-

Teen Konstas to open for Australia in Boxing Day India Test

Teen Konstas to open for Australia in Boxing Day India Test

-

Asian stocks mostly up after US tech rally

-

US panel could not reach consensus on US-Japan steel deal: Nippon

US panel could not reach consensus on US-Japan steel deal: Nippon

-

The real-life violence that inspired South Korea's 'Squid Game'

-

Blogs to Bluesky: social media shifts responses after 2004 tsunami

Blogs to Bluesky: social media shifts responses after 2004 tsunami

-

Tennis power couple de Minaur and Boulter get engaged

-

Supermaxi yachts eye record in gruelling Sydney-Hobart race

Supermaxi yachts eye record in gruelling Sydney-Hobart race

-

Hawaii's Kilauea volcano erupts, spewing columns of lava

-

El Salvador Congress votes to end ban on metal mining

El Salvador Congress votes to end ban on metal mining

-

Five things to know about Panama Canal, in Trump's sights

-

NBA fines Minnesota guard Edwards $75,000 for outburst

NBA fines Minnesota guard Edwards $75,000 for outburst

-

Haitians massacred for practicing voodoo were abducted, hacked to death: UN

-

Inter beat Como to keep in touch with leaders Atalanta

Inter beat Como to keep in touch with leaders Atalanta

-

Mixed day for global stocks as market hopes for 'Santa Claus rally'

-

Man Utd boss Amorim questions 'choices' of Rashford's entourage

Man Utd boss Amorim questions 'choices' of Rashford's entourage

-

Trump's TikTok love raises stakes in battle over app's fate

-

Is he serious? Trump stirs unease with Panama, Greenland ploys

Is he serious? Trump stirs unease with Panama, Greenland ploys

-

England captain Stokes to miss three months with torn hamstring

-

Support grows for Blake Lively over smear campaign claim

Support grows for Blake Lively over smear campaign claim

-

Canada records 50,000 opioid overdose deaths since 2016

-

Jordanian, Qatari envoys hold talks with Syria's new leader

Jordanian, Qatari envoys hold talks with Syria's new leader

-

France's second woman premier makes surprise frontline return

-

France's Macron announces fourth government of the year

France's Macron announces fourth government of the year

-

Netanyahu tells Israel parliament 'some progress' on Gaza hostage deal

-

Guatemalan authorities recover minors taken by sect members

Guatemalan authorities recover minors taken by sect members

-

Germany's far-right AfD holds march after Christmas market attack

-

European, US markets wobble awaiting Santa rally

European, US markets wobble awaiting Santa rally

-

Serie A basement club Monza fire coach Nesta

-

Mozambique top court confirms ruling party disputed win

Mozambique top court confirms ruling party disputed win

-

Biden commutes almost all federal death sentences

-

Syrian medics say were coerced into false chemical attack testimony

Syrian medics say were coerced into false chemical attack testimony

-

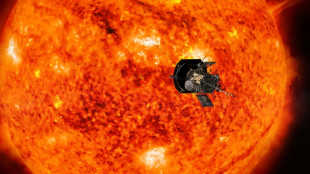

NASA solar probe to make its closest ever pass of Sun

-

France's new government to be announced Monday evening: Elysee

France's new government to be announced Monday evening: Elysee

-

London toy 'shop' window where nothing is for sale

-

Volkswagen boss hails cost-cutting deal but shares fall

Volkswagen boss hails cost-cutting deal but shares fall

-

Accused killer of US insurance CEO pleads not guilty to 'terrorist' murder

-

Global stock markets mostly higher

Global stock markets mostly higher

-

Not for sale. Greenland shrugs off Trump's new push

-

Sweden says China blocked prosecutors' probe of ship linked to cut cables

Sweden says China blocked prosecutors' probe of ship linked to cut cables

-

Acid complicates search after deadly Brazil bridge collapse

-

Norwegian Haugan dazzles in men's World Cup slalom win

Norwegian Haugan dazzles in men's World Cup slalom win

-

Arsenal's Saka out for 'many weeks' with hamstring injury

-

Mali singer Traore child custody case postponed

Mali singer Traore child custody case postponed

-

France mourns Mayotte victims amid uncertainy over government

-

UK economy stagnant in third quarter in fresh setback

UK economy stagnant in third quarter in fresh setback

-

Sweden says China denied request for prosecutors to probe ship linked to cut undersea cables

-

African players in Europe: Salah leads Golden Boot race after brace

African players in Europe: Salah leads Golden Boot race after brace

-

Global stock markets edge higher as US inflation eases rate fears

-

German far-right AfD to march in city hit by Christmas market attack

German far-right AfD to march in city hit by Christmas market attack

-

Ireland centre Henshaw signs IRFU contract extension

Wall Street bounces while oil prices gain on geopolitical fears

Wall Street stocks rebounded Friday from tame tech earnings and investor jitters less than a week before a neck-and-neck US presidential election.

