-

US sanctions top Hungary minister over 'corruption'

US sanctions top Hungary minister over 'corruption'

-

Frigid temps hit US behind major winter storm

-

Former Cambodian opposition MP shot dead in Bangkok: Thai media

Former Cambodian opposition MP shot dead in Bangkok: Thai media

-

US says Sudan's RSF committed 'genocide' in Darfur

-

UK government urges cricket chiefs to 'deliver on own rules' after Afghanistan boycott calls

UK government urges cricket chiefs to 'deliver on own rules' after Afghanistan boycott calls

-

Barca's Olmo absence 'better' for us: Athletic coach Valverde

-

Jean-Marie Le Pen, architect of French far-right surge, dies at 96

Jean-Marie Le Pen, architect of French far-right surge, dies at 96

-

Spurs boss Postecoglou not in favour of VAR stadium announcements

-

Meta abruptly ends US fact-checks ahead of Trump term

Meta abruptly ends US fact-checks ahead of Trump term

-

Quake in China's Tibet kills 126 with tremors felt in Nepal, India

-

Trump Jr in Greenland on 'tourist' day trip as father eyes territory

Trump Jr in Greenland on 'tourist' day trip as father eyes territory

-

Postecoglou wants trophy for Son as Spurs extend contract

-

Loeb limps home as teenager wins Dakar stage

Loeb limps home as teenager wins Dakar stage

-

US trade deficit widens in November on imports jump

-

Macron irks allies, left with Africa 'forgot to say thank you' jibe

Macron irks allies, left with Africa 'forgot to say thank you' jibe

-

Key dates in the rise of the French far right

-

Meta announces ending fact-checking program in the US

Meta announces ending fact-checking program in the US

-

Liverpool's Slot says contract issues not affecting Alexander-Arnold's form

-

Ghana's John Mahama sworn in after presidential comeback

Ghana's John Mahama sworn in after presidential comeback

-

Hundreds of young workers sue McDonald's UK alleging harassment

-

Jabeur beats Collins to step up comeback ahead of Melbourne

Jabeur beats Collins to step up comeback ahead of Melbourne

-

Eurozone inflation rises, likely forcing slower ECB rate cuts

-

France remembers Charlie Hebdo attacks 10 years on

France remembers Charlie Hebdo attacks 10 years on

-

Microsoft announces $3 bn AI investment in India

-

French far-right figurehead Jean-Marie Le Pen dies at 96

French far-right figurehead Jean-Marie Le Pen dies at 96

-

South Korea investigators get new warrant to arrest President Yoon

-

French far-right figurehead Jean-Marie Le Pen dies

French far-right figurehead Jean-Marie Le Pen dies

-

South Sudan says will resume oil production from Jan 8

-

Pope names Sister Brambilla to head major Vatican office

Pope names Sister Brambilla to head major Vatican office

-

Stock markets mostly rise on US optimism

-

Olmo's Barcelona registration battle puts Laporta under pressure

Olmo's Barcelona registration battle puts Laporta under pressure

-

Taste of 2034 World Cup as Saudi Asian Cup stadiums named

-

Eurozone inflation picks up in December

Eurozone inflation picks up in December

-

France flanker Ollivon out for season, to miss Six Nations

-

S. Korea investigators get new warrant to arrest President Yoon

S. Korea investigators get new warrant to arrest President Yoon

-

Tottenham trigger Son contract extension

-

China's most successful team kicked out of professional football

China's most successful team kicked out of professional football

-

Eyeing green legacy, Biden declares new national monuments

-

South Korea rival parties form plane crash task force

South Korea rival parties form plane crash task force

-

Georgians hold anti-government protest on Orthodox Christmas

-

Japan actor fired from beer ad after drunken escapade

Japan actor fired from beer ad after drunken escapade

-

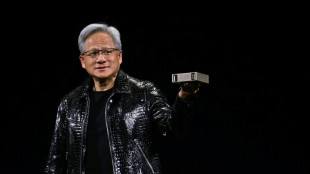

Nvidia ramps up AI tech for games, robots and autos

-

Blinken says US-Japan ties solid despite rift over steel deal

Blinken says US-Japan ties solid despite rift over steel deal

-

Quake in China's Tibet kills 95 with tremors felt in Nepal, India

-

Taiwan says Chinese-owned ship suspected of damaging sea cable goes dark

Taiwan says Chinese-owned ship suspected of damaging sea cable goes dark

-

North Korea's Kim says new hypersonic missile will deter 'rivals'

