-

Teen Konstas to open for Australia in Boxing Day India Test

Teen Konstas to open for Australia in Boxing Day India Test

-

Asian stocks mostly up after US tech rally

-

US panel could not reach consensus on US-Japan steel deal: Nippon

US panel could not reach consensus on US-Japan steel deal: Nippon

-

The real-life violence that inspired South Korea's 'Squid Game'

-

Blogs to Bluesky: social media shifts responses after 2004 tsunami

Blogs to Bluesky: social media shifts responses after 2004 tsunami

-

Tennis power couple de Minaur and Boulter get engaged

-

Supermaxi yachts eye record in gruelling Sydney-Hobart race

Supermaxi yachts eye record in gruelling Sydney-Hobart race

-

Hawaii's Kilauea volcano erupts, spewing columns of lava

-

El Salvador Congress votes to end ban on metal mining

El Salvador Congress votes to end ban on metal mining

-

Five things to know about Panama Canal, in Trump's sights

-

NBA fines Minnesota guard Edwards $75,000 for outburst

NBA fines Minnesota guard Edwards $75,000 for outburst

-

Haitians massacred for practicing voodoo were abducted, hacked to death: UN

-

Inter beat Como to keep in touch with leaders Atalanta

Inter beat Como to keep in touch with leaders Atalanta

-

Mixed day for global stocks as market hopes for 'Santa Claus rally'

-

Man Utd boss Amorim questions 'choices' of Rashford's entourage

Man Utd boss Amorim questions 'choices' of Rashford's entourage

-

Trump's TikTok love raises stakes in battle over app's fate

-

Is he serious? Trump stirs unease with Panama, Greenland ploys

Is he serious? Trump stirs unease with Panama, Greenland ploys

-

England captain Stokes to miss three months with torn hamstring

-

Support grows for Blake Lively over smear campaign claim

Support grows for Blake Lively over smear campaign claim

-

Canada records 50,000 opioid overdose deaths since 2016

-

Jordanian, Qatari envoys hold talks with Syria's new leader

Jordanian, Qatari envoys hold talks with Syria's new leader

-

France's second woman premier makes surprise frontline return

-

France's Macron announces fourth government of the year

France's Macron announces fourth government of the year

-

Netanyahu tells Israel parliament 'some progress' on Gaza hostage deal

-

Guatemalan authorities recover minors taken by sect members

Guatemalan authorities recover minors taken by sect members

-

Germany's far-right AfD holds march after Christmas market attack

-

European, US markets wobble awaiting Santa rally

European, US markets wobble awaiting Santa rally

-

Serie A basement club Monza fire coach Nesta

-

Mozambique top court confirms ruling party disputed win

Mozambique top court confirms ruling party disputed win

-

Biden commutes almost all federal death sentences

-

Syrian medics say were coerced into false chemical attack testimony

Syrian medics say were coerced into false chemical attack testimony

-

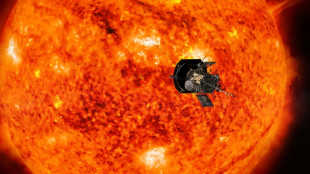

NASA solar probe to make its closest ever pass of Sun

-

France's new government to be announced Monday evening: Elysee

France's new government to be announced Monday evening: Elysee

-

London toy 'shop' window where nothing is for sale

-

Volkswagen boss hails cost-cutting deal but shares fall

Volkswagen boss hails cost-cutting deal but shares fall

-

Accused killer of US insurance CEO pleads not guilty to 'terrorist' murder

-

Global stock markets mostly higher

Global stock markets mostly higher

-

Not for sale. Greenland shrugs off Trump's new push

-

Sweden says China blocked prosecutors' probe of ship linked to cut cables

Sweden says China blocked prosecutors' probe of ship linked to cut cables

-

Acid complicates search after deadly Brazil bridge collapse

-

Norwegian Haugan dazzles in men's World Cup slalom win

Norwegian Haugan dazzles in men's World Cup slalom win

-

Arsenal's Saka out for 'many weeks' with hamstring injury

-

Mali singer Traore child custody case postponed

Mali singer Traore child custody case postponed

-

France mourns Mayotte victims amid uncertainy over government

-

UK economy stagnant in third quarter in fresh setback

UK economy stagnant in third quarter in fresh setback

-

Sweden says China denied request for prosecutors to probe ship linked to cut undersea cables

