-

Demand for Japanese content booms post 'Shogun'

Demand for Japanese content booms post 'Shogun'

-

As India's Bollywood shifts, stars and snappers click

-

Mystery drones won't interfere with Santa's work: US tracker

Mystery drones won't interfere with Santa's work: US tracker

-

Djokovic eyes more Slam glory as Swiatek returns under doping cloud

-

Australia's in-form Head confirmed fit for Boxing Day Test

Australia's in-form Head confirmed fit for Boxing Day Test

-

Brazilian midfielder Oscar returns to Sao Paulo

-

'Wemby' and 'Ant-Man' to make NBA Christmas debuts

'Wemby' and 'Ant-Man' to make NBA Christmas debuts

-

US agency focused on foreign disinformation shuts down

-

On Christmas Eve, Pope Francis launches holy Jubilee year

On Christmas Eve, Pope Francis launches holy Jubilee year

-

'Like a dream': AFP photographer's return to Syria

-

Chiefs seek top seed in holiday test for playoff-bound NFL teams

Chiefs seek top seed in holiday test for playoff-bound NFL teams

-

Panamanians protest 'public enemy' Trump's canal threat

-

Cyclone death toll in Mayotte rises to 39

Cyclone death toll in Mayotte rises to 39

-

Ecuador vice president says Noboa seeking her 'banishment'

-

Leicester boss Van Nistelrooy aware of 'bigger picture' as Liverpool await

Leicester boss Van Nistelrooy aware of 'bigger picture' as Liverpool await

-

Syria authorities say armed groups have agreed to disband

-

Maresca expects Man City to be in title hunt as he downplays Chelsea's chancs

Maresca expects Man City to be in title hunt as he downplays Chelsea's chancs

-

Man Utd boss Amorim vows to stay on course despite Rashford row

-

South Africa opt for all-pace attack against Pakistan

South Africa opt for all-pace attack against Pakistan

-

Guardiola adamant Man City slump not all about Haaland

-

Global stocks mostly higher in thin pre-Christmas trade

Global stocks mostly higher in thin pre-Christmas trade

-

Bethlehem marks sombre Christmas under shadow of war

-

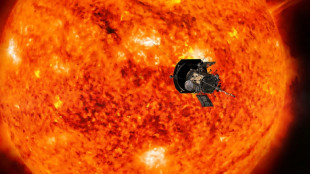

NASA probe makes closest ever pass by the Sun

NASA probe makes closest ever pass by the Sun

-

11 killed in blast at Turkey explosives plant

-

Indonesia considers parole for ex-terror chiefs: official

Indonesia considers parole for ex-terror chiefs: official

-

Global stocks mostly rise in thin pre-Christmas trade

-

Postecoglou says Spurs 'need to reinforce' in transfer window

Postecoglou says Spurs 'need to reinforce' in transfer window

-

Le Pen says days of new French govt numbered

-

Global stocks mostly rise after US tech rally

Global stocks mostly rise after US tech rally

-

Villa boss Emery set for 'very difficult' clash with Newcastle

-

Investors swoop in to save German flying taxi startup

Investors swoop in to save German flying taxi startup

-

How Finnish youth learn to spot disinformation

-

South Korean opposition postpones decision to impeach acting president

South Korean opposition postpones decision to impeach acting president

-

12 killed in blast at Turkey explosives plant

-

Panama leaders past and present reject Trump's threat of Canal takeover

Panama leaders past and present reject Trump's threat of Canal takeover

-

Hong Kong police issue fresh bounties for activists overseas

-

Saving the mysterious African manatee at Cameroon hotspot

Saving the mysterious African manatee at Cameroon hotspot

-

India consider second spinner for Boxing Day Test

-

London wall illuminates Covid's enduring pain at Christmas

London wall illuminates Covid's enduring pain at Christmas

-

Poyet appointed manager at South Korea's Jeonbuk

-

South Korea's opposition vows to impeach acting president

South Korea's opposition vows to impeach acting president

-

The tsunami detection buoys safeguarding lives in Thailand

-

Teen Konstas to open for Australia in Boxing Day India Test

Teen Konstas to open for Australia in Boxing Day India Test

-

Asian stocks mostly up after US tech rally

-

US panel could not reach consensus on US-Japan steel deal: Nippon

US panel could not reach consensus on US-Japan steel deal: Nippon

-

The real-life violence that inspired South Korea's 'Squid Game'

-

Blogs to Bluesky: social media shifts responses after 2004 tsunami

Blogs to Bluesky: social media shifts responses after 2004 tsunami

-

Tennis power couple de Minaur and Boulter get engaged

-

Supermaxi yachts eye record in gruelling Sydney-Hobart race

Supermaxi yachts eye record in gruelling Sydney-Hobart race

-

Hawaii's Kilauea volcano erupts, spewing columns of lava

Pantheon Resources PLC Announces Final Results for the Year Ended 30 June 2024

Pantheon Resources PLC (AIM:PANR)(OTCQX:PTHRF) ("Pantheon" or the "Company"), an oil and gas company developing the Kodiak and Ahpun oil fields in close proximity to pipeline and transportation infrastructure on Alaska's North Slope, today announced its results for the year ended 30 June 2024.

