

US envoy to visit Moscow as US pushes for ceasefire

US envoy to visit Moscow as US pushes for ceasefire

-

At least 24 killed in Kashmir attack on tourists: Indian police source

-

Philippine typhoon victims remember day Pope Francis brought hope

Philippine typhoon victims remember day Pope Francis brought hope

-

IMF slashes global growth outlook on impact of Trump tariffs

-

BASF exits Xinjiang ventures after Uyghur abuse reports

BASF exits Xinjiang ventures after Uyghur abuse reports

-

Nordics, Lithuania plan joint purchase of combat vehicles

-

Gold hits record, stocks diverge as Trump fuels Fed fears

Gold hits record, stocks diverge as Trump fuels Fed fears

-

World could boost growth by reducing trade doubt: IMF chief economist

-

IMF slashes global growth outlook on impact of US tariffs

IMF slashes global growth outlook on impact of US tariffs

-

IMF slashes China growth forecasts as trade war deepens

-

Skipper Shanto leads Bangladesh fightback in Zimbabwe Test

Skipper Shanto leads Bangladesh fightback in Zimbabwe Test

-

US VP Vance says 'progress' in India trade talks

-

Ex-England star Youngs to retire from rugby

Ex-England star Youngs to retire from rugby

-

Black Ferns star Woodman-Wickliffe returning for World Cup

-

Kremlin warns against rushing Ukraine talks

Kremlin warns against rushing Ukraine talks

-

Mbappe aiming for Copa del Rey final return: Ancelotti

-

US universities issue letter condemning Trump's 'political interference'

US universities issue letter condemning Trump's 'political interference'

-

Pope Francis's unfulfilled wish: declaring PNG's first saint

-

Myanmar rebels prepare to hand key city back to junta, China says

Myanmar rebels prepare to hand key city back to junta, China says

-

Hamas team heads to Cairo for Gaza talks as Israel strikes kill 26

-

Pianist to perform London musical marathon

Pianist to perform London musical marathon

-

India's Bumrah, Mandhana win top Wisden cricket awards

-

Zurab Tsereteli, whose monumental works won over Russian elites, dies aged 91

Zurab Tsereteli, whose monumental works won over Russian elites, dies aged 91

-

Roche says will invest $50 bn in US, as tariff war uncertainty swells

-

Pope Francis's funeral set for Saturday, world leaders expected

Pope Francis's funeral set for Saturday, world leaders expected

-

US official asserts Trump's agenda in tariff-hit Southeast Asia

-

World leaders set to attend Francis's funeral as cardinals gather

World leaders set to attend Francis's funeral as cardinals gather

-

Gold hits record, stocks mixed as Trump fuels Fed fears

-

Roche says will invest $50 bn in US over next five years

Roche says will invest $50 bn in US over next five years

-

Fleeing Pakistan, Afghans rebuild from nothing

-

US Supreme Court to hear case against LGBTQ books in schools

US Supreme Court to hear case against LGBTQ books in schools

-

Pistons snap NBA playoff skid, vintage Leonard leads Clippers

-

Migrants mourn pope who fought for their rights

Migrants mourn pope who fought for their rights

-

Duplantis kicks off Diamond League amid Johnson-led changing landscape

-

Taliban change tune towards Afghan heritage sites

Taliban change tune towards Afghan heritage sites

-

Kosovo's 'hidden Catholics' baptised as Pope Francis mourned

-

Global warming is a security threat and armies must adapt: experts

Global warming is a security threat and armies must adapt: experts

-

Can Europe's richest family turn Paris into a city of football rivals?

