-

China's elite don traditional garb for annual 'Two Sessions' talking shop

China's elite don traditional garb for annual 'Two Sessions' talking shop

-

Chinese lessons in Saudi schools show growing ties

-

France opposes seizing frozen Russian assets: minister

France opposes seizing frozen Russian assets: minister

-

Inter and AC Milan ultras stand trial over organised crime offences

-

Hundreds evacuated as torrential rains flood Indonesia capital

Hundreds evacuated as torrential rains flood Indonesia capital

-

Markets fall on trade war fears after US, China tariffs

-

Saudi Aramco profits drop 12 percent on lower prices, volumes

Saudi Aramco profits drop 12 percent on lower prices, volumes

-

Pope slept all night, resting after two breathing attacks: Vatican

-

Dolly Parton's longtime husband dies aged 82

Dolly Parton's longtime husband dies aged 82

-

Thai court accepts invasive fish case against food giant

-

Asian stocks pare their losses after China's retaliatory tariffs

Asian stocks pare their losses after China's retaliatory tariffs

-

Pope 'slept all night' after two breathing attacks: Vatican

-

Japan startup targets June 6 Moon landing

Japan startup targets June 6 Moon landing

-

Malaria deaths soar in shadow of Ethiopia conflict

-

Plan B: Climate change forces Pakistan beekeepers to widen pursuit of flowers

Plan B: Climate change forces Pakistan beekeepers to widen pursuit of flowers

-

Trade wars intensify as US tariffs on Canada, Mexico and China take force

-

TSMC announces $100 billion investment in new US chip plants

TSMC announces $100 billion investment in new US chip plants

-

7-Eleven says Couche-Tard takeover still under consideration

-

Trump to pledge new 'American dream' in Congress speech

Trump to pledge new 'American dream' in Congress speech

-

Plan B: Pakistan beekeepers widen pursuit of flowers

-

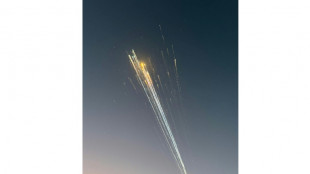

Asian stocks tumble after Trump tariffs

Asian stocks tumble after Trump tariffs

-

US tariffs on Canada, Mexico imports come into effect

-

Gilgeous-Alexander stars again for rumbling Thunder

Gilgeous-Alexander stars again for rumbling Thunder

-

Japan's worst wildfire in half a century spreads

-

Work, housing, marriage: issues at China's annual political meetings

Work, housing, marriage: issues at China's annual political meetings

-

Asia stocks tumble after Trump tariffs

-

Starmer puts UK back on world stage as 'bridge' over Ukraine

Starmer puts UK back on world stage as 'bridge' over Ukraine

-

'Absolute underdogs': Bayern irked by outsiders tag against Leverkusen

-

Prolific PSG appear a formidable prospect ahead of Liverpool showdown

Prolific PSG appear a formidable prospect ahead of Liverpool showdown

-

Trade war casts pall as China's leaders meet

-

Adrien Brody breaks longest Oscars speech record as ratings dip

Adrien Brody breaks longest Oscars speech record as ratings dip

-

7-Eleven shares plunge on reported plan to reject takeover

-

Walkouts on global disarmament treaties

Walkouts on global disarmament treaties

-

Trump's China tariffs eclipse first term, more hikes likely: analysts

-

Arab leaders gather to hash out alternative to Trump's Gaza plan

Arab leaders gather to hash out alternative to Trump's Gaza plan

-

Marking Ramadan at Canada's 'Little Mosque on the Tundra'

-

Tunisia opposition figures go on trial on state security charges

Tunisia opposition figures go on trial on state security charges

-

US Supreme Court to hear Mexico's suit against US gunmakers

-

'A slap': US Ukrainians stunned by Trump-Zelensky showdown

'A slap': US Ukrainians stunned by Trump-Zelensky showdown

-

Fact-check: Trump's claims about Canada

-

'Terrifying': Canadian auto workers dismayed at looming US tariffs

'Terrifying': Canadian auto workers dismayed at looming US tariffs

-

Trump says Canada and Mexico cannot avert tariffs, hikes China levy

-

Trump pauses aid to Ukraine after Zelensky clash

Trump pauses aid to Ukraine after Zelensky clash

-

60% of adults will be overweight or obese by 2050: study

-

Paris return 'too soon' for Liverpool fans traumatised by 2022 Champions League final

