-

Japan's Panasonic targets 10,000 job cuts worldwide

Japan's Panasonic targets 10,000 job cuts worldwide

-

Putin evokes WWII victory to rally Russia behind Ukraine offensive

-

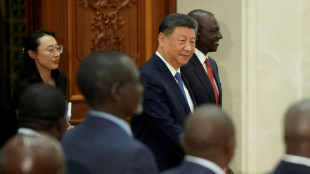

China exports beat forecasts ahead of US tariff talks

China exports beat forecasts ahead of US tariff talks

-

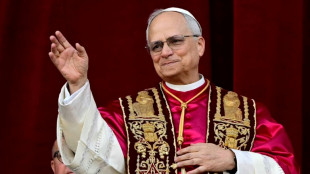

Leo XIV, the 'Latin Yankee', to celebrate first mass as pope

-

Most stocks lifted by hopes for US-China talks after UK deal

Most stocks lifted by hopes for US-China talks after UK deal

-

IPL suspended indefinitely over India-Pakistan conflict: reports

-

German lender Commerzbank's profits jump as it fends off UniCredit

German lender Commerzbank's profits jump as it fends off UniCredit

-

Rare bone-eroding disease ruining lives in Kenya's poorest county

-

India says repulsed fresh Pakistan attacks as de-escalation efforts grow

India says repulsed fresh Pakistan attacks as de-escalation efforts grow

-

Zhao's historic snooker title sparks talk of China world domination

-

'High expectations': EU looks to Merz for boost in tough times

'High expectations': EU looks to Merz for boost in tough times

-

Poisoned guests rarely invited before deadly mushroom lunch, Australia trial hears

-

China sales to US slump even as exports beat forecasts

China sales to US slump even as exports beat forecasts

-

Indian cricket to make 'final decision' on IPL over Pakistan conflict

-

Dethroned Bundesliga champions Leverkusen face uncertain future

Dethroned Bundesliga champions Leverkusen face uncertain future

-

China can play hardball at looming trade talks with US: analysts

-

French monuments in trouble while PSG prepare for Champions League final

French monuments in trouble while PSG prepare for Champions League final

-

Newcastle face Chelsea in top five showdown, Alexander-Arnold in spotlight

-

Flick's Barca must show 'hunger' in crunch Liga Clasico

Flick's Barca must show 'hunger' in crunch Liga Clasico

-

Clasico the last chance saloon for Ancelotti's Real Madrid

-

Timberwolves overpower Warriors to level series

Timberwolves overpower Warriors to level series

-

Chinese fabric exporters anxious for US trade patch-up

-

Putin gears up to host world leaders at lavish army parade

Putin gears up to host world leaders at lavish army parade

-

Nearing 100, Malaysian ex-PM Mahathir blasts 'old world' Trump

-

Leo XIV, first US pope, to celebrate first mass as pontiff

Leo XIV, first US pope, to celebrate first mass as pontiff

-

Asian stocks lifted by hopes for US-China talks after UK deal

-

Former head of crypto platform Celsius sentenced 12 years

Former head of crypto platform Celsius sentenced 12 years

-

Ex-model testifies in NY court that Weinstein assaulted her at 16

-

Nestlé and OMP Showcase Approach to Future-Ready Supply Chain at Gartner Supply Chain Symposium/Xpo in Barcelona

Nestlé and OMP Showcase Approach to Future-Ready Supply Chain at Gartner Supply Chain Symposium/Xpo in Barcelona

-

Genflow Biosciences PLC Announces Share Subscription, Director's Dealing and Update

