-

Van Dijk has 'no idea' over his Liverpool future

Van Dijk has 'no idea' over his Liverpool future

-

US trading partners hit back on steel, aluminum tariffs

-

Dog shoots man in bed, 'paw stuck in trigger'

Dog shoots man in bed, 'paw stuck in trigger'

-

Zelensky expects 'strong' action from US if Russia refuses truce

-

Marcus Smith returns to full-back in England's Six Nations finale with Wales

Marcus Smith returns to full-back in England's Six Nations finale with Wales

-

McIlroy doubts injured Woods will play in 2026, tips comeback

-

S.Africa revised budget gets booed despite smaller tax hike

S.Africa revised budget gets booed despite smaller tax hike

-

Marcus Smith starts at full-back in England's Six Nations finale with Wales

-

Stocks advance on US inflation slowing, Ukraine ceasefire plan

Stocks advance on US inflation slowing, Ukraine ceasefire plan

-

Asani's extra-time stunner knocks Kobe out of AFC Champions League

-

Shares in Zara owner Inditex sink despite record profit

Shares in Zara owner Inditex sink despite record profit

-

US consumer inflation cools slightly as tariff worries flare

-

Captain of cargo ship in North Sea crash is Russian

Captain of cargo ship in North Sea crash is Russian

-

Arrested Filipino ex-president Duterte's lawyers demand his return

-

EU hits back hard at Trump tariffs to force dialogue

EU hits back hard at Trump tariffs to force dialogue

-

Greenland to get new government to lead independence process

-

Former star Eto'o elected to CAF executive by acclamation

Former star Eto'o elected to CAF executive by acclamation

-

'Humiliated': Palestinian victims of Israel sexual abuse testify at UN

-

Stocks diverge over Trump tariffs, Ukraine ceasefire plan

Stocks diverge over Trump tariffs, Ukraine ceasefire plan

-

Ireland prop Porter denies wrongdoing after Dupont Six Nations injury

-

Captain of cargo ship in North Sea crash is Russian: vessel owner

Captain of cargo ship in North Sea crash is Russian: vessel owner

-

West says next step 'up to Putin' on Ukraine ceasefire proposal

-

Battery maker Northvolt files for bankruptcy in Sweden

Battery maker Northvolt files for bankruptcy in Sweden

-

Arrested former Philippine president Duterte's lawyers demand his return

-

Eubank Jr fined £100,000 for hitting boxing rival Benn in face with an egg

Eubank Jr fined £100,000 for hitting boxing rival Benn in face with an egg

-

Snorkel with me to understand climate change, Palau president tells Trump

-

Georgia court extends ex-president Saakashvili's jail term

Georgia court extends ex-president Saakashvili's jail term

-

China, EU vow countermeasures against sweeping US steel tariffs

-

Markets mixed as Trump trade policy sows uncertainty

Markets mixed as Trump trade policy sows uncertainty

-

German arms firm Rheinmetall seizes on European 'era of rearmament'

