-

US announces $306 mn in new bird flu funding

US announces $306 mn in new bird flu funding

-

Salah targets Premier League glory in 'last year' at Liverpool

-

Rockets fired from Gaza as Israeli strikes kill 16, rescuers say

Rockets fired from Gaza as Israeli strikes kill 16, rescuers say

-

Marseille coach De Zerbi defends 'strong' Ligue 1

-

Rickelton, Bavuma tons put South Africa in strong position

Rickelton, Bavuma tons put South Africa in strong position

-

Breeding success: London zoo counts its animals one-by-one

-

Fofana could miss rest of Chelsea's season

Fofana could miss rest of Chelsea's season

-

Republican speaker, Trump face test in Congress leadership fight

-

Man Utd 'starving for leaders' ahead of Liverpool clash: Amorim

Man Utd 'starving for leaders' ahead of Liverpool clash: Amorim

-

Alcohol should have cancer warning label: US surgeon general

-

Biden blocks US Steel sale to Japan's Nippon Steel

Biden blocks US Steel sale to Japan's Nippon Steel

-

Wall Street stocks bounce higher, Europe retreats

-

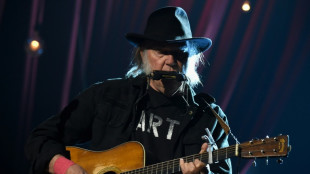

Neil Young says he will play Glastonbury after all

Neil Young says he will play Glastonbury after all

-

Frenchman Castera plots roadmap for Dakar success

-

Doha hosts PSG clash with Monaco in French Champions Trophy

Doha hosts PSG clash with Monaco in French Champions Trophy

-

Hamilton 'excited for year ahead' after Ferrari switch

-

Man City must 'think' about De Bruyne future: Guardiola

Man City must 'think' about De Bruyne future: Guardiola

-

Biden blocks US-Japan steel deal

-

French police to face trial for 'suffocating' death

French police to face trial for 'suffocating' death

-

British novelist David Lodge dies aged 89

-

Indonesia says 2024 was hottest year on record

Indonesia says 2024 was hottest year on record

-

South African Lategan wins Dakar Rally prologue

-

Barca coach Flick optimistic but 'not happy' over Olmo situation

Barca coach Flick optimistic but 'not happy' over Olmo situation

-

Djokovic Australian Open preparations take hit with loss to Opelka

-

Indian duo self-immolate in Bhopal waste protest

Indian duo self-immolate in Bhopal waste protest

-

Indian food delivery app rolls out ambulance service

-

Arsenal must 'flip coin' in Premier League title race, says Arteta

Arsenal must 'flip coin' in Premier League title race, says Arteta

-

European stock markets retreat after positive start to year

-

World food prices dip 2% in 2024: FAO

World food prices dip 2% in 2024: FAO

-

The horror of Saydnaya jail, symbol of Assad excesses

-

Sabalenka sets up Brisbane semi against Russian teen Andreeva

Sabalenka sets up Brisbane semi against Russian teen Andreeva

-

Top European diplomats urge inclusive transition in Syria visit

-

Liverpool's Slot says Man Utd 'much better' than league table shows

Liverpool's Slot says Man Utd 'much better' than league table shows

-

UK electricity cleanest on record in 2024: study

-

Rampant Czechs set up United Cup semi-final against US

Rampant Czechs set up United Cup semi-final against US

-

Rohit omission from decisive Test 'emotional' says India's Pant

-

Beijing slams US over potential Chinese drone ban

Beijing slams US over potential Chinese drone ban

-

Blinken to visit South Korea with eye on political crisis

-

Vietnam's capital blanketed by toxic smog

Vietnam's capital blanketed by toxic smog

-

Top European diplomats in Syria for talks with leader Sharaa

-

Andreeva, Dimitrov into Brisbane semis in contrasting fashion

Andreeva, Dimitrov into Brisbane semis in contrasting fashion

-

Australia in charge as Boland rips through Rohit-less India

-

Biden to block US-Japan steel deal: US media

Biden to block US-Japan steel deal: US media

-

Thai PM declares millions in watches and bags among $400 mn assets

-

Kim Jong Un's sister seen with children in state media images

Kim Jong Un's sister seen with children in state media images

-

China says 'determined' to open up to world in 2025

-

South Korea begins lifting Jeju Air wreckage after fatal crash

South Korea begins lifting Jeju Air wreckage after fatal crash

