-

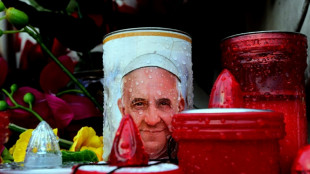

Critically-ill Pope Francis shows 'slight improvement' says Vatican

Critically-ill Pope Francis shows 'slight improvement' says Vatican

-

France heavyweight Meafou a doubt for Ireland showdown

-

Ravindra ton powers NZ into Champions Trophy semis, hosts Pakistan out

Ravindra ton powers NZ into Champions Trophy semis, hosts Pakistan out

-

£2.8m gold toilet stolen from UK show never found: court

-

US opposes Ukraine territorial integrity in UN vote

US opposes Ukraine territorial integrity in UN vote

-

Mexico president hopeful of deal this week to avert US tariffs

-

Man Utd announce up to 200 fresh job cuts

Man Utd announce up to 200 fresh job cuts

-

EU vows to enforce digital rules despite Trump tariff warning

-

Ravindra ton powers NZ into semis, hosts Pakistan out

Ravindra ton powers NZ into semis, hosts Pakistan out

-

Macron urges Trump to support Ukraine against 'aggressor' Russia

-

Frankfurt stocks rise on German vote outcome

Frankfurt stocks rise on German vote outcome

-

Roberta Flack of 'Killing Me Softly' fame dies at 88

-

Upset stomach to overdose: A child's ordeal at France abuse trial

Upset stomach to overdose: A child's ordeal at France abuse trial

-

Greenpeace trial begins in North Dakota in key free speech case

-

Mercedes unveil 2025 F1 car ahead of pre-season testing

Mercedes unveil 2025 F1 car ahead of pre-season testing

-

Macron holds 'very friendly' Trump talks as transatlantic ties shaken

-

Critically-ill pope 'not in pain': Vatican source

Critically-ill pope 'not in pain': Vatican source

-

Trump names right-wing podcaster as FBI deputy director

-

'Monster Hunter' on prowl for new audiences as latest game drops

'Monster Hunter' on prowl for new audiences as latest game drops

-

Stunned SPD turns to supporting role in new German government

-

Russian court upholds French researcher's jail sentence

Russian court upholds French researcher's jail sentence

-

Apple says to invest $500 bn in US as Trump tariffs bite

-

French actor Gerard Depardieu probed for tax fraud: source close to case

French actor Gerard Depardieu probed for tax fraud: source close to case

-

Over 7,000 killed in eastern DR Congo since January: PM

-

Macron meets Trump as transatlantic alliance shaken

Macron meets Trump as transatlantic alliance shaken

-

Apple says to invest $500 bn in US over four years, hire 20,000 staff

-

Liverpool's Van Dijk wants Anfield to be 'horrible' during title run-in

Liverpool's Van Dijk wants Anfield to be 'horrible' during title run-in

-

Swedish major winner Nordqvist named Europe's Solheim Cup captain

-

Marseille president Longoria says 'no corruption' in Ligue 1 after outburst

Marseille president Longoria says 'no corruption' in Ligue 1 after outburst

-

US shuns climate science meeting as UN warns 'time is not on our side'

-

New Zealand's Bracewell puts Bangladesh in a spin in Champions Trophy

New Zealand's Bracewell puts Bangladesh in a spin in Champions Trophy

-

'Bullish' Bavuma wary of Australia ahead of Champions Trophy clash

-

German vote winner Merz seeks to build govt as Europe waits

German vote winner Merz seeks to build govt as Europe waits

-

Muted London fashion week wraps up with Burberry show

-

Zelensky wants peace 'this year' on third anniversary of Russian invasion

Zelensky wants peace 'this year' on third anniversary of Russian invasion

-

Frankfurt stocks, euro rise on German vote outcome

-

Maresca says Chelsea are over-reliant on Palmer

Maresca says Chelsea are over-reliant on Palmer

-

German business urges 'new beginning' after election

-

UN warns nations at climate science meeting 'time is not on our side'

