-

Djokovic joins Alcaraz, Sinner in Melbourne round two but Kyrgios out

Djokovic joins Alcaraz, Sinner in Melbourne round two but Kyrgios out

-

Djokovic survives wobble to launch bid for record 25th Slam crown

-

British PM vows AI will usher in 'golden age'

British PM vows AI will usher in 'golden age'

-

Forest are Premier League title contenders, says Liverpool's Slot

-

Nortje back in South Africa squad for Champions Trophy

Nortje back in South Africa squad for Champions Trophy

-

Stock markets fall as traders trim US rate cut bets

-

Sore, swearing Kyrgios out at first hurdle on Australian Open return

Sore, swearing Kyrgios out at first hurdle on Australian Open return

-

Alcaraz makes fast start in bid for first Melbourne title

-

Russia says Ukraine targeted infrastructure of gas pipeline to Turkey

Russia says Ukraine targeted infrastructure of gas pipeline to Turkey

-

Oliviero Toscani, photographer famed for Benetton ads, dies aged 82

-

Japan FM in South Korea for talks before Trump takes office

Japan FM in South Korea for talks before Trump takes office

-

Swiatek embraces new approach in hunt for first Melbourne title

-

Blue Origin pushes back first launch of giant New Glenn rocket

Blue Origin pushes back first launch of giant New Glenn rocket

-

Markets track Wall St losses after blockbuster US jobs report

-

Italy's Benetton ad photographer Toscani dies: family

Italy's Benetton ad photographer Toscani dies: family

-

Tiafoe vomits on court during five-set marathon win

-

Philippine sect gathers to oppose VP Duterte impeachment

Philippine sect gathers to oppose VP Duterte impeachment

-

Tiafoe vomits on court on during five-set marathon win

-

Sinner relief at warm Australian Open welcome amid doping scandal

Sinner relief at warm Australian Open welcome amid doping scandal

-

Billion-pound lawsuit against Apple over App Store opens in UK

-

Sinner gets warm welcome and survives tough workout at Australian Open

Sinner gets warm welcome and survives tough workout at Australian Open

-

Ruthless Gauff 'sets tone' for Australian Open title bid

-

Seoul says 300 North Korean soldiers killed fighting Ukraine

Seoul says 300 North Korean soldiers killed fighting Ukraine

-

IOC long-shot Watanabe hopes 'crazy' Olympic idea sparks debate

-

Cyclone-battered region sees storm Dikeledi leave Mayotte for Mozambique

Cyclone-battered region sees storm Dikeledi leave Mayotte for Mozambique

-

Gauff, Swiatek off to flyers as Djokovic, Sinner launch Open quests

-

Swiatek battles past Siniakova into Australian Open second round

Swiatek battles past Siniakova into Australian Open second round

-

Japan PM tells Biden 'strong' concerns over steel deal

-

Commanders win in NFL playoff return, Bills and Eagles advance

Commanders win in NFL playoff return, Bills and Eagles advance

-

'It sucks': Tsitsipas first big name to fall at Australian Open

-

China saw booming exports in 2024 as Trump tariffs loom

China saw booming exports in 2024 as Trump tariffs loom

-

Gauff off to a flyer before Djokovic, Sinner begin Open quests

-

Tsitsipas sent packing in Australian Open first round

Tsitsipas sent packing in Australian Open first round

-

Chinese artist cashes in on Buddha-like Trump statues

-

Asian markets track Wall St losses after blockbuster US jobs report

Asian markets track Wall St losses after blockbuster US jobs report

-

South Korea's Gen-Z divided over political crisis

-

Australian mum says son killed in LA fires as water ran out

Australian mum says son killed in LA fires as water ran out

-

In-form Gauff sweeps past Kenin to fire Australian Open warning

-

Pacers halt Cavaliers' NBA winning streak, Celtics edge Pelicans

Pacers halt Cavaliers' NBA winning streak, Celtics edge Pelicans

-

Taylor beats Echavarria in playoff to take PGA Hawaii title

-

New Australian Open coaching 'pods' get mixed reaction

New Australian Open coaching 'pods' get mixed reaction

-

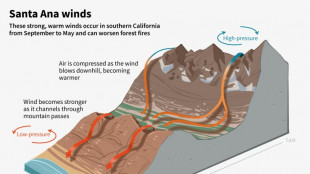

Fueling the Los Angeles fires: the Santa Ana winds

-

New Lebanon president starts consultations on naming PM

New Lebanon president starts consultations on naming PM

-

Let's dance! Sabalenka busts out her best moves at Australian Open

-

At least 10 dead in Brazil landslides

At least 10 dead in Brazil landslides

-

India opens giant Hindu festival for 400 million pilgrims

-

Bills trample Broncos, Eagles beat Packers in NFL playoffs

Bills trample Broncos, Eagles beat Packers in NFL playoffs

-

Cummins, Hazlewood return for Australia's Champions Trophy bid

-

Nuggets erase 19-point deficit to beat Mavs

Nuggets erase 19-point deficit to beat Mavs

-

Ares Management Corporation Schedules Earnings Release and Conference Call for the Fourth Quarter and Full Year Ending December 31, 2024