Paris return 'too soon' for Liverpool fans traumatised by 2022 Champions League final

-

Bitcoin value dives as uncertainty grips market

-

Adrien Brody breaks longest Oscars speech record

Adrien Brody breaks longest Oscars speech record

-

SpaceX calls off Starship test flight at last minute

-

USU Acquires SaaS Management Software Provider saasmetrix and Strengthens Innovation Leadership

USU Acquires SaaS Management Software Provider saasmetrix and Strengthens Innovation Leadership

-

FERNRIDE Selects QNX for Safety-Certified Autonomous Terminal Tractor Solution

Asian stocks pare their losses after China's retaliatory tariffs

Asian markets recouped some of their early losses in volatile trade on Tuesday after China announced fresh tariffs on US imports in retaliation to President Donald Trump's latest levies.

China said it would impose levies of 10 and 15 percent on a range of US agricultural imports in response to Trump's tariffs.

The US president signed an executive order to increase a previously imposed 10 percent tariff on Chinese goods to 20 percent, the White House said on Monday.

US tariffs also came into effect on imports from major trading partners Canada and Mexico after a deadline to avert the levies passed without a deal being struck.

Canada said it would respond in kind, with 25 percent tariffs on $155 billion worth of American goods taking effect after the deadline.

Fears of a full-blown trade war increased volatility in markets across Asia.

Tokyo and Hong Kong recovered some of their losses after China announced its retaliatory tariffs.

The Nikkei was down 1.2 percent, while the Hang Seng rose by 0.5 percent.

Shanghai, Bangkok and Manila were also slightly up, while Sydney, Wellington, Taipei, Jakarta, Kuala Lumpur and Seoul were down.

Japanese automakers with Mexican factories in their supply chains also suffered, with Nissan, Toyota and Honda among the major losers.

"The spectre of a full-blown trade war is once again looming, threatening to choke global economic growth just as investors were starting to regain confidence," said Stephen Innes of SPI Asset Management.

Investors are hoping that China will announce a huge economic stimulus package at its key parliamentary meeting, the National People's Congress, on Wednesday.

"In the upcoming National People's Congress, Chinese policymakers could provide more pro-growth measures including announcing a larger budget deficit target and maintaining a five percent growth target for this year," said MUFG Bank's Lloyd Chan.

Both the Mexican peso and Canadian dollar have dropped against the greenback over the past few days.

Trump expressed outrage on Monday over the weakening of certain currencies, accusing Beijing and Tokyo of using it as a trade strategy, although the Japanese government fiercely refuted the claim.

The oil market also saw sharp declines, with West Texas Intermediate crude falling to $67.99 per barrel and Brent crude dropping to $71.05 per barrel at around 0700 GMT.

Bitcoin's price plunged nearly 10 percent on Monday as concerns of an escalating trade war pushed investors to seek safer investments.

Bitcoin and similar digital assets had surged at the weekend after Trump suggested creating a national cryptocurrency reserve.

"Everything is getting sold," Forexlive manager Adam Button said. "There's a de-risking that's unfolding" among crypto investors, he said.

- Key figures around 0700 GMT -

Tokyo - Nikkei 225: DOWN 1.2 percent at 37,331.18 (close)

Hong Kong - Hang Seng Index: UP 0.4 percent at 23,015.77

Shanghai - Composite: UP 0.2 percent at 3,324.21

Euro/dollar: UP at 1.0493 from $1.0419 on Monday

Pound/dollar: UP at $1.2703 from $1.2612

Dollar/yen: DOWN 149.21 from 150.28 yen

Euro/pound: DOWN at 82.60 pence from 82.62 pence

West Texas Intermediate: DOWN 0.56 percent at $67.99 per barrel

Brent North Sea Crude: DOWN 0.80 percent at $71.05 per barrel

New York - Dow: DOWN 1.5 percent at 43,191.24 (close)

London - FTSE 100: UP 0.7 percent at 8,871.31 (close)

M.Thompson--AMWN