UN warns nations at climate science meeting 'time is not on our side'

-

Critically-ill pope had a good night, Vatican says

-

Asian markets track Wall St loss; Frankfurt lifted by German vote

Asian markets track Wall St loss; Frankfurt lifted by German vote

-

Paedophile French surgeon on trial for abusing almost 300 patients

-

Zelensky hails Ukraine's 'heroism' on third anniversary of Russia's invasion

Zelensky hails Ukraine's 'heroism' on third anniversary of Russia's invasion

-

In Ukraine, anticipating the 'next' war with Russia

-

Macron to present Trump with 'proposals' on peace in Ukraine

Macron to present Trump with 'proposals' on peace in Ukraine

-

Zelensky hails Ukraine's 'heroism' on third annniversary of Russia's invasion

-

Cavs hold off Grizzlies for seventh straight NBA win

Cavs hold off Grizzlies for seventh straight NBA win

-

China's Alibaba to invest $50 bn in AI, cloud computing

-

Vatican thriller 'Conclave' wins top prize in SAG Awards upset

Vatican thriller 'Conclave' wins top prize in SAG Awards upset

-

Dominant Ducati unleash deposed MotoGP kings Marquez and Bagnaia

AZURE Holding Group ($AZRH) Announces Accelerated Share Repurchase Program

WEATHERFORD, TEXAS / ACCESS Newswire / February 24, 2025 / AZURE Holding Group Corp. (OTC PINK:$AZRH) today announced that it has initiated a treasury share repurchase ("TSR") program to repurchase up to 5,000,000 shares of AZURE common stock over the next 12 months, beginning as early as March 3, 2025.

"We are entering 2025 with considerable momentum and expect to continue scaling our free cash flows significantly, enabling us to return meaningful capital to shareholders while still investing heavily in growth," said Josh Watson and Josh Cohen. "Our stock is undervalued relative to the strength of our business, and we plan to initiate and accelerate our buybacks under this program. This TSR represents a value-enhancing deployment of capital, buying back with the potential to retire up to 35.9% of our free trading market cap held at DTC." (Note that the company's restricted shares currently outstanding are held only by officers of the company, all of which have agreed to a longer hold / restricted time than required by the SEC and Rule 144).

The total number of shares to be repurchased by AZURE pursuant to the TSR agreement will be based on the volume-weighted average price of AZURE common stock on specified dates during the term of the TSR agreement.

The transactions under the TSR agreement are expected to be completed during the second, third and fourth quarters of 2025 in preparation for the company's OTCQX and NASDAQ uplist goals.

About Azure Holding Group

Azure Holding Group Corp. is an acquisition corporation focused on Oil Field Services and Construction, Oil & Gas Exploration & Production, and Oil & Gas Distribution. Azure Holding Group Corp. has completed Reverse Mergers with the following companies: American Industries, Freedom Well Testing, and CST Drilling Fluids. The Company has completed a Joint Venture with Coil Tubing Technologies. The Company is currently evaluating mergers with Button Energy, Bullzeye Wireline, Oil Field Services AI, and several other companies. The Company is currently evaluating a joint venture Drilling Program with Mountain V Oil & Gas.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995, including, but not limited to, statements about Azure's expectations, beliefs, plans or forecasts. All statements other than statements of historical fact are "forward-looking statements" for purposes of federal and state securities laws, including, but not limited to: any projections of earnings, revenue or other financial items or future financial position or sources of financing; any statements of the plans, strategies and objectives of management for future operations or business strategy; any statements regarding future economic conditions or performance; any statements of belief; and any statements of assumptions underlying any of the foregoing. Words such as "estimate," "project," "predict," "will," "would," "should," "could," "may," "might," "anticipate," "plan," "intend," "believe," "expect," "aim," "goal," "target," "objective," "commit," "advance," "likely" or similar expressions that convey the prospective nature of events or outcomes are generally indicative of forward-looking statements. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this press release unless an earlier date is specified. Unless legally required, Azure does not undertake any obligation to update, modify or withdraw any forward-looking statements as a result of new information, future events or otherwise.