-

Top US Republican fights for future in cliffhanger vote

-

Kohli out cheaply as Australia pin down India in fifth Test

Kohli out cheaply as Australia pin down India in fifth Test

-

South Korea to lift Jeju Air plane tail after fatal crash

| BCE | 1.47% | 23.606 | $ | |

| BCC | 0.5% | 117.82 | $ | |

| GSK | -1.4% | 33.48 | $ | |

| RBGPF | -4.54% | 59.31 | $ | |

| NGG | -0.36% | 59.324 | $ | |

| SCS | -0.6% | 11.59 | $ | |

| CMSC | 1.06% | 23.5 | $ | |

| JRI | 1.18% | 12.285 | $ | |

| RYCEF | 0.14% | 7.26 | $ | |

| RIO | -0.41% | 58.53 | $ | |

| AZN | 0.66% | 66.315 | $ | |

| RELX | 0.16% | 45.411 | $ | |

| CMSD | 0.68% | 23.621 | $ | |

| VOD | -0.29% | 8.485 | $ | |

| BTI | 1.11% | 36.95 | $ | |

| BP | 1.68% | 30.44 | $ |

European stock markets end year with gains

Europe's main stock markets ended the year Tuesday with solid gains, as all eyes turn to 2025 and the impact that the policies of US president-elect Donald Trump will have on the global economy.

London's benchmark FTSE 100 index closed up 0.6 percent and the Paris CAC 40 rallied 0.9 percent in a shortened trading day.

Over 2024, London gained nearly six percent as falling global inflation triggered interest-rate cuts from major central banks.

That pushed global stock markets to record-high levels this year, as did a tech boom on rapid growth for the artificial intelligence sector.

Paris fell 2.2 percent over the year, with the index hit late in the year by political turmoil in France, while China's economic slowdown impacted the luxury sector.

Frankfurt, whose last trading day was Monday, surged nearly 19 percent over the year despite Europe's biggest economy Germany enduring a tough time.

Traders closed out the year "amid uncertainty over monetary policy and the economic outlook under a Trump presidency", Matt Britzman, senior equity analyst at Hargreaves Lansdown, noted Tuesday.

Asian stock markets ended the year mainly in the red after worries about 2025 and profit-taking turned Wall Street's usual holiday period "Santa Claus rally" into a mini-rout.

The three main US indices all slumped around one percent on Monday, with the tech sector extending Friday's losses.

Volumes were thin but brokers said investors were locking in gains after a bumper 2024, particularly for the "Magnificent Seven" troop of US tech giants.

Concerns about the slow pace of US interest rate cuts by the Federal Reserve and uncertainty about Trump's tariff plans soured the mood.

"In Asia, notably China, tariffs may appear to be a manageable obstacle if they were the only concern," said Stephen Innes at SPI Asset Management.

"However, China's economic difficulties go well beyond simple trade conflicts. The nation is also contending with serious domestic consumption challenges and self-induced setbacks in its technology sector," Innes added.

China's Purchasing Managers' Index (PMI) for manufacturing was 50.1 in December, signalling a third consecutive month of expansion, official data showed on Tuesday.

President Xi Jinping said China would put in place "more proactive" macroeconomic policies next year, according to state media, with economists warning that more direct fiscal stimulus aimed at shoring up domestic consumption was needed.

The yuan on Tuesday reached the lowest level versus the dollar since October 2023.

Tokyo's Nikkei 225 index, which closed out the year Monday, gained almost 20 percent in 2024, finally surpassing the high seen before Japan's asset bubble burst in the 1990s.

- Key figures around 1300 GMT -

London - FTSE 100: UP 0.6 percent at 8,173.02 points (close)

Paris - CAC 40: UP 0.9 percent at 7,380.74 (close)

Frankfurt - DAX: closed

Tokyo - Nikkei 225: closed

Hong Kong - Hang Seng Index: UP 0.1 percent at 20,059.95 (close)

Shanghai - Composite: DOWN 1.6 percent at 3,351.76 (close)

Euro/dollar: DOWN at $1.0397 from $1.0401 on Monday

Pound/dollar: DOWN at $1.2535 from $1.2548

Dollar/yen: UP at 156.87 yen from 156.41 yen

Euro/pound: DOWN at 82.92 pence from 82.93 pence

West Texas Intermediate: FLAT at $70.98 per barrel

Brent North Sea Crude: FLAT at $73.96 per barrel

burs-bcp/rl

H.E.Young--AMWN