-

US senator smashes record with 25-hour anti-Trump speech

US senator smashes record with 25-hour anti-Trump speech

-

Brazil binman finds newborn baby on garbage route

-

US senator smashes record with marathon anti-Trump speech

US senator smashes record with marathon anti-Trump speech

-

Trump advisor Waltz faces new pressure over Gmail usage

-

Niger junta frees ministers of overthrown government

Niger junta frees ministers of overthrown government

-

Trump set to unleash 'Liberation Day' tariffs

-

Boeing chief to acknowledge 'serious missteps' at US Senate hearing

Boeing chief to acknowledge 'serious missteps' at US Senate hearing

-

Real Madrid hold Real Sociedad in eight-goal thriller to reach Copa del Rey final

-

Nuno salutes 'special' Elanga after stunning strike fires Forest

Nuno salutes 'special' Elanga after stunning strike fires Forest

-

PSG survive scare against Dunkerque to reach French Cup final

-

Sundowns edge Esperance as crowd violence mars quarter-final

Sundowns edge Esperance as crowd violence mars quarter-final

-

Nottingham Forest beat Man Utd, Saka scores on Arsenal return

-

Elanga wonder-goal sinks Man Utd as Forest eye Champions League berth

Elanga wonder-goal sinks Man Utd as Forest eye Champions League berth

-

Stock markets mostly advance ahead of Trump tariffs deadline

-

US movie theaters urge 45-day 'baseline' before films hit streaming

US movie theaters urge 45-day 'baseline' before films hit streaming

-

Saka scores on return as Arsenal beat Fulham

-

Third-division Bielefeld shock holders Leverkusen in German Cup

Third-division Bielefeld shock holders Leverkusen in German Cup

-

Ball-blasting 'Torpedo bats' making waves across MLB opening weekend

-

Newsmax shares surge more than 2,000% in days after IPO

Newsmax shares surge more than 2,000% in days after IPO

-

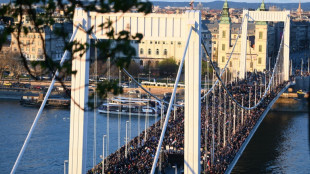

Thousands of Hungarians protest against Pride ban law

-

GM leads first quarter US auto sales as tariffs loom

GM leads first quarter US auto sales as tariffs loom

-

Tesla sales tumble in Europe in the first quarter

-

No 'eye for an eye' approach to US tariffs: Mexico

No 'eye for an eye' approach to US tariffs: Mexico

-

NFL club owners back dynamic kickoffs, delay tush push vote

-

Trump 'perfecting' new tariffs as nervous world braces

Trump 'perfecting' new tariffs as nervous world braces

-

Trump nominee says to press UK on Israel arms

-

French court says Le Pen appeal ruling could come before presidential vote

French court says Le Pen appeal ruling could come before presidential vote

-

The battle to control assets behind Bosnia crisis

-

Prabhsimran powers Punjab to IPL win over Lucknow

Prabhsimran powers Punjab to IPL win over Lucknow

-

Mass layoffs targeting 10,000 jobs hit US health agencies

-

Tiger's April Foolishness: plan to play Masters just a joke

Tiger's April Foolishness: plan to play Masters just a joke

-

Myanmar quake toll passes 2,700, nation halts to honour victims

-

Turkish fans, artists urge Muse to cancel Istanbul gig

Turkish fans, artists urge Muse to cancel Istanbul gig

-

US seeks death penalty for accused killer of insurance CEO

-

UK govt moves to block sentencing guidelines for minority defendants

UK govt moves to block sentencing guidelines for minority defendants

-

Trump puts world on edge as 'Liberation Day' tariffs loom

-

Swedish journalist jailed in Turkey kept 'isolated': employer

Swedish journalist jailed in Turkey kept 'isolated': employer

-

Stock markets advance ahead of Trump tariffs deadline

-

Gulf between Everton and Liverpool has never been bigger, says Moyes

Gulf between Everton and Liverpool has never been bigger, says Moyes

-

Finland to withdraw from anti-personnel mine ban treaty

-

UK vows £20 million to boost drone and 'flying taxi' services

UK vows £20 million to boost drone and 'flying taxi' services

-

Ford's US auto sales dip in first quarter as tariffs loom

-

Digging for box office gold, 'A Minecraft Movie' hits cinemas

Digging for box office gold, 'A Minecraft Movie' hits cinemas

-

Southampton boss Juric desperate to avoid Premier League 'worst team' tag

-

Thailand rescue dogs double as emotional support

Thailand rescue dogs double as emotional support

-

Five takeaways from Marine Le Pen verdict

-

Stock markets split ahead of Trump tariffs deadline

Stock markets split ahead of Trump tariffs deadline

-

Turkish fans, artists urge Muse to cancel Istanbul gig over protest dispute

-

Former captain Edwards named new England women's cricket coach

Former captain Edwards named new England women's cricket coach

-

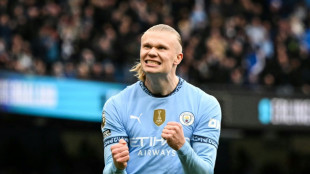

Haaland ruled out for up to seven weeks: Man City boss Guardiola

Greenlane Holdings, Inc. Announces Closing of $25.0 Million Private Placement

BOCA RATON, FL / ACCESS Newswire / February 19, 2025 / Greenlane Holdings, Inc. (NASDAQ:GNLN) (the "Company"), one of the premier global sellers of premium cannabis accessories, child-resistant packaging, and specialty vaporization products, today announced the closing of its previously announced private placement of approximately $25.0 million of shares of Common Stock and investor warrants at a price of $1.19 per Common Unit. The entire transaction was priced at the market under Nasdaq rules.