| RBGPF | 100% | 60.49 | $ | |

| CMSD | -0.65% | 23.25 | $ | |

| NGG | -3.3% | 56.13 | $ | |

| GSK | -1.99% | 33.09 | $ | |

| SCS | -3.01% | 10.97 | $ | |

| RIO | 0.36% | 58.84 | $ | |

| AZN | 0.64% | 67.01 | $ | |

| CMSC | -0.79% | 22.92 | $ | |

| BTI | -2.34% | 35.9 | $ | |

| RYCEF | -0.42% | 7.07 | $ | |

| BCC | -1.31% | 115.88 | $ | |

| RELX | -0.86% | 46.37 | $ | |

| BP | 0.54% | 31.29 | $ | |

| JRI | -1.16% | 12.08 | $ | |

| VOD | -1.99% | 8.05 | $ | |

| BCE | -2.92% | 22.96 | $ |

Markets track Wall St losses after blockbuster US jobs report

Asian and European markets sank Monday after an outsized US jobs report dealt another blow to hopes for more interest rate cuts, while oil extended a rally sparked by new sanctions on Russia's energy sector.

The equity sell-off tracked hefty losses on Wall Street, where all three main indexes finished more than one percent lower as the new trading year continued to falter.

Keenly awaited data on Friday showed the US economy created 256,000 jobs last month, a jump from November's revised 212,000 and smashing forecasts of 150,000-160,000.

The figures followed news that the crucial US services sector picked up in December, with the prices component soaring more than expected to the highest level since last January, while another report showed job openings hit a six-month high in November.

Hopes that the Federal Reserve will continue cutting rates through 2025 -- having made three trims last year -- were dashed when in December it indicated just two reductions over the next 12 months, down from four tipped previously.

The hawkish pivot came as inflation continues to hover above the bank's two percent target, while there are also concerns that president-elect Donald Trump's plans to slash taxes, regulations and immigration will reignite prices.

"Given a resilient labour market, we now think the Fed cutting cycle is over," said Bank of America's Aditya Bhave and other economists.

"Inflation is stuck above target: in the December (summary of economic projections), the Fed not only marked up its base case for 2025 significantly, but also indicated that inflation risks were skewed to the upside. Economic activity is robust.

"We see little reason for additional easing."

Markets in Sydney, Singapore, Seoul, Mumbai, Taipei, Manila, Bangkok and Jakarta all sank. Tokyo was closed for a holiday.

Hong Kong and Shanghai also fell but pared initial losses as data showed Chinese exports and imports topped forecasts in December.

London, Paris and Frankfurt fell at the open.

On currency markets the pound was wallowing around lows not seen since the end of 2023 owing to fading hopes for US rate cuts as well as worries about the British economy. The euro struggled at its weakest since November 2022.

Surging oil prices added to unease, with both main contracts jumping more than percent -- extending Friday's gains of more than three percent -- after the United States and Britain announced new sanctions against Russia's energy sector, including oil giant Gazprom Neft.

However, commentators do not expect prices to spike too much, even amid speculation that Trump will hit Iran with fresh sanctions.

"A significant and perhaps underpriced risk to crude oil prices is the potential for supply to outstrip demand, especially given OPEC+'s intention to reintroduce barrels to the market," said Stephen Innes at SPI Asset Management.

"Even if US sanctions curtail Iranian oil production by 1.5 million barrels a day -- a scenario similar to that during Trump’s previous presidency -- this amount could easily be compensated by OPEC+, which is currently holding back 5.8 million barrels a day, or 5.3 percent of the total global production capacity."

However, he added that some issues could lead crude to rocket, including an escalation of the Middle East crisis, a significant reduction in Russian output or exports and a strategic about-face by OPEC+ to slash production.

- Key figures around 0815 GMT -

Hong Kong - Hang Seng Index: DOWN 1.0 percent at 18,874.14

Shanghai - Composite: DOWN 0.3 percent at 3,160.76 (close)

London - FTSE 100: DOWN 0.3 percent at 8,224.50

Tokyo - Nikkei 225: Closed for a holiday

Euro/dollar: DOWN at $1.0216 from $1.0244 on Friday

Pound/dollar: DOWN at $1.2140 from $1.2210

Dollar/yen: DOWN at 157.39 yen from 157.74 yen

Euro/pound: UP at 84.17 pence from 83.90 pence

West Texas Intermediate: UP 1.5 percent at $77.75 per barrel

Brent North Sea Crude: UP 1.4 percent at $80.86 per barrel

New York - Dow: DOWN 1.6 percent at 41,938.45 (close)

D.Kaufman--AMWN