-

Sinner turns focus to Australian Open defence after 'amazing' year

Sinner turns focus to Australian Open defence after 'amazing' year

-

Ostapenko begins Adelaide title defence with comeback win

-

Asian markets mostly up after tech-fuelled Wall St rally

Asian markets mostly up after tech-fuelled Wall St rally

-

Pace of German emissions cuts slows in 2024: study

| RBGPF | -4.54% | 59.31 | $ | |

| CMSC | -0.69% | 23.33 | $ | |

| BTI | -0.04% | 36.955 | $ | |

| RELX | 1.01% | 46.115 | $ | |

| BCE | 0.15% | 23.975 | $ | |

| SCS | -2.05% | 11.21 | $ | |

| NGG | -0.15% | 58.78 | $ | |

| GSK | 0.75% | 34.216 | $ | |

| RIO | 0.03% | 58.4 | $ | |

| RYCEF | 1.53% | 7.2 | $ | |

| BCC | -2.26% | 117.56 | $ | |

| BP | 2.32% | 31.757 | $ | |

| CMSD | -1.29% | 23.427 | $ | |

| AZN | 0.1% | 66.905 | $ | |

| VOD | -0.3% | 8.445 | $ | |

| JRI | -1.8% | 12.23 | $ |

Most Asian markets cautiously higher as traders eye Trump 2.0

Asian markets started the first full week of 2025 on a positive but cautious note as traders struggled to track a healthy run-up on Wall Street, with minds turning to Donald Trump's second presidency.

Ongoing concerns about China's stuttering economy, the outlook for US interest rates and the wars in Ukraine and the Middle East were also causing a sense of uncertainty.

As Trump prepares to return to the White House on January 20, investors are steeling themselves for another four years of friction with China, particularly after he warned he would impose hefty tariffs on imports from the country and other key trade partners.

Those fears were being compounded by warnings that his pledges to cut taxes and remove regulations could reignite inflation, though there is hope such moves could boost profits.

The prospect of prices spiking again has caused traders to pare bets on how many rate cuts the Federal Reserve will make this year, with a hawkish pivot last month taking the wind out of the sails of an equity rally.

Richmond Fed boss Tom Barkin stoked worries that borrowing costs will remain elevated on Friday when he indicated his backing for a slower pace of reductions.

"I think there is more upside risk than downside risk," he said. "So I put myself in the camp of wanting to stay restricted for longer."

US jobs data at the end of this week will provide the latest snapshot of the world's top economy and could play a key role in officials' decision-making.

All three main indexes on Wall Street ended last week on a positive note, with the S&P 500 and Nasdaq both piling on more than one percent.

Asia largely followed suit, though the gains were limited.

Hong Kong, Shanghai, Sydney, Singapore, Manila, Taipei, Wellington and Jakarta all edged up, while Seoul piled on more than one percent even as South Korea remains gripped by political uncertainty following last month's brief martial law attempt by President Yoon Suk Yeol.

Tokyo retreated more than one percent, with Nippon Steel taking a hit after US President Joe Biden blocked its proposed $14.9 billion purchase of US Steel, saying it would "create risk for our national security and our critical supply chains".

"We view 2025 as a year with greater uncertainty given increasing concerns over Trump's tariffs and an escalating trade war," said Kai Wang, Asia equity market strategist at Morningstar.

Focus is also on Beijing as it tries to kickstart growth with a series of stimulus measures aimed particularly at boosting consumption and supporting the battered property sector.

However, analysts pointed out that their work could be made harder by Trump.

"For 2025, China's economy will likely be stuck between the rock of higher trade tariffs and the hard place of a domestic crisis of confidence," analysts at Moody's Analytics wrote.

"China's Houdini act to escape without much economic injury is unfolding via stimulus announcements. Big promises of new stimulus lie ahead, with details likely to come at the Two Sessions meetings in March."

- Key figures around 0230 GMT -

Tokyo - Nikkei 225: DOWN 1.3 percent at 39,394.27 (break)

Hong Kong - Hang Seng Index: UP 0.3 percent at 19,809.68

Shanghai - Composite: UP 0.1 percent at 3,215.50

Euro/dollar: UP at $1.0308 from $1.0307 on Friday

Pound/dollar: UP at $1.2432 from $1.2425

Dollar/yen: UP at 157.60 yen from 157.33 yen

Euro/pound: DOWN at 82.90 pence from 82.95 pence

West Texas Intermediate: UP 0.3 percent at $74.20 per barrel

Brent North Sea Crude: UP 0.2 percent at $76.69 per barrel

New York - Dow: UP 0.8 percent at 42,732.13 (close)

London - FTSE 100: DOWN 0.4 percent at 8,223.98 (close)

A.Malone--AMWN