The offering consisted of the sale of 21,008,405 Common Units (or Pre-Funded Units), each consisting of (i) one (1) share of Common Stock or one (1) Pre-Funded Warrant, (ii) one (1) Series A PIPE Common Warrant to purchase one (1) share of Common Stock per warrant at an exercise price of $1.4875 ("Series A Warrant") and (iii) one (1) Series B PIPE Common Warrant to purchase one (1) share of Common Stock per warrant at an exercise price of $2.975 ("Series B Warrant" and together with the Series A Warrant, the "Warrants"). The price per Common Unit was $1.19. The initial exercise price of each Series A Warrant is $1.4875 per share of Common Stock. The Series A Warrants are exercisable following stockholder approval and expire five (5) years thereafter. The number of securities issuable under the Series A Warrant is subject to adjustment as described in more detail in the report on Form 8-K filed in connection with the offering. The initial exercise price of each Series B Warrant is $2.975 per share of Common Stock or pursuant to an alternative cashless exercise option. The Series B Warrants are exercisable following stockholder approval and expire two and one-half (2.5) years thereafter. The number of securities issuable under the Series B Warrant is subject to adjustment as described in more detail in the report on Form 8-K filed in connection with the offering.

Aggregate gross proceeds to the Company were approximately $25.0 million. The transaction closed on February 19, 2025. The Company expects to use the net proceeds from the offering, together with its existing cash, for the repayment of existing indebtedness, general corporate purposes and working capital.

Aegis Capital Corp. acted as exclusive placement agent for the private placement. Sichenzia Ross Ference Carmel LLP acted as counsel to the Company. Kaufman & Canoles, P.C. acted as counsel to Aegis Capital Corp.

The securities described above were sold in a private placement transaction not involving a public offering and have not been registered under the Securities Act of 1933, as amended (the "Securities Act"), or applicable state securities laws. Accordingly, the securities may not be reoffered or resold in the United States except pursuant to an effective registration statement or an applicable exemption from the registration requirements of the Securities Act and such applicable state securities laws. The securities were offered only to accredited investors. Pursuant to a registration rights agreement with the investors, the Company has agreed to file one or more registration statements with the SEC covering the resale of the Common Stock and the Shares issuable upon exercise of the Pre-Funded Warrants and Warrants.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

About Greenlane Holdings, Inc.

Founded in 2005, Greenlane is a premier global platform for the development and distribution of premium smoking accessories, vape devices, and lifestyle products to thousands of producers, processors, specialty retailers, smoke shops, convenience stores, and retail consumers. We operate as a powerful family of brands, third-party brand accelerator, and an omnichannel distribution platform.

We proudly offer our own diverse brand portfolio and our licensed Marley Natural and K.Haring branded products. We also offer a carefully curated set of third-party products through our direct sales channels and our proprietary, owned and operated e-commerce platforms which include Vapor.com, PuffItUp.com, HigherStandards.com, Wholesale.Greenlane.com and MarleyNaturalShop.com.

For additional information, please visit: https://investor.gnln.com. https://gnln.com/.

Forward-Looking Statements

The foregoing material may contain "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, each as amended. Forward-looking statements include all statements that do not relate solely to historical or current facts, including without limitation statements regarding the Company's product development and business prospects, and can be identified by the use of words such as "may," "will," "expect," "project," "estimate," "anticipate," "plan," "believe," "potential," "should," "continue" or the negative versions of those words or other comparable words. Forward-looking statements are not guarantees of future actions or performance. These forward-looking statements are based on information currently available to the Company and its current plans or expectations and are subject to a number of risks and uncertainties that could significantly affect current plans. Should one or more of these risks or uncertainties materialize, or the underlying assumptions prove incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected, intended, or planned. Although the Company believes that the expectations reflected in the forward-looking statements are reasonable, the Company cannot guarantee future results, performance, or achievements. Except as required by applicable law, including the security laws of the United States, the Company does not intend to update any of the forward-looking statements to conform these statements to actual results.

Investor Contact:

[email protected]

or

TraDigital IR

Kevin McGrath

+1-646-418-7002

[email protected]

SOURCE: Greenlane Holdings, Inc.

View the original press release on ACCESS Newswire

F.Dubois--AMWN