Forward-looking statements involve estimates, expectations, projections, goals, forecasts, assumptions, risks and uncertainties. Actual outcomes or results may differ from anticipated results, sometimes materially. Factors that could cause results to differ from those projected or assumed in any forward-looking statement include, but are not limited to: general economic conditions, including slowdowns and recessions, domestically or internationally; Azure's indebtedness and other payment obligations, including the need to generate sufficient cash flows to fund operations; Azure's ability to successfully monetize select assets and repay or refinance debt and the impact of changes in Azure's credit ratings or future increases in interest rates; assumptions about energy markets; global and local commodity and commodity-futures pricing fluctuations and volatility; supply and demand considerations for, and the prices of, Azure's products and services; actions by the Organization of the Petroleum Exporting Countries (OPEC) and non-OPEC oil producing countries; results from operations and competitive conditions; future impairments of Azure's proved and unproved oil and gas properties or equity investments, or write-downs of productive assets, causing charges to earnings; unexpected changes in costs; inflation, its impact on markets and economic activity and related monetary policy actions by governments in response to inflation; availability of capital resources, levels of capital expenditures and contractual obligations; the regulatory approval environment, including Azure's ability to timely obtain or maintain permits or other government approvals, including those necessary for drilling and/or development projects; Azure's ability to successfully complete, or any material delay of, field developments, expansion projects, capital expenditures, efficiency projects, acquisitions or divestitures; risks associated with acquisitions (including our anticipated acquisition of Button Energy), mergers and joint ventures, such as difficulties integrating businesses, uncertainty associated with financial projections, projected synergies, restructuring, increased costs and adverse tax consequences; uncertainties and liabilities associated with acquired and divested properties and businesses; uncertainties about the estimated quantities of oil, NGL and natural gas reserves; lower-than-expected production from development projects or acquisitions; Azure's ability to realize the anticipated benefits from prior or future streamlining actions to reduce fixed costs, simplify or improve processes and improve Azure's competitiveness; exploration, drilling and other operational risks; disruptions to, capacity constraints in, or other limitations on the pipeline systems that deliver Azure's oil and natural gas and other processing and transportation considerations; volatility in the securities, capital or credit markets, including capital market disruptions and instability of financial institutions; government actions, war (including the Russia-Ukraine war and conflicts in the Middle East) and political conditions and events; health, safety and environmental (HSE) risks, costs and liability under existing or future federal, regional, state, provincial, tribal, local and international HSE laws, regulations and litigation (including related to climate change or remedial actions or assessments); legislative or regulatory changes, including changes relating to hydraulic fracturing or other oil and natural gas operations, retroactive royalty or production tax regimes, and deep-water and onshore drilling and permitting regulations; Azure's ability to recognize intended benefits from its business strategies and initiatives, such as Azure's low-carbon ventures businesses or announced greenhouse gas emissions reduction targets or net-zero goals; potential liability resulting from pending or future litigation, government investigations and other proceedings; disruption or interruption of production or manufacturing or facility damage due to accidents, chemical releases, labor unrest, weather, power outages, natural disasters, cyber-attacks, terrorist acts or insurgent activity; the scope and duration of global or regional health pandemics or epidemics, and actions taken by government authorities and other third parties in connection therewith; the creditworthiness and performance of Azure's counterparties, including financial institutions, operating partners and other parties; failure of risk management; Azure's ability to retain and hire key personnel; supply, transportation and labor constraints; reorganization or restructuring of Azure's operations; changes in state, federal or international tax rates; and actions by third parties that are beyond Azure's control.

Contact:

[email protected]

(917) 584-7042

SOURCE: Azure Holding Group Corp.

View the original press release on ACCESS Newswire

Th.Berger--AMWN