Fiscal 2024 and Subsequent Operational Highlights

Receipt of three separate Independent Expert Reports, certifying a combined total of c. 1.6 billion barrels of ANS Crude and 6.6 trillion cubic feet ("Tcf") natural gas

Refreshed corporate strategy with an objective to deliver financial self-sufficiency and sustainable market recognition of a value of $5 - $10 per barrel of recoverable resources by 2028

Signed a Gas Sales Precedent Agreement with Alaska Gasline Development Corporation ("AGDC") for the proposed long term supply of natural gas to Phase 1 (pipeline component) of the Alaska LNG project

Alaska Industrial Development and Export Authority resolved to provide letter of credit support to AGDC removing impediments to the start of Front End Engineering Design on Phase 1 of the proposed Alaska LNG project.

Strengthened Board with appointment of two well qualified independent non-executive directors

Commencement of work on Environmental Impact Statement submission and engineering hot-tap into the Trans-Alaska Pipeline System ("TAPS") main oil line

Awarded an additional c. 66,000 acres of leases following the December 2023 Alaska lease sale

Spudded the Megrez-1 well on the Ahpun, Eastern Topset

Fiscal 2024 Financial & Corporate Highlights

Total comprehensive loss for the year of $11.6 million, as compared to $4.6 million in fiscal 2023, with non-cash items accounting for the majority of the year-over-year change

Reduced convertible loan balance to $17.2 million as of 9 December 2024 (further reducing to $14.7 million on 13 December), from $24.5 million at 1 July 2023.

Cash and cash equivalents at 30 June 2024 totalled $7.9 million, as compared to $20.7 million as of 30 June 2023. As of 9 December 2024, unaudited cash and cash equivalents totalled $23.7 million, which are currently funding the ongoing Megrez-1 well operations, with the majority of the costs remaining to be spent.

David Hobbs, Executive Chairman of Pantheon Resources, said: "The past 18 months have seen extraordinary progress in three key areas. We received independent validation of the Company's contingent resources base at 1.6 billion barrels of ANS crude. We funded and are executing the Megrez-1 well programme, with its potential to add up to a further c. 40% to the overall resource base. We secured a path to potential monetisation of the 6.6 trillion cubic feet of natural gas in a way that may support the development capital needs from Ahpun FID."

Annual Report and Accounts

The Annual Report and Accounts for the financial year ended 30 June 2024 will be posted to shareholders shortly, together with a Notice of Annual General Meeting ("AGM") which is scheduled for late January, 2025. As in recent years, the presentation portion of the AGM will be held by webinar to enable participation by all shareholders and investors. Details of the webinar will be provided in due course. Copies of the presentation will be available before the AGM on the Company's website at:

-ENDS-

UK Corporate and Investor Relations Contact

Pantheon Resources PLC

Justin Hondris

+44 20 7484 5361

[email protected]

Nominated Adviser and Broker

Canaccord Genuity Limited

Henry Fitzgerald-O'Connor, James Asensio, Charlie Hammond

+44 20 7523 8000

Public Relations Contact

BlytheRay

Tim Blythe, Megan Ray, Matthew Bowld

+44 20 7138 3204

U.S. Investor Relations Contact

MZ Group

Lucas Zimmerman, Ian Scargill

+1 949 259 4987

[email protected]

AboutPantheon Resources

Pantheon Resources PLC is an AIM listed Oil & Gas company focused on developing its 100% owned Ahpun and Kodiak fields located on State of Alaska land on the North Slope, onshore USA. Independently certified best estimate contingent recoverable resources attributable to these projects currently total c. 1.6 billion barrels of ANS crude and 6.6 Tcf (trillion cubic feet) of associated natural gas. The Company owns 100% working interest in c. 259,000 acres.

Pantheon's stated objective is to demonstrate sustainable market recognition of a value of $5-$10/bbl of recoverable resources by end 2028. This is based on bringing the Ahpun field forward to FID and producing into the TAPS main oil line (ANS crude) by the end of 2028. The Gas Sales Precedent Agreement signed with AGDC (Alaska Gasline Development Corporation) provides the potential for Pantheon's natural gas to be produced into the proposed 807 mile pipeline from the North Slope to Southcentral Alaska during 2029. Once the Company achieves financial self-sufficiency, it will apply the resultant cashflows to support the FID on the Kodiak field planned, subject to regulatory approvals, targeted by the end of 2028 or early 2029.

A major differentiator to other ANS projects is the close proximity to existing roads and pipelines which offers a significant competitive advantage to Pantheon, allowing for shorter development timeframes, materially lower infrastructure costs and the ability to support the development with a significantly lower pre-cashflow funding requirement than is typical in Alaska. Furthermore, the low CO2 content of the associated gas allows export into the planned natural gas pipeline from the North Slope to Southcentral Alaska without significant pre-treatment.

The Company's project portfolio has been endorsed by world renowned experts. Netherland, Sewell & Associates estimate a 2C contingent recoverable resource in the Kodiak project that total 1,208 mmbbl (million barrels) of ANS crude and 5,396 bcf (billion cubic feet) of natural gas. Cawley Gillespie & Associates estimate 2C contingent recoverable resources for Ahpun's western topset horizons at 282 mmbbl of ANS crude and 803 bcf of natural gas. Lee Keeling & Associates estimated possible reserves and 2C contingent recoverable resources totalling 79 mmbbl of ANS crude and 424 bcf natural gas.

For more information visit www.pantheonresources.com.

Please click on or paste the following URL into your web browser to view the full announcement ;

http://www.rns-pdf.londonstockexchange.com/rns/2474P_2-2024-12-8.pdf

This information is provided by RNS, the news service of the London Stock Exchange. RNS is approved by the Financial Conduct Authority to act as a Primary Information Provider in the United Kingdom. Terms and conditions relating to the use and distribution of this information may apply. For further information, please contact [email protected] or visit www.rns.com.

SOURCE: Pantheon Resources PLC

M.A.Colin--AMWN