-

AI chatbot helps victims of digital sexual violence in Latin America

AI chatbot helps victims of digital sexual violence in Latin America

-

Russian playwright tells story of wounded soldiers

-

'Stranded' astronauts closer to coming home after next ISS launch

'Stranded' astronauts closer to coming home after next ISS launch

-

Medvedev tops Paul to reach quarter-finals at rainy Indian Wells

-

Thailand sacks senior cop over illicit gambling, fraud

Thailand sacks senior cop over illicit gambling, fraud

-

Pakistan launches 'full-scale' operation to free train hostages

-

What to know about Manus, China's latest AI assistant

What to know about Manus, China's latest AI assistant

-

Ukraine's Svitolina feels the love in US after Trump-Zelensky dust up

-

US tariffs of 25% on steel, aluminum imports take effect

US tariffs of 25% on steel, aluminum imports take effect

-

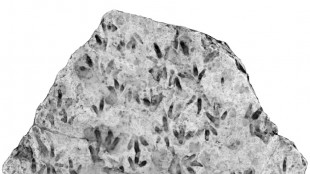

Trove of dinosaur footprints found at Australian school

-

Mongolia's children choke in toxic pollution

Mongolia's children choke in toxic pollution

-

Rubio heads to Canada as Trump wages trade war

-

South Korean pastor vows revolt against Yoon's impeachment

South Korean pastor vows revolt against Yoon's impeachment

-

Pakistan to launch 'full-scale' operation to free train hostages

-

Syria determined to 'prevent unlawful revenge' says fact-finding committee

Syria determined to 'prevent unlawful revenge' says fact-finding committee

-

Most Asian stocks drop as Trump trade policy sows uncertainty

-

Morocco fights measles outbreak amid vaccine misinformation

Morocco fights measles outbreak amid vaccine misinformation

-

Garland stars as comeback Cavs bag 15th straight with defeat of Nets

-

Hamilton eyes dream Ferrari start as F1 revs up in Melbourne

Hamilton eyes dream Ferrari start as F1 revs up in Melbourne

-

Talk of the town: Iconic covers of the New Yorker magazine

Stocks diverge over Trump tariffs, Ukraine ceasefire plan

European stock markets rose Wednesday but Asian equities sputtered as investors tracked President Donald Trump's latest tariffs and a potential ceasefire in Ukraine.

Analysts said support came from Ukraine endorsing an American proposal for a 30-day ceasefire, which was awaiting a response from Russia.

Chinese stock markets closed lower Wednesday, while Europe's main equity indices made solid gains nearing the half-way stage.

There had been a further equities selloff in New York on Tuesday that saw the Nasdaq extend Monday's four percent dive.

All eyes were also on US inflation data due Wednesday.

"Market volatility is rising as visibility (over tariffs) becomes cloudier by the day," noted Ipek Ozkardeskaya, senior analyst at Swissquote Bank.

The on-off nature of the trade policies has fuelled uncertainty in markets, and has sent the VIX "fear index" of volatility to its highest level since August.

Global markets have endured severe swings this month as Trump looks to ramp up pressure on global partners by imposing or threatening hefty duties on their goods, citing huge trade imbalances.

In the latest move, sweeping 25 percent levies on all US aluminium and steel imports came into effect at midnight in Washington, hitting numerous nations from Brazil to South Korea, as well as the European Union.

Trump had threatened to double those on Canada after Ontario imposed an electricity surcharge on three US states, but he called that off after the province halted the charge.

China and the European Union on Wednesday vowed to strike back and defend their economic interests, moving Washington closer to an all-out trade war with two major partners.

Also in focus Wednesday is the release of key US consumer inflation data, which the Federal Reserve will keep a close eye on as it tries to determine monetary policy in light of the latest moves by Trump.

There is a fear that the tariffs, and plans to slash taxes, regulation and immigration will fan inflation again, forcing the bank to hold borrowing costs for longer or even hike them.

Analysts said high uncertainty in US stocks markets made other regions more attractive as investors seek out stability.

"For years, the US has been the undisputed leader of global markets, fuelled by aggressive fiscal spending, tech dominance, and a strong consumer," said Charu Chanana, chief investment strategist at Saxo.

"But cracks are starting to show. Investors are increasingly looking overseas as concerns mount over US stock valuations, monetary policy, and economic uncertainty."

- Key figures around 1030 GMT -

London - FTSE 100: UP 0.5 percent at 8,536.22 points

Paris - CAC 40: UP 1.1 percent at 8,027.20

Frankfurt - DAX: UP 1.5 percent at 22,652.33

Tokyo - Nikkei 225: UP 0.1 percent at 36,819.09 (close)

Hong Kong - Hang Seng Index: DOWN 0.8 percent at 23,600.31 (close)

Shanghai - Composite: DOWN 0.2 percent at 3,371.92 (close)

New York - Dow: DOWN 1.1 percent at 41,433.48 points (close)

Euro/dollar: UP at $1.0918 from $1.0915 on Tuesday

Pound/dollar: DOWN at $1.2941 from $1.2954

Dollar/yen: UP at 148.69 yen from 147.70 yen

Euro/pound: UP at 84.36 pence from 84.26 pence

Brent North Sea Crude: UP 1.0 percent at $70.29 per barrel

West Texas Intermediate: UP 1.1 percent at $67.00 per barrel

L.Davis--AMWN