Oil prices gained following reports that Iran was planning a major retaliatory strike on Israel, reviving the market's geopolitical fears.

Big tech delivered a mixed bag of earnings this week, with concerns over AI spending overshadowing better-than-expected results from Microsoft and Facebook-parent Meta.

Wall Street closed sharply lower Thursday, with the tech-rich Nasdaq Composite index dropping nearly three percent.

But they snapped higher at the start of trading on Friday, with the Nasdaq gaining 0.5 percent in what Briefing.com analyst Patrick O'Hare called buy-the-dip action following Thursday's losses.

"The pertinent question is, will buy-the-dip interest win out (again) or will there be follow-through selling?"

Data showing US job growth slowed drastically in October -- albeit affected by hurricanes and strikes -- reassured investors that the US Federal Reserve will continue cutting interest rates.

The world's biggest economy added 12,000 jobs last month, far below expectations and down from a revised 223,000 in September, said the Department of Labor in its monthly non-farm payrolls report.

"The key takeaway from the report is that it has reinvigorated the market's view that the Fed will stay on a steady rate-cut path," O'Hare said.

"The Treasury market seems to be corroborating this thought," he added, pointing to the drop in yields on US government bonds.

Expectations of a major rate cut by the Fed, like the bumper 50 basis point cut in September, have receded after data showed strong economic growth in the United States and that inflation is just above the central bank's long-term two percent target.

But the "lower-than-expected jobs creation could prompt the Fed to follow through with the widely anticipated 25 basis point cut following their next meeting later next week," said Mahmoud Alkudsi, senior market analyst at ADSS brokerage.

The fresh jobs data came ahead of next week's coin-toss US election between Vice President Kamala Harris and former president Donald Trump, with jobs and the cost of living being key issues for voters.

Major European markets were higher in afternoon trading.

London gained 0.8 percent, despite lingering fears of the consequences of the Labour government's high-tax, high-spending budget unveiled this week.

The UK's 10-year borrowing rate reached its highest level since November 2023 on Thursday, on fears of a resurgence in inflation.

"Worries continue to swirl about the UK Budget stoking inflation and adding to the debt burden," said Susannah Streeter, head of money and markets at Hargreaves Lansdown.

Asian markets closed mix, with Tokyo down more than two percent as tech shares on the Nikkei were dragged down following the drop on Wall Street.

Shanghai also ended lower despite a forecast-beating Chinese manufacturing report that boosted hopes for recovery in the world's second-largest economy.

"Markets have already priced in some risks of a second Trump presidency as they await the US presidential election," Lloyd Chan, an analyst at MUFG Global Markets Research, said in a note.

He added that Trump's proposed economic policies, including tariffs, could hurt the outlook for Asian economies.

- Key figures around 1340 GMT -

New York - Dow: UP 0.5 percent at 41,963.22 points

New York - S&P 500: UP 0.4 percent at 5,727.81

New York - Nasdaq Composite: UP 0.5 percent at 18,184.83

London - FTSE 100: UP 1.0 percent at 8,192.81

Paris - CAC 40: UP 0.8 percent at 7,407.08

Frankfurt - DAX: UP 0.7 percent at 19,219.22

Tokyo - Nikkei 225: DOWN 2.6 percent at 38,053.67 (close)

Hong Kong - Hang Seng Index: UP 0.9 percent at 20,506.43 (close)

Shanghai - Composite: DOWN 0.2 percent at 3,272.01 (close)

New York - Dow: DOWN 0.9 percent at 41,763.46 (close)

Euro/dollar: DOWN at $1.0870 from $1.0883 on Thursday

Pound/dollar: UP at $1.2953 from $1.2896

Dollar/yen: UP at 152.22 yen from 152.00 yen

Euro/pound: DOWN at 83.92 from 84.38 pence

Brent North Sea Crude: UP 1.8 percent at $74.62 per barrel

West Texas Intermediate: UP 2.8 percent at $71.23 per barrel

burs-rl

T.Ward--AMWN