-

African players in Europe: Salah leads Golden Boot race after brace

African players in Europe: Salah leads Golden Boot race after brace

-

Global stock markets edge higher as US inflation eases rate fears

-

German far-right AfD to march in city hit by Christmas market attack

German far-right AfD to march in city hit by Christmas market attack

-

Ireland centre Henshaw signs IRFU contract extension

Saudi Aramco's quarterly profit drops 15% on low oil prices

Energy giant Saudi Aramco reported a 15 percent year-on-year drop in third quarter profit on Tuesday, citing prices which have stayed low despite production cuts and war in the Middle East.

The fall in net income to $27.56 billion from $32.58 billion in 2023 is the seventh consecutive quarterly drop for Aramco, one of the world's biggest companies by market capitalisation.

Aramco is the chief source of revenue for Crown Prince Mohammed bin Salman's Vision 2030 reform agenda, which aims to remodel the Gulf kingdom's crude-reliant economy.

The lower third quarter profit "was mainly due to the impact of lower crude oil prices and weakening refining margins", Aramco said in a statement to the Saudi stock exchange.

Following a series of output cuts since October 2022, the world's biggest crude oil exporter is currently producing roughly nine million barrels per day (bpd), well below its capacity of 12 million bpd.

Yet despite lower production, as well as widening conflict in the Middle East, prices have remained low because of concerns about market oversupply.

Brent crude was priced at around $75 per barrel on Tuesday -- much cheaper than Saudi Arabia's estimated fiscal break-even mark.

"Aramco delivered robust net income and generated strong free cash flow during the third quarter, despite a lower oil price environment," chief executive Amin Nasser said in a statement.

The firm will maintain its $10.8 billion performance-based dividend for another quarter alongside its $20.3 billion base dividend, the statement said.

- 'No supply disruptions' -

Soaring energy prices following Russia's invasion of Ukraine allowed Aramco to post record profits in 2022, before they dipped by 25 percent last year.

Profits were down 14.5 percent in the first quarter of 2024 and 3.4 percent in the second quarter.

Israel's war against Hamas has drawn in Iran-backed groups from across the region and led to direct strikes between Israel and Iran, spurring fears about oil supply.

Yet while Brent rose above $80 per barrel in early October, it has not approached $96.2 -- the mark the International Monetary Fund has identified as break-even for the Saudi budget at current production levels.

"The markets appear to be dismissing geopolitical risk in the Middle East, so anything short of an actual supply disruption" will be unlikely to exert upward pressure on prices, said Amena Bakr, senior research analyst at Energy Intelligence.

"So far there have been no supply disruptions."

The year-on-year drop in profits "isn't coming as a surprise to the government which has already revised down revenue expectations for this year based on weakening oil markets", said Jamie Ingram, senior editor at the Middle East Economic Survey.

- 'Maximising prices' -

On Sunday, Saudi Arabia and seven other members of the OPEC+ group of oil-producing nations said they were extending a 2.2 million-barrel reduction announced in November 2023 by another month, until the end of December.

"When it comes to oil production policy, they'll be trying to assess what will ultimately bring in the most revenue," Ingram said.

"Is it maximising volumes or maximising prices? For now, the strategy remains the latter."

The government's stake in Aramco is around 81.5 percent, while the Saudi sovereign wealth fund, the Public Investment Fund, holds 16 percent.

Aramco is pushing to diversify from its core business, "investing big-time in renewable and hydrogen and carbon capture and storage" while also "making sure that we are growing our oil and gas activities and petrochemicals", Nasser told an investor forum in Riyadh last week.

The company's initial public offering in 2019, the biggest flotation in history, raised $29.4 billion, and a secondary offering this year of nearly 1.7 billion shares fetched $12.35 billion.

Aramco's profits help finance flagship projects including NEOM, the planned futuristic mega-city being built in the desert, a giant airport in Riyadh and major tourism and leisure developments.

The Saudi finance ministry has acknowledged that spending will outstrip revenue in the short term, and in September it projected a budget deficit of 2.3 percent of GDP in 2025 and for deficits to continue through 2027.

Y.Aukaiv--AMWN