-

Pope kicks off Christmas under shadow of war

Pope kicks off Christmas under shadow of war

-

Catholics hold muted Christmas mass in Indonesia's Sharia stronghold

-

Japan's top diplomat in China to address 'challenges'

Japan's top diplomat in China to address 'challenges'

-

Thousands attend Christmas charity dinner in Buenos Aires

-

Demand for Japanese content booms post 'Shogun'

Demand for Japanese content booms post 'Shogun'

-

As India's Bollywood shifts, stars and snappers click

-

Mystery drones won't interfere with Santa's work: US tracker

Mystery drones won't interfere with Santa's work: US tracker

-

Djokovic eyes more Slam glory as Swiatek returns under doping cloud

-

Australia's in-form Head confirmed fit for Boxing Day Test

Australia's in-form Head confirmed fit for Boxing Day Test

-

Brazilian midfielder Oscar returns to Sao Paulo

-

'Wemby' and 'Ant-Man' to make NBA Christmas debuts

'Wemby' and 'Ant-Man' to make NBA Christmas debuts

-

US agency focused on foreign disinformation shuts down

-

On Christmas Eve, Pope Francis launches holy Jubilee year

On Christmas Eve, Pope Francis launches holy Jubilee year

-

'Like a dream': AFP photographer's return to Syria

-

Chiefs seek top seed in holiday test for playoff-bound NFL teams

Chiefs seek top seed in holiday test for playoff-bound NFL teams

-

Panamanians protest 'public enemy' Trump's canal threat

-

Cyclone death toll in Mayotte rises to 39

Cyclone death toll in Mayotte rises to 39

-

Ecuador vice president says Noboa seeking her 'banishment'