-

Climate campaigners praise a cool pope

Climate campaigners praise a cool pope

-

As world mourns, cardinals prepare pope's funeral

-

US to impose new duties on solar imports from Southeast Asia

US to impose new duties on solar imports from Southeast Asia

-

Draft NZ law seeks 'biological' definition of man, woman

-

Auto Shanghai to showcase electric competition at sector's new frontier

Auto Shanghai to showcase electric competition at sector's new frontier

-

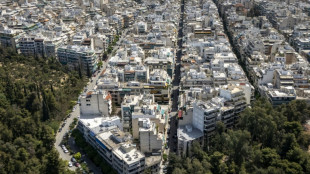

Tentative tree planting 'decades overdue' in sweltering Athens

-

Indonesia food plan risks 'world's largest' deforestation

Indonesia food plan risks 'world's largest' deforestation

-

Gold hits record, stocks slip as Trump fuels Fed fears

-

Trump helps enflame anti-LGBTQ feeling from Hungary to Romania

Trump helps enflame anti-LGBTQ feeling from Hungary to Romania

-

Woe is the pinata, a casualty of Trump trade war

UniCredit gets ECB nod on Commerzbank stake, but delays merger decision

Italian banking giant UniCredit said Friday it had secured approval from the European Central Bank to up its stake in Commerzbank, but warned there were still hurdles ahead before a possible takeover of its German rival.

The ECB, which supervises the banking system in the European Union's shared currency zone, agreed that the Italian lender could buy up to 29.9 percent of Commerzbank, UniCredit said in a statement.

Yet the bank said it would take longer than initially expected to make a decision on a potential takeover, which both Commerzbank and Berlin oppose, with the timeline "now likely to extend well beyond the end of 2025".

Commerzbank has vowed to fight any takeover, and UniCredit's approach has angered German politicians, including outgoing Chancellor Olaf Scholz and his likely successor, Friedrich Merz, whose conservatives won elections last month.

UniCredit, Italy's second largest bank, said Friday it was "awaiting the opportunity to initiate a constructive dialogue with the new German government once formed".

The saga began in September when UniCredit revealed it had built up a stake in its rival, triggering talk that chief executive Andrea Orcel wanted to push for an ambitious pan-European banking merger.

UniCredit has since boosted its holding in Germany's second-biggest bank to around 28 percent, 18.5 percent of which is held through derivatives, a form of financial contract.

A spokeswoman for the German government said the ECB decision did not change the position of Berlin, which supports Commerzbank's autonomy.

"The government has also repeatedly reiterated its rejection of a haphazard and hostile approach, and considers that hostile takeovers in the banking sector are not appropriate," she said.

- Still many factors -

Commerzbank also said the ECB's green light Friday "does not change the fundamental situation: UniCredit continues to be a shareholder of Commerzbank".

"We are convinced of our strategy, which aims for profitable growth and value increase, and we are focusing on its successful implementation," it said.

Last month, Commerzbank announced it planned to cut about 3,900 jobs -- around 10 percent of its workforce -- and hiked its financial targets, in a bid to boost its share price and bolster its defences against its Italian suitor.

The job cuts, to be implemented by 2028, come after the lender booked a record profit in 2024.

UniCredit on Friday welcomed "some positive change at Commerzbank, which, together with the recent more optimistic view on German macro (economy), has driven a substantial increase in the bank share price".

Commerzbank's shares have almost doubled in price since UniCredit's move in September.

"However, only significant time will reveal if the plan is executable and hence determine whether such price appreciation is justified and sustainable," the Italian bank said.

UniCredit said the ECB authorisation underscored its own "financial strength and regulatory compliance" but said there were "still many factors" that will determine its plans on Commerzbank.

"Several further approvals are still required before the around 18.5 percent shares held through derivatives can be converted into physical shares, including from the Germany Federal Cartel Office," it said.

Orcel said in January he would not rush a takeover, and was willing to walk away, but would wait until the outcome of Germany's elections.

Berlin still holds a 12-percent stake in the lender, the legacy of a government bailout during the 2008 global financial crisis.

Merz, who is in talks to form a coalition government after the February vote, described a possible bid for Commerzbank as "hostile" in an interview with The Economist magazine last month.

However, some EU policymakers have backed the idea of a tie-up, saying it would create a heavyweight better able to compete internationally.

D.Sawyer--AMWN