-

Argo Blockchain PLC Announces 2024 Annual Results and Restoration of Listing

Argo Blockchain PLC Announces 2024 Annual Results and Restoration of Listing

-

'Great honor': world leaders welcome first US pope

-

Pacquiao to un-retire and fight Barrios for welterweight title: report

Pacquiao to un-retire and fight Barrios for welterweight title: report

-

Trump unveils UK trade deal, first since tariff blitz

-

Man Utd one step away from Europa League glory despite horror season

Man Utd one step away from Europa League glory despite horror season

-

Jeeno shines on greens to grab LPGA lead at Liberty National

-

Mitchell fires PGA career-low 61 to grab Truist lead

Mitchell fires PGA career-low 61 to grab Truist lead

-

AI tool uses selfies to predict biological age and cancer survival

-

Extremely online new pope unafraid to talk politics

Extremely online new pope unafraid to talk politics

-

Postecoglou hits back as Spurs reach Europa League final

-

Chelsea ease into Conference League final against Betis

Chelsea ease into Conference League final against Betis

-

Pope Leo XIV: Soft-spoken American spent decades amid poor in Peru

-

First US pope shared articles critical of Trump, Vance

First US pope shared articles critical of Trump, Vance

-

'Inexcusable' - NBA champs Boston in trouble after letting big leads slip

-

US automakers blast Trump's UK trade deal

US automakers blast Trump's UK trade deal

-

Stocks mostly rise as US-UK unveil trade deal

-

Trump presses Russia for unconditional 30-day Ukraine ceasefire

Trump presses Russia for unconditional 30-day Ukraine ceasefire

-

Anything but Europa League glory 'means nothing' for Man Utd: Amorim

-

'Inexcuseable' - NBA champs Boston in trouble after letting big leads slip

'Inexcuseable' - NBA champs Boston in trouble after letting big leads slip

-

Pope Leo 'fell in love with Peru'and ceviche: Peru bishop

US consumer inflation rises in December but underlying pressures ease

US consumer inflation rose for a third straight month in December as energy prices jumped but a widely watched measure eased slightly, raising hopes that underlying inflation may be moderating.

The consumer price index (CPI) accelerated to 2.9 percent last month from a year ago, up from 2.7 percent in November, the Labor Department said in a statement on Wednesday.

This was in line with the median forecast of economists surveyed by Dow Jones Newswires and The Wall Street Journal.

Stocks jumped on the news, with all three major indices on Wall Street closing sharply higher.

On a monthly basis, inflation rose by 0.4 percent, slightly faster than expected.

One of the biggest drivers of inflation in December was the energy index, which jumped by 2.6 percent, accounting for "over" 40 percent of the monthly increase, according to the Labor Department.

In some good news for the Federal Reserve, annual inflation excluding volatile food and energy costs came in at a lower-than-expected 3.2 percent, marking a slight decline from the month earlier.

- Focus on the core -

The so-called "core" measure of inflation increased by 0.2 percent, also slightly below expectations.

"The focus is really on the core reading, and the core reading did come in better than the consensus expectations," Nationwide chief economist Kathy Bostjancic told AFP.

The US central bank has cut rates by a full percentage point since September as it looks to bolster the labor market.

The recent uptick in inflation adds to expectations that it will remain firmly on pause at its next rate decision later this month.

However, higher prices could complicate President-elect Donald Trump's economic plans as he prepares to return to office on Monday.

Trump has floated several policies, from tariffs to deportation, that many economists say could have an inflationary impact.

The Republican and his supporters have disputed this characterization, claiming that many of his proposals aimed at deregulation and boosting energy production should help keep prices in check.

- Bond yields drop -

US bonds rallied as investors reacted to signs of slowing core inflation, pushing down yields, which move inversely to prices.

"The softer core reading is really what the markets are focusing on right now, and that's why you're seeing a big rally in the bond market," said Bostjancic from Nationwide.

Lower yields on US Treasurys -- especially the popular 10-year note -- would be good news for consumers, since they are referenced by businesses when they price mortgages and car loans.

Wednesday's data release is nevertheless expected to fuel expectations that the Fed will pause rate cuts later this month, as headline inflation appears to be moving away from its long-term goal of two percent.

The Fed uses a different inflation measure to set interest rates, known as the personal consumption expenditures (PCE) price index. That index has also been rising in recent months.

Futures traders see a roughly 97 percent chance that Fed policymakers will vote to hold interest rates between 4.25 and 4.50 percent at the next rate meeting on January 28 and 29, according to data from CME Group.

"The pace of inflation is still elevated," said Bostjancic.

"There's strength in the labor market, and the prospects of changes in tariffs and immigration policies that could push inflation higher will keep the Fed cautious and patient with regard to cutting rates further," she said.

"In that light, we see the Fed moving to the sidelines in the first half of the year to assess the evolving economic inflation and policy landscape," she added.

The financial markets see a roughly 80 percent chance that the Fed will make no more than two rate cuts this year, according to data from CME Group.

L.Durand--AMWN