-

Leicester boss Van Nistelrooy aware of 'bigger picture' as Liverpool await

Leicester boss Van Nistelrooy aware of 'bigger picture' as Liverpool await

-

Syria authorities say armed groups have agreed to disband

-

Maresca expects Man City to be in title hunt as he downplays Chelsea's chancs

Maresca expects Man City to be in title hunt as he downplays Chelsea's chancs

-

Man Utd boss Amorim vows to stay on course despite Rashford row

-

South Africa opt for all-pace attack against Pakistan

South Africa opt for all-pace attack against Pakistan

-

Guardiola adamant Man City slump not all about Haaland

-

Global stocks mostly higher in thin pre-Christmas trade

Global stocks mostly higher in thin pre-Christmas trade

-

Bethlehem marks sombre Christmas under shadow of war

-

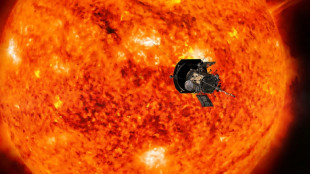

NASA probe makes closest ever pass by the Sun

NASA probe makes closest ever pass by the Sun

-

11 killed in blast at Turkey explosives plant

-

Indonesia considers parole for ex-terror chiefs: official

Indonesia considers parole for ex-terror chiefs: official

-

Global stocks mostly rise in thin pre-Christmas trade

-

Postecoglou says Spurs 'need to reinforce' in transfer window

Postecoglou says Spurs 'need to reinforce' in transfer window

-

Le Pen says days of new French govt numbered

-

Global stocks mostly rise after US tech rally

Global stocks mostly rise after US tech rally

-

Villa boss Emery set for 'very difficult' clash with Newcastle

-

Investors swoop in to save German flying taxi startup

Investors swoop in to save German flying taxi startup

-

How Finnish youth learn to spot disinformation

-

South Korean opposition postpones decision to impeach acting president

South Korean opposition postpones decision to impeach acting president

-

12 killed in blast at Turkey explosives plant

-

Panama leaders past and present reject Trump's threat of Canal takeover

Panama leaders past and present reject Trump's threat of Canal takeover

-

Hong Kong police issue fresh bounties for activists overseas

-

Saving the mysterious African manatee at Cameroon hotspot

Saving the mysterious African manatee at Cameroon hotspot

-

India consider second spinner for Boxing Day Test

-

London wall illuminates Covid's enduring pain at Christmas

London wall illuminates Covid's enduring pain at Christmas

-

Poyet appointed manager at South Korea's Jeonbuk

-

South Korea's opposition vows to impeach acting president

South Korea's opposition vows to impeach acting president

-

The tsunami detection buoys safeguarding lives in Thailand

-

Teen Konstas to open for Australia in Boxing Day India Test

Teen Konstas to open for Australia in Boxing Day India Test

-

Asian stocks mostly up after US tech rally

-

US panel could not reach consensus on US-Japan steel deal: Nippon

US panel could not reach consensus on US-Japan steel deal: Nippon

-

The real-life violence that inspired South Korea's 'Squid Game'

Global stocks mostly higher in thin pre-Christmas trade

Global stocks mostly pushed higher on Tuesday in thin Christmas Eve trade as investors waited to see if a so-called Santa Claus rally would sweep the market.

"Santa Claus comes tonight, but if stock market participants are lucky he will start sprinkling some gifts today, which marks the official start to the 'Santa Claus Rally' period," said Briefing.com analyst Patrick O'Hare.

US stock markets have traditionally fared well in the last five trading days of the year and the first two in the new year, with experts advancing a number of possible reasons as the festive holiday mood and purchasing ahead of the end of the tax year.

Wall Street opened with modest gains, with the Dow essentially flat.

"It looks like Santa Claus's sleigh will be a little slow getting off the ground, but he would be the first to tell you that it isn't how he starts, it's how he finishes," added O'Hare.

There was little news to push trading in the half-day trading session in New York.

Shares in American Airlines fell more than two percent as trading got away after a technical issue forced the world's largest carrier to ground all its US flights for an hour during the busy year-end travel period.

The airline and the Federal Aviation Administration have yet to describe the nature of the technical issue.

In Europe, Paris's CAC 40 closed higher in a pre-holiday short session while Frankfurt was closed all day.

London also closed in the green, despite a week clouded by lacklustre economic data that is "stoking concerns about the UK's slowing momentum heading into the new year," said Matt Britzman, senior equity analyst at Hargreaves Lansdown.

Hong Kong and Shanghai stock markets closed up over one percent, as China announced fresh fiscal measures to boost its ailing economy.

On Tuesday, state media reported that China will raise its deficit in order to boost spending next year, as the world's second-largest economy battles sluggish domestic consumption, a property crisis and soaring government debt.

In company news, Honda shares closed more than 12 percent higher after the Japanese auto giant announced a buyback of up to 1.1 trillion yen ($7 billion), as it enters merger talks with struggling rival Nissan.

The talks on collaboration between Honda and Nissan would create the world's third-largest automaker, expanding development of EVs and self-driving tech.

Honda's CEO insisted it was not a bailout for Nissan, which announced thousands of job cuts last month and reported a 93 percent plunge in first-half net profit.

- Key figures around 1430 GMT -

New York - Dow: FLAT at 42,919.12 points

New York - S&P 500: UP 0.2 percent at 5,983.46

New York - Nasdaq Composite: UP 0.3 percent at 19,822.98

London - FTSE 100: UP 0.4 percent at 8,136.99 (close)

Paris - CAC 40: UP 0.1 percent at 7,282.69 (close)

Frankfurt - DAX: Closed

Tokyo - Nikkei 225: DOWN 0.3 percent at 39,036.85 (close)

Hong Kong - Hang Seng Index: UP 1.1 percent at 20,098.29 (close)

Shanghai - Composite: UP 1.3 percent at 3,393.53 (close)

Euro/dollar: UP at $1.0411 from $1.0408 on Monday

Pound/dollar: UP at $1.2575 from $1.2531

Dollar/yen: UP at 157.20 yen from 157.14 yen

Euro/pound: DOWN at 82.79 pence from 83.03 pence

West Texas Intermediate: UP 1.4 percent at $70.18 per barrel

Brent North Sea Crude: UP 1.2 percent at $73.15 per barrel

burs-rl/phz

C